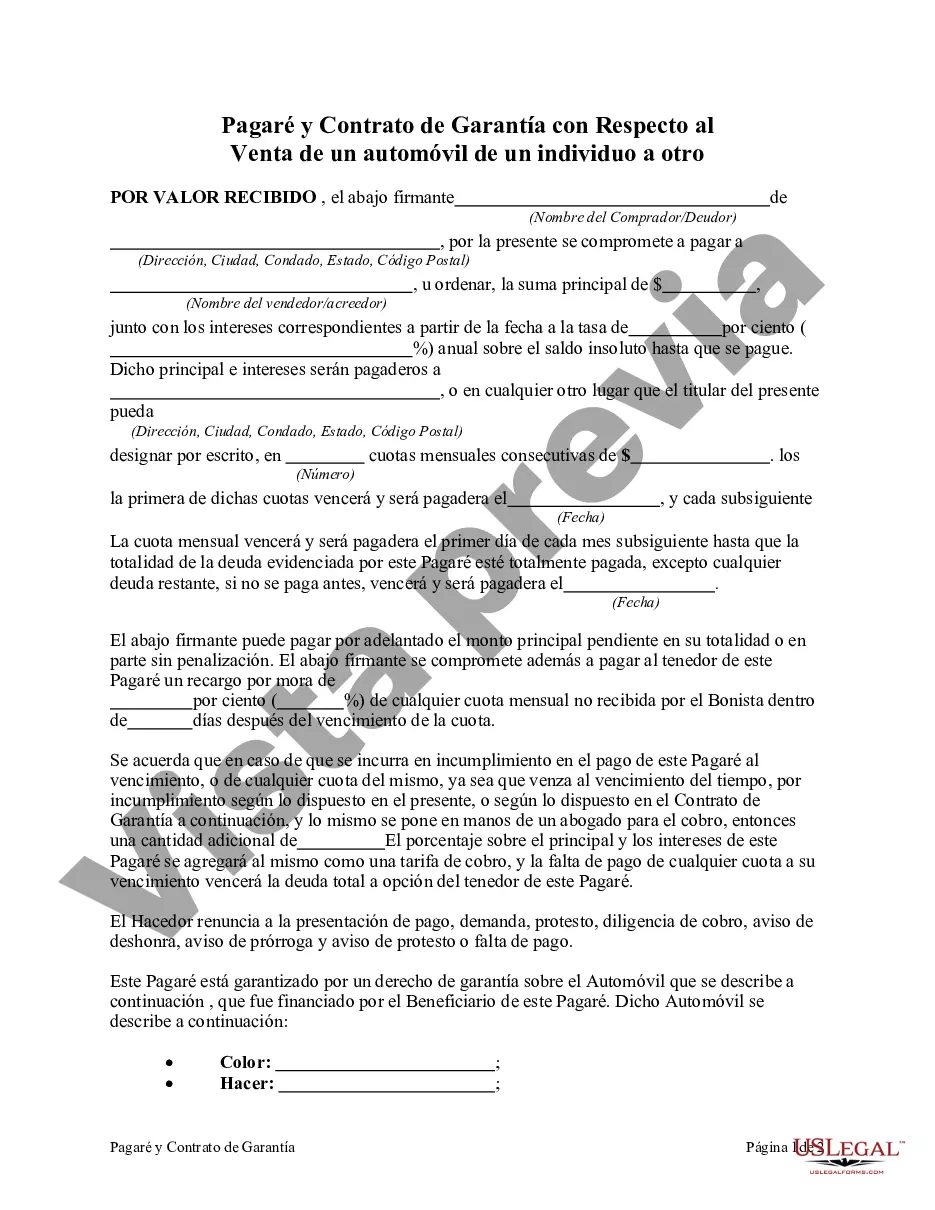

Cook Illinois Promissory Note and Security Agreement with Regard to the Sale of an Automobile is a legal document that outlines the terms and conditions of the sale when one individual sells an automobile to another individual, while including a promissory note and security agreement. The Cook Illinois Promissory Note is a written promise from the buyer to the seller, acknowledging the amount owed for the purchased automobile and agreeing to repay the amount in installments over a specific period of time. The promissory note includes details like the purchase price, interest rate (if any), repayment schedule, and consequences for defaulting on payments. It serves as evidence of the debt owed by the buyer to the seller. The Security Agreement is a contractual agreement that secures the promissory note by designating the automobile as collateral. This agreement states that if the buyer fails to make the agreed-upon payments, the seller has the right to repossess the automobile as a form of repayment. It helps protect the seller's interest and provides legal recourse if the buyer defaults on the payment. There may be different types of Cook Illinois Promissory Note and Security Agreements depending on the specific terms and agreements between the buyer and seller. Some variations may include: 1. Lump Sum Payment Agreement: In this type of agreement, the buyer agrees to make a single lump sum payment to the seller for the automobile, without the need for installment payments. 2. Installment Payment Agreement: This agreement allows the buyer to repay the purchase price in a series of regular installments, typically monthly or quarterly, along with any applicable interest. 3. Balloon Payment Agreement: With this type of agreement, the buyer makes regular installment payments for a specific period, but there is a larger final payment called a balloon payment due at the end of the term. This option is suitable for buyers who can afford smaller installments but expect a future lump sum payment to cover the final amount. 4. Secured Agreement with Co-Signer: In certain situations, if the buyer's creditworthiness is a concern, a co-signer may be required. This agreement involves a third party who assumes liability for the buyer's debt if they default on their payments. It's essential for both parties to have a clear understanding of the terms in the Cook Illinois Promissory Note and Security Agreement. Consulting with legal professionals or utilizing pre-made agreement templates specific to Cook Illinois can help ensure all legal requirements are met and protect the interests of both parties involved in the automobile sale.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Cook Illinois Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

Draftwing forms, like Cook Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, to take care of your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for various cases and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Cook Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another template. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Cook Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another:

- Make sure that your form is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the Cook Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our service and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!