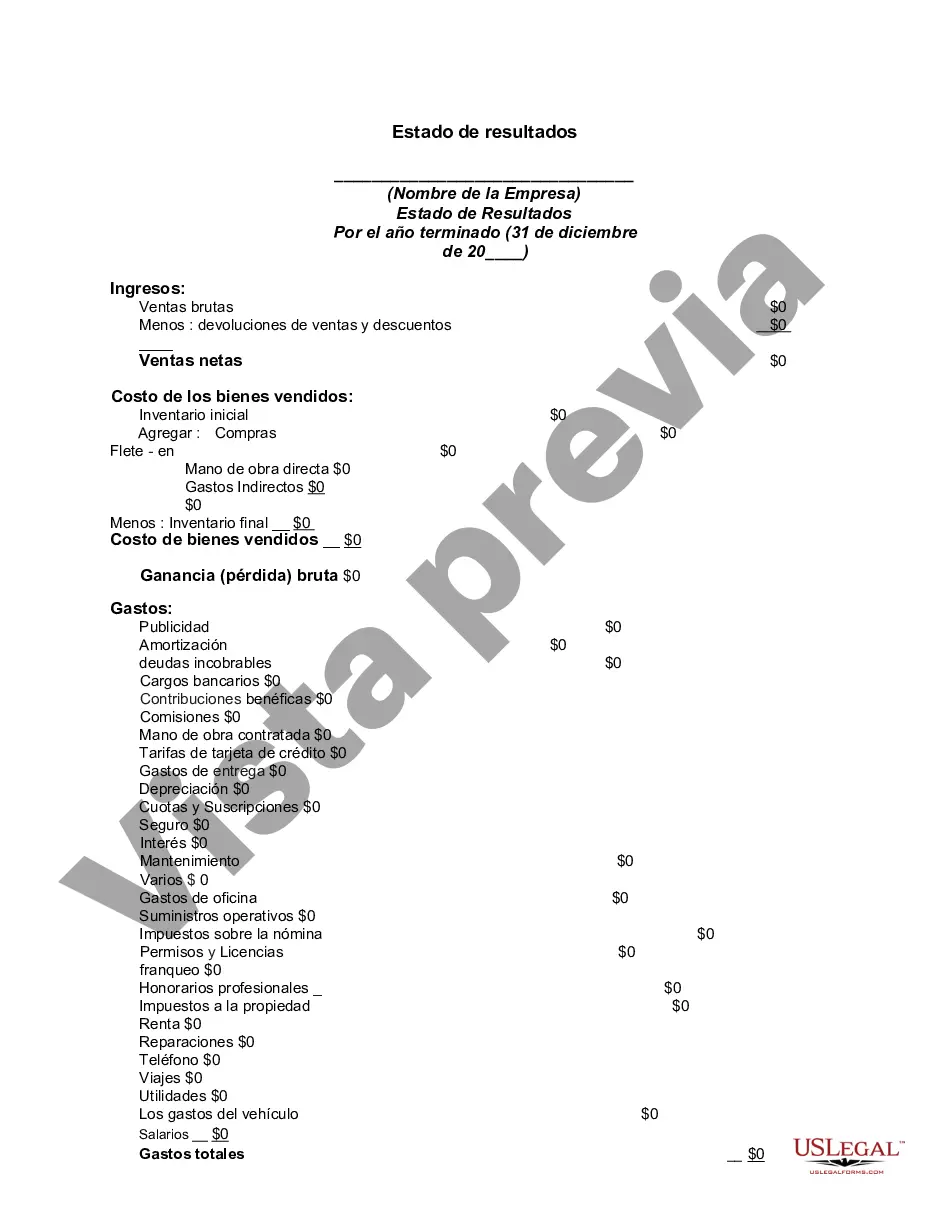

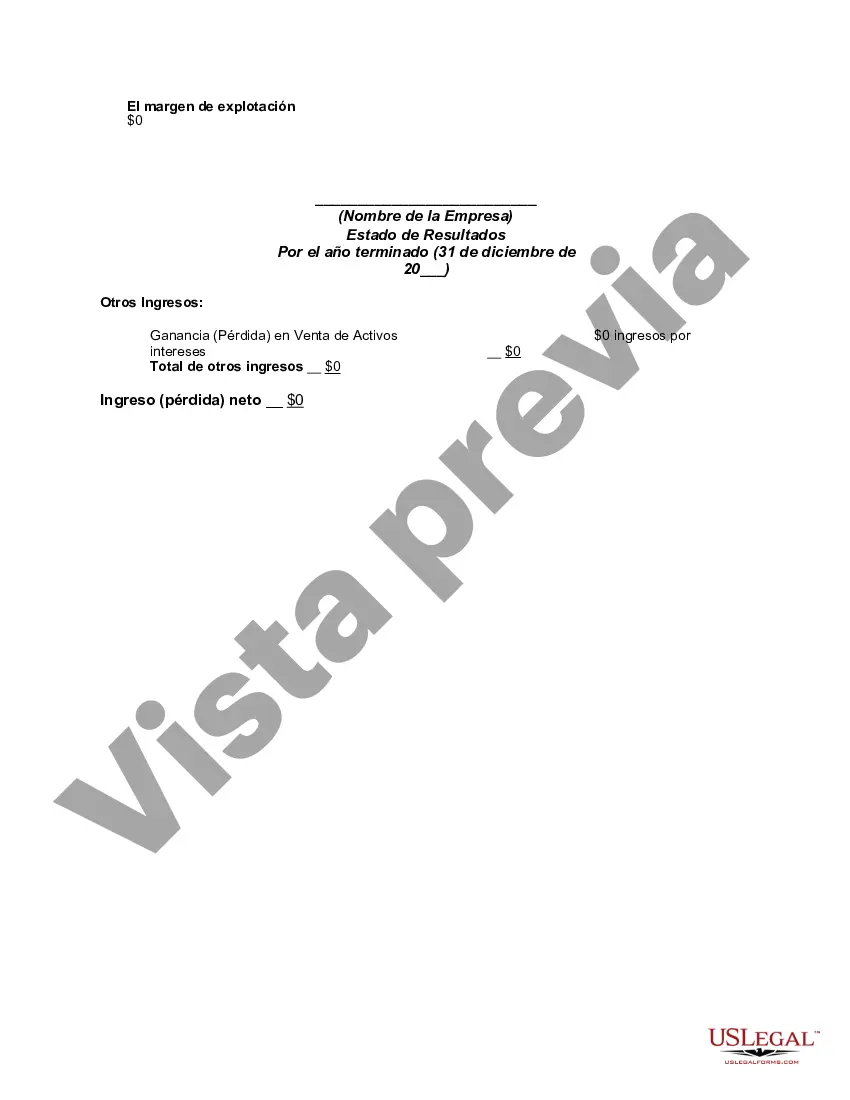

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Chicago Illinois Income Statement is a financial document used to analyze the revenues, expenses, and overall profitability of individuals, businesses, or organizations in the city of Chicago, Illinois. It provides a comprehensive overview of the financial performance by detailing the sources of income, costs, and ultimately, the net profit or loss generated during a specific period. The primary purpose of the Chicago Illinois Income Statement is to assess the financial health and performance of entities operating within Chicago, allowing businesses, investors, and stakeholders to make informed decisions based on the financial data presented. Some relevant keywords associated with the Chicago Illinois Income Statement include: 1. Revenue: This refers to the total amount of money earned by businesses or individuals through the sale of their products or services in Chicago. 2. Sales: This represents the income generated from the primary operations of a business within Chicago. 3. Expenses: These are the costs incurred while producing goods or delivering services in Chicago, such as raw materials, labor, rent, utilities, marketing expenses, etc. 4. Gross Profit: It is determined by subtracting the direct costs of production or service delivery from the revenue, indicating the profitability at an operational level. 5. Operating Expenses: These are the indirect costs associated with running a business or organization in Chicago, including salaries, rent, utilities, marketing, and administrative expenses. 6. Earnings Before Interest and Taxes (EBIT): This represents the operating profit before accounting for interest and taxes. 7. Net Income: Also known as net profit or net earnings, it is the final figure on the income statement, calculated by deducting all expenses (including taxes) from the revenue. Net income reflects the overall profitability of the entity. 8. Non-operating Income: This includes income from investments, interest, or other non-primary business activities conducted within Chicago. 9. Non-operating Expenses: These are costs not directly related to the primary operations of a business, such as interest paid on loans or other financing arrangements. 10. Multiple-Step Income Statement: A type of income statement that segregates operating and non-operating items, providing a more detailed analysis of revenues, expenses, and profit. 11. Single-Step Income Statement: This type of income statement only presents the total revenues, total expenses, and resulting net income without the differentiation of specific items. These keywords help to understand the various components of the Chicago Illinois Income Statement, offering insights into the financial performance of entities operating within the city.The Chicago Illinois Income Statement is a financial document used to analyze the revenues, expenses, and overall profitability of individuals, businesses, or organizations in the city of Chicago, Illinois. It provides a comprehensive overview of the financial performance by detailing the sources of income, costs, and ultimately, the net profit or loss generated during a specific period. The primary purpose of the Chicago Illinois Income Statement is to assess the financial health and performance of entities operating within Chicago, allowing businesses, investors, and stakeholders to make informed decisions based on the financial data presented. Some relevant keywords associated with the Chicago Illinois Income Statement include: 1. Revenue: This refers to the total amount of money earned by businesses or individuals through the sale of their products or services in Chicago. 2. Sales: This represents the income generated from the primary operations of a business within Chicago. 3. Expenses: These are the costs incurred while producing goods or delivering services in Chicago, such as raw materials, labor, rent, utilities, marketing expenses, etc. 4. Gross Profit: It is determined by subtracting the direct costs of production or service delivery from the revenue, indicating the profitability at an operational level. 5. Operating Expenses: These are the indirect costs associated with running a business or organization in Chicago, including salaries, rent, utilities, marketing, and administrative expenses. 6. Earnings Before Interest and Taxes (EBIT): This represents the operating profit before accounting for interest and taxes. 7. Net Income: Also known as net profit or net earnings, it is the final figure on the income statement, calculated by deducting all expenses (including taxes) from the revenue. Net income reflects the overall profitability of the entity. 8. Non-operating Income: This includes income from investments, interest, or other non-primary business activities conducted within Chicago. 9. Non-operating Expenses: These are costs not directly related to the primary operations of a business, such as interest paid on loans or other financing arrangements. 10. Multiple-Step Income Statement: A type of income statement that segregates operating and non-operating items, providing a more detailed analysis of revenues, expenses, and profit. 11. Single-Step Income Statement: This type of income statement only presents the total revenues, total expenses, and resulting net income without the differentiation of specific items. These keywords help to understand the various components of the Chicago Illinois Income Statement, offering insights into the financial performance of entities operating within the city.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.