A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships. The duties owed by joint venturers to each are the same as those that partners owe to each other.

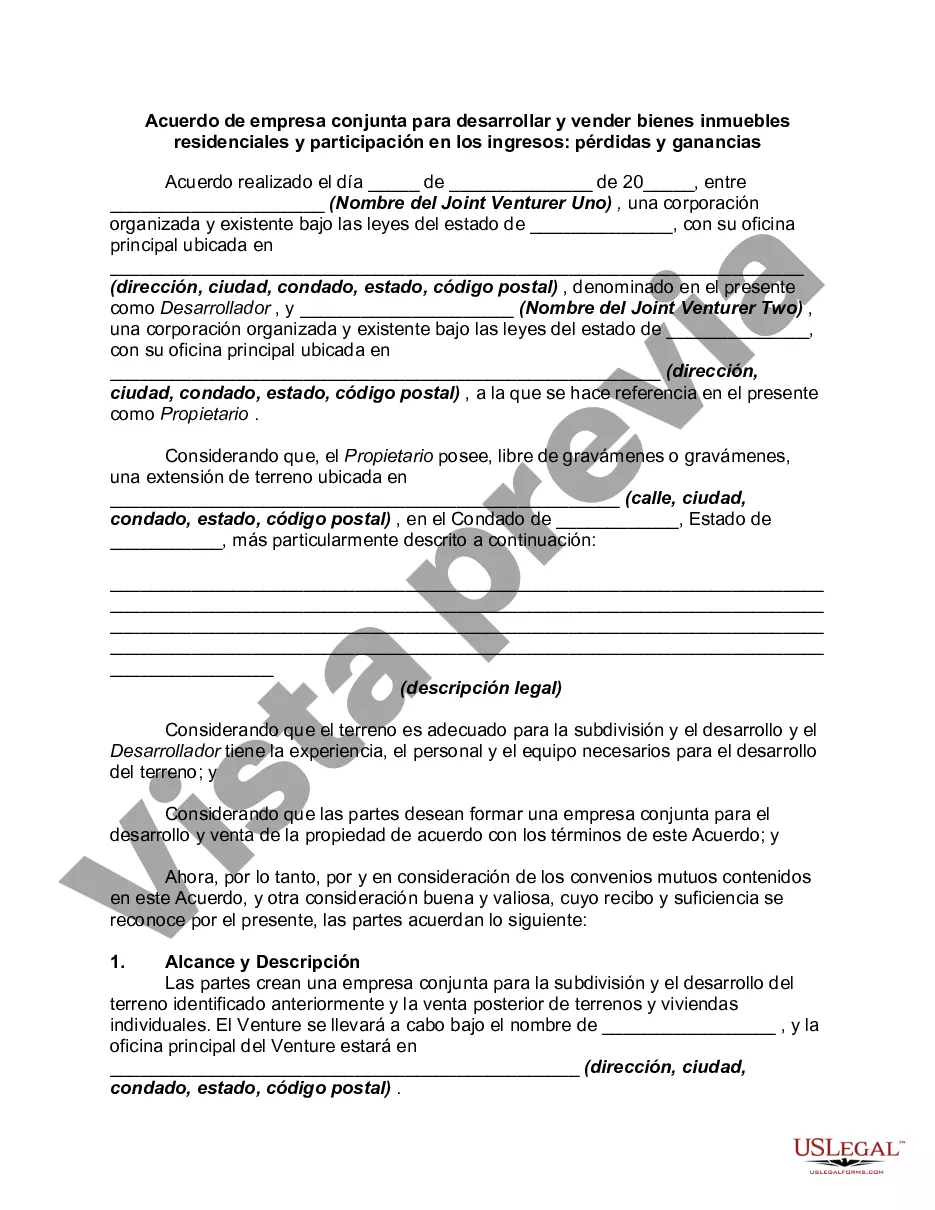

Collin Texas Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a legally binding contract entered into by two or more parties to jointly develop and sell residential real estate properties in Collin County, Texas. This agreement outlines the terms and conditions under which the joint venture will operate, including the sharing of revenues, profits, and losses. It is important to note that there are different types of Joint Venture Agreements in Collin, Texas. They can be categorized based on their specific focus or structure, such as: 1. Land Acquisition Joint Venture: This type of agreement occurs when the joint venture partners pool their resources to acquire land for residential real estate development in Collin County. The agreement specifies how the partners will contribute financially, the division of land ownership, and the sharing of profits and losses when the property is sold. 2. Development and Construction Joint Venture: In this type of joint venture, the partners collaborate to develop and construct residential properties in Collin County. The agreement details the roles and responsibilities of each partner, the financial contributions required for development and construction, and the sharing of revenue and expenses throughout the project. 3. Marketing and Sales Joint Venture: This type of agreement focuses on jointly marketing and selling residential real estate properties in Collin County. The partners collaborate on advertising, sales strategies, and customer acquisition efforts. The agreement outlines how the revenue generated from property sales will be shared between the partners, as well as the allocation of expenses and losses. 4. Property Management Joint Venture: This type of agreement involves partners collaborating to manage and maintain residential real estate properties in Collin County. The agreement specifies the responsibilities of each partner in property management, the division of revenue and expenses generated through rental income or property maintenance, and the sharing of any profits or losses incurred during the term of the agreement. In conclusion, the Collin Texas Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a comprehensive contract that dictates the terms and conditions for joint ventures focused on residential real estate development and sales in Collin County, Texas. It is essential for all parties involved to carefully review and understand the agreement, ensuring a clear understanding of their obligations, rights, and the allocation of revenues, expenses, profits, and losses as per the specific type of joint venture involved.Collin Texas Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a legally binding contract entered into by two or more parties to jointly develop and sell residential real estate properties in Collin County, Texas. This agreement outlines the terms and conditions under which the joint venture will operate, including the sharing of revenues, profits, and losses. It is important to note that there are different types of Joint Venture Agreements in Collin, Texas. They can be categorized based on their specific focus or structure, such as: 1. Land Acquisition Joint Venture: This type of agreement occurs when the joint venture partners pool their resources to acquire land for residential real estate development in Collin County. The agreement specifies how the partners will contribute financially, the division of land ownership, and the sharing of profits and losses when the property is sold. 2. Development and Construction Joint Venture: In this type of joint venture, the partners collaborate to develop and construct residential properties in Collin County. The agreement details the roles and responsibilities of each partner, the financial contributions required for development and construction, and the sharing of revenue and expenses throughout the project. 3. Marketing and Sales Joint Venture: This type of agreement focuses on jointly marketing and selling residential real estate properties in Collin County. The partners collaborate on advertising, sales strategies, and customer acquisition efforts. The agreement outlines how the revenue generated from property sales will be shared between the partners, as well as the allocation of expenses and losses. 4. Property Management Joint Venture: This type of agreement involves partners collaborating to manage and maintain residential real estate properties in Collin County. The agreement specifies the responsibilities of each partner in property management, the division of revenue and expenses generated through rental income or property maintenance, and the sharing of any profits or losses incurred during the term of the agreement. In conclusion, the Collin Texas Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a comprehensive contract that dictates the terms and conditions for joint ventures focused on residential real estate development and sales in Collin County, Texas. It is essential for all parties involved to carefully review and understand the agreement, ensuring a clear understanding of their obligations, rights, and the allocation of revenues, expenses, profits, and losses as per the specific type of joint venture involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.