A joint venture is a relationship between two or more people who combine their labor or property for a single business undertaking. They share profits and losses equally, or as otherwise provided in the joint venture agreement. The single business undertaking aspect is a key to determining whether or not a business entity is a joint venture as opposed to a partnership.

A joint venture is very similar to a partnership. In fact, some States treat joint ventures the same as partnerships with regard to partnership statutes such as the Uniform Partnership Act. The main difference between a partnership and a joint venture is that a joint venture usually relates to the pursuit of a single transaction or enterprise even though this may require several years to accomplish. A partnership is generally a continuing or ongoing business or activity. While a partnership may be expressly created for a single transaction, this is very unusual. Most Courts hold that joint ventures are subject to the same principles of law as partnerships. The duties owed by joint venturers to each are the same as those that partners owe to each other.

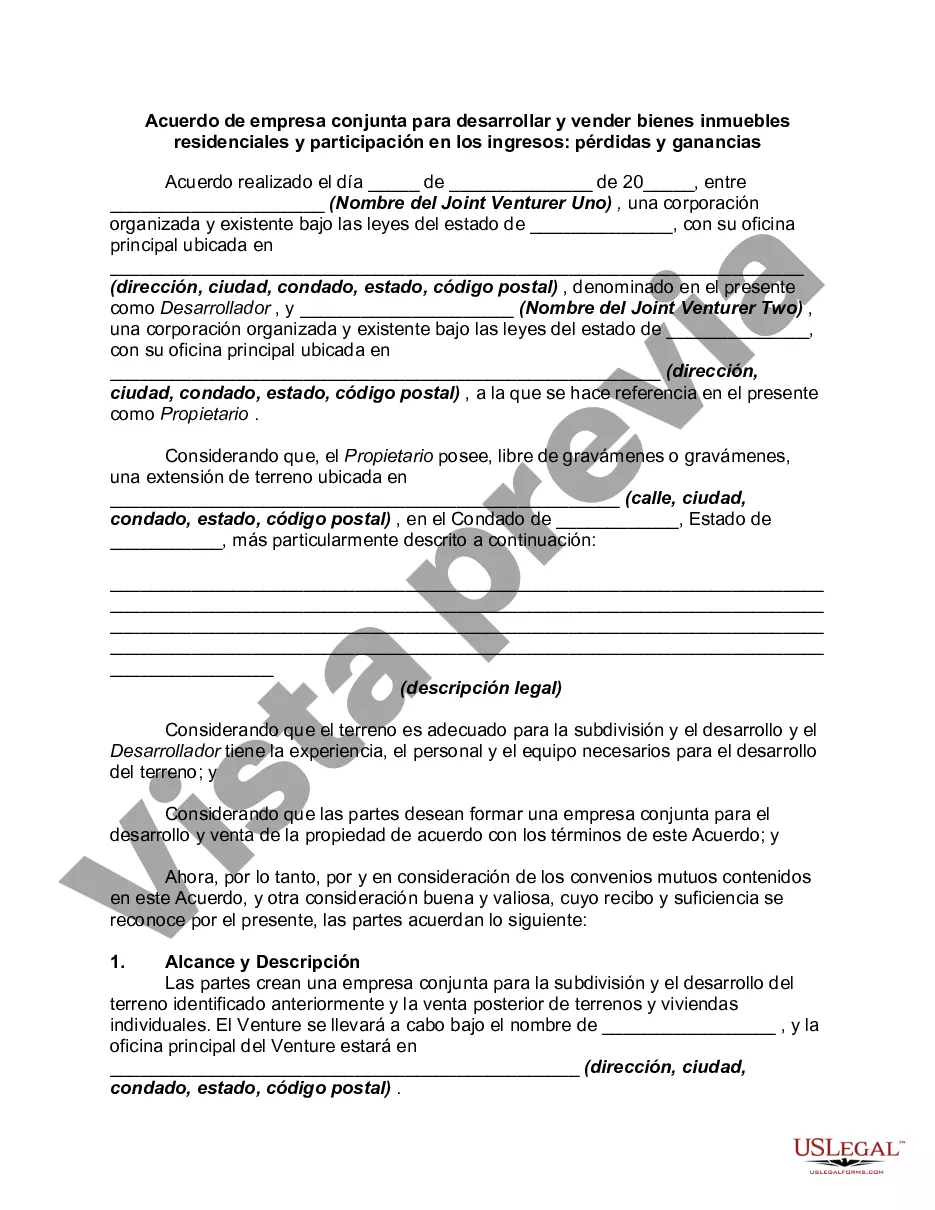

A Montgomery Maryland Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a legally binding contract that sets forth the terms and conditions for a partnership between two or more parties to develop and sell residential real estate in the Montgomery County area of Maryland. This partnership aims to share both the profits and losses incurred during the project. Key elements of this agreement will include the following: 1. Parties Involved: Clearly define the names and contact information of all parties entering into the joint venture. In this case, it will involve individuals or entities interested in developing and selling residential properties in Montgomery County, Maryland. 2. Purpose: State the objective of the joint venture, which is to develop and sell residential real estate in the Montgomery County area. This can include the construction of new properties, renovation of existing structures, or any other real estate development projects related to residential properties. 3. Contribution of Capital: Describe the financial contributions each party will make to fund the project. This may include cash investments, land, services, or other valuable assets. The agreement should outline the specific amounts and timing of these contributions. 4. Roles and Responsibilities: Define the responsibilities of each party involved, such as securing permits, managing construction, marketing, sales, and any other tasks related to the development and sale of residential properties. This section should also outline decision-making processes and dispute resolution mechanisms. 5. Profit and Loss Sharing: Detail how the revenue, profits, and losses from the joint venture will be allocated among the parties. Common methods include percentage-based sharing, wherein profits or losses are distributed according to the initial capital contributions or a predetermined ratio agreed upon by the parties. 6. Ownership and Transfer of Property: Address the ownership of the developed properties and the mechanisms for transferring ownership. This may include provisions for the sale or rental of completed properties and guidelines for the division of proceeds between parties. 7. Term and Termination: Specify the duration of the joint venture and any specific milestones or deadlines. Additionally, outline circumstances under which the agreement may be terminated by either party, including breach of contract, insolvency, or failure to meet agreed-upon terms. Types of Montgomery Maryland Joint Venture Agreements to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses may vary based on the size and nature of the project. Examples could include: 1. Small-Scale Residential Development Joint Venture Agreement: This type of agreement may be applicable for a joint venture involving a few individuals or entities coming together to develop and sell a limited number of residential properties within a specific community or neighborhood in Montgomery County. 2. Large-Scale Residential Development Joint Venture Agreement: This agreement is designed for more extensive residential development projects involving multiple parties, substantial capital investment, and the construction of a significant number of residential properties. This could include the development of entire communities or residential complexes. 3. Renovation and Flip Joint Venture Agreement: This type of joint venture focuses on purchasing existing residential properties in need of renovation, making necessary enhancements, and then selling them for a profit. The agreement would outline the responsibilities, costs, profit-sharing, and potential risks associated with renovating and selling properties in Montgomery County. In summary, a Montgomery Maryland Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a comprehensive legal document that establishes a partnership for the purpose of developing and selling residential properties in Montgomery County. The agreement clarifies the rights, responsibilities, and contributions of all involved parties and ensures a fair distribution of profits and losses.A Montgomery Maryland Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a legally binding contract that sets forth the terms and conditions for a partnership between two or more parties to develop and sell residential real estate in the Montgomery County area of Maryland. This partnership aims to share both the profits and losses incurred during the project. Key elements of this agreement will include the following: 1. Parties Involved: Clearly define the names and contact information of all parties entering into the joint venture. In this case, it will involve individuals or entities interested in developing and selling residential properties in Montgomery County, Maryland. 2. Purpose: State the objective of the joint venture, which is to develop and sell residential real estate in the Montgomery County area. This can include the construction of new properties, renovation of existing structures, or any other real estate development projects related to residential properties. 3. Contribution of Capital: Describe the financial contributions each party will make to fund the project. This may include cash investments, land, services, or other valuable assets. The agreement should outline the specific amounts and timing of these contributions. 4. Roles and Responsibilities: Define the responsibilities of each party involved, such as securing permits, managing construction, marketing, sales, and any other tasks related to the development and sale of residential properties. This section should also outline decision-making processes and dispute resolution mechanisms. 5. Profit and Loss Sharing: Detail how the revenue, profits, and losses from the joint venture will be allocated among the parties. Common methods include percentage-based sharing, wherein profits or losses are distributed according to the initial capital contributions or a predetermined ratio agreed upon by the parties. 6. Ownership and Transfer of Property: Address the ownership of the developed properties and the mechanisms for transferring ownership. This may include provisions for the sale or rental of completed properties and guidelines for the division of proceeds between parties. 7. Term and Termination: Specify the duration of the joint venture and any specific milestones or deadlines. Additionally, outline circumstances under which the agreement may be terminated by either party, including breach of contract, insolvency, or failure to meet agreed-upon terms. Types of Montgomery Maryland Joint Venture Agreements to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses may vary based on the size and nature of the project. Examples could include: 1. Small-Scale Residential Development Joint Venture Agreement: This type of agreement may be applicable for a joint venture involving a few individuals or entities coming together to develop and sell a limited number of residential properties within a specific community or neighborhood in Montgomery County. 2. Large-Scale Residential Development Joint Venture Agreement: This agreement is designed for more extensive residential development projects involving multiple parties, substantial capital investment, and the construction of a significant number of residential properties. This could include the development of entire communities or residential complexes. 3. Renovation and Flip Joint Venture Agreement: This type of joint venture focuses on purchasing existing residential properties in need of renovation, making necessary enhancements, and then selling them for a profit. The agreement would outline the responsibilities, costs, profit-sharing, and potential risks associated with renovating and selling properties in Montgomery County. In summary, a Montgomery Maryland Joint Venture Agreement to Develop and to Sell Residential Real Property and Share Revenue — Profits and Losses is a comprehensive legal document that establishes a partnership for the purpose of developing and selling residential properties in Montgomery County. The agreement clarifies the rights, responsibilities, and contributions of all involved parties and ensures a fair distribution of profits and losses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.