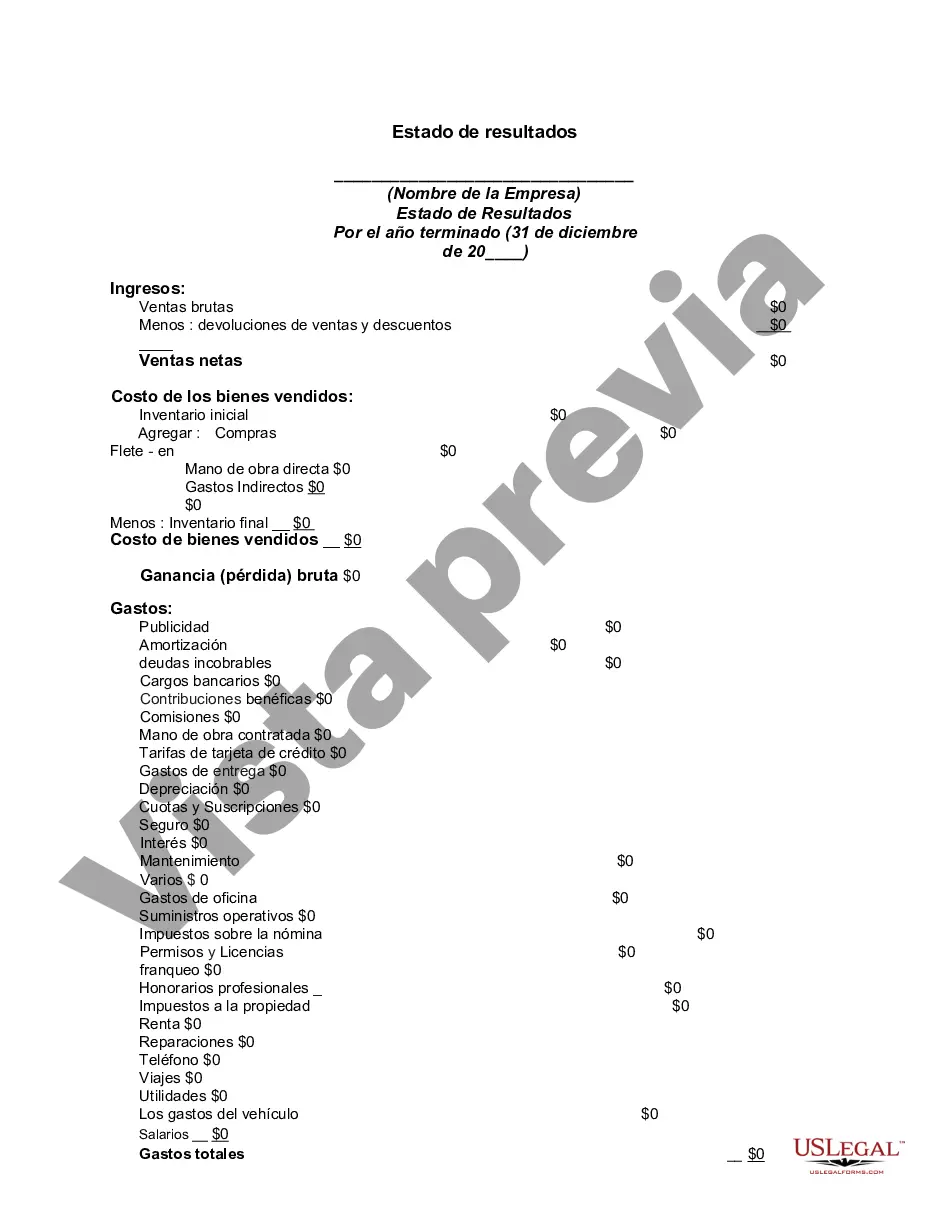

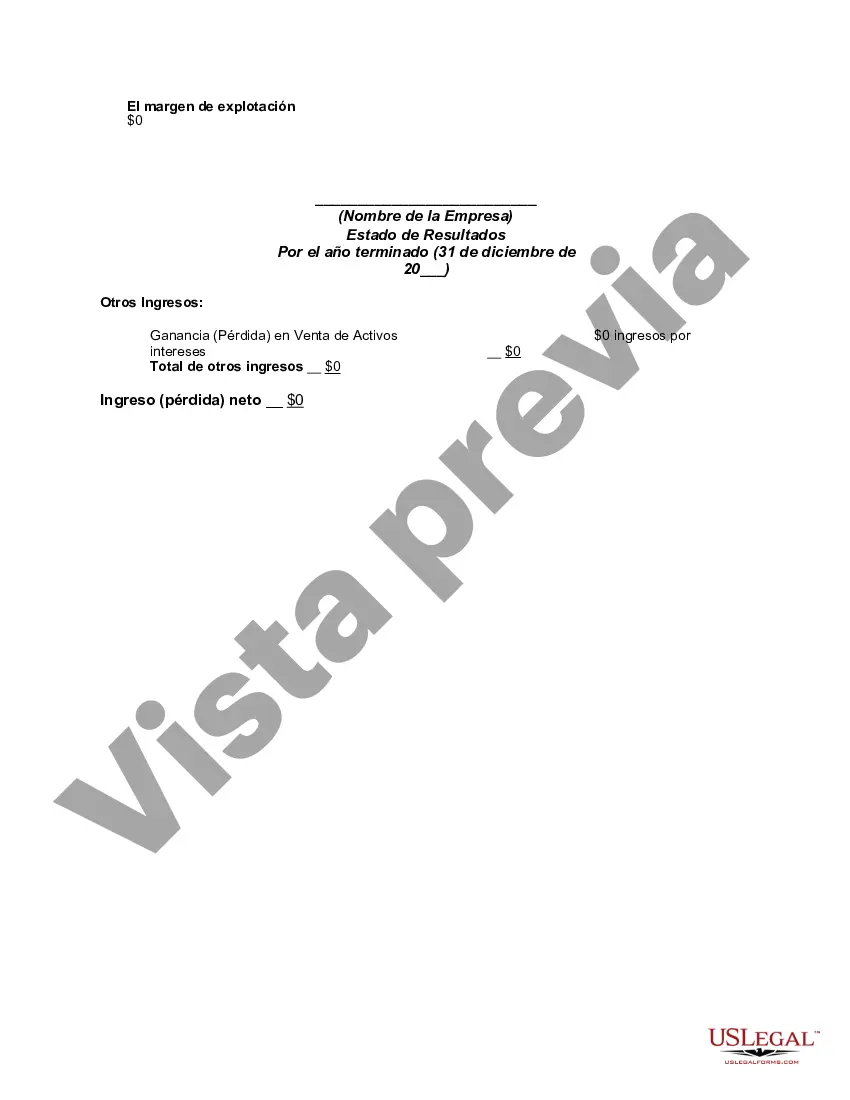

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Cook Illinois is a leading transportation company based in Illinois that specializes in providing comprehensive transportation services to school districts and private organizations. The Cook Illinois Income Statement is a financial statement that reflects the revenue, expenses, and net income of the company over a specific period. It is an essential tool in evaluating the financial performance and profitability of Cook Illinois. The Cook Illinois Income Statement is typically prepared annually and follows generally accepted accounting principles (GAAP). It provides an overview of the company's financial performance by breaking down various sources of income and categorizing expenses incurred during the reporting period. This statement is vital for investors, lenders, and stakeholders as it helps them assess the company's profitability, efficiency, and viability. The Cook Illinois Income Statement typically consists of several sections, including: 1. Revenue: This section outlines the primary sources of income earned by Cook Illinois, such as transportation fees, contracts with school districts, and government subsidies. 2. Cost of Goods Sold (COGS): COGS represents the direct expenses associated with providing transportation services, including fuel costs, maintenance expenses, and wages for drivers and staff. 3. Gross Profit: Gross profit is calculated by deducting the COGS from the total revenue. It reflects the profitability of Cook Illinois' core operations before accounting for other operating expenses. 4. Operating Expenses: This section includes various expenses not directly related to providing transportation services. It typically includes administrative and office expenses, marketing costs, insurance premiums, and salaries of non-operational staff. 5. Operating Income: Operating income is derived by subtracting the operating expenses from the gross profit. It represents the company's profitability from its regular business operations. 6. Other Income and Expenses: Cook Illinois may have additional income or expenses that are not part of its primary operations. These may include gains or losses from the sale of assets, interests earned on investments, or any one-time extraordinary items. 7. Net Income: Net income is the final figure on the income statement and is calculated by subtracting other income and expenses from the operating income. It represents the company's ultimate profitability or loss during the reporting period. Cook Illinois may have different types of income statements depending on the level of detail and reporting requirements. Common variations include single-step income statements, which calculate the total revenue and subtract all expenses in one step, and multi-step income statements, which provide further breakdowns of revenue, expenses, and profitability measures. In summary, the Cook Illinois Income Statement is a financial statement that provides a comprehensive overview of the company's revenue, expenses, and net income. It helps stakeholders assess the financial performance and profitability of Cook Illinois, making it an essential tool in decision-making and evaluating the company's overall financial health.Cook Illinois is a leading transportation company based in Illinois that specializes in providing comprehensive transportation services to school districts and private organizations. The Cook Illinois Income Statement is a financial statement that reflects the revenue, expenses, and net income of the company over a specific period. It is an essential tool in evaluating the financial performance and profitability of Cook Illinois. The Cook Illinois Income Statement is typically prepared annually and follows generally accepted accounting principles (GAAP). It provides an overview of the company's financial performance by breaking down various sources of income and categorizing expenses incurred during the reporting period. This statement is vital for investors, lenders, and stakeholders as it helps them assess the company's profitability, efficiency, and viability. The Cook Illinois Income Statement typically consists of several sections, including: 1. Revenue: This section outlines the primary sources of income earned by Cook Illinois, such as transportation fees, contracts with school districts, and government subsidies. 2. Cost of Goods Sold (COGS): COGS represents the direct expenses associated with providing transportation services, including fuel costs, maintenance expenses, and wages for drivers and staff. 3. Gross Profit: Gross profit is calculated by deducting the COGS from the total revenue. It reflects the profitability of Cook Illinois' core operations before accounting for other operating expenses. 4. Operating Expenses: This section includes various expenses not directly related to providing transportation services. It typically includes administrative and office expenses, marketing costs, insurance premiums, and salaries of non-operational staff. 5. Operating Income: Operating income is derived by subtracting the operating expenses from the gross profit. It represents the company's profitability from its regular business operations. 6. Other Income and Expenses: Cook Illinois may have additional income or expenses that are not part of its primary operations. These may include gains or losses from the sale of assets, interests earned on investments, or any one-time extraordinary items. 7. Net Income: Net income is the final figure on the income statement and is calculated by subtracting other income and expenses from the operating income. It represents the company's ultimate profitability or loss during the reporting period. Cook Illinois may have different types of income statements depending on the level of detail and reporting requirements. Common variations include single-step income statements, which calculate the total revenue and subtract all expenses in one step, and multi-step income statements, which provide further breakdowns of revenue, expenses, and profitability measures. In summary, the Cook Illinois Income Statement is a financial statement that provides a comprehensive overview of the company's revenue, expenses, and net income. It helps stakeholders assess the financial performance and profitability of Cook Illinois, making it an essential tool in decision-making and evaluating the company's overall financial health.

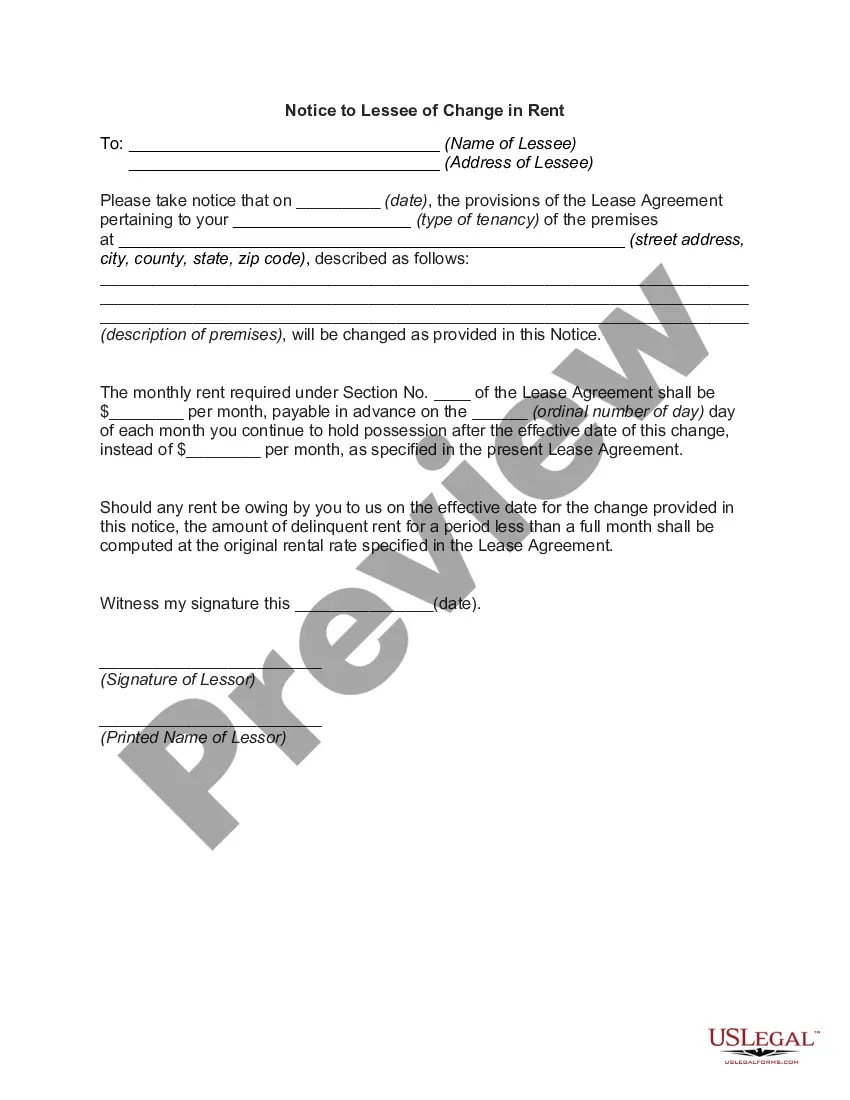

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.