Partnership agreements are written documents that explicitly detail the relationship between the business partners and their individual obligations and contributions to the partnership. Since partnership agreements should cover all possible business situations that could arise during the partnership's life, the documents are often complex; legal counsel in drafting and reviewing the finished contract is generally recommended. If a partnership does not have a partnership agreement in place when it dissolves, the guidelines of the Uniform Partnership Act and various state laws will determine how the assets and debts of the partnership are distributed.

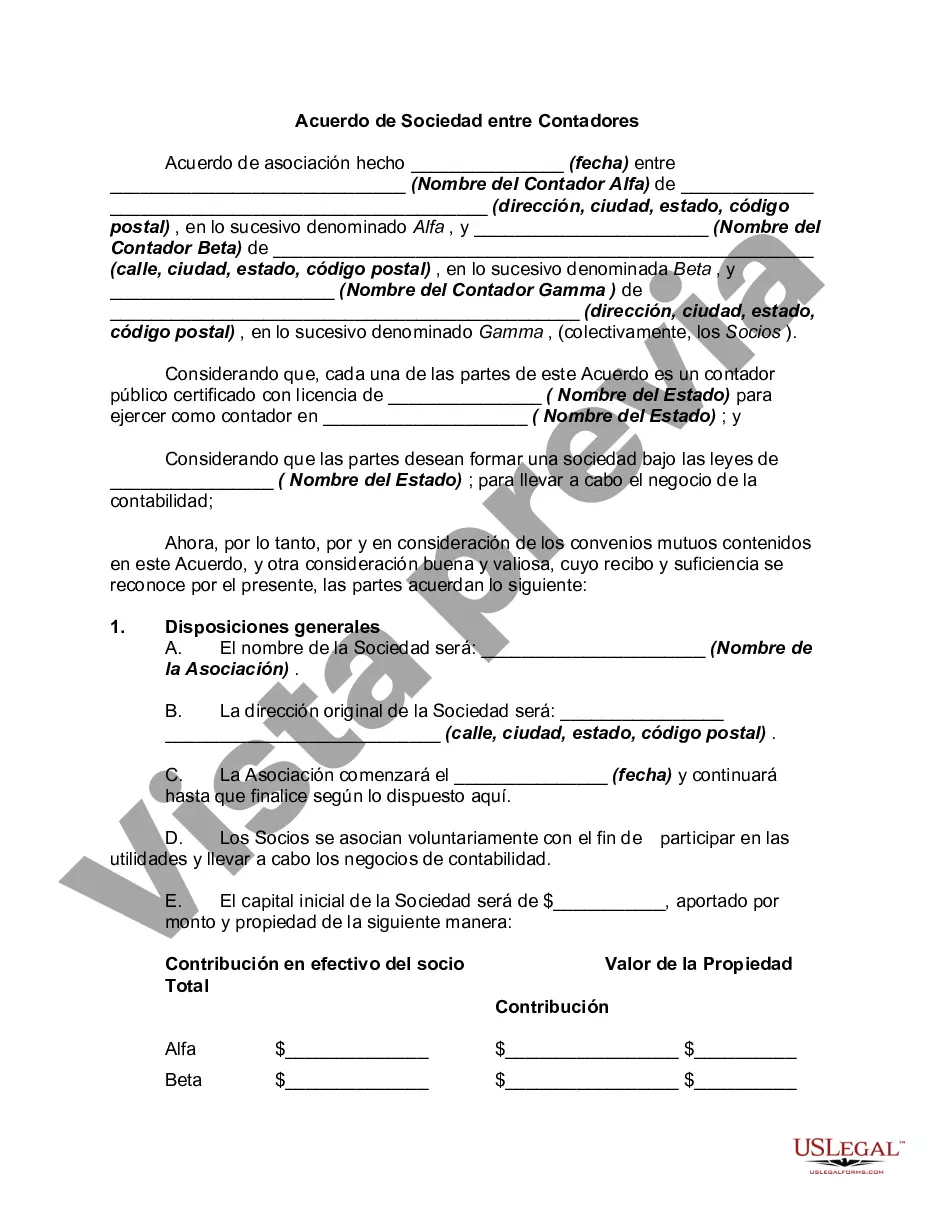

A San Antonio Texas Partnership Agreement between accountants is a legally binding document that outlines the terms and conditions of a partnership between two or more accountants or accounting firms in San Antonio, Texas. This agreement establishes a formal collaboration for the purpose of jointly providing accounting services to clients or collaborating on various accounting projects. Keywords: San Antonio Texas, Partnership Agreement, Accountants, Collaboration, Accounting Services, Clients, Collaboration. Types of San Antonio Texas Partnership Agreement Between Accountants: 1. General Partnership Agreement: This type of partnership agreement involves two or more accountants coming together to form a partnership where they pool their resources, expertise, and share the risks and profits equally. Each partner has equal rights and authority to make decisions on behalf of the partnership. 2. Limited Partnership Agreement: In a limited partnership agreement, there are two types of partners involved — general partners and limited partners. General partners are responsible for the day-to-day operations and management of the partnership, while limited partners contribute financially but have limited liability in the partnership's activities. 3. Limited Liability Partnership (LLP) Agreement: This partnership agreement provides liability protection to individual partners. It allows accountants to operate their accounting practice with the benefits of a partnership structure while limiting personal liability for the actions of other partners. 4. Joint Venture Partnership Agreement: A joint venture partnership agreement in San Antonio, Texas, refers to a temporary partnership between two or more accounting firms for a specific project or business venture. This agreement outlines the terms, goals, responsibilities, and profit-sharing arrangements for the joint venture. 5. Merger Partnership Agreement: A merger partnership agreement involves the consolidation of two or more accounting firms in San Antonio to form a single entity. This agreement lays out the terms and conditions regarding the allocation of assets, liabilities, client base, and the rights and obligations of each partner in the newly formed partnership. 6. Franchise Partnership Agreement: In a franchise partnership agreement, an accounting firm in San Antonio grants another accounting firm the right to use its brand, business model, and systems in a specified location. The franchise partner pays a fee or royalty to the original firm in exchange for this privilege. 7. Strategic Alliance Partnership Agreement: A strategic alliance partnership agreement enables two or more accounting firms to collaborate on specific projects or services without forming a formal partnership. This agreement outlines the terms, objectives, and responsibilities of each firm involved in the alliance. In San Antonio, Texas, these different types of partnership agreements between accountants cater to various business arrangements, allowing accountants to collaborate, share resources, and provide quality accounting services to clients effectively.A San Antonio Texas Partnership Agreement between accountants is a legally binding document that outlines the terms and conditions of a partnership between two or more accountants or accounting firms in San Antonio, Texas. This agreement establishes a formal collaboration for the purpose of jointly providing accounting services to clients or collaborating on various accounting projects. Keywords: San Antonio Texas, Partnership Agreement, Accountants, Collaboration, Accounting Services, Clients, Collaboration. Types of San Antonio Texas Partnership Agreement Between Accountants: 1. General Partnership Agreement: This type of partnership agreement involves two or more accountants coming together to form a partnership where they pool their resources, expertise, and share the risks and profits equally. Each partner has equal rights and authority to make decisions on behalf of the partnership. 2. Limited Partnership Agreement: In a limited partnership agreement, there are two types of partners involved — general partners and limited partners. General partners are responsible for the day-to-day operations and management of the partnership, while limited partners contribute financially but have limited liability in the partnership's activities. 3. Limited Liability Partnership (LLP) Agreement: This partnership agreement provides liability protection to individual partners. It allows accountants to operate their accounting practice with the benefits of a partnership structure while limiting personal liability for the actions of other partners. 4. Joint Venture Partnership Agreement: A joint venture partnership agreement in San Antonio, Texas, refers to a temporary partnership between two or more accounting firms for a specific project or business venture. This agreement outlines the terms, goals, responsibilities, and profit-sharing arrangements for the joint venture. 5. Merger Partnership Agreement: A merger partnership agreement involves the consolidation of two or more accounting firms in San Antonio to form a single entity. This agreement lays out the terms and conditions regarding the allocation of assets, liabilities, client base, and the rights and obligations of each partner in the newly formed partnership. 6. Franchise Partnership Agreement: In a franchise partnership agreement, an accounting firm in San Antonio grants another accounting firm the right to use its brand, business model, and systems in a specified location. The franchise partner pays a fee or royalty to the original firm in exchange for this privilege. 7. Strategic Alliance Partnership Agreement: A strategic alliance partnership agreement enables two or more accounting firms to collaborate on specific projects or services without forming a formal partnership. This agreement outlines the terms, objectives, and responsibilities of each firm involved in the alliance. In San Antonio, Texas, these different types of partnership agreements between accountants cater to various business arrangements, allowing accountants to collaborate, share resources, and provide quality accounting services to clients effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.