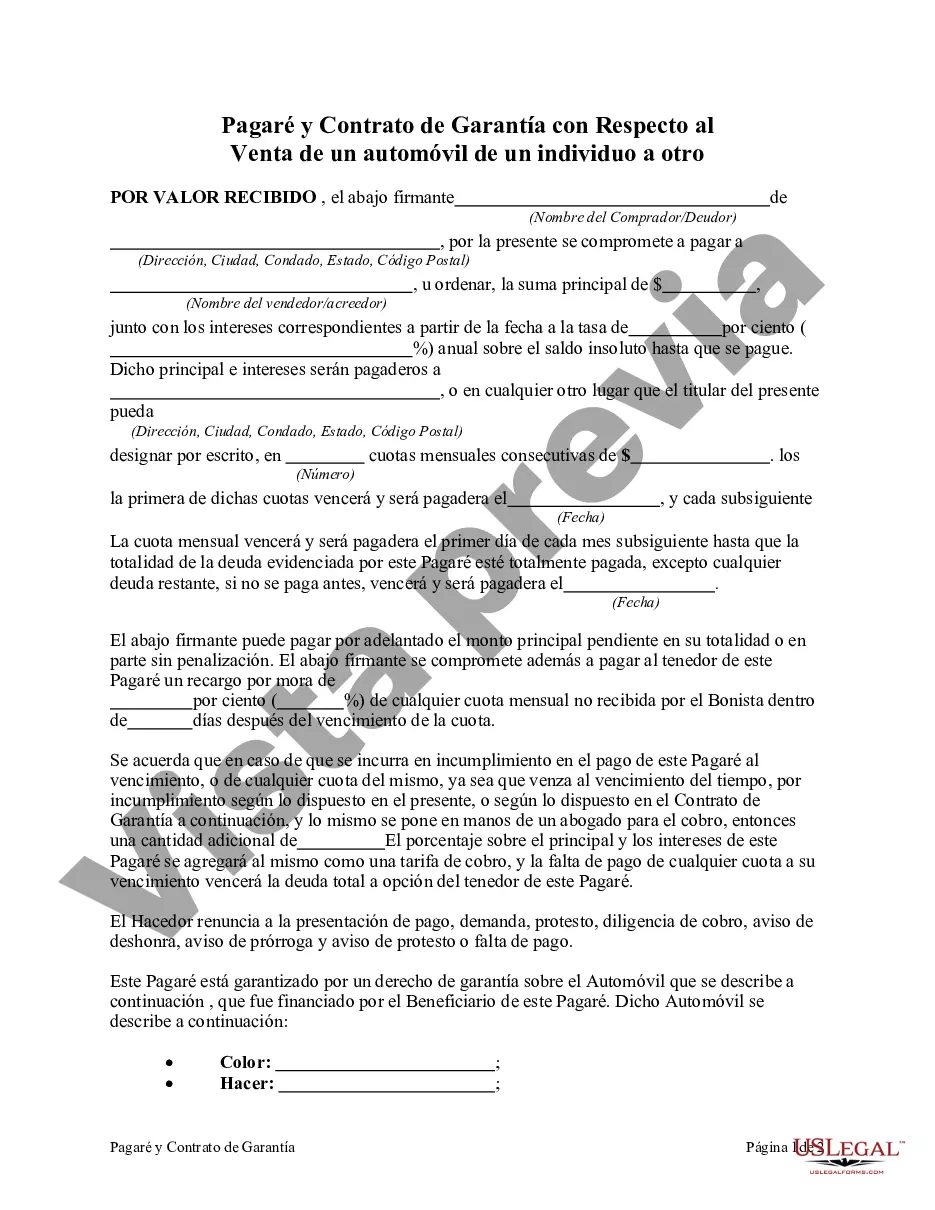

The Nassau New York Promissory Note and Security Agreement is a legal document that establishes the terms and conditions of the sale of an automobile from one individual to another. This agreement is designed to protect both the buyer and the seller by outlining the obligations and responsibilities of each party involved in the transaction. It serves as a binding contract that ensures the smooth transfer of ownership while ensuring the financial obligations are met. The Promissory Note is an integral part of this agreement, and it outlines the specifics of the financial arrangement. It includes details such as the total purchase price, the agreed-upon down payment, the repayment schedule, and any interest rates or fees associated with the loan. The note clearly states the buyer's promise to repay the seller in regular installments until the total amount is satisfied. The Security Agreement, on the other hand, acts as collateral for the loan and enforces the repayment terms. As the automobile serves as the security, this agreement grants the seller certain rights in case of default. It includes provisions that allow the seller to repossess the vehicle in the event of non-payment or breach of contract. Furthermore, the security agreement may require the buyer to maintain comprehensive insurance coverage on the vehicle until the loan is fully repaid. In Nassau New York, there may be different types of Promissory Note and Security Agreement variations based on specific circumstances or preferences. Some notable types include: 1. Fixed Interest Rate Agreement: This type of agreement establishes a fixed interest rate on the loan throughout the repayment period. It ensures that the buyer and seller have a clear understanding of the financial obligations without any fluctuation in interest rates. 2. Variable Interest Rate Agreement: Unlike the fixed interest rate agreement, a variable interest rate agreement allows the interest to change over time based on market conditions. The agreement will define the parameters for interest rate adjustments, ensuring transparency and fairness for both parties. 3. Balloon Payment Agreement: In some cases, the buyer and seller may agree to a balloon payment arrangement, where the buyer makes regular installments for a set period, and at the end, a larger final payment is due to complete the loan. This type of agreement allows for more flexible payment options but comes with greater financial responsibility towards the end of the term. Overall, the Nassau New York Promissory Note and Security Agreement with regard to the sale of an automobile serve as vital legal documents that protect both the buyer and seller. This agreement ensures the terms and conditions of the sale are clear and provides a mechanism for enforcement in case of default or breach. It is crucial to consult legal professionals to tailor the agreement according to specific requirements and ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Nassau New York Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Nassau Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Nassau Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Nassau Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another:

- Take a look at the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!