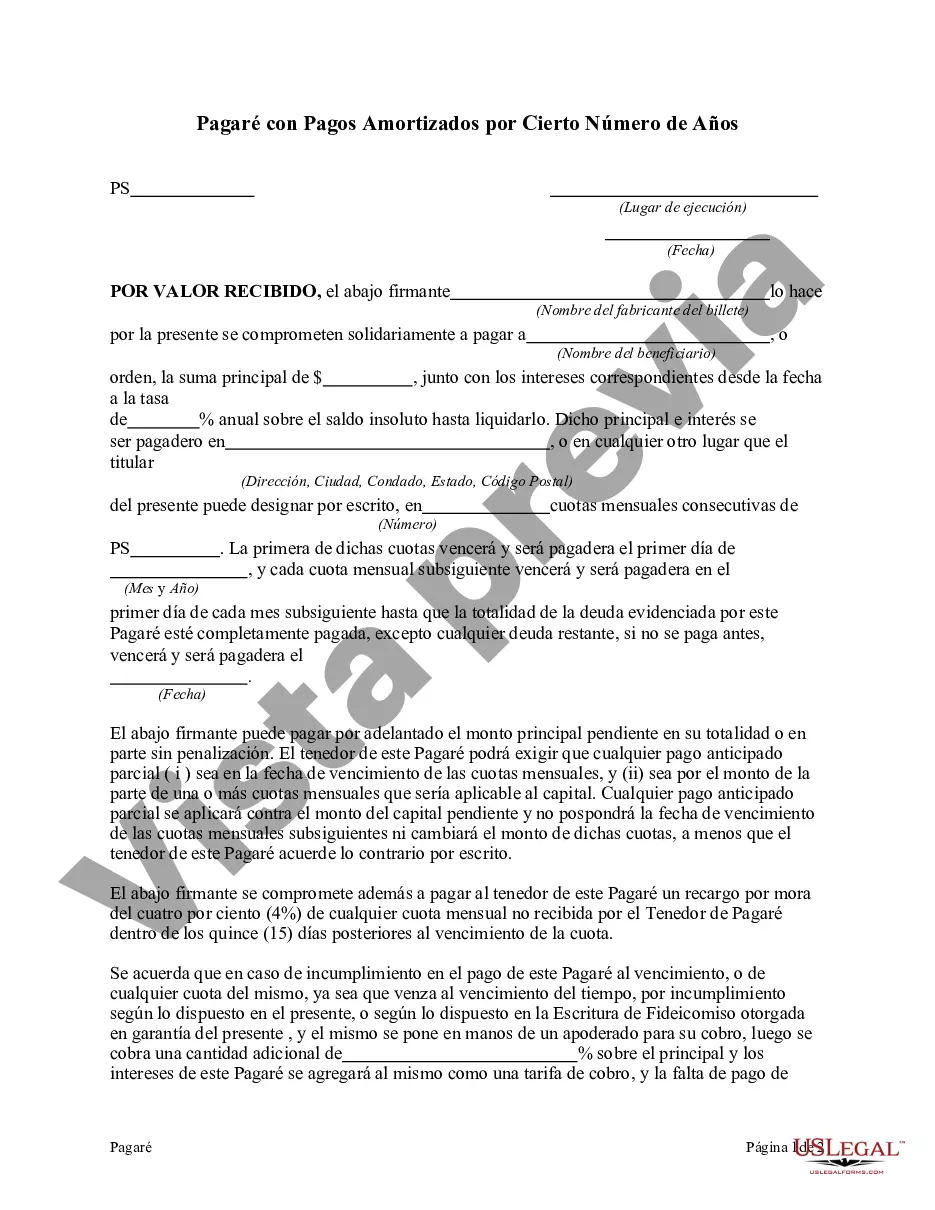

Santa Clara California Promissory Note with Payments Amortized for a Certain Number of Years is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the region of Santa Clara, California. This type of promissory note specifically includes provisions for the amortization of payments over a predetermined period of time. Keywords: Santa Clara California, Promissory Note, Payments, Amortized, Certain Number of Years, loan agreement, lender, borrower, provisions, predetermined period of time. There are several variations of Santa Clara California Promissory Note with Payments Amortized for a Certain Number of Years, such as: 1. Traditional Promissory Note: This type of promissory note incorporates standard terms and conditions, including the principal amount, interest rate, repayment schedule, and the specified amortization period. 2. Balloon Promissory Note: In this variation, the borrower makes smaller payments over the amortization period, but a large "balloon payment" is due at the end of the term. This allows for flexibility in cash flow during the initial period. 3. Adjustable-Rate Promissory Note: With an adjustable-rate promissory note, the interest rate fluctuates based on market conditions. This type of note may be suitable for borrowers who anticipate changes in interest rates during the amortization period. 4. Installment Promissory Note: This variation allows the borrower to repay the loan over a fixed period of time in equal installments. It simplifies the repayment process and ensures a predictable payment schedule. 5. Interest-Only Promissory Note: In this type of note, the borrower only pays the interest during the amortization period, and the principal amount is due at the end of the term. This allows for lower monthly payments during the initial period. It's essential to consult with a legal professional to ensure compliance with state laws, regulations, and individual circumstances when drafting or entering into a Santa Clara California Promissory Note with Payments Amortized for a Certain Number of Years.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Santa Clara California Pagaré Con Pagos Amortizados Por Cierto Número De Años?

If you need to find a reliable legal form provider to obtain the Santa Clara Promissory Note with Payments Amortized for a Certain Number of Years, consider US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it simple to locate and complete different papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to look for or browse Santa Clara Promissory Note with Payments Amortized for a Certain Number of Years, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Santa Clara Promissory Note with Payments Amortized for a Certain Number of Years template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less costly and more reasonably priced. Create your first business, organize your advance care planning, draft a real estate contract, or execute the Santa Clara Promissory Note with Payments Amortized for a Certain Number of Years - all from the comfort of your sofa.

Sign up for US Legal Forms now!