Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

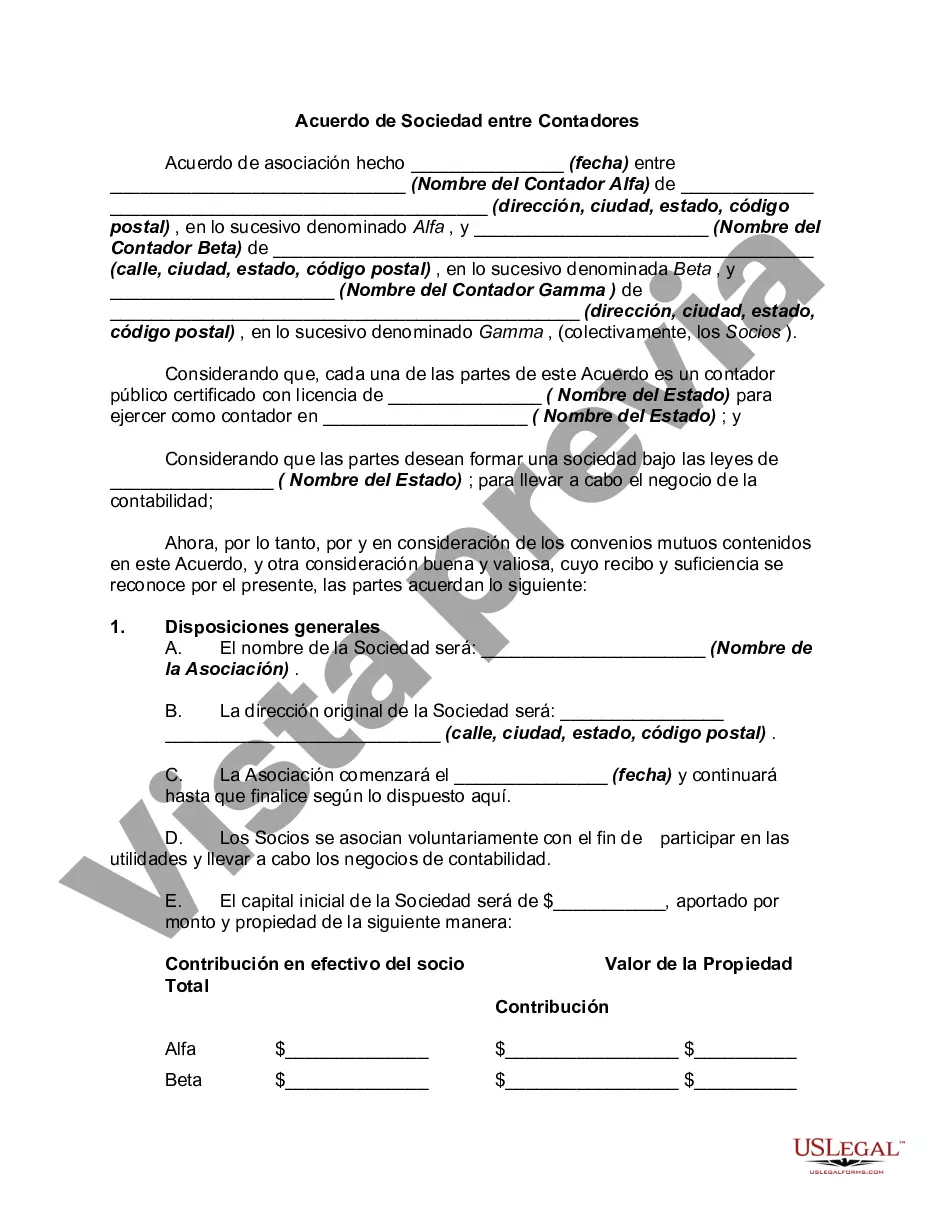

Contra Costa California Partnership Agreement Between Accountants is a legally binding document that outlines the terms and conditions governing the partnership between accountants in Contra Costa County, California. This agreement is crucial for establishing the roles, responsibilities, and obligations of the parties involved in the partnership. Key elements included in a Contra Costa California Partnership Agreement Between Accountants typically comprise the following: 1. Partnership Formation: This section covers the date of partnership formation and provides a brief overview of the purpose and objectives of the partnership. It specifies that the partnership is formed under the laws of Contra Costa County and complies with relevant state regulations. 2. Partners' Roles and Responsibilities: The agreement defines the roles and responsibilities of each partner, highlighting their specific areas of expertise and the scope of their authority in making financial decisions on behalf of the partnership. 3. Capital Contributions: This section outlines each partner's initial capital contribution to the partnership, which may be in the form of cash, assets, or other resources. It clarifies how additional capital contributions may be made and whether partners have an obligation or the option to make further investments. 4. Profit Sharing and Loss Allocation: The partnership agreement specifies the method by which profits and losses will be distributed among the partners. It may include an equal distribution or a predetermined ratio based on each partner's capital contribution or specific arrangements agreed upon by the partners. 5. Decision-Making and Voting: This section outlines how decisions will be made within the partnership, including major business decisions, daily operations, and financial matters. It may specify whether voting power is based on capital contributions or if unanimous consent is necessary for certain decisions. 6. Partnership Dissolution or Withdrawal: The agreement includes provisions for dissolving the partnership or allowing partners to withdraw from the partnership before its completion. It provides guidelines for the distribution of remaining assets and liabilities in case of dissolution. Different types of Contra Costa California Partnership Agreements Between Accountants can vary based on the specific needs and preferences of the partners. Some examples include: 1. General Partnership Agreement: This is the most common type of partnership agreement, wherein partners share equal rights, responsibilities, and liabilities. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who manage the business and have unlimited liability, while limited partners contribute capital but have limited liability and lesser involvement in decision-making. 3. Professional Partnership Agreement: This agreement is specific to partnerships formed by professional accountants, and it may include clauses addressing client confidentiality, ethical considerations, and professional conduct. 4. Limited Liability Partnership Agreement: This type of agreement offers partners limited liability protection, allowing them to shield personal assets from partnership obligations to some extent. 5. Joint Venture Partnership Agreement: This agreement is formed when two or more accounting firms come together for a specific project or business endeavor, usually with a defined timeline or purpose. In summary, a Contra Costa California Partnership Agreement Between Accountants is a legal contract that establishes the terms and conditions of a partnership between accountants in Contra Costa County. It covers various aspects such as partnership formation, partners' roles and responsibilities, capital contributions, profit sharing, decision-making, and the dissolution or withdrawal process. Different types of partnership agreements can exist, including general partnerships, limited partnerships, professional partnerships, limited liability partnerships, or joint venture partnership agreements.Contra Costa California Partnership Agreement Between Accountants is a legally binding document that outlines the terms and conditions governing the partnership between accountants in Contra Costa County, California. This agreement is crucial for establishing the roles, responsibilities, and obligations of the parties involved in the partnership. Key elements included in a Contra Costa California Partnership Agreement Between Accountants typically comprise the following: 1. Partnership Formation: This section covers the date of partnership formation and provides a brief overview of the purpose and objectives of the partnership. It specifies that the partnership is formed under the laws of Contra Costa County and complies with relevant state regulations. 2. Partners' Roles and Responsibilities: The agreement defines the roles and responsibilities of each partner, highlighting their specific areas of expertise and the scope of their authority in making financial decisions on behalf of the partnership. 3. Capital Contributions: This section outlines each partner's initial capital contribution to the partnership, which may be in the form of cash, assets, or other resources. It clarifies how additional capital contributions may be made and whether partners have an obligation or the option to make further investments. 4. Profit Sharing and Loss Allocation: The partnership agreement specifies the method by which profits and losses will be distributed among the partners. It may include an equal distribution or a predetermined ratio based on each partner's capital contribution or specific arrangements agreed upon by the partners. 5. Decision-Making and Voting: This section outlines how decisions will be made within the partnership, including major business decisions, daily operations, and financial matters. It may specify whether voting power is based on capital contributions or if unanimous consent is necessary for certain decisions. 6. Partnership Dissolution or Withdrawal: The agreement includes provisions for dissolving the partnership or allowing partners to withdraw from the partnership before its completion. It provides guidelines for the distribution of remaining assets and liabilities in case of dissolution. Different types of Contra Costa California Partnership Agreements Between Accountants can vary based on the specific needs and preferences of the partners. Some examples include: 1. General Partnership Agreement: This is the most common type of partnership agreement, wherein partners share equal rights, responsibilities, and liabilities. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who manage the business and have unlimited liability, while limited partners contribute capital but have limited liability and lesser involvement in decision-making. 3. Professional Partnership Agreement: This agreement is specific to partnerships formed by professional accountants, and it may include clauses addressing client confidentiality, ethical considerations, and professional conduct. 4. Limited Liability Partnership Agreement: This type of agreement offers partners limited liability protection, allowing them to shield personal assets from partnership obligations to some extent. 5. Joint Venture Partnership Agreement: This agreement is formed when two or more accounting firms come together for a specific project or business endeavor, usually with a defined timeline or purpose. In summary, a Contra Costa California Partnership Agreement Between Accountants is a legal contract that establishes the terms and conditions of a partnership between accountants in Contra Costa County. It covers various aspects such as partnership formation, partners' roles and responsibilities, capital contributions, profit sharing, decision-making, and the dissolution or withdrawal process. Different types of partnership agreements can exist, including general partnerships, limited partnerships, professional partnerships, limited liability partnerships, or joint venture partnership agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.