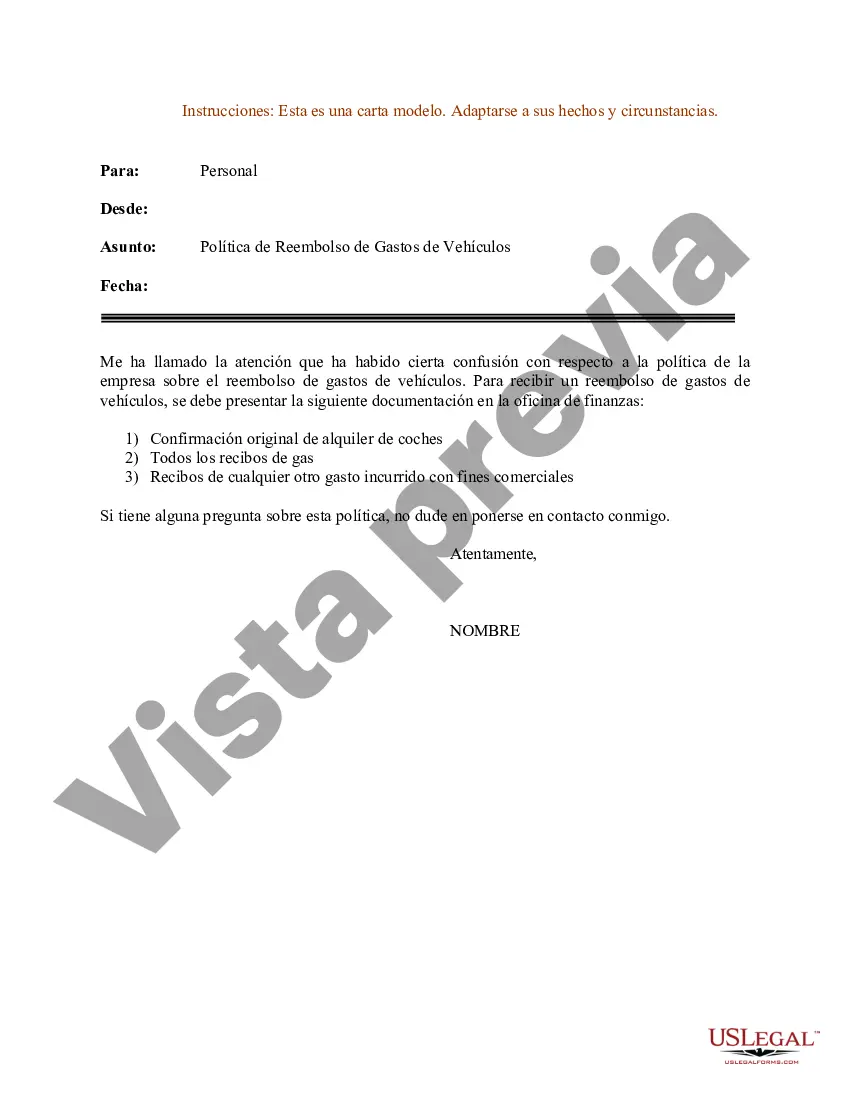

Title: Harris Texas Sample Letter for Policy on Vehicle Expense Reimbursement — Guidelines and Types Introduction: Harris Texas employers often need to establish clear policies regarding vehicle-related expense reimbursement to ensure fairness and compliance with applicable laws. A well-crafted sample letter for the policy can help employers communicate the guidelines effectively. In this article, we provide a detailed description of what a Harris Texas Sample Letter for Policy on Vehicle Expense Reimbursement entails, covering various types of policies based on different scenarios. Content: I. Overview and Purpose of the Policy — Why having a policcrucialia— - Ensuring equitable reimbursement for job-related vehicle expenses — Compliance with state and federal regulations II. General Guidelines for Vehicle Expense Reimbursement Policy — Clearly define eligible vehicle expenses (fuel, maintenance, insurance, etc.) — Specify expense documentation requirements (receipts, mileage logs, etc.) — Establish mileage reimbursement rates based on applicable standards (IRS, Harris Texas regulations) — Include limitations on personal use of company vehicles — Outline the process of submitting reimbursement requests and timelines III. Types of Harris Texas Sample Letter Policies on Vehicle Expense Reimbursement: 1. Employee-Owned Vehicles Policy: — Addressing reimbursement guidelines for employees using their own vehicles for work-related purposes — Specify the criteria for vehicle eligibility (e.g., properly registered and insured, meeting safety standards) — Provide details on mileage tracking methods and how reimbursement rates are calculated 2. Company-Owned Vehicles Policy: — Highlight the rules for employees utilizing company-owned vehicles for business purposes — Clarify the obligations of employees to care for the company vehicle and maintain necessary documentation — Outline potential consequences for policy violations or negligent behavior 3. Carpooling Policy: — Offer guidelines on vehicle expense reimbursement for employees participating in carpooling arrangements — Define how mileage will be calculated and distributed among carpool participants — Specify any additional requirements for participants, such as documenting each trip 4. Commuting Policy: — Address the reimbursement of expenses related to commuting to and from the workplace — Explain any conditions or limitations on reimbursement eligibility for commuting expenses — Include details on the preferred mode of transportation, if applicable (e.g., carpooling, public transportation) Conclusion: Crafting a comprehensive Harris Texas Sample Letter for Policy on Vehicle Expense Reimbursement is essential for employers to set clear expectations, ensure fair reimbursement practices, and comply with legal requirements. By tailoring the policy to specific scenarios (e.g., employee-owned vehicles, company-owned vehicles, carpooling, commuting), employers can provide clear guidelines to their workforce, fostering transparency and trust in the reimbursement process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Modelo de carta para la política de reembolso de gastos de vehículos - Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Harris Texas Modelo De Carta Para La Política De Reembolso De Gastos De Vehículos?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to generate Harris Sample Letter for Policy on Vehicle Expense Reimbursement without expert assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Harris Sample Letter for Policy on Vehicle Expense Reimbursement by yourself, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Harris Sample Letter for Policy on Vehicle Expense Reimbursement:

- Examine the page you've opened and check if it has the sample you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that suits your needs, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!