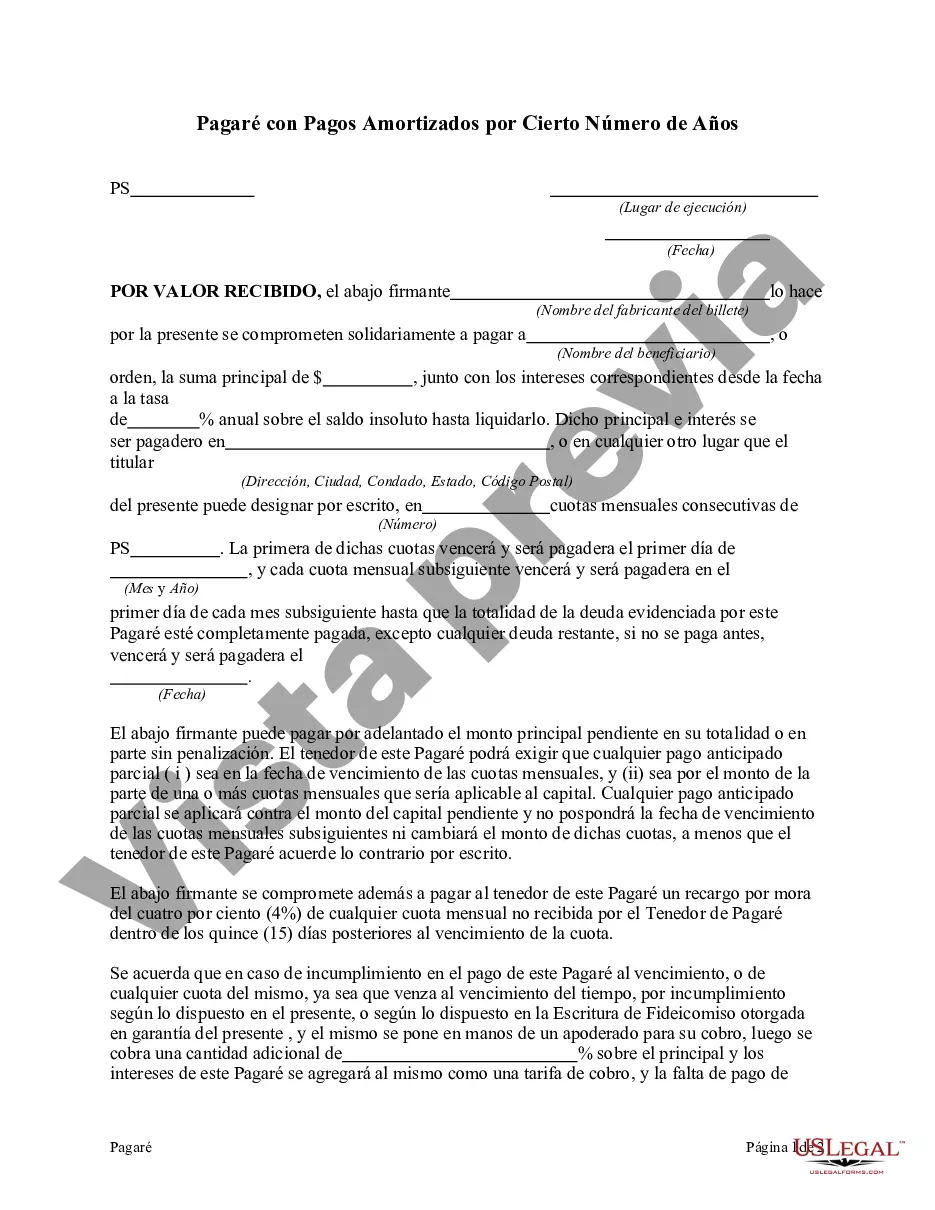

Wake North Carolina Promissory Note with Payments Amortized for a Certain Number of Years is a legally binding agreement that outlines the terms and conditions of a loan between a lender and a borrower in the Wake County, North Carolina area. This type of promissory note is designed to have regular payments made over a specific number of years, allowing the borrower to spread out the repayment of the loan in more manageable installments. The Wake North Carolina Promissory Note with Payments Amortized for a Certain Number of Years includes important details such as the principal amount borrowed, the interest rate applied, the repayment period, and the agreed-upon payment schedule. By specifying these terms, the promissory note ensures clarity and transparency for both parties involved. One type of Wake North Carolina Promissory Note with Payments Amortized for a Certain Number of Years is the fixed-rate promissory note. This type of note has a consistent interest rate throughout the loan term, which remains unchanged despite fluctuations in the market. Another type is the adjustable-rate promissory note, where the interest rate may vary over time based on predetermined factors such as the prime rate or the rate set by the Federal Reserve. This type of note allows borrowers to benefit from potential decreases in interest rates but may also result in increased payments if interest rates rise. A third type of Wake North Carolina Promissory Note with Payments Amortized for a Certain Number of Years is the balloon promissory note. This type of note includes smaller payments initially, but a significant lump sum payment (balloon payment) is required at the end of the loan term. The balloon payment often represents the remaining principal balance and may be refinanced or settled in other ways. It is essential for both lenders and borrowers in Wake North Carolina to understand the terms and conditions of a promissory note before entering into an agreement. Seeking legal advice and ensuring compliance with applicable laws and regulations can help protect the rights and interests of both parties involved in the borrowing process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Pagaré con Pagos Amortizados por Cierto Número de Años - Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Wake North Carolina Pagaré Con Pagos Amortizados Por Cierto Número De Años?

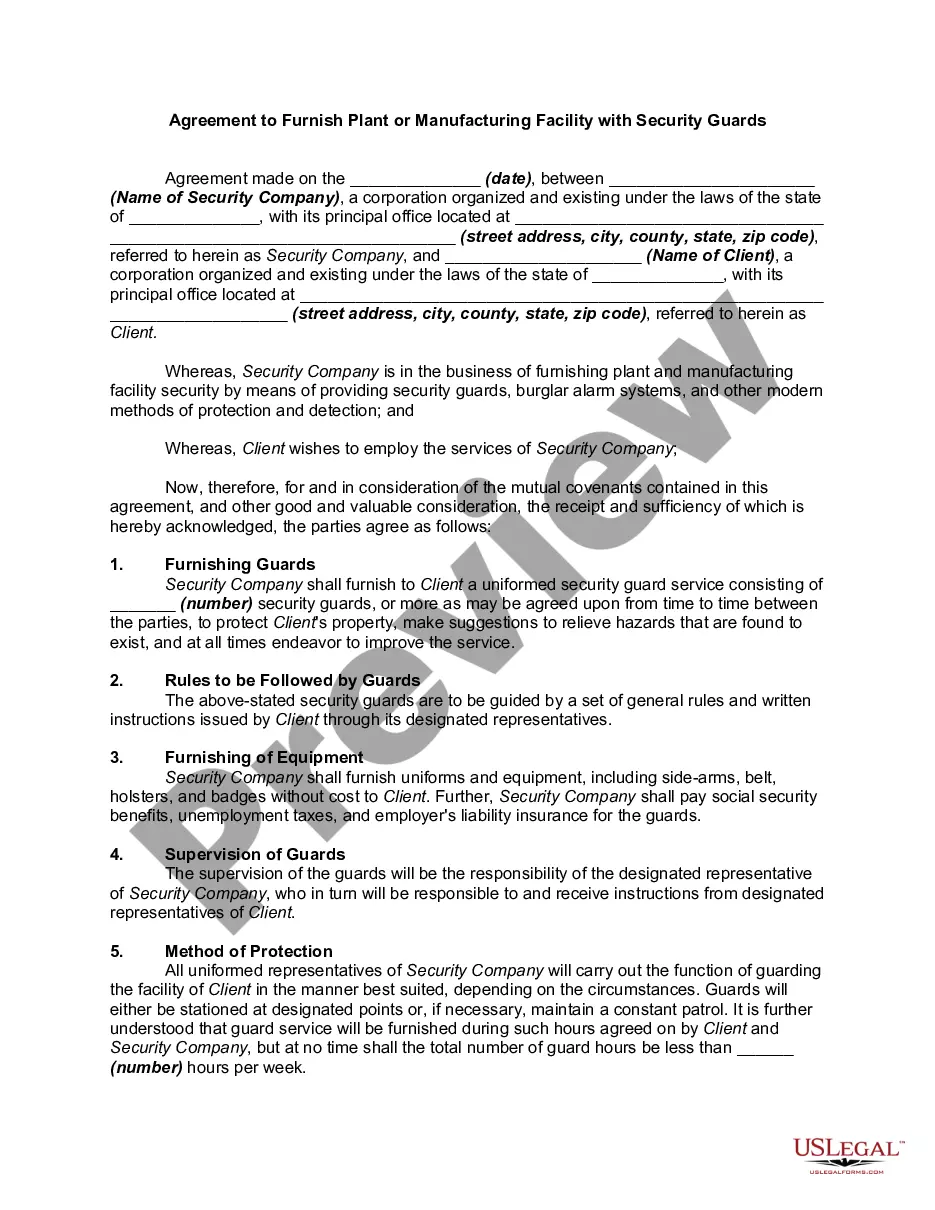

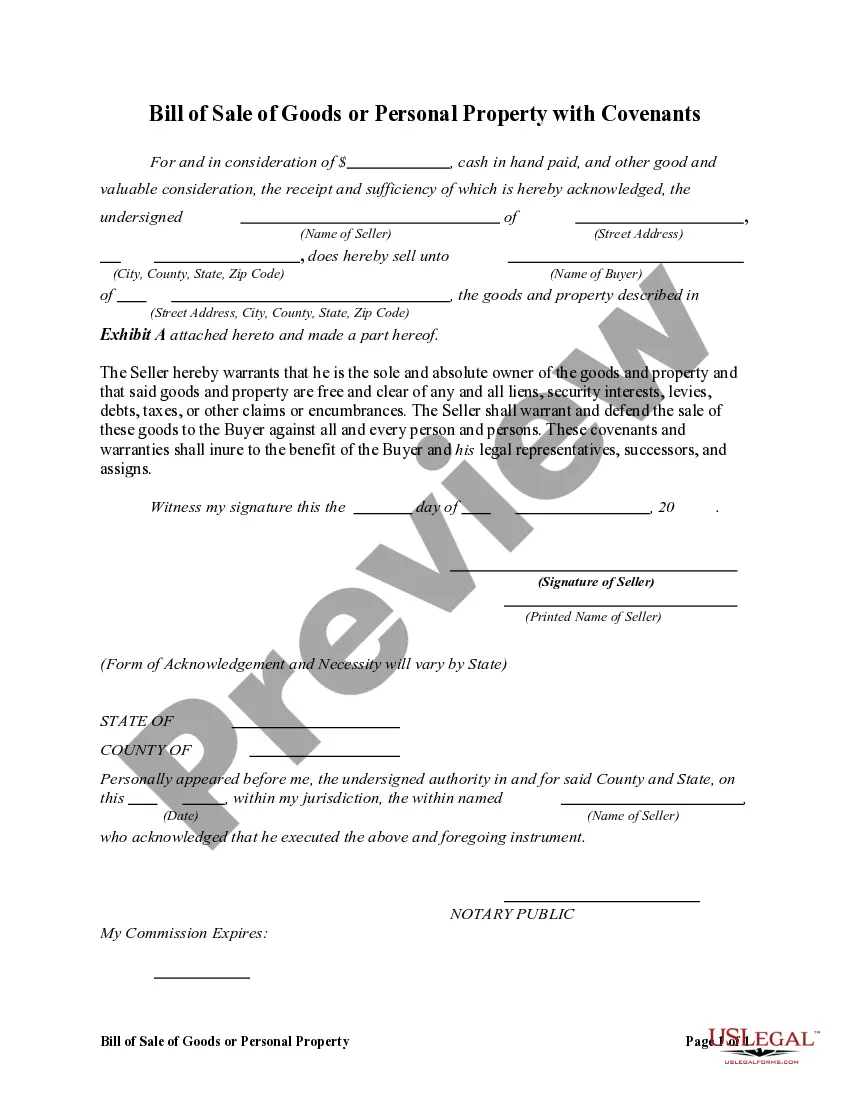

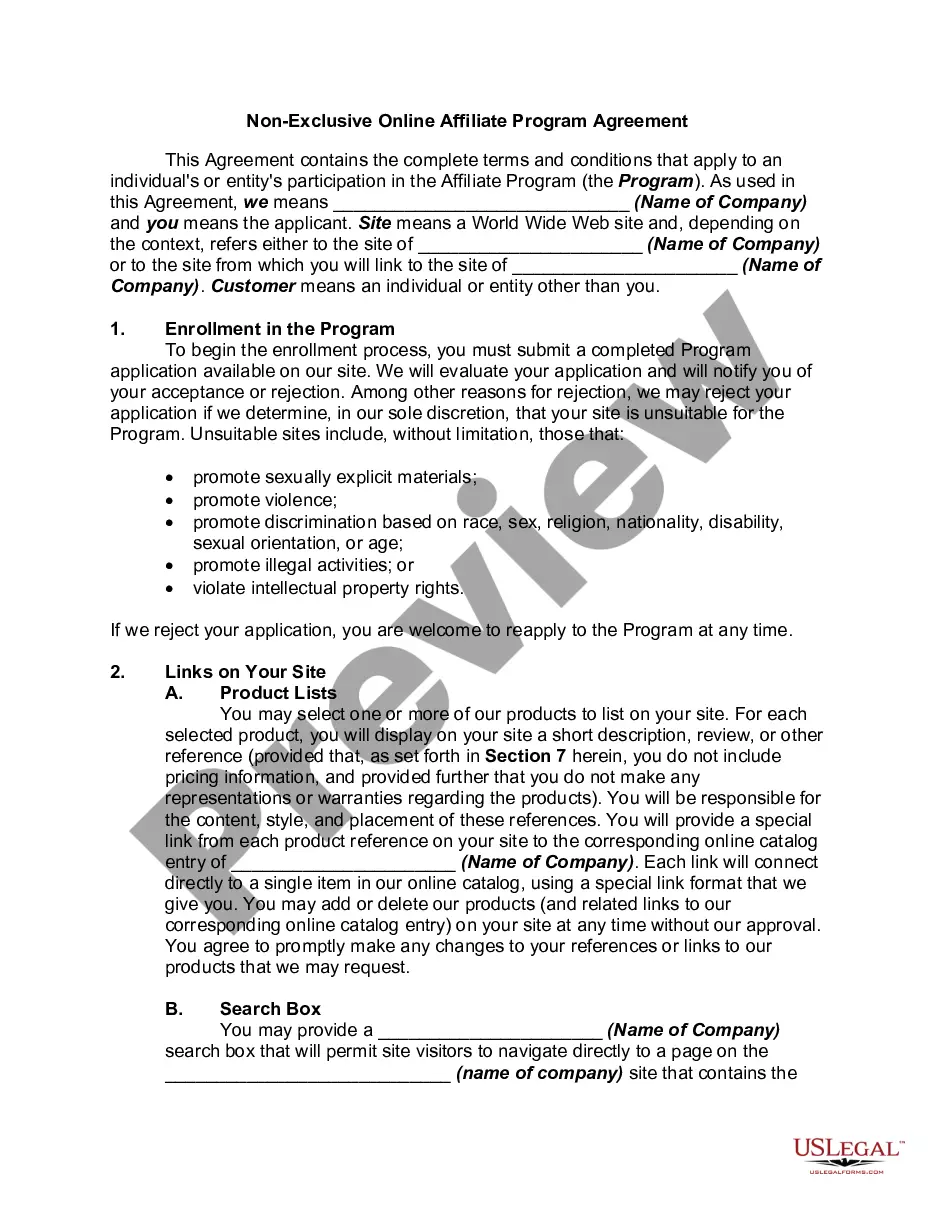

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Wake Promissory Note with Payments Amortized for a Certain Number of Years, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different types varying from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities associated with document execution straightforward.

Here's how you can find and download Wake Promissory Note with Payments Amortized for a Certain Number of Years.

- Take a look at the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can impact the validity of some records.

- Check the similar document templates or start the search over to find the appropriate document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and purchase Wake Promissory Note with Payments Amortized for a Certain Number of Years.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Wake Promissory Note with Payments Amortized for a Certain Number of Years, log in to your account, and download it. Of course, our platform can’t replace a lawyer entirely. If you need to cope with an exceptionally complicated situation, we advise getting an attorney to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for various legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

¿Como llenar un pagare? Importe a pagar: Escribe tanto en numeros como en letras el importe que queda pendiente de pago.Fecha de vencimiento: Es importante indicar la fecha en que se realizara el pago.Nombre del beneficiario:Lugar de pago:Porcentaje de interes:La palabra pagare:Firma:Barra de truncabilidad:

Partes de un pagare Fecha y lugar de emision del pagare Nombre de la entidad y oficina librada. Nombre completo o razon social del beneficiario (puede ser una persona fisica o juridica) Importe expresado en numeros y letras. Fecha y lugar de vencimiento. Numero de cuenta y Codigo IBAN de la cuenta del emisor.

¿Que contenido debe tener un pagare? La mencion de ser pagare inserta en el texto del documento. La promesa incondicional de pagar una suma determinada de dinero. El nombre de la persona a quien ha de hacerse el pago. La epoca y lugar del pago. La fecha y el lugar en que se suscribe el documento.

Un pagare es un documento contable que contiene la promesa incondicional de una persona, denominada suscriptora o deudor, de que pagara a una segunda persona, llamada beneficiario o acreedor, una suma monetaria en un determinado plazo.

En un pagare se deben diligenciar los siguientes conceptos: El valor o monto del pago. La fecha en que se debe pagar. Los intereses si los hay. Nombre del beneficiario (a quien se paga) Lugar en que se pagara. Firma del otorgante (quien se compromete a pagar).

La palabra Pagare o la expresion A la orden (esto es un buen uso para diferenciarlos de los recibos, ya que son parecidos y con los que la gente suele confundirlos). Firma del deudor (librador), no hace falta aclaracion. Fecha y lugar de celebracion (el dia en que se firma el pagare). Fecha y lugar de pago.

- Prescriben por cuatro anos, las acciones: c)la proveniente de cualquier instrumento endosable o al portador, salvo disposiciones de leyes especiales. El plazo comienza a correr, en los titulos a la vista, desde la fecha de su emision, y en aquellos a plazo, desde su vencimiento.

¿Como llenar un pagare? Importe a pagar: Escribe tanto en numeros como en letras el importe que queda pendiente de pago.Fecha de vencimiento: Es importante indicar la fecha en que se realizara el pago.Nombre del beneficiario:Lugar de pago:Porcentaje de interes:La palabra pagare:Firma:Barra de truncabilidad:

Lleva escrita la palabra PAGARE. Es firmado por el deudor. Se debe consignar claramente el monto a ser pagado en numero y letra, y el tipo de moneda. El nombre del beneficiario y la firma del que contrajo la deuda deben estar escritos correctamente, asi como la fecha de vencimiento del pago.

El pagare debe contener: La mencion de ser pagare, inserta en el texto del documento; La promesa incondicional de pagar una suma determinada de dinero; El nombre de la persona a quien ha de hacerse el pago; La epoca y el lugar del pago; La fecha y el lugar en que se subscriba el documento; y.