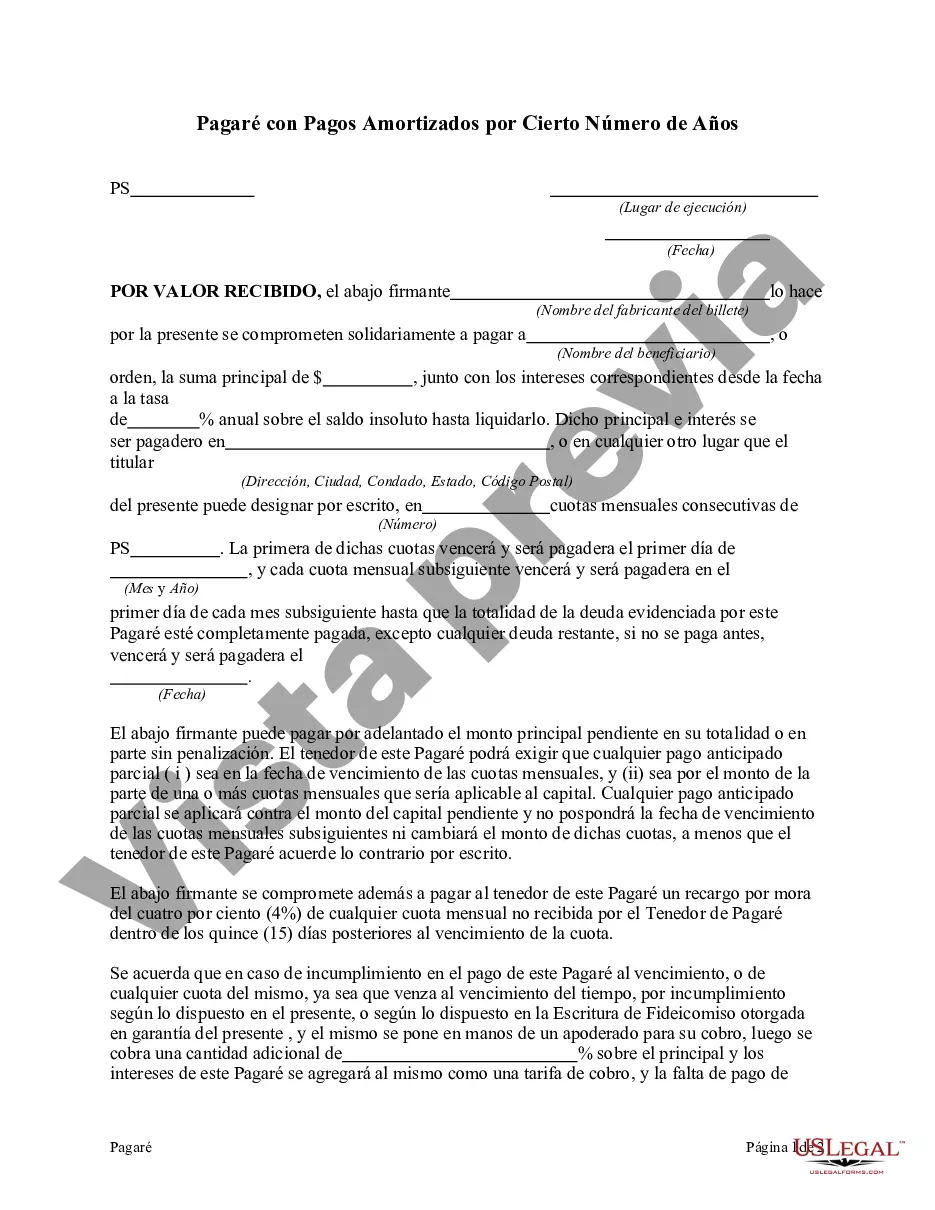

A San Jose California Promissory Note with Payments Amortized for a Certain Number of Years is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower in San Jose, California. This type of promissory note is specifically designed to detail the agreed-upon schedule of payments that will be made over a specified period, with the loan amount being gradually paid off through regular installments. The San Jose California Promissory Note with Payments Amortized for a Certain Number of Years provides a structured repayment plan, ensuring that both parties are aware of the amount, timing, and frequency of payments required. It sets out the principal loan amount, interest rate, and the number of years within which the borrower must repay the debt. The note typically includes a payment schedule, specifying the amount to be paid, due dates, and any other relevant terms. In San Jose, California, there are different types of promissory notes that fall under the category of payments amortized for a certain number of years, including: 1. Fixed Interest Rate Promissory Note: This type of promissory note maintains a constant interest rate throughout the loan's term, resulting in consistent monthly payments for the borrower. 2. Adjustable Interest Rate Promissory Note: This note allows for periodic adjustments to the interest rate, based on predetermined factors such as market conditions. As a result, the monthly payments may vary over time. 3. Balloon Payment Promissory Note: This type of note requires the borrower to make regular payments for a specific period, with a large "balloon" payment due at the end of the term. This structure is often employed when the borrower anticipates a future lump sum payment or significant increase in income. 4. Interest-Only Promissory Note: In this arrangement, the borrower is obligated to pay only the interest accrued on the loan for a set period, with the principal amount remaining unchanged. This results in lower monthly payments during the interest-only period, followed by larger payments to cover both principal and interest thereafter. When executing a San Jose California Promissory Note with Payments Amortized for a Certain Number of Years, it is vital for both parties to fully understand the terms and implications of the agreement. Seeking legal advice or consulting with a professional familiar with California lending laws and regulations is highly recommended.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out San Jose California Pagaré Con Pagos Amortizados Por Cierto Número De Años?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the San Jose Promissory Note with Payments Amortized for a Certain Number of Years, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case accumulated all in one place. Consequently, if you need the recent version of the San Jose Promissory Note with Payments Amortized for a Certain Number of Years, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Jose Promissory Note with Payments Amortized for a Certain Number of Years:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your San Jose Promissory Note with Payments Amortized for a Certain Number of Years and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!