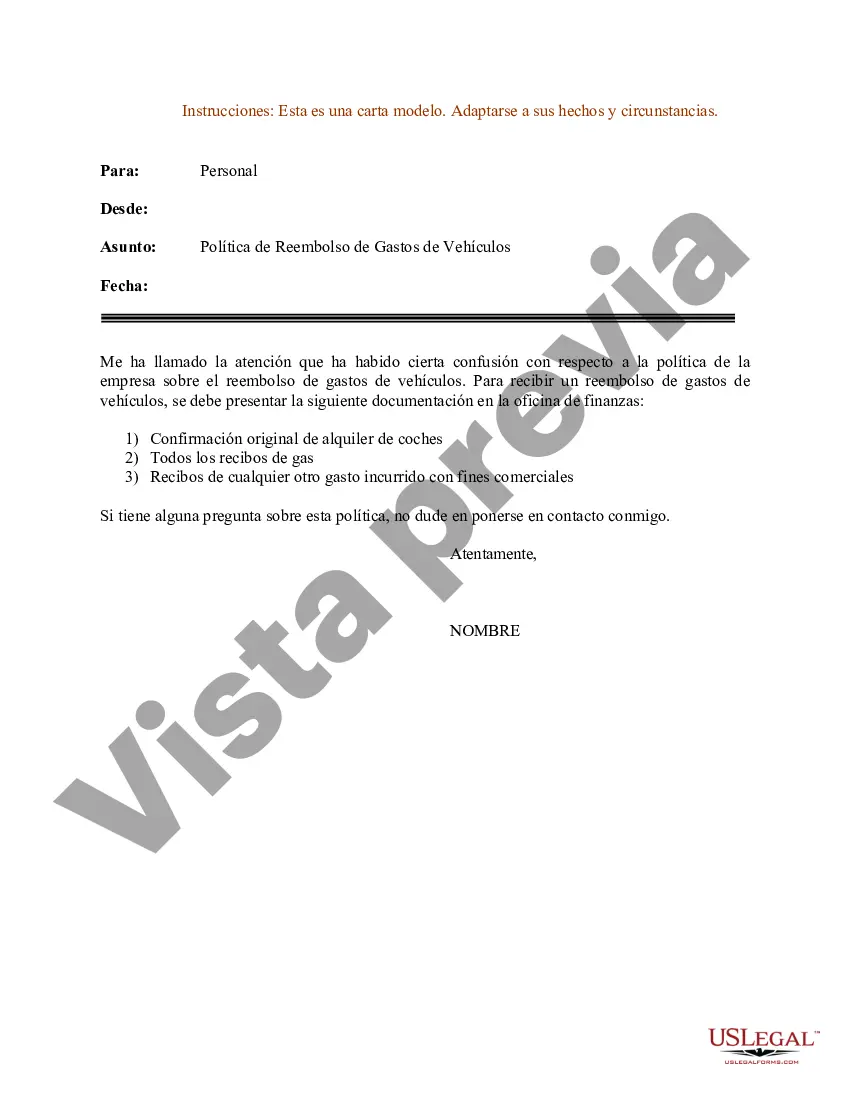

Dear [Employee], We are writing to inform you about the updated policy on vehicle expense reimbursement for employees residing or working in Fairfax, Virginia. This comprehensive policy is designed to ensure clarity and fairness in handling vehicle-related expenses incurred during work-related activities. The purpose of this policy is to streamline the process of reimbursement and set the guidelines for eligible expenses, as well as to provide a framework for employees to follow when using their personal vehicles for work purposes. By adhering to this policy, we aim to create an efficient and transparent system for both employees and the company. Key Points of the Fairfax Virginia Vehicle Expense Reimbursement Policy: 1. Eligibility: All employees who are authorized to use their personal vehicles for work-related activities are eligible for vehicle expense reimbursement. 2. Covered Expenses: The policy covers various expenses related to the use of a personal vehicle, including fuel, maintenance, repairs, insurance, parking fees, and toll charges. These expenses must be reasonable and necessary for the completion of work duties. 3. Mileage Reimbursement: Employees will be reimbursed for mileage incurred during work-related travel at the current IRS-approved rate per mile. To ensure accurate reimbursement, employees must keep a record of mileage driven for work purposes, including the starting and ending locations. 4. Required Documentation: To process vehicle expense reimbursement, the following documents must be submitted: a completed reimbursement form, a copy of the vehicle's registration and insurance, receipts for expenses incurred (fuel, maintenance, repairs, etc.), and a mileage log if applicable. 5. Approval Process: Prior approval from the supervisor or manager is required for any planned work-related travel using a personal vehicle. Failure to obtain approval may result in denial of reimbursement. 6. Limitations and Exceptions: The company reserves the right to make exceptions to this policy in special circumstances, which will be evaluated on a case-by-case basis. Personal vehicle use for commuting between home and the regular workplace is generally not eligible for reimbursement. Different Types of Fairfax Virginia Sample Letters for Policy on Vehicle Expense Reimbursement: 1. Regular Employee: This sample letter is suitable for all regular employees who are authorized to use their personal vehicles for work-related activities. 2. Remote Employee: This sample letter is intended for employees who work remotely in Fairfax, Virginia, and may occasionally need to use their personal vehicles for work purposes. 3. Sales Representative: This sample letter is tailored for sales representatives who heavily rely on their personal vehicles for client visits, product demonstrations, or other sales-related activities in Fairfax, Virginia. In conclusion, this Fairfax Virginia Vehicle Expense Reimbursement Policy aims to provide a fair and efficient process for employees to seek reimbursement for reasonable and necessary vehicle expenses incurred during work-related activities. By adhering to this policy, we create a supportive environment that acknowledges the efforts and expenses incurred by employees. Should you have any questions or require further clarification, please do not hesitate to contact the HR department. Sincerely, [Your Name] [Company Name]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Modelo de carta para la política de reembolso de gastos de vehículos - Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Fairfax Virginia Modelo De Carta Para La Política De Reembolso De Gastos De Vehículos?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Fairfax Sample Letter for Policy on Vehicle Expense Reimbursement, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Sample Letter for Policy on Vehicle Expense Reimbursement from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Fairfax Sample Letter for Policy on Vehicle Expense Reimbursement:

- Take a look at the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the document once you find the appropriate one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!