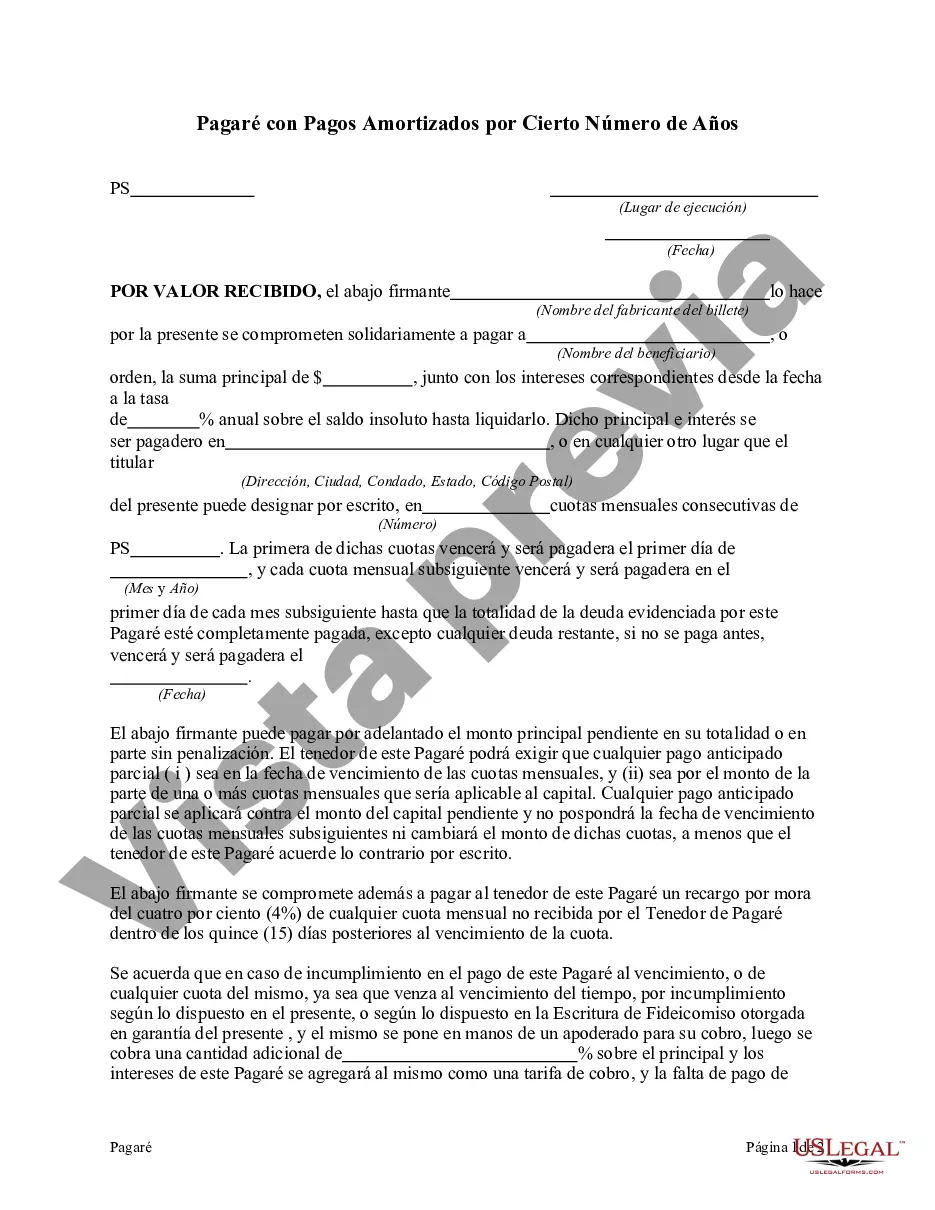

A San Diego California promissory note is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in San Diego, California. This specific type of promissory note is characterized by having payments amortized over a certain number of years. The promissory note includes essential details such as the names and contact information of both parties involved, the principal amount of the loan, the interest rate, the repayment schedule, and the number of years over which the payments will be amortized. It serves as a written commitment by the borrower to repay the loan according to the agreed-upon terms. There can be different variations of San Diego California promissory notes with payments amortized for a certain number of years based on specific circumstances and requirements. These variations may include: 1. Fixed-Rate Promissory Note: This type of promissory note features a fixed interest rate throughout the loan term. The borrower makes equal payments over a specified period, usually ranging from 5 to 30 years. As the note is amortized, each payment consists of both principal and interest, with the interest portion decreasing as the loan is repaid. 2. Adjustable Rate Promissory Note: Unlike the fixed-rate note, an adjustable rate promissory note has an interest rate that changes periodically. The interest rate can be initially lower, making the initial payments more affordable. However, it adjusts periodically based on a predetermined index, resulting in potential fluctuations in payment amounts over time. 3. Balloon Payment Promissory Note: A balloon payment promissory note requires the borrower to make regular payments based on a specific repayment schedule, spanning several years. However, at the end of the term, there remains a significant final payment, referred to as the "balloon payment." Borrowers often use this type of note when they anticipate having a significant amount of money available at the end of the term. When creating or entering into a San Diego California promissory note, it is crucial to seek legal advice to ensure compliance with state and federal regulations. Additionally, the lender and borrower must discuss and agree on the terms, interest rates, and payment structures to establish a mutually beneficial loan agreement. By understanding the various types of San Diego California promissory notes with payments amortized for a certain number of years, individuals and businesses can make informed decisions based on their financial needs and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out San Diego California Pagaré Con Pagos Amortizados Por Cierto Número De Años?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and download a document for any individual or business objective utilized in your county, including the San Diego Promissory Note with Payments Amortized for a Certain Number of Years.

Locating templates on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the San Diego Promissory Note with Payments Amortized for a Certain Number of Years will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the San Diego Promissory Note with Payments Amortized for a Certain Number of Years:

- Make sure you have opened the right page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the San Diego Promissory Note with Payments Amortized for a Certain Number of Years on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!