Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

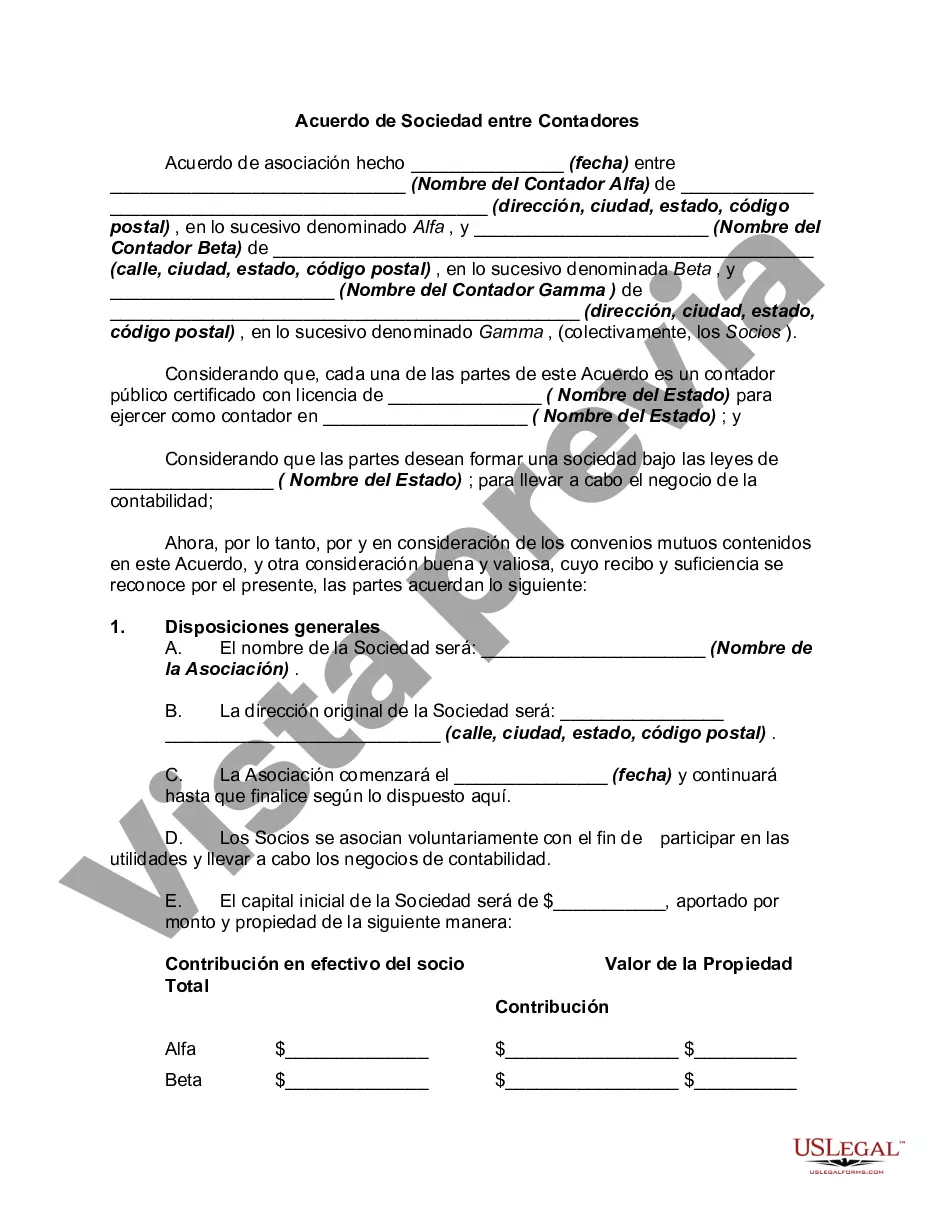

A partnership agreement between accountants in Phoenix, Arizona is a legally binding document that outlines the terms and conditions of a partnership between two or more accountants or accounting firms in the area. This type of agreement is crucial for establishing a successful partnership and ensuring that all parties involved are aware of their rights, responsibilities, and obligations. The purpose of a Phoenix Arizona partnership agreement between accountants is to establish a framework for the partnership, clarify the roles and responsibilities of each partner, outline profit-sharing and decision-making processes, and provide guidelines for resolving disputes or conflicts that may arise during the partnership. Key elements that are commonly included in a partnership agreement between accountants in Phoenix, Arizona may include: 1. Partnership Details: This section identifies the name of the partnership, its principal place of business, and the purpose of the partnership. 2. Duration: Specifies the duration of the partnership, whether it is for a fixed term or indefinite. 3. Capital Contributions: Outlines the initial and ongoing financial contributions made by each partner to the partnership. 4. Profit and Loss Allocation: Specifies how profits and losses will be allocated among partners, typically based on their agreed-upon contribution percentages or other criteria. 5. Decision-Making: Describes the decision-making processes within the partnership, such as voting rights, consensus requirements, or appointment of a managing partner. 6. Partner Roles and Responsibilities: Clearly defines the roles and responsibilities of each partner, outlining their specific duties and obligations to the partnership. 7. Partnership Dissolution: Outlines the procedures to be followed in the event that the partnership is dissolved, including the distribution of assets and liabilities. Phoenix Arizona may have different types of partnership agreements between accountants depending on the nature and structure of the partnership: 1. General Partnership Agreement: This is the most common type of partnership agreement, where each partner shares equal rights and responsibilities, as well as the profits and losses of the partnership. 2. Limited Partnership Agreement: In a limited partnership, there are general partners who assume management responsibilities and limited partners who contribute capital but have no active role in the business operations. 3. Limited Liability Partnership (LLP) Agreement: Laps provide liability protection for partners while maintaining flexibility in management and partnership structures. This type of partnership agreement is often preferred by accounting firms. In conclusion, a partnership agreement between accountants in Phoenix, Arizona is a vital legal document that establishes the framework and guidelines for a successful partnership, outlining the rights, duties, profit-sharing, and decision-making processes of the partners. Different types of partnership agreements, such as general partnerships, limited partnerships, and limited liability partnerships, can be found in Phoenix depending on the specific needs and preferences of the accountants or accounting firms involved.A partnership agreement between accountants in Phoenix, Arizona is a legally binding document that outlines the terms and conditions of a partnership between two or more accountants or accounting firms in the area. This type of agreement is crucial for establishing a successful partnership and ensuring that all parties involved are aware of their rights, responsibilities, and obligations. The purpose of a Phoenix Arizona partnership agreement between accountants is to establish a framework for the partnership, clarify the roles and responsibilities of each partner, outline profit-sharing and decision-making processes, and provide guidelines for resolving disputes or conflicts that may arise during the partnership. Key elements that are commonly included in a partnership agreement between accountants in Phoenix, Arizona may include: 1. Partnership Details: This section identifies the name of the partnership, its principal place of business, and the purpose of the partnership. 2. Duration: Specifies the duration of the partnership, whether it is for a fixed term or indefinite. 3. Capital Contributions: Outlines the initial and ongoing financial contributions made by each partner to the partnership. 4. Profit and Loss Allocation: Specifies how profits and losses will be allocated among partners, typically based on their agreed-upon contribution percentages or other criteria. 5. Decision-Making: Describes the decision-making processes within the partnership, such as voting rights, consensus requirements, or appointment of a managing partner. 6. Partner Roles and Responsibilities: Clearly defines the roles and responsibilities of each partner, outlining their specific duties and obligations to the partnership. 7. Partnership Dissolution: Outlines the procedures to be followed in the event that the partnership is dissolved, including the distribution of assets and liabilities. Phoenix Arizona may have different types of partnership agreements between accountants depending on the nature and structure of the partnership: 1. General Partnership Agreement: This is the most common type of partnership agreement, where each partner shares equal rights and responsibilities, as well as the profits and losses of the partnership. 2. Limited Partnership Agreement: In a limited partnership, there are general partners who assume management responsibilities and limited partners who contribute capital but have no active role in the business operations. 3. Limited Liability Partnership (LLP) Agreement: Laps provide liability protection for partners while maintaining flexibility in management and partnership structures. This type of partnership agreement is often preferred by accounting firms. In conclusion, a partnership agreement between accountants in Phoenix, Arizona is a vital legal document that establishes the framework and guidelines for a successful partnership, outlining the rights, duties, profit-sharing, and decision-making processes of the partners. Different types of partnership agreements, such as general partnerships, limited partnerships, and limited liability partnerships, can be found in Phoenix depending on the specific needs and preferences of the accountants or accounting firms involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.