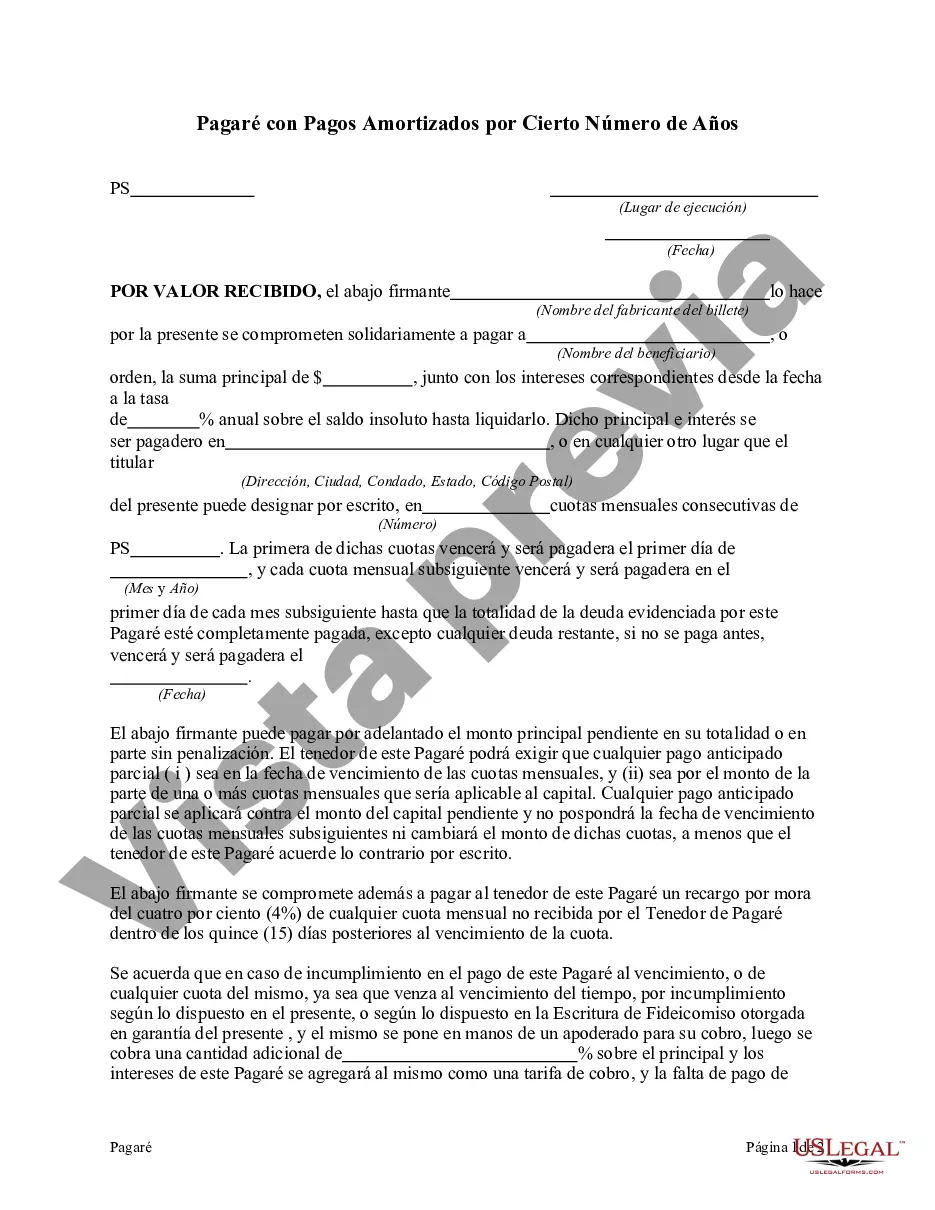

Maricopa, Arizona Promissory Note with Payments Amortized for a Certain Number of Years: Explained A Maricopa, Arizona Promissory Note with Payments Amortized for a Certain Number of Years is a legally binding agreement that outlines the terms and conditions under which a borrower agrees to repay a loan received from a lender over a specified period. This type of promissory note offers advantageous features for both the borrower and lender. By structuring the loan with amortized payments, the borrower can spread out the repayment over a set number of years, making it more manageable and predictable. Additionally, amortized payments can help borrowers establish a repayment plan that aligns with their financial capabilities, reducing the risk of default. Here are some relevant keywords associated with Maricopa, Arizona Promissory Note with Payments Amortized for a Certain Number of Years: 1. Interest Rate: The promissory note will detail the agreed-upon interest rate, which is the cost of borrowing the money. 2. Principal: This is the initial amount borrowed, which the borrower promises to repay over time. 3. Term: The term refers to the length of time over which the loan will be repaid. This can vary depending on the specific agreement, but common durations include five, ten, or fifteen years. 4. Monthly Payments: The borrower is required to make regular monthly payments that include both principal and interest. These payments are calculated to ensure that the loan is fully repaid by the end of the agreed term. 5. Late Payment Penalties: The promissory note may include provisions for penalties or fees in case of late payments. Different Types of Maricopa, Arizona Promissory Note with Payments Amortized for a Certain Number of Years: 1. Fixed-Rate Promissory Note: This type of promissory note has a fixed interest rate throughout the term of the loan, ensuring consistent monthly payments. 2. Adjustable-Rate Promissory Note: This type of promissory note features an interest rate that can adjust periodically, usually based on changes in market conditions. 3. Balloon Payment Promissory Note: Under this type of note, the borrower makes fixed monthly payments for a certain period, with the remaining balance due in one lump sum at the end of the specified term. In conclusion, a Maricopa, Arizona Promissory Note with Payments Amortized for a Certain Number of Years is a contractual agreement that explains the terms of loan repayment between a borrower and lender. By considering the relevant keywords and understanding the various types available, borrowers and lenders in Maricopa, Arizona can make informed decisions when entering such agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Maricopa Arizona Pagaré Con Pagos Amortizados Por Cierto Número De Años?

Whether you intend to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are collected by state and area of use, so picking a copy like Maricopa Promissory Note with Payments Amortized for a Certain Number of Years is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Maricopa Promissory Note with Payments Amortized for a Certain Number of Years. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Promissory Note with Payments Amortized for a Certain Number of Years in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you can access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!