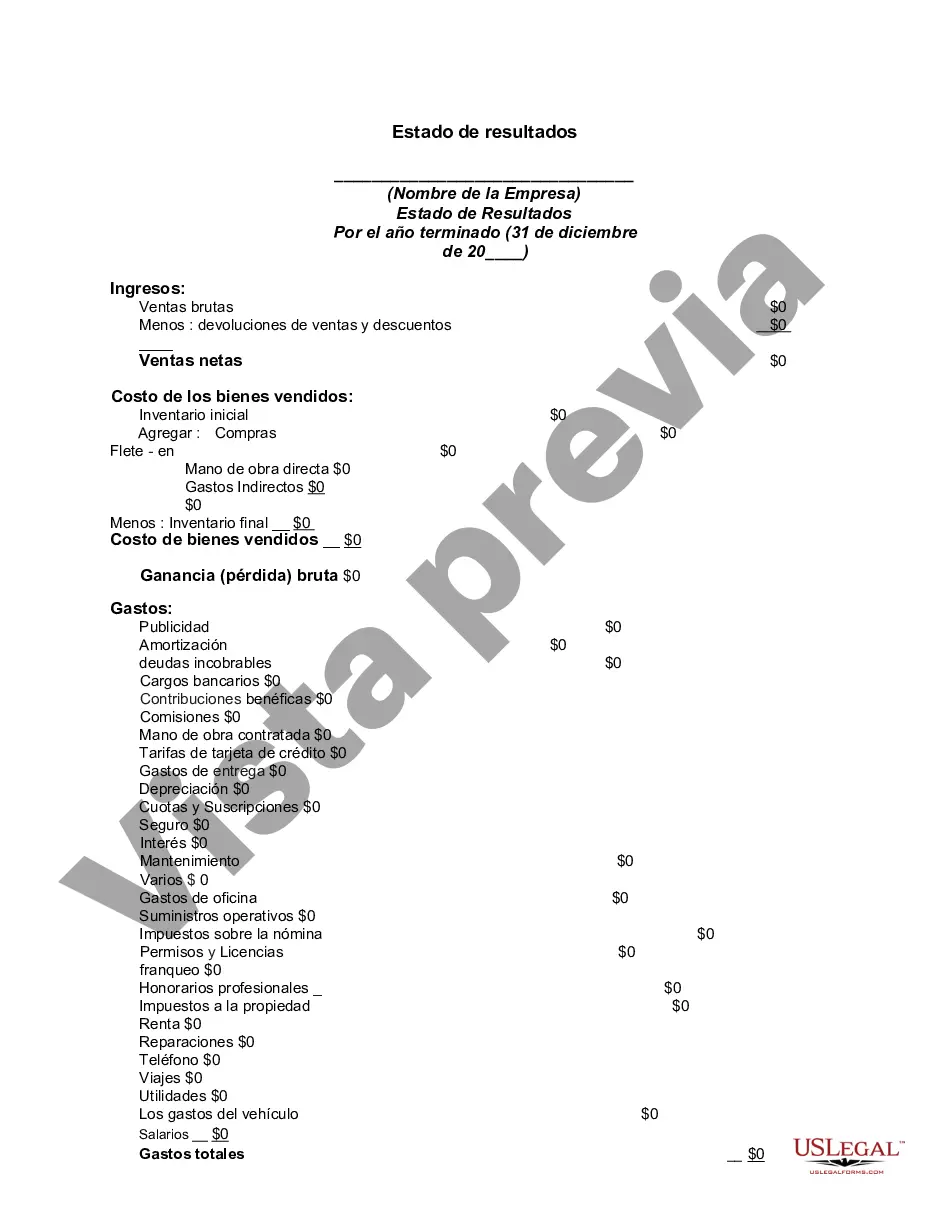

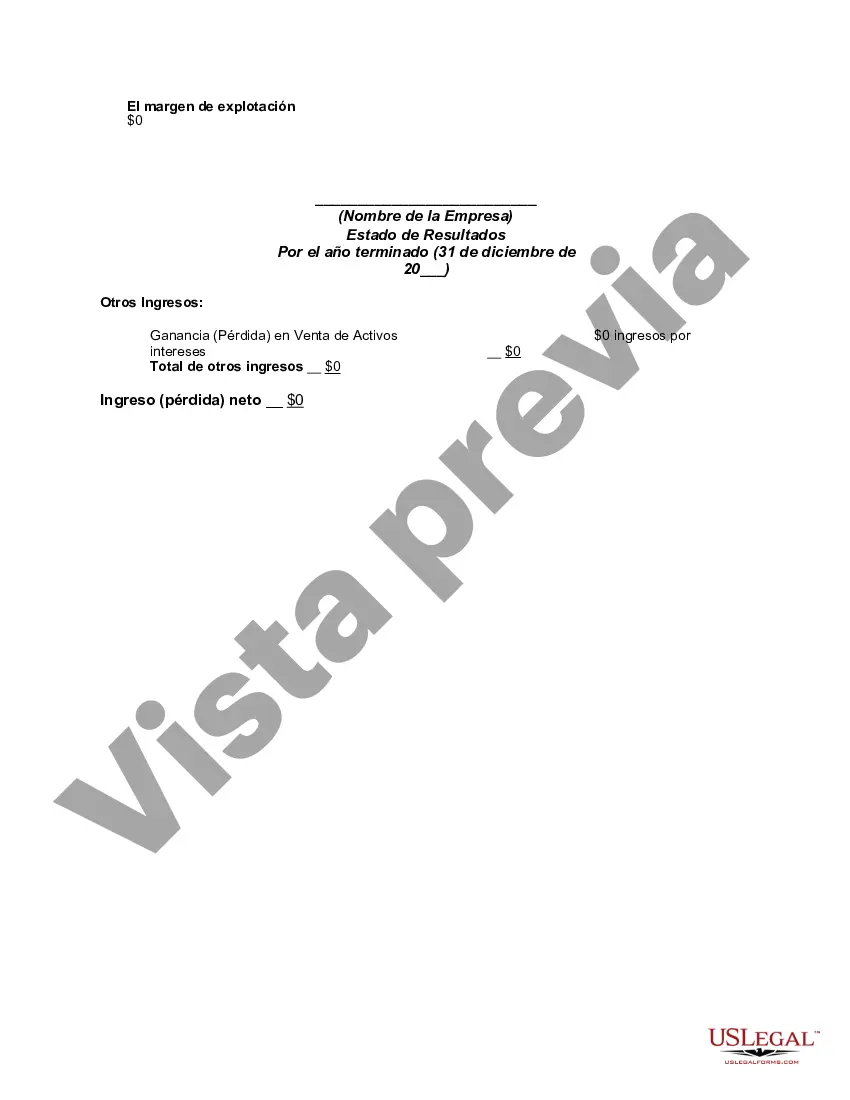

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Fairfax Virginia Income Statement is a financial document that provides a detailed breakdown of the revenue, expenses, and net income of a business or individual residing in Fairfax, Virginia. It is a crucial component of financial reporting and helps in assessing the financial performance of the entity. The income statement is also referred to as a profit and loss statement, statement of earnings, or statement of operations. The Fairfax Virginia Income Statement consists of several key sections that depict the financial activities of the entity over a specific period, such as a month, quarter, or year. These sections include: 1. Revenue: This section outlines the total income generated from the sale of goods, services, or other sources such as rentals or royalties. 2. Cost of Goods Sold (COGS): COGS encompasses all the direct costs associated with producing or manufacturing the goods or services sold. It includes costs like raw materials, direct labor, and production overheads. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue and represents the amount of money earned after considering the direct costs. 4. Operating Expenses: This section includes all the expenses incurred in running the day-to-day operations of the business. It encompasses various items like rent, utilities, salaries, marketing, maintenance, and other general administrative costs. 5. Operating Income: Operating income is derived by deducting the operating expenses from the gross profit. It indicates the profitability of the core operating activities of the entity. 6. Non-Operating Income/Expenses: This section accounts for income or expenses that are not directly related to the regular operations of the business. Examples include interest income, interest expense, gains or losses from the sale of assets, or investments. 7. Income Taxes: This part reflects the income tax expense based on the taxable income of the entity, incorporating federal, state, and local taxes. 8. Net Income: Net income, also known as profit or net earnings, represents the final amount earned by the business or individual after deducting all the expenses, including taxes, from the revenue. It reflects the overall profitability and financial health of the entity. Different types of Fairfax Virginia Income Statements may exist depending on the type of entity and specific industry-related requirements. For instance, a Fairfax County nonprofit organization would have a nonprofit income statement focused on revenue from donations, grants, and program services, while a Fairfax-based manufacturing company may have a manufacturing income statement emphasizing COGS and inventory-related expenses. In conclusion, the Fairfax Virginia Income Statement is an essential financial statement reflecting the revenue, expenses, and net income of an entity in Fairfax, Virginia. It serves as a fundamental tool for analyzing financial performance, making informed business decisions, and complying with accounting and tax regulations.Fairfax Virginia Income Statement is a financial document that provides a detailed breakdown of the revenue, expenses, and net income of a business or individual residing in Fairfax, Virginia. It is a crucial component of financial reporting and helps in assessing the financial performance of the entity. The income statement is also referred to as a profit and loss statement, statement of earnings, or statement of operations. The Fairfax Virginia Income Statement consists of several key sections that depict the financial activities of the entity over a specific period, such as a month, quarter, or year. These sections include: 1. Revenue: This section outlines the total income generated from the sale of goods, services, or other sources such as rentals or royalties. 2. Cost of Goods Sold (COGS): COGS encompasses all the direct costs associated with producing or manufacturing the goods or services sold. It includes costs like raw materials, direct labor, and production overheads. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue and represents the amount of money earned after considering the direct costs. 4. Operating Expenses: This section includes all the expenses incurred in running the day-to-day operations of the business. It encompasses various items like rent, utilities, salaries, marketing, maintenance, and other general administrative costs. 5. Operating Income: Operating income is derived by deducting the operating expenses from the gross profit. It indicates the profitability of the core operating activities of the entity. 6. Non-Operating Income/Expenses: This section accounts for income or expenses that are not directly related to the regular operations of the business. Examples include interest income, interest expense, gains or losses from the sale of assets, or investments. 7. Income Taxes: This part reflects the income tax expense based on the taxable income of the entity, incorporating federal, state, and local taxes. 8. Net Income: Net income, also known as profit or net earnings, represents the final amount earned by the business or individual after deducting all the expenses, including taxes, from the revenue. It reflects the overall profitability and financial health of the entity. Different types of Fairfax Virginia Income Statements may exist depending on the type of entity and specific industry-related requirements. For instance, a Fairfax County nonprofit organization would have a nonprofit income statement focused on revenue from donations, grants, and program services, while a Fairfax-based manufacturing company may have a manufacturing income statement emphasizing COGS and inventory-related expenses. In conclusion, the Fairfax Virginia Income Statement is an essential financial statement reflecting the revenue, expenses, and net income of an entity in Fairfax, Virginia. It serves as a fundamental tool for analyzing financial performance, making informed business decisions, and complying with accounting and tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.