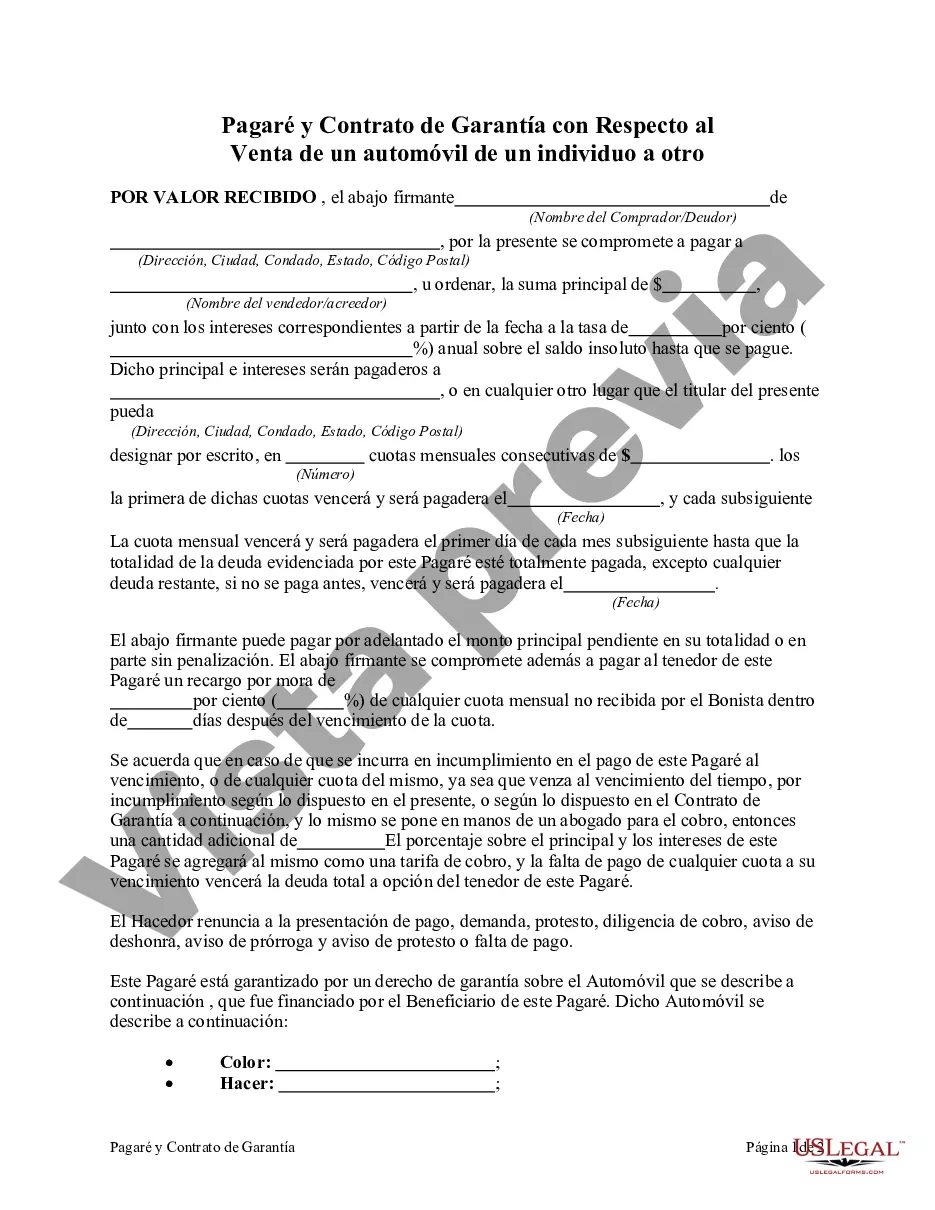

Keywords: Palm Beach Florida, promissory note, security agreement, sale of an automobile, individual, types In Palm Beach Florida, a promissory note and security agreement is a legal document used when one individual sells an automobile to another and agrees to receive payments over time. This agreement provides protection to both parties involved in the transaction by outlining the terms and conditions of the sale. The Palm Beach Florida promissory note is a written promise from the buyer to the seller stating that they will pay a specific amount of money in installments. It includes details such as the purchase price, interest rate (if applicable), payment schedule, and any late fees or penalties. The promissory note serves as evidence of the buyer's debt and their commitment to make timely payments. The security agreement, on the other hand, grants the seller a security interest in the automobile being sold. This means that if the buyer fails to make payments as agreed, the seller has the right to repossess the vehicle to satisfy the outstanding debt. The security agreement also allows the seller to take legal action to recover any remaining balance if the vehicle's value does not cover the full debt. When it comes to the various types of Palm Beach Florida promissory notes and security agreements for automobile sales, there can be variations in terms depending on the specific circumstances and negotiations between the parties involved. Examples of different types of promissory notes and security agreements may include: 1. Installment Sale Promissory Note: This type of promissory note outlines the agreed-upon installment payments, the purchase price, and the interest rate (if applicable). 2. Balloon Payment Promissory Note: In this case, the buyer agrees to make smaller regular payments with a final larger payment (balloon payment) due at a specific future date. 3. Secured Promissory Note: This type of promissory note includes a security agreement where the seller is granted a security interest in the vehicle being sold. 4. Unsecured Promissory Note: This variation does not have a security agreement, so the seller does not have collateral rights in case of non-payment. It is important for both the buyer and seller to understand the terms and obligations set forth in the Palm Beach Florida promissory note and security agreement. It is advisable to consult with legal professionals to ensure that the agreements meet all legal requirements and protect the interests of both parties involved in the sale of the automobile.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Palm Beach Florida Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Palm Beach Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Palm Beach Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Palm Beach Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another:

- Ensure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Palm Beach Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

El vendedor debera de reparar el coche, realizar una devolucion o dar, en su defecto, un coche tasado con el mismo precio. Esta garantia de un ano es la minima exigida por Ley, esta garantia se puede ampliar por contrato.

Durante la garantia el comprador de un producto tiene derecho a la reparacion gratuita de los defectos de origen o de aquellas faltas de conformidad con el producto. Esa reparacion gratuita incluye las piezas, mano de obra y gastos de desplazamiento.

El plazo que tiene el comprador para efectuar la reclamacion es de un ano a contar desde la fecha de entrega. Pasado este tiempo, no tendra derecho a exigir ninguna responsabilidad.

Para ayudarte en la compra de un auto usado, puedes poner atencion en los siguientes consejos: Revisa los antecedentes del vehiculo.Realiza una prueba del auto.Ejecuta una inspeccion tecnica.Realiza una inspeccion visual.Verifica el historial del auto y modelo.

COMO RECLAMAR LA GARANTIA Revisa bien la cobertura, terminos y condiciones de la garantia. Si aplica, lleva al concesionario el vehiculo para una exhaustiva revision. Entrega los documentos que amparan la compra del auto, la poliza de garantia vigente y la bitacora de servicios de mantenimiento.

Las Garantias Extendidas son contratos donde se brindar una cobertura que abarca mas tiempo despues que vence la que ofrecen los fabricantes de los vehiculos. Este tipo de Garantias para Vehiculos ofrece una cobertura donde se incluyen una variedad atractiva de beneficios.

Las garantias entre autos nuevos y usadossuelen ser similares en caracteristicas y restricciones, pero no asi en la duracion. Los coches usados con garantia llegan a tener un periodo de cobertura de dos anos en el mejor de los casos, pero existen concesionarias que solo dan tres meses de garantia.

Esta garantia cumple con las mismas caracteristicas que la garantia de un coche de segunda mano particular, es decir, cubre cualquier averia anterior a la compra del coche, por lo que el comprador del coche de segunda mano estara protegido durante un ano.

COMO RECLAMAR LA GARANTIA Es recomendable enviar un correo a la agencia y a los contactos de servicio al cliente de la marca directamente, los cuales encuentras en sus paginas web oficiales, explicando el problema para obtener un mejor resultado del reclamo.

¿Que cubre una grantia de auto? La garantia de un auto nuevo es la promesa del fabricante de ayudarte a pagar las refacciones y las reparaciones cubiertas durante el periodo especificado en la garantia, de acuerdo con Kelley Blue Book.