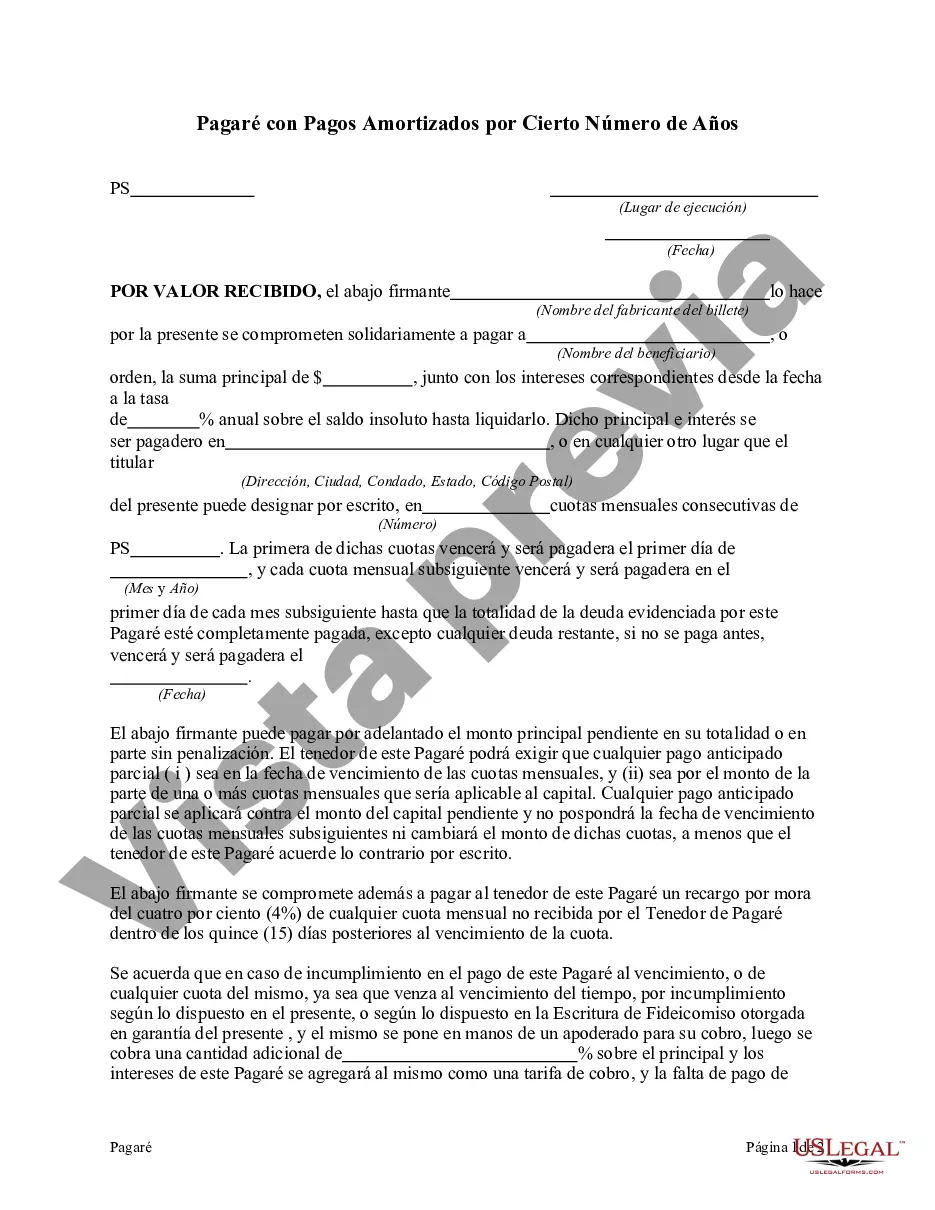

Los Angeles California Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Pagaré Con Pagos Amortizados Por Cierto Número De Años?

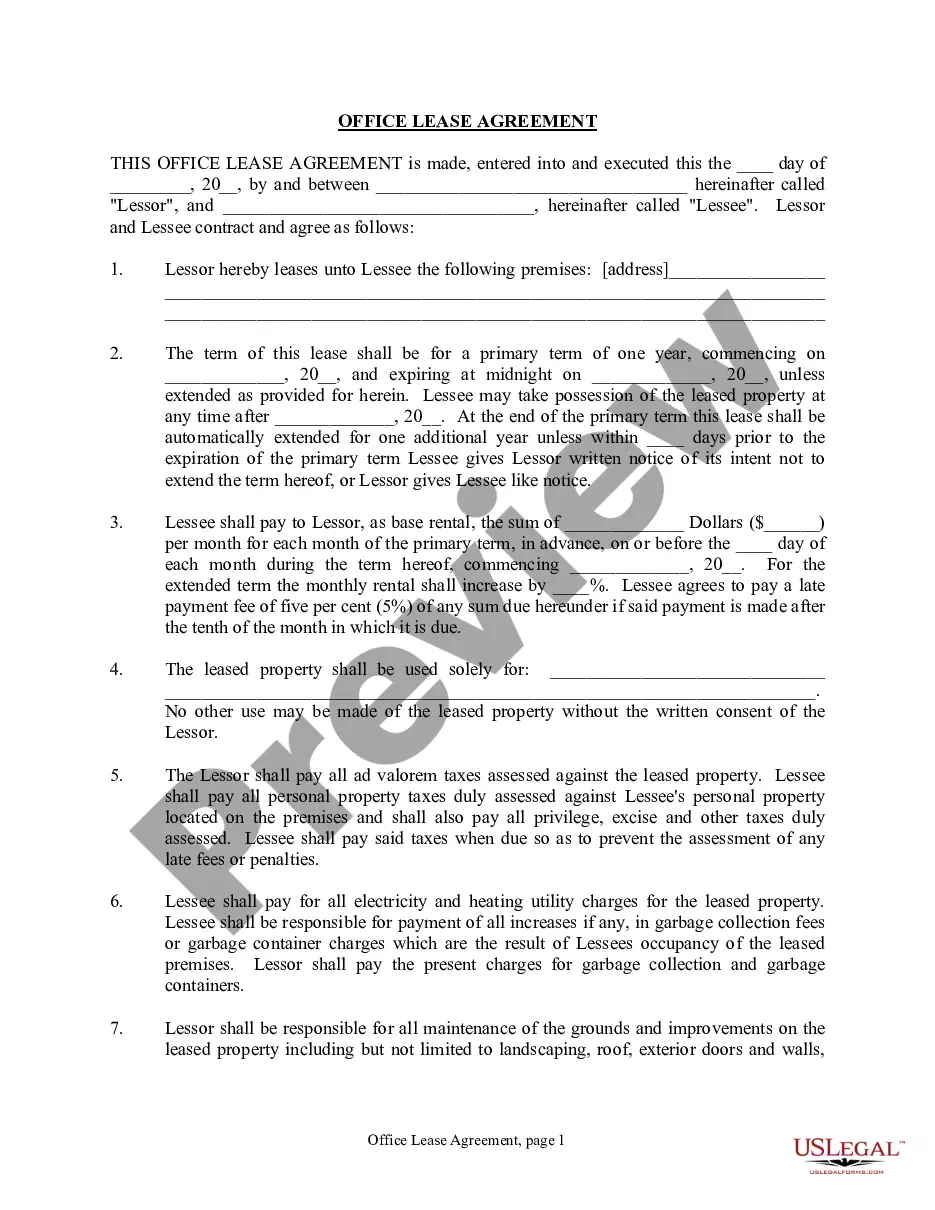

Formulating legal documents is essential in the contemporary landscape.

Nonetheless, you may not always need to seek professional help to craft certain forms from the ground up, such as the Los Angeles Promissory Note with Payments Amortized for a Designated Period, utilizing a service like US Legal Forms.

US Legal Forms boasts over 85,000 documents to choose from across diverse categories ranging from living wills to real estate contracts to divorce forms.

If you are already enrolled in US Legal Forms, you can locate the requisite Los Angeles Promissory Note with Payments Amortized for a Designated Period, Log In to your account, and download it.

It goes without saying that our website cannot fully substitute for an attorney. If you face an exceptionally complex case, we recommend consulting a lawyer to review your document before executing and submitting it.

- Review the document's preview and description (if provided) to acquire a basic understanding of what you'll receive after obtaining the form.

- Confirm that the template you select is pertinent to your state/county/region as state laws can influence the validity of some documents.

- Inspect the related document templates or restart your search to locate the appropriate form.

- Click Buy now and create your account. If you already possess one, opt to Log In.

- Choose the option, then a suitable payment method, and purchase the Los Angeles Promissory Note with Payments Amortized for a Designated Period.

- Decide to save the form template in any provided file format.

- Navigate to the My documents tab to retrieve the document again.