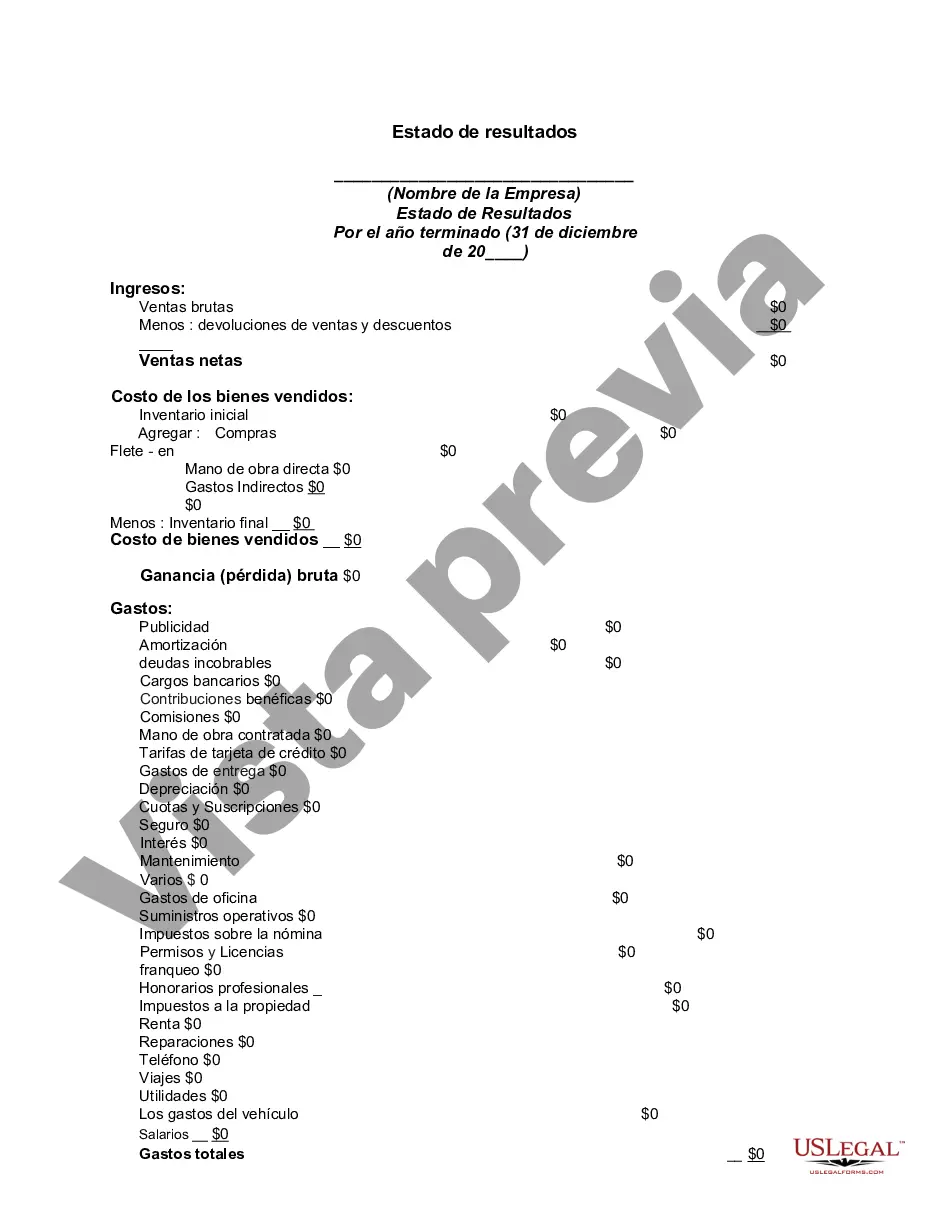

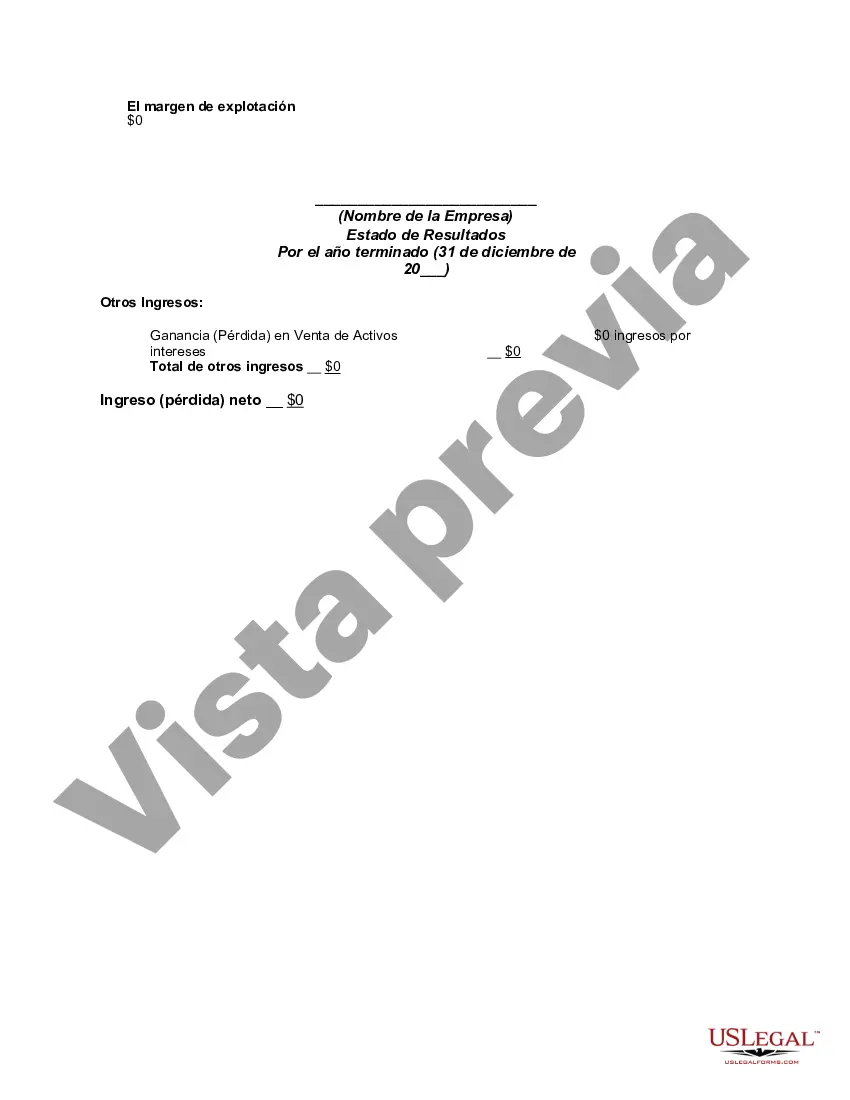

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Contra Costa California Income Statement is a financial document that provides a comprehensive overview of an individual's or company's revenue, expenses, and net income within a specific period in Contra Costa County, California. It plays a crucial role in understanding the financial health and performance of an entity. By analyzing the income statement, individuals, businesses, and investors can assess profitability, evaluate cost management, identify trends, and make informed decisions. The Contra Costa California Income Statement typically consists of several key sections, including: 1. Revenue: This section summarizes the total income generated by an individual or business. It includes revenues from the sale of goods or services, rental income, investment income, and any other sources of income. 2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or delivering goods or services. It accounts for expenses such as raw materials, manufacturing or production costs, direct labor, and any other expenses directly related to revenue generation. 3. Gross Profit: Calculated by subtracting the COGS from the total revenue, the gross profit reflects the profitability of core operations before considering operating expenses. 4. Operating Expenses: This section covers the expenses incurred for running day-to-day operations. It includes costs related to sales and marketing, research and development, administrative expenses, utilities, salaries, rent, and other overhead costs. 5. Operating Income: Obtained by deducting operating expenses from the gross profit, operating income reveals the profitability from the core business activities. 6. Non-Operating Income and Expenses: This category incorporates any income or expenses that are not directly linked to the primary business operations. It could include gains or losses from investments, interest income, or expenses from loans, taxes, or fines. 7. Net Income Before Taxes: Derived by subtracting non-operating income and expenses from the operating income, net income before taxes indicates the overall profitability before tax obligations. 8. Taxes: This section covers the income taxes imposed by federal, state, and local authorities on the net income before taxes. 9. Net Income: The final section of the income statement, net income, represents the entity's overall profitability after taking taxes into account. It provides a clear picture of the income available for distribution to shareholders, partners, or owners. Regarding different types of Contra Costa California Income Statements, there are no distinct variations specific to Contra Costa County. Income statements generally follow a standard format; however, they can differ based on the nature of the business, industry, or organization. For example, nonprofit organizations may present a statement of activities instead of a traditional profit and loss statement. In summary, the Contra Costa California Income Statement is a crucial financial tool that summarizes the revenue, expenses, and net income of individuals or businesses operating in Contra Costa County. It helps monitor financial performance, identify strengths and weaknesses, and make informed decisions based on the generated financial data.The Contra Costa California Income Statement is a financial document that provides a comprehensive overview of an individual's or company's revenue, expenses, and net income within a specific period in Contra Costa County, California. It plays a crucial role in understanding the financial health and performance of an entity. By analyzing the income statement, individuals, businesses, and investors can assess profitability, evaluate cost management, identify trends, and make informed decisions. The Contra Costa California Income Statement typically consists of several key sections, including: 1. Revenue: This section summarizes the total income generated by an individual or business. It includes revenues from the sale of goods or services, rental income, investment income, and any other sources of income. 2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or delivering goods or services. It accounts for expenses such as raw materials, manufacturing or production costs, direct labor, and any other expenses directly related to revenue generation. 3. Gross Profit: Calculated by subtracting the COGS from the total revenue, the gross profit reflects the profitability of core operations before considering operating expenses. 4. Operating Expenses: This section covers the expenses incurred for running day-to-day operations. It includes costs related to sales and marketing, research and development, administrative expenses, utilities, salaries, rent, and other overhead costs. 5. Operating Income: Obtained by deducting operating expenses from the gross profit, operating income reveals the profitability from the core business activities. 6. Non-Operating Income and Expenses: This category incorporates any income or expenses that are not directly linked to the primary business operations. It could include gains or losses from investments, interest income, or expenses from loans, taxes, or fines. 7. Net Income Before Taxes: Derived by subtracting non-operating income and expenses from the operating income, net income before taxes indicates the overall profitability before tax obligations. 8. Taxes: This section covers the income taxes imposed by federal, state, and local authorities on the net income before taxes. 9. Net Income: The final section of the income statement, net income, represents the entity's overall profitability after taking taxes into account. It provides a clear picture of the income available for distribution to shareholders, partners, or owners. Regarding different types of Contra Costa California Income Statements, there are no distinct variations specific to Contra Costa County. Income statements generally follow a standard format; however, they can differ based on the nature of the business, industry, or organization. For example, nonprofit organizations may present a statement of activities instead of a traditional profit and loss statement. In summary, the Contra Costa California Income Statement is a crucial financial tool that summarizes the revenue, expenses, and net income of individuals or businesses operating in Contra Costa County. It helps monitor financial performance, identify strengths and weaknesses, and make informed decisions based on the generated financial data.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.