Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

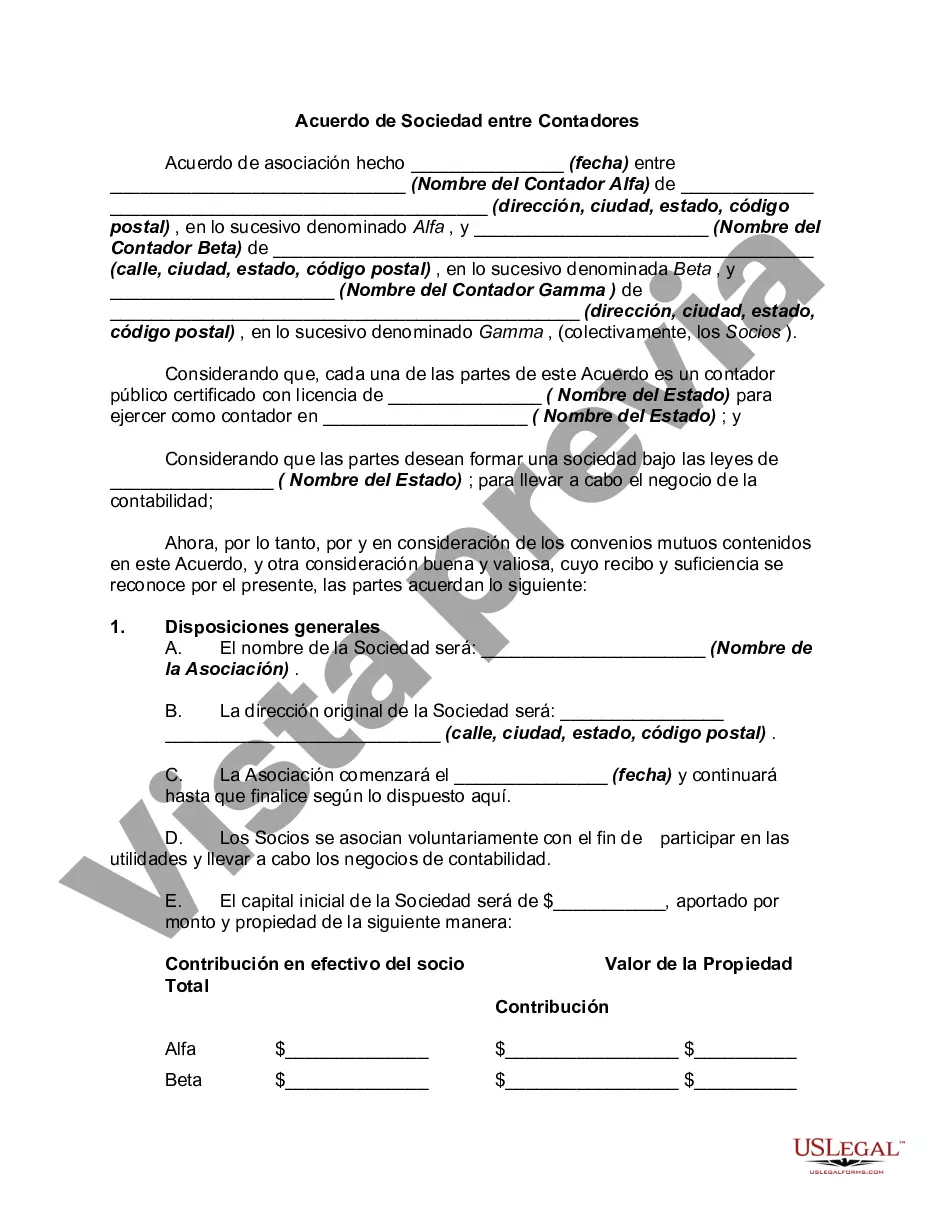

Maricopa Arizona Partnership Agreement Between Accountants is a legally binding document that outlines the terms and conditions agreed upon by two or more accountants who wish to establish a partnership within the Maricopa region of Arizona. This agreement serves as the foundation for the partnership, ensuring clarity and transparency in all financial and operational aspects. The Maricopa Arizona Partnership Agreement Between Accountants governs various critical aspects of the partnership, including the roles and responsibilities of each partner, profit and loss sharing ratios, decision-making procedures, contribution of capital and assets, dispute resolution mechanisms, and the duration and termination terms of the partnership. This type of agreement is applicable to different kinds of partnerships involving accountants in Maricopa, Arizona. Some common types include: 1. General Partnership Agreement: This agreement is formed when two or more accountants decide to come together and operate a business jointly. All partners bear unlimited liability for the debts and obligations of the partnership. Each partner contributes capital and shares equal responsibility for managing the daily operations. 2. Limited Partnership Agreement: In this type of agreement, there are both general partners and limited partners. General partners have unlimited liability and participate in the management of the partnership, while limited partners contribute capital but have limited liability and are not involved in the day-to-day decision-making. 3. Professional Partnership Agreement: This agreement is specifically tailored for partnerships involving professional accountants in Maricopa, Arizona. It addresses the regulations and ethical standards of the accounting profession, highlighting the responsibility of each partner to uphold professional conduct and provide quality accounting services to clients. 4. Joint Venture Agreement: A joint venture partnership agreement is formed when two or more accountants collaborate for a specific project or set of projects with a defined objective and timeline. This agreement outlines the scope of the joint venture, profit-sharing arrangements, and the roles and responsibilities of each partner. In conclusion, the Maricopa Arizona Partnership Agreement Between Accountants is a comprehensive document that establishes the framework for various types of partnerships in the accounting sector in Maricopa, Arizona. It ensures clear communication, defined responsibilities, and fair distribution of profits and losses, ultimately paving the way for a successful and legally sound partnership.Maricopa Arizona Partnership Agreement Between Accountants is a legally binding document that outlines the terms and conditions agreed upon by two or more accountants who wish to establish a partnership within the Maricopa region of Arizona. This agreement serves as the foundation for the partnership, ensuring clarity and transparency in all financial and operational aspects. The Maricopa Arizona Partnership Agreement Between Accountants governs various critical aspects of the partnership, including the roles and responsibilities of each partner, profit and loss sharing ratios, decision-making procedures, contribution of capital and assets, dispute resolution mechanisms, and the duration and termination terms of the partnership. This type of agreement is applicable to different kinds of partnerships involving accountants in Maricopa, Arizona. Some common types include: 1. General Partnership Agreement: This agreement is formed when two or more accountants decide to come together and operate a business jointly. All partners bear unlimited liability for the debts and obligations of the partnership. Each partner contributes capital and shares equal responsibility for managing the daily operations. 2. Limited Partnership Agreement: In this type of agreement, there are both general partners and limited partners. General partners have unlimited liability and participate in the management of the partnership, while limited partners contribute capital but have limited liability and are not involved in the day-to-day decision-making. 3. Professional Partnership Agreement: This agreement is specifically tailored for partnerships involving professional accountants in Maricopa, Arizona. It addresses the regulations and ethical standards of the accounting profession, highlighting the responsibility of each partner to uphold professional conduct and provide quality accounting services to clients. 4. Joint Venture Agreement: A joint venture partnership agreement is formed when two or more accountants collaborate for a specific project or set of projects with a defined objective and timeline. This agreement outlines the scope of the joint venture, profit-sharing arrangements, and the roles and responsibilities of each partner. In conclusion, the Maricopa Arizona Partnership Agreement Between Accountants is a comprehensive document that establishes the framework for various types of partnerships in the accounting sector in Maricopa, Arizona. It ensures clear communication, defined responsibilities, and fair distribution of profits and losses, ultimately paving the way for a successful and legally sound partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.