An addendum is a thing to be added; an addition. For example, it may be used to add supplemental terms or conditions to a contract or make corrections or supply omissions to a document. An addendum is often used to supply additional terms to standardized contracts, such as leases. Addendum is singular; the plural form is addenda.

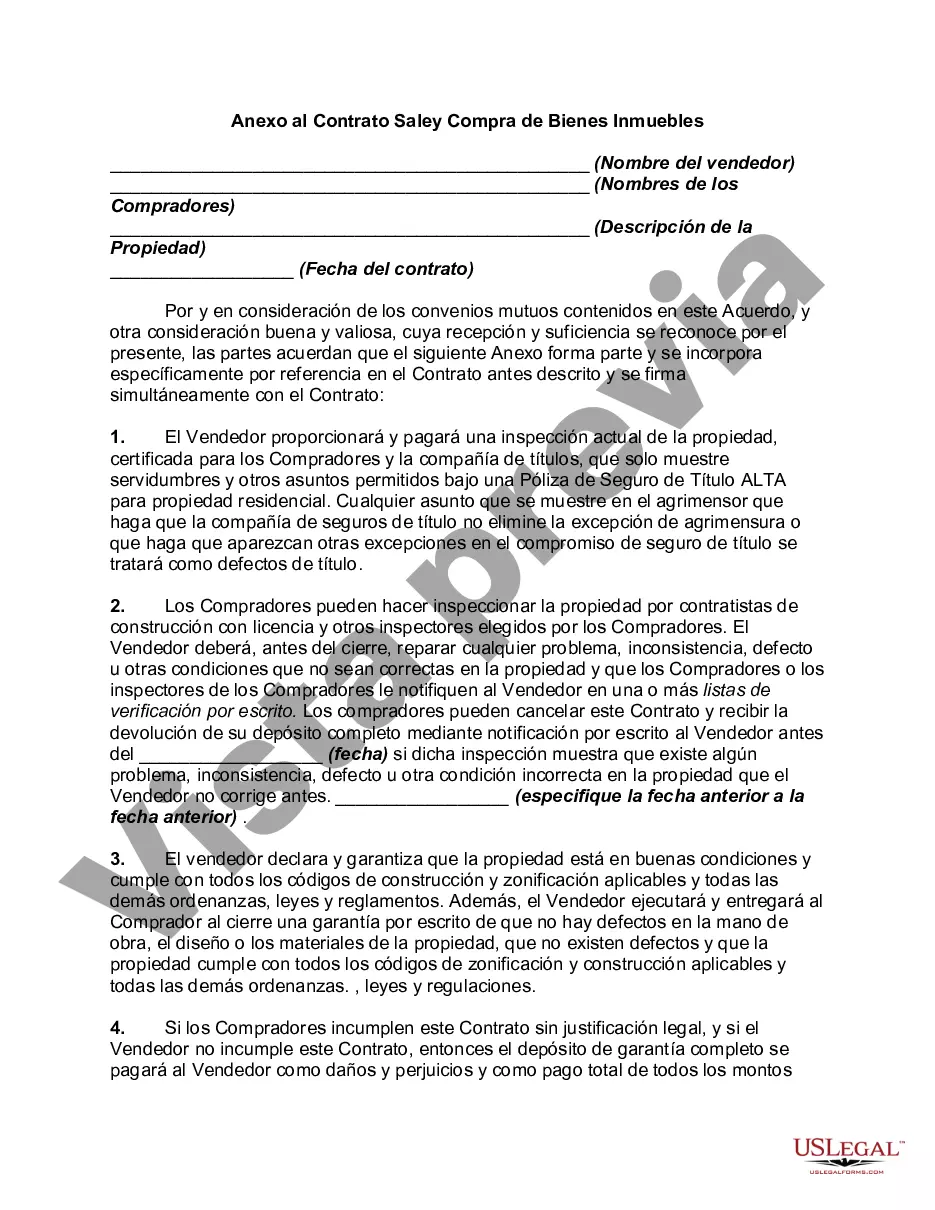

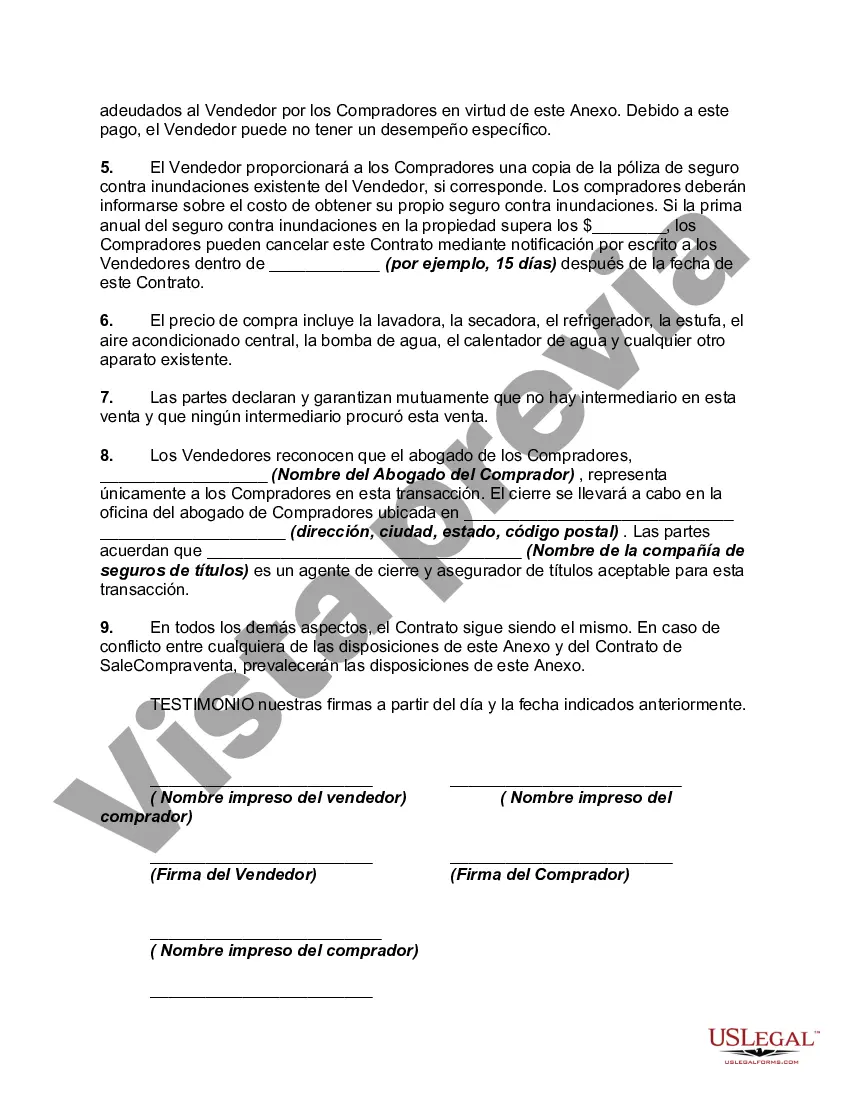

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Anexo al Contrato de Compraventa de Bienes Inmuebles - Addendum to Contract for Sale and Purchase of Real Property

Description

How to fill out Anexo Al Contrato De Compraventa De Bienes Inmuebles?

Drafting legal papers can be challenging. Moreover, if you choose to hire a legal expert to create a business contract, documents for property transfer, pre-nuptial agreement, divorce documents, or the San Diego Addendum to Contract for Sale and Purchase of Real Property, it might drain your finances significantly.

So, what is the optimal approach to save both time and resources while creating legitimate documents that adhere fully to your state and local regulations.

Examine the form description and utilize the Preview option, if accessible, to ensure it's the form you require. Don't worry if the form doesn't meet your criteria - search for the correct one in the header. Click Buy Now once you locate the desired sample and choose the most suitable subscription. Log In or create an account to buy your subscription. Process the payment using a credit card or through PayPal. Choose the document format for your San Diego Addendum to Contract for Sale and Purchase of Real Property and download it. Afterward, you can print it out and fill it in on paper or upload the template to an online editor for quicker and easier completion. US Legal Forms allows you to utilize all the documents previously obtained multiple times - you can find your templates in the My documents section of your profile. Give it a go now!

- US Legal Forms is a superb choice, whether you're in need of templates for personal or commercial purposes.

- US Legal Forms is the largest online repository of state-specific legal documents, offering users current and professionally verified forms for any situation all in one location.

- Therefore, if you require the latest edition of the San Diego Addendum to Contract for Sale and Purchase of Real Property, you can swiftly find it on our site.

- Acquiring the documents requires minimal time.

- Users with existing accounts should verify the status of their subscription, Log In, and select the form using the Download button.

- If you haven’t subscribed yet, here’s the process to obtain the San Diego Addendum to Contract for Sale and Purchase of Real Property.

- Review the page and confirm there is a sample applicable to your jurisdiction.