A Mecklenburg North Carolina Promissory Note and Security Agreement with regard to the sale of an automobile from one individual to another is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller. This agreement is used when the buyer does not have enough funds to make the full payment upfront and instead agrees to make installment payments over a specified period of time. The Mecklenburg North Carolina Promissory Note and Security Agreement include important details such as the names and addresses of the buyer and seller, the description of the automobile being sold (make, model, year, and VIN), the total purchase price, the amount of the down payment (if any), the interest rate (if applicable), the duration of the loan, and the payment schedule. The agreement also includes provisions regarding the consequences of defaulting on payments, such as repossession of the vehicle, penalties, and remedies available to both parties in case of a breach of contract. It may also include clauses regarding insurance requirements and the responsibilities of each party in maintaining the vehicle during the loan term. Different types of Mecklenburg North Carolina Promissory Note and Security Agreement with regard to the sale of an automobile from one individual to another may include variations such as: 1. Installment Sales Contract: This agreement specifies the terms for the buyer to make regular installment payments until the full purchase price is paid. The seller remains the owner of the vehicle until the buyer fulfills all payment obligations. 2. Balloon Payment Contract: In this type of agreement, the buyer makes smaller monthly payments for a specified period, but a larger final payment (the balloon payment) is due at the end of the term. This type of agreement is suitable for buyers who anticipate having a larger sum of money available at a certain future date. 3. Lease-to-Own Agreement: This agreement allows the buyer to lease the vehicle for a specific period with the option to purchase it at the end. The lease payments typically cover the depreciation of the vehicle and a portion of the purchase price, making it an attractive option for those with lower monthly budgets. 4. Loan Agreement with Collateral: In cases where the buyer pledges another valuable asset (such as property) as collateral, this type of agreement secures the loan with that asset. In the event of default, the seller has the right to take possession of the collateral to satisfy the outstanding debt. Before entering into any agreement, it is advisable for both parties to consult with legal professionals to ensure compliance with Mecklenburg North Carolina laws and to protect their interests during the sale and financing of an automobile.

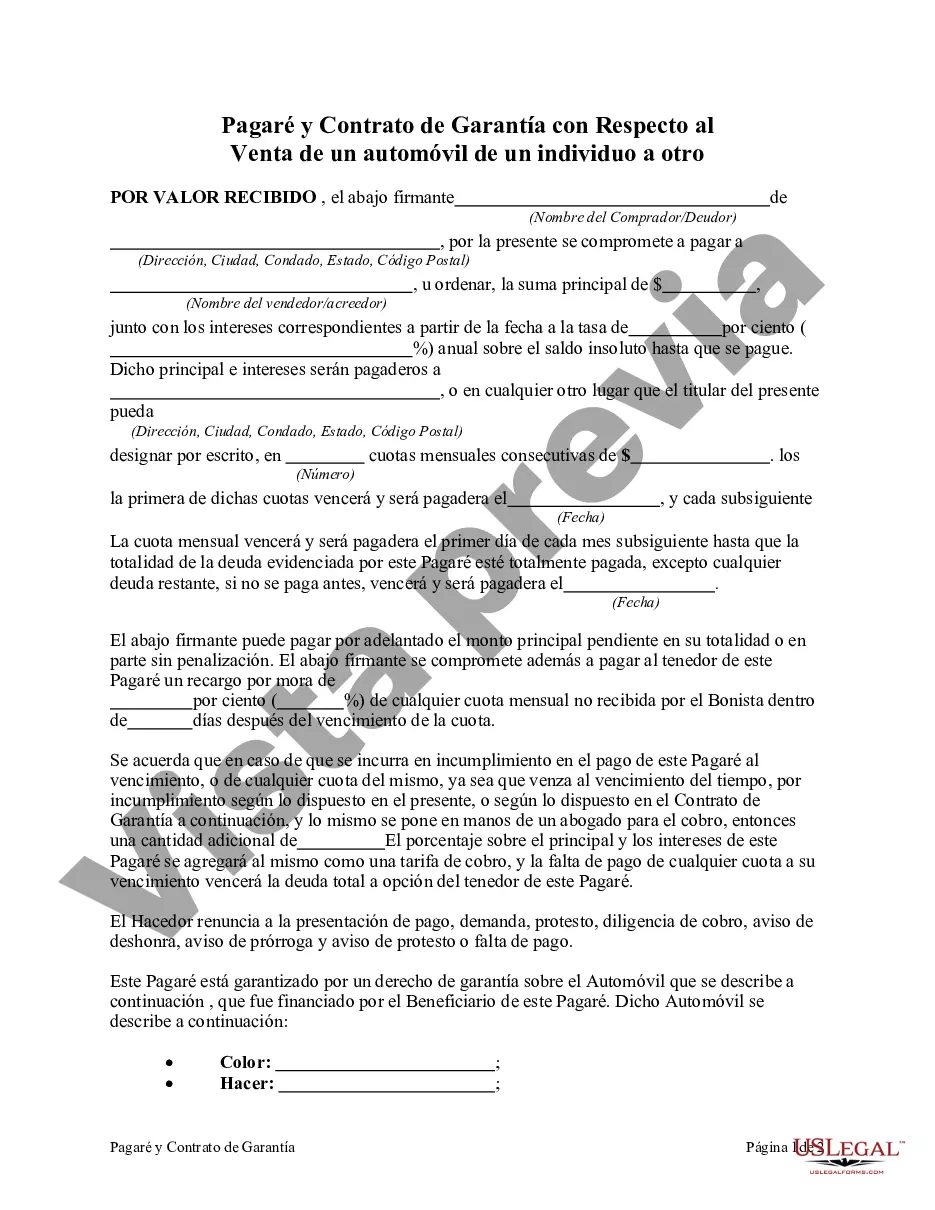

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Mecklenburg North Carolina Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Mecklenburg Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information resources and guides on the website to make any tasks related to document execution straightforward.

Here's how you can find and download Mecklenburg Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the similar document templates or start the search over to find the right file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Mecklenburg Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Mecklenburg Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, log in to your account, and download it. Needless to say, our website can’t replace an attorney entirely. If you have to deal with an extremely complicated case, we recommend getting a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork effortlessly!