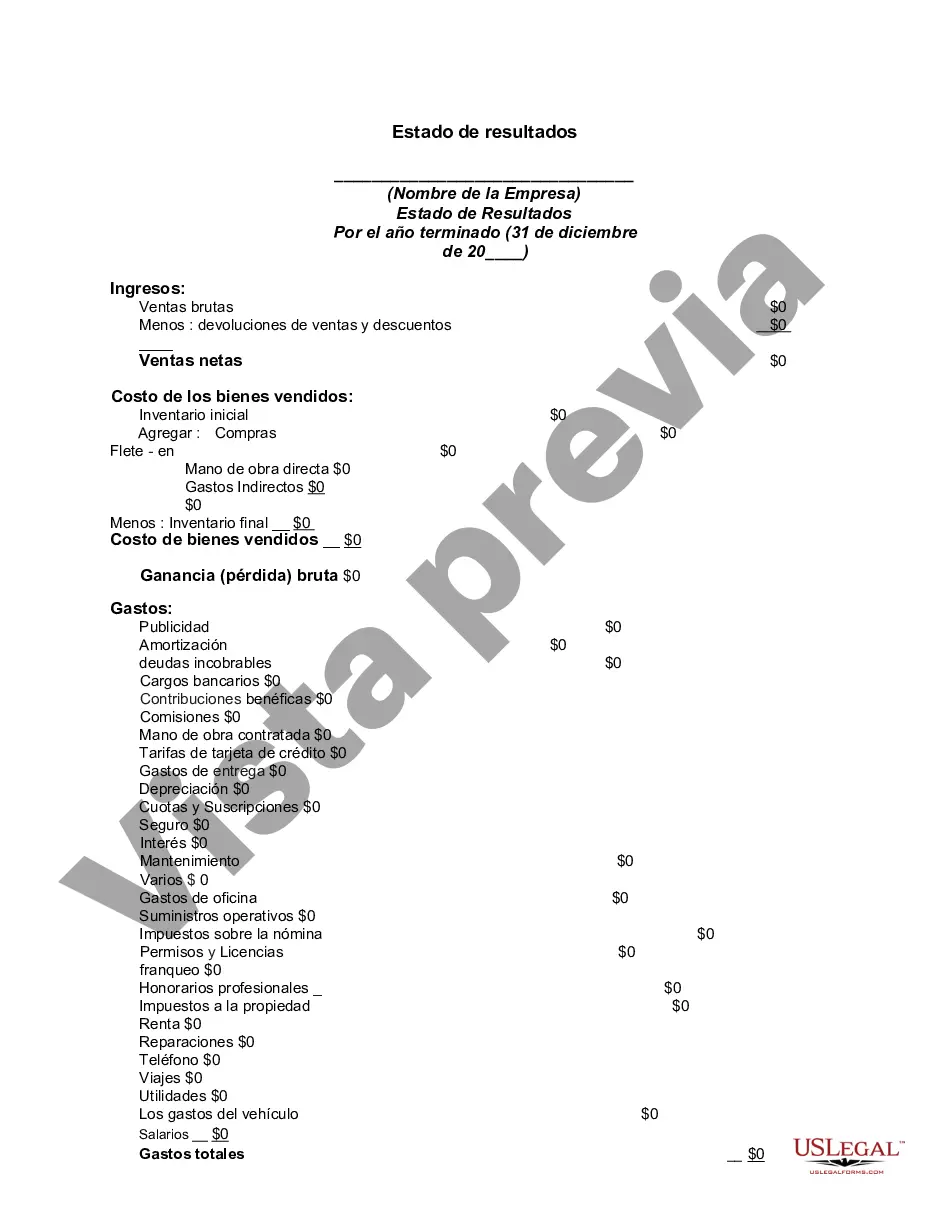

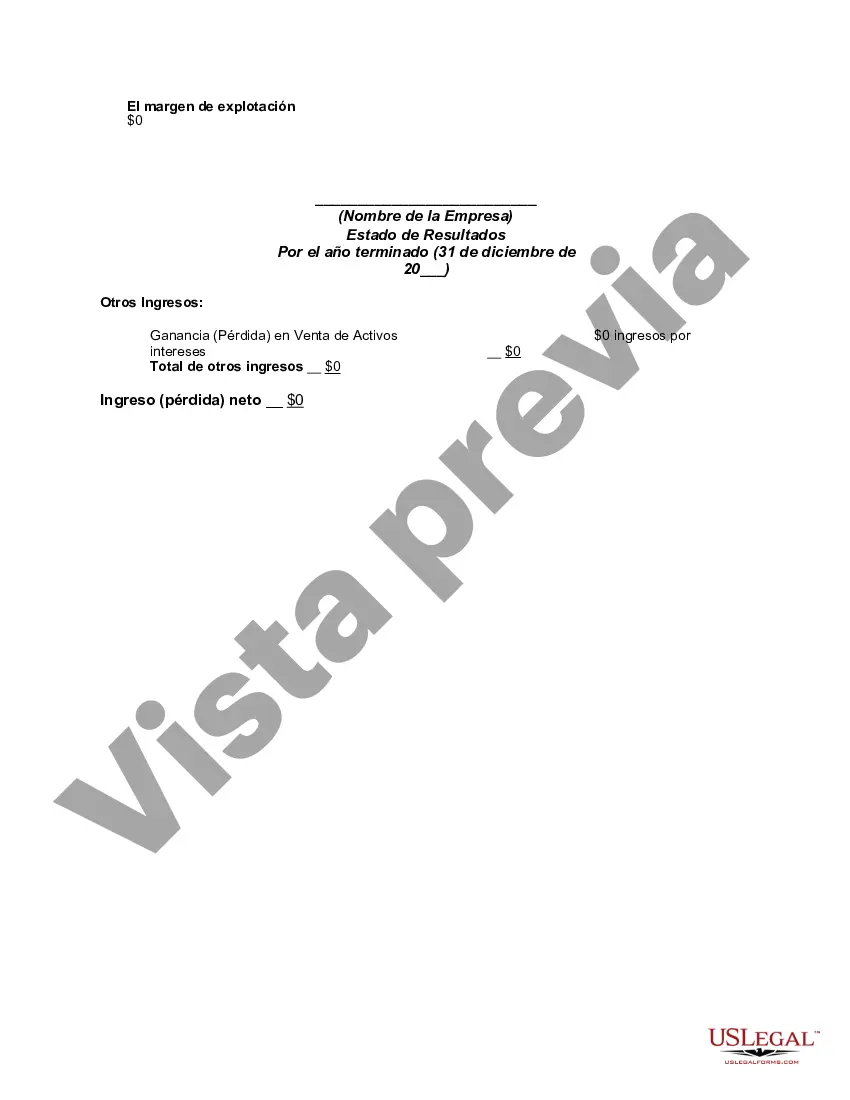

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Cuyahoga County, Ohio Income Statement is a financial document that provides a summary of revenue, expenses, and net income for a specific period within Cuyahoga County, Ohio. It showcases the financial performance and profitability of individuals, businesses, or organizations within the county. This statement is crucial for various purposes, such as measuring financial health, making informed decisions, and tracking economic trends in the county. The Cuyahoga Ohio Income Statement typically includes several key components. Firstly, it includes revenues or income, which refers to the inflow of funds or economic benefits generated by activities within Cuyahoga County. This section may account for various sources such as taxes, grants, investments, fees, and sales. Secondly, the statement comprises expenses or costs, which represent the outflow of funds or economic resources used by entities within the county. These expenses may include salaries, operational costs, supplies, utilities, maintenance, and other expenditures necessary for running businesses or delivering services. Moreover, the Cuyahoga Ohio Income Statement calculates the net income or net loss, which is the difference between total revenue and total expenses. A positive net income indicates a profit, while a negative net income suggests a loss. This figure demonstrates the financial outcome of activities within Cuyahoga County, serving as a measure of economic success or challenges. There are various types or formats of income statements that may be applicable to Cuyahoga County, Ohio. These include: 1. Single-step income statement: This statement presents revenue, followed by expenses, resulting in a single-step calculation of net income or loss. 2. Multi-step income statement: Unlike the single-step income statement, the multi-step income statement provides multiple sections, allowing for more detailed analysis. It distinguishes between operating and non-operating revenues and expenses, calculates gross profit, operating income, and net income. 3. Comparative income statement: The comparative income statement highlights the financial performance over two or more periods, enabling a comparison of revenue, expenses, and net income over time. It aids in identifying trends and evaluating growth or decline. In summary, the Cuyahoga Ohio Income Statement is a vital financial document that serves as a comprehensive summary of revenues, expenses, and net income for individuals, businesses, or organizations within Cuyahoga County, Ohio. The statement helps gauge financial health, make informed decisions, and track economic trends within the county. Different types of income statements, such as single-step, multi-step, and comparative, offer varying levels of detail and analysis.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.