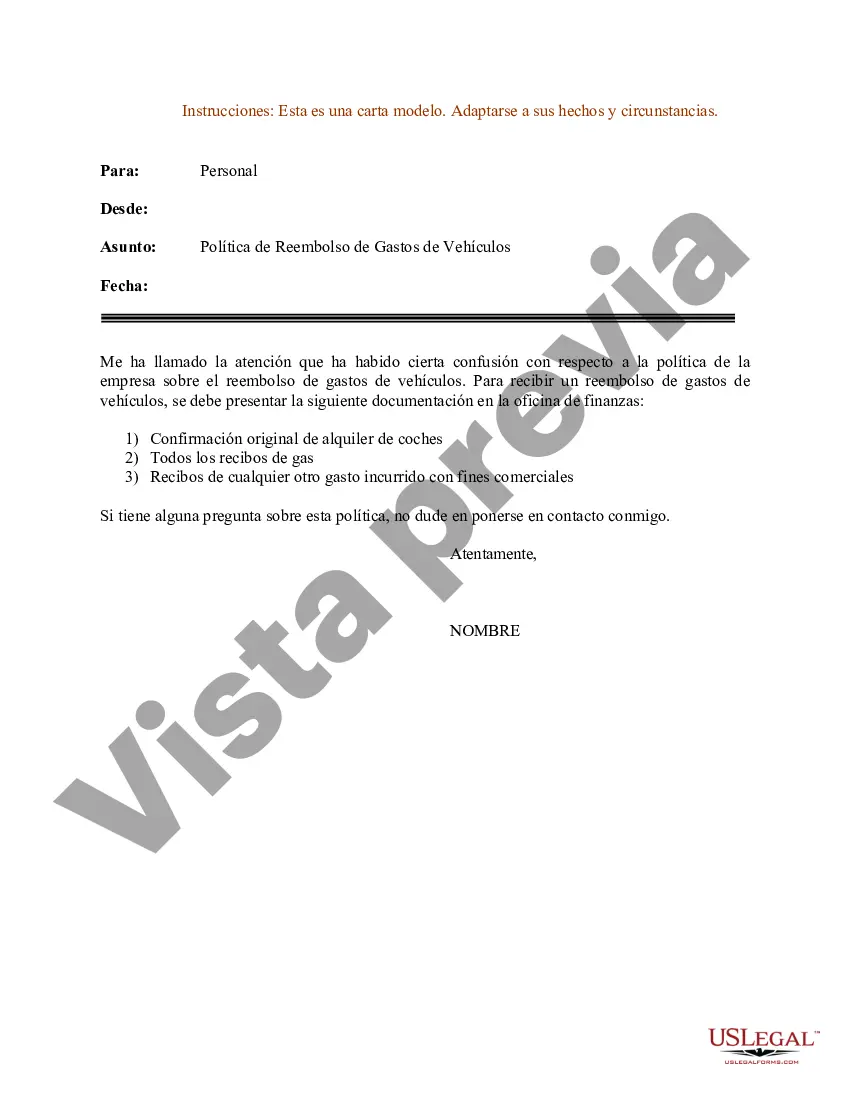

Title: Comprehensive Sample Letter for Policy on Vehicle Expense Reimbursement in Phoenix, Arizona Keywords: Phoenix, Arizona, vehicle expense reimbursement policy, guidelines, mileage reimbursement rates, reimbursement process, eligible expenses, fleet vehicle policy Dear [Employee's Name], Re: Policy on Vehicle Expense Reimbursement in Phoenix, Arizona We are pleased to present the comprehensive policy on vehicle expense reimbursement for Phoenix, Arizona, to ensure fair and accurate compensation for employees who utilize their personal vehicles for work-related purposes. Please carefully review the guidelines outlined below to understand the requisite regulations and procedures in this regard. 1. Purpose: The purpose of this policy is to provide employees with clear instructions for reimbursement of vehicle-related expenses incurred during the performance of business activities in Phoenix, Arizona. 2. Eligibility: All employees who use personal vehicles for work-related purposes, including travel to client meetings, running office errands or other job-specific tasks, are eligible for vehicle expense reimbursement. 3. Reimbursable Expenses: Reimbursable expenses include but are not limited to: a. Mileage: Employees will be reimbursed for the business miles driven based on the approved mileage reimbursement rate set by the company and the Internal Revenue Service (IRS). b. Fuel: Employees may submit valid receipts for fuel purchased while conducting business tasks within Phoenix, Arizona. c. Parking and Tolls: Valid expenses related to parking fees and tolls incurred during business-related activities can be submitted for reimbursement. d. Maintenance and Repairs: Reasonable and necessary expenses related to the maintenance and repairs of the vehicle, directly resulting from business-related activities within Phoenix, Arizona, are eligible for reimbursement. 4. Mileage Reimbursement Rate: The mileage reimbursement rate will be consistent with the rates set by the company and in accordance with the current IRS guidelines. The rate is subject to change based on local economic conditions, policy updates, or government regulations, and employees will be notified accordingly. 5. Reimbursement Process: To be eligible for reimbursement, employees must: a. Maintain accurate and detailed records of mileage, dates, purpose, and destination of each trip using the approved company format. b. Complete the expense reimbursement form, available on our company's internal portal, providing all necessary information and attaching the relevant receipts. c. Submit the completed reimbursement form to the designated department within [number of days] following the completion of the business activity or trip. 6. Fleet Vehicle Policy: For employees who have access to company-owned vehicles, the policy and procedure for usage and reimbursement will differ. The separate fleet vehicle policy provides comprehensive guidelines for those specific cases. Please familiarize yourself with the Phoenix, Arizona, Fleet Vehicle Policy if you are a designated employee with access to company vehicles. In conclusion, this policy is designed to facilitate fair and accurate reimbursement for employees who utilize personal vehicles for business purposes in Phoenix, Arizona. Should you have any questions or require further clarification, please contact the Human Resources department. Thank you for your cooperation in adhering to these guidelines, which will take effect starting [effective date]. Sincerely, [Your Name] [Your Title/Position] [Company Name]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Modelo de carta para la política de reembolso de gastos de vehículos - Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Phoenix Arizona Modelo De Carta Para La Política De Reembolso De Gastos De Vehículos?

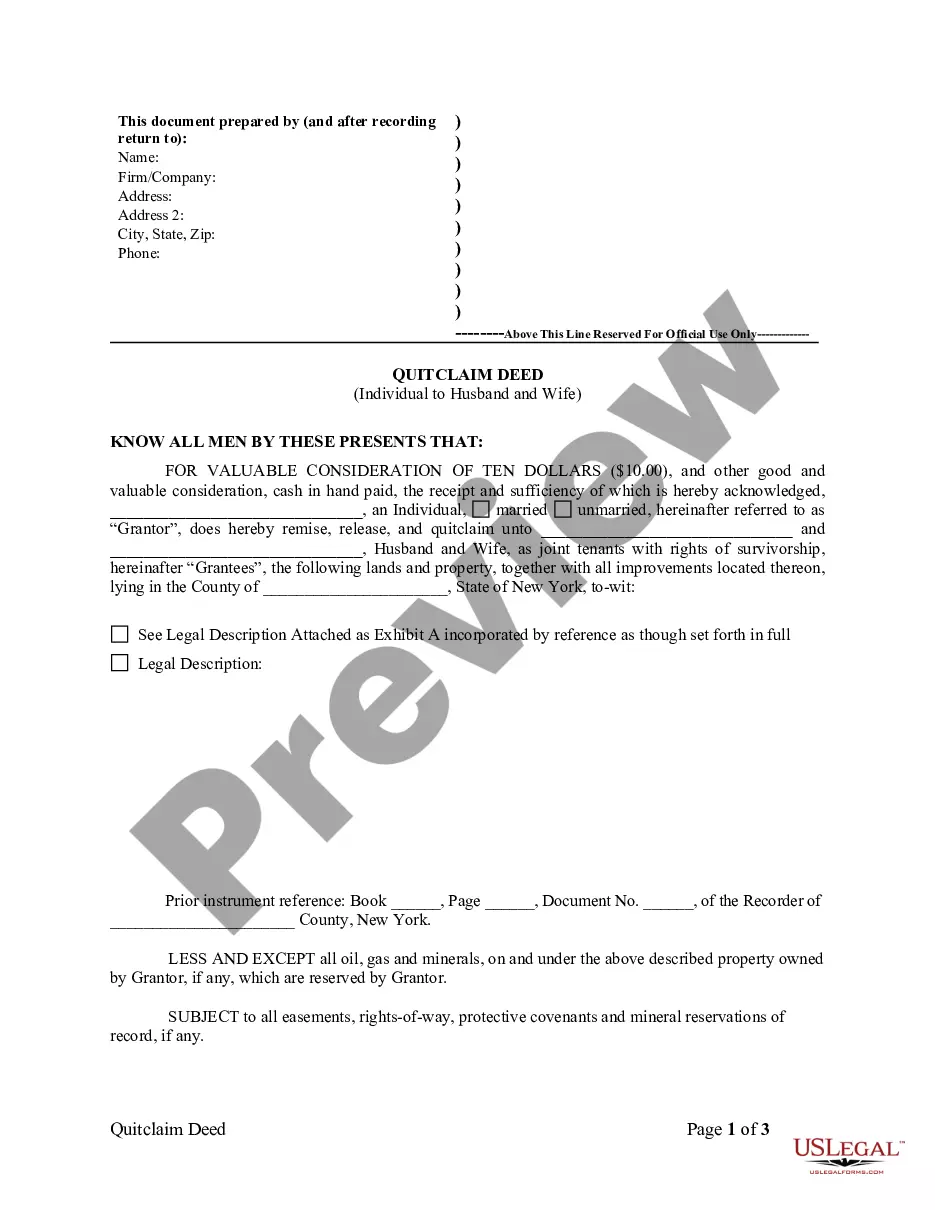

If you need to get a reliable legal document provider to get the Phoenix Sample Letter for Policy on Vehicle Expense Reimbursement, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support team make it simple to find and complete different documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

Simply type to look for or browse Phoenix Sample Letter for Policy on Vehicle Expense Reimbursement, either by a keyword or by the state/county the form is created for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Phoenix Sample Letter for Policy on Vehicle Expense Reimbursement template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Phoenix Sample Letter for Policy on Vehicle Expense Reimbursement - all from the convenience of your home.

Sign up for US Legal Forms now!