A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships. The duties owed by joint venturers to each are the same as those that partners owe to each other.

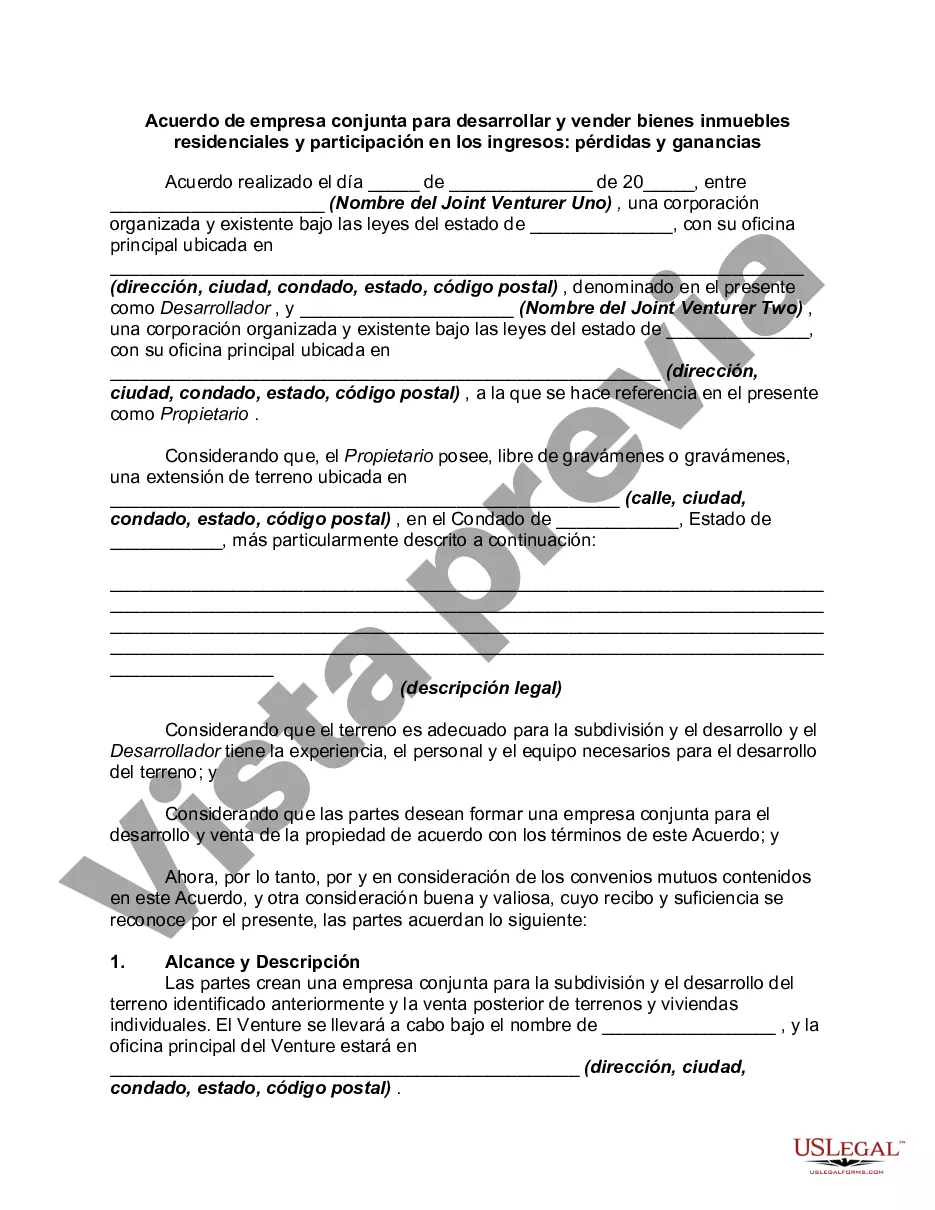

A Hennepin Minnesota Joint Venture Agreement to Develop and Sell Residential Real Property is a legal contract between two or more parties who agree to collaborate and pool resources for the development and sale of residential real estate in Hennepin County, Minnesota. This agreement outlines the terms and conditions that govern the joint venture, including the sharing of revenue, profits, and losses between the parties involved. Keywords: Hennepin Minnesota, joint venture agreement, develop, sell, residential real property, share revenue, profits, losses Types of Hennepin Minnesota Joint Venture Agreement to Develop and Sell Residential Real Property and Share Revenue — Profits and Losses: 1. Equity-Based Joint Venture Agreement: This type of agreement involves partners contributing capital or property as equity, with the revenue, profits, and losses shared based on the percentage of contribution. Each partner has a share in the ownership and decision-making process according to their equity stake. 2. Profit-Sharing Joint Venture Agreement: In this agreement, the revenue, profits, and losses are distributed based on a predetermined profit-sharing ratio agreed upon by the parties. This ratio can be based on each party's contribution, effort, or other factors as negotiated. 3. Loss-Sharing Joint Venture Agreement: Sometimes, parties may agree to bear losses collectively in a joint venture. In this type of agreement, all partners share the losses in equal proportions, regardless of their individual contributions. 4. Landowner — Developer Joint Venture Agreement: This type of joint venture involves a landowner and a developer collaborating to develop and sell residential real property. The landowner contributes the land, while the developer provides the expertise and financial resources necessary for the development. Revenue, profits, and losses are typically shared based on a predetermined distribution scheme negotiated between the parties involved. 5. Contractor — Developer Joint Venture Agreement: This agreement brings together a contractor and a developer to develop and sell residential real property. The contractor provides construction services, and the developer contributes financing, project management, and marketing expertise. The sharing of revenue, profits, and losses can be structured based on various factors, such as the performance of each party or a predetermined percentage split. In conclusion, a Hennepin Minnesota Joint Venture Agreement to Develop and Sell Residential Real Property and Share Revenue — Profits and Losses is a legal document that outlines the partnership terms for collaborating on the development and sale of residential real estate in Hennepin County. The agreement can take different forms depending on the specific circumstances and objectives of the parties involved.A Hennepin Minnesota Joint Venture Agreement to Develop and Sell Residential Real Property is a legal contract between two or more parties who agree to collaborate and pool resources for the development and sale of residential real estate in Hennepin County, Minnesota. This agreement outlines the terms and conditions that govern the joint venture, including the sharing of revenue, profits, and losses between the parties involved. Keywords: Hennepin Minnesota, joint venture agreement, develop, sell, residential real property, share revenue, profits, losses Types of Hennepin Minnesota Joint Venture Agreement to Develop and Sell Residential Real Property and Share Revenue — Profits and Losses: 1. Equity-Based Joint Venture Agreement: This type of agreement involves partners contributing capital or property as equity, with the revenue, profits, and losses shared based on the percentage of contribution. Each partner has a share in the ownership and decision-making process according to their equity stake. 2. Profit-Sharing Joint Venture Agreement: In this agreement, the revenue, profits, and losses are distributed based on a predetermined profit-sharing ratio agreed upon by the parties. This ratio can be based on each party's contribution, effort, or other factors as negotiated. 3. Loss-Sharing Joint Venture Agreement: Sometimes, parties may agree to bear losses collectively in a joint venture. In this type of agreement, all partners share the losses in equal proportions, regardless of their individual contributions. 4. Landowner — Developer Joint Venture Agreement: This type of joint venture involves a landowner and a developer collaborating to develop and sell residential real property. The landowner contributes the land, while the developer provides the expertise and financial resources necessary for the development. Revenue, profits, and losses are typically shared based on a predetermined distribution scheme negotiated between the parties involved. 5. Contractor — Developer Joint Venture Agreement: This agreement brings together a contractor and a developer to develop and sell residential real property. The contractor provides construction services, and the developer contributes financing, project management, and marketing expertise. The sharing of revenue, profits, and losses can be structured based on various factors, such as the performance of each party or a predetermined percentage split. In conclusion, a Hennepin Minnesota Joint Venture Agreement to Develop and Sell Residential Real Property and Share Revenue — Profits and Losses is a legal document that outlines the partnership terms for collaborating on the development and sale of residential real estate in Hennepin County. The agreement can take different forms depending on the specific circumstances and objectives of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.