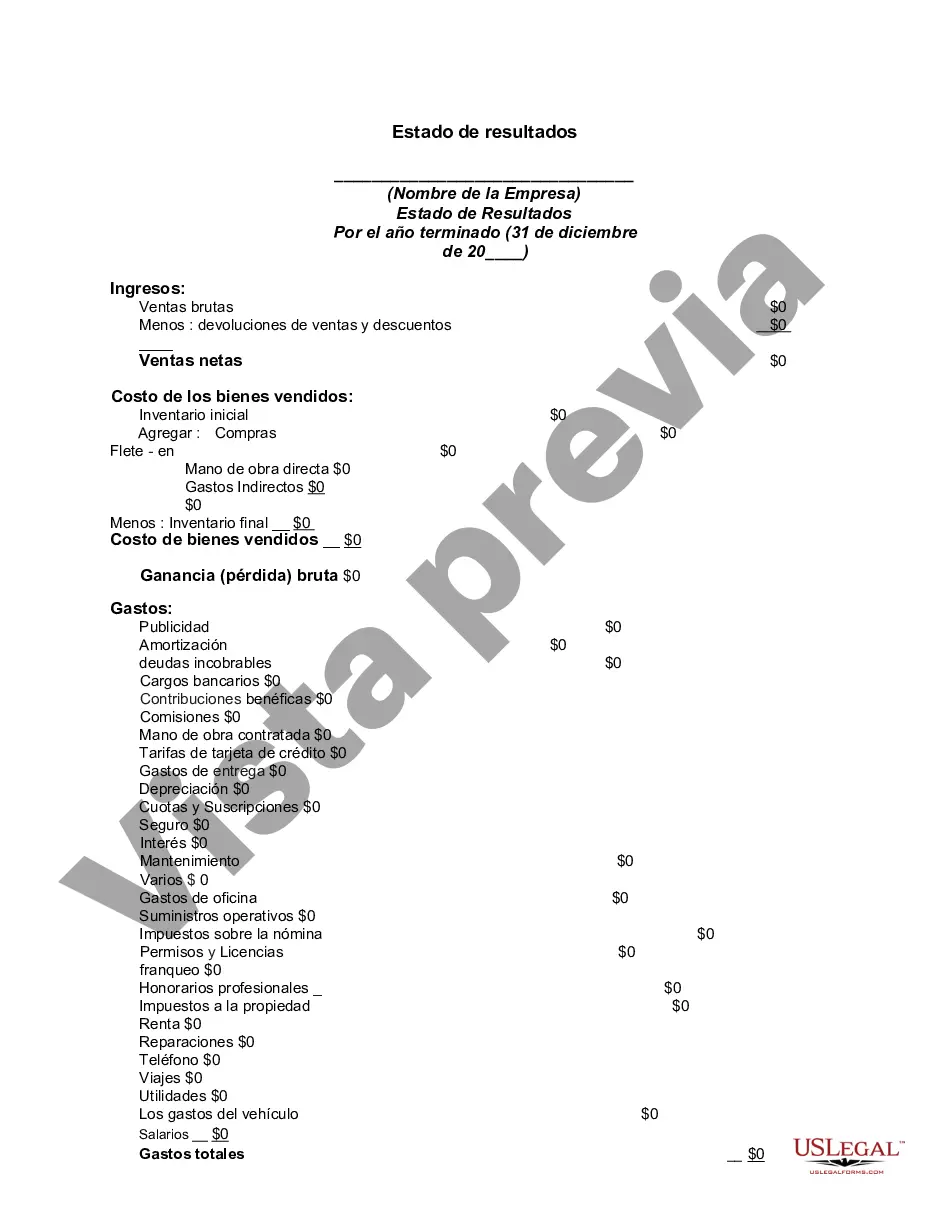

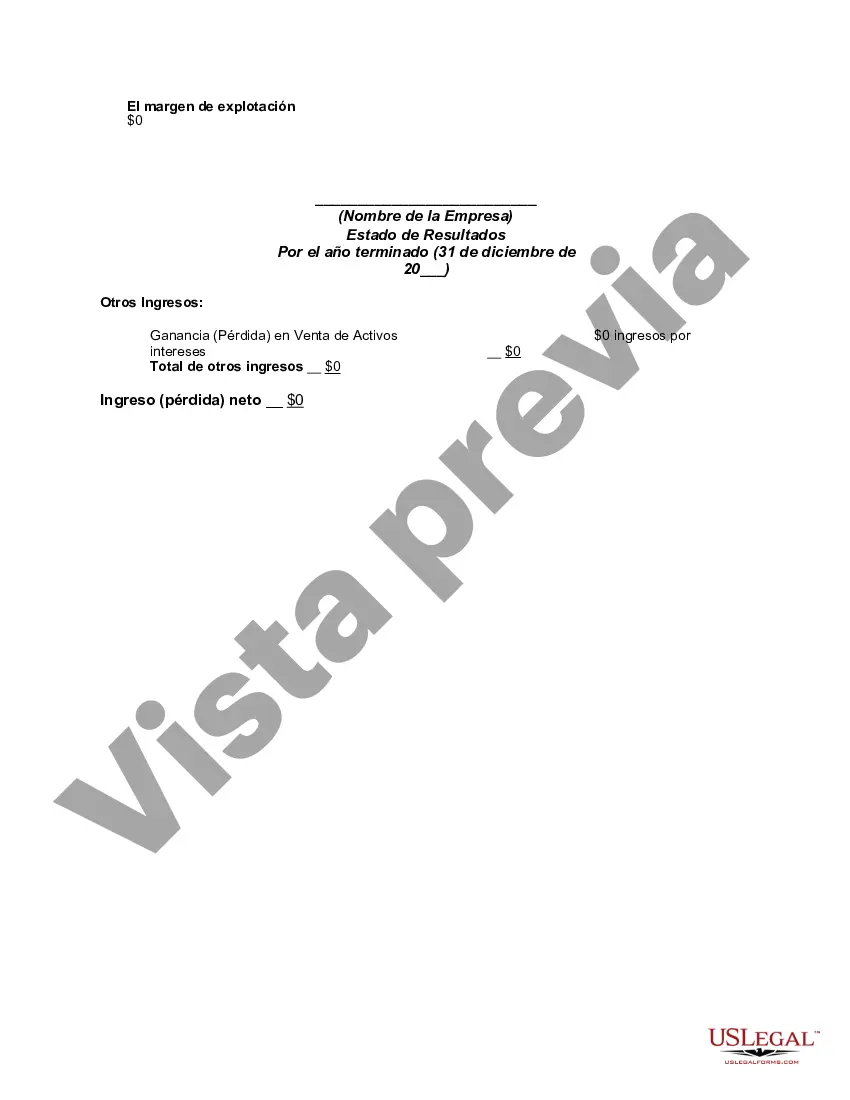

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

In Collin County, Texas, an income statement serves as a crucial financial document for businesses and individuals. Also known as a profit and loss statement or P&L statement, it provides a comprehensive overview of a company's revenues, expenses, and net income over a specific period. This financial statement assists organizations in evaluating their financial performance, identifying areas of profitability, and making informed decisions regarding future financial strategies. One type of Collin Texas income statement is the single-step income statement. This simplified format categorizes all revenues and gains together, while grouping all expenses and losses in a separate section. By subtracting the total expenses from the total revenues, the net income is determined. Another type of income statement is the multi-step income statement. This format includes multiple sections that provide more detailed information about a company's financial performance. It distinguishes between operating and non-operating revenues and expenses, allowing for a more accurate analysis of a business's operational efficiency. The Collin Texas income statement typically includes the following key components: 1. Revenues or Sales: This section highlights the total income generated from the sale of goods or services offered by the business. 2. Cost of Goods Sold (COGS): Expenses directly associated with producing goods or providing services are listed here, including manufacturing costs, raw materials, and direct labor costs. 3. Gross Profit: Calculated by deducting the COGS from the total revenue, it represents the profit made before considering operating expenses. 4. Operating Expenses: This category encompasses costs incurred by a company in its day-to-day operations, such as rent, salaries, utilities, marketing, and administrative expenses. 5. Operating Income: By subtracting operating expenses from gross profit, the operating income determines the profit generated solely from core business activities. 6. Non-Operating Revenues and Expenses: These are revenues and expenses that are not directly related to regular business operations, such as interest income, investment gains or losses, and non-operating expenses. 7. Net Income: The final section of the income statement, net income reflects the overall profit or loss generated by a business after considering all revenues, expenses (including taxes), and other adjustments. Evaluating and understanding the Collin Texas income statement is vital for businesses as it enables them to assess their financial health and performance. It aids in making informed decisions, identifying potential areas for improvement, and comparing performance across different periods or against industry benchmarks. Financial professionals and accountants rely on this statement to provide accurate financial analysis and insight into a business's profitability in Collin County, Texas.In Collin County, Texas, an income statement serves as a crucial financial document for businesses and individuals. Also known as a profit and loss statement or P&L statement, it provides a comprehensive overview of a company's revenues, expenses, and net income over a specific period. This financial statement assists organizations in evaluating their financial performance, identifying areas of profitability, and making informed decisions regarding future financial strategies. One type of Collin Texas income statement is the single-step income statement. This simplified format categorizes all revenues and gains together, while grouping all expenses and losses in a separate section. By subtracting the total expenses from the total revenues, the net income is determined. Another type of income statement is the multi-step income statement. This format includes multiple sections that provide more detailed information about a company's financial performance. It distinguishes between operating and non-operating revenues and expenses, allowing for a more accurate analysis of a business's operational efficiency. The Collin Texas income statement typically includes the following key components: 1. Revenues or Sales: This section highlights the total income generated from the sale of goods or services offered by the business. 2. Cost of Goods Sold (COGS): Expenses directly associated with producing goods or providing services are listed here, including manufacturing costs, raw materials, and direct labor costs. 3. Gross Profit: Calculated by deducting the COGS from the total revenue, it represents the profit made before considering operating expenses. 4. Operating Expenses: This category encompasses costs incurred by a company in its day-to-day operations, such as rent, salaries, utilities, marketing, and administrative expenses. 5. Operating Income: By subtracting operating expenses from gross profit, the operating income determines the profit generated solely from core business activities. 6. Non-Operating Revenues and Expenses: These are revenues and expenses that are not directly related to regular business operations, such as interest income, investment gains or losses, and non-operating expenses. 7. Net Income: The final section of the income statement, net income reflects the overall profit or loss generated by a business after considering all revenues, expenses (including taxes), and other adjustments. Evaluating and understanding the Collin Texas income statement is vital for businesses as it enables them to assess their financial health and performance. It aids in making informed decisions, identifying potential areas for improvement, and comparing performance across different periods or against industry benchmarks. Financial professionals and accountants rely on this statement to provide accurate financial analysis and insight into a business's profitability in Collin County, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.