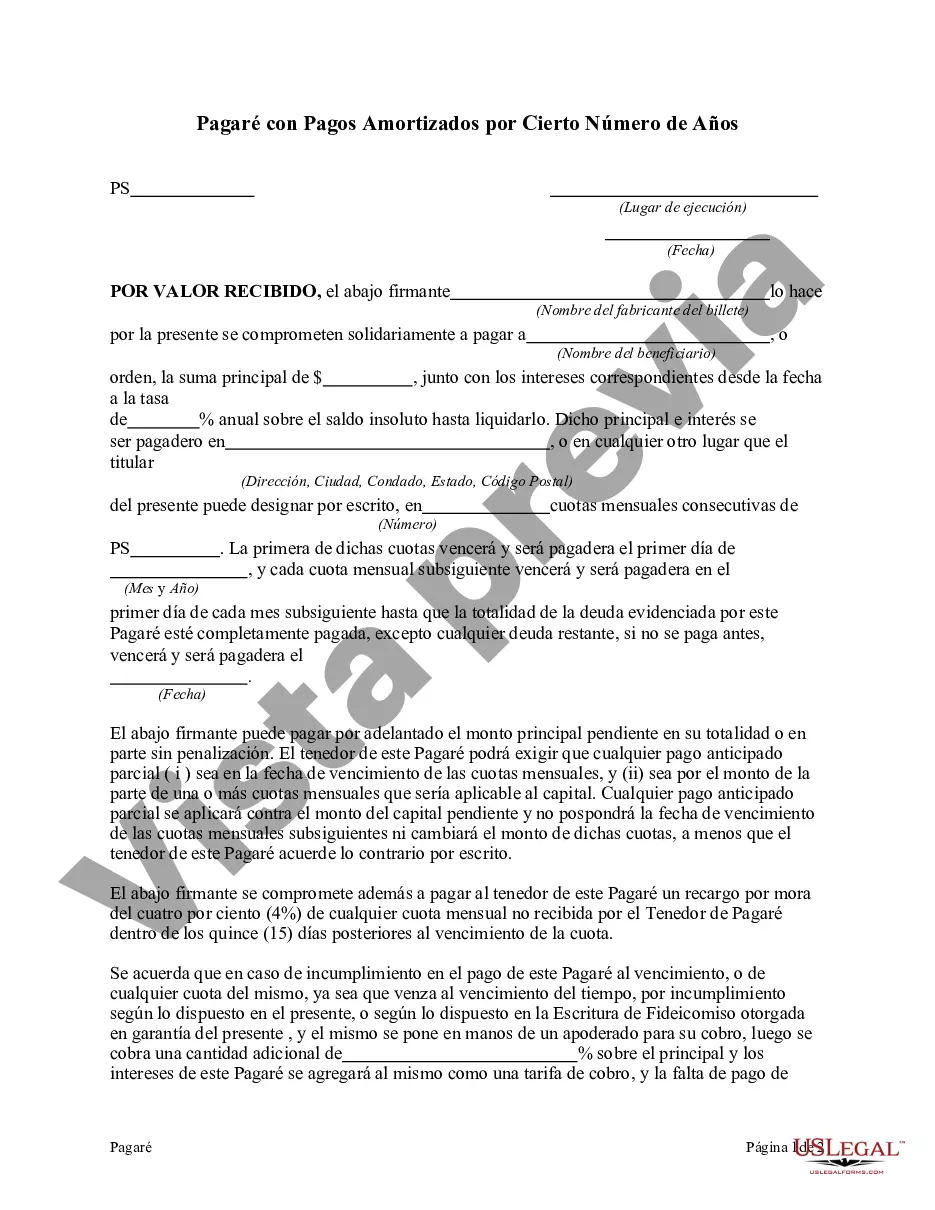

Franklin Ohio Promissory Note with Payments Amortized for a Certain Number of Years is a legal document used in Franklin, Ohio, for loan transactions. This type of promissory note involves a borrower (the debtor) promising to repay a certain amount of money, known as the principal, to the lender (the creditor), along with interest over a specified period. Keywords: Franklin Ohio Promissory Note, Payments Amortized, Certain Number of Years, legal document, loan transactions, borrower, debtor, lender, creditor, principal, interest, specified period. There are different types of Franklin Ohio Promissory Notes with Payments Amortized for a Certain Number of Years, which include: 1. Fixed-Rate Promissory Note: This type of promissory note has a fixed interest rate throughout the specified period. The borrower pays the principal amount along with equal monthly installments, with the interest amount calculated based on the original principal. 2. Adjustable-Rate Promissory Note: In contrast to the fixed-rate note, an adjustable-rate promissory note has an interest rate that can change periodically. This change may occur annually, semi-annually, or at predetermined intervals, depending on the terms agreed upon. The interest rate adjustments may be based on an index, such as the treasury bill rate or the prime rate. 3. Balloon Promissory Note: This type of promissory note involves smaller monthly payments for a set number of years, with a substantial payment, known as the balloon payment, due at the end of the specified period. The balloon payment typically covers the remaining principal balance. These notes are useful when the borrower expects a significant source of funds to pay off the loan at the end. 4. Graduated Payment Promissory Note: This type of promissory note allows the borrower to make lower initial payments, which gradually increase over time. The increased payments are designed to match the borrower's expected income growth or affordability. 5. Interest-Only Promissory Note: With an interest-only promissory note, the borrower pays only the interest amount during the specified period, typically for the initial years. Afterward, the borrower starts paying both the principal and interest until the loan is fully repaid. Each type of Franklin Ohio Promissory Note with Payments Amortized for a Certain Number of Years has specific terms, conditions, and requirements. It is essential for both borrowers and lenders to review and understand these documents thoroughly before entering into any financial agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Franklin Ohio Pagaré Con Pagos Amortizados Por Cierto Número De Años?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Franklin Promissory Note with Payments Amortized for a Certain Number of Years.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Franklin Promissory Note with Payments Amortized for a Certain Number of Years will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to get the Franklin Promissory Note with Payments Amortized for a Certain Number of Years:

- Ensure you have opened the correct page with your local form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Franklin Promissory Note with Payments Amortized for a Certain Number of Years on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!