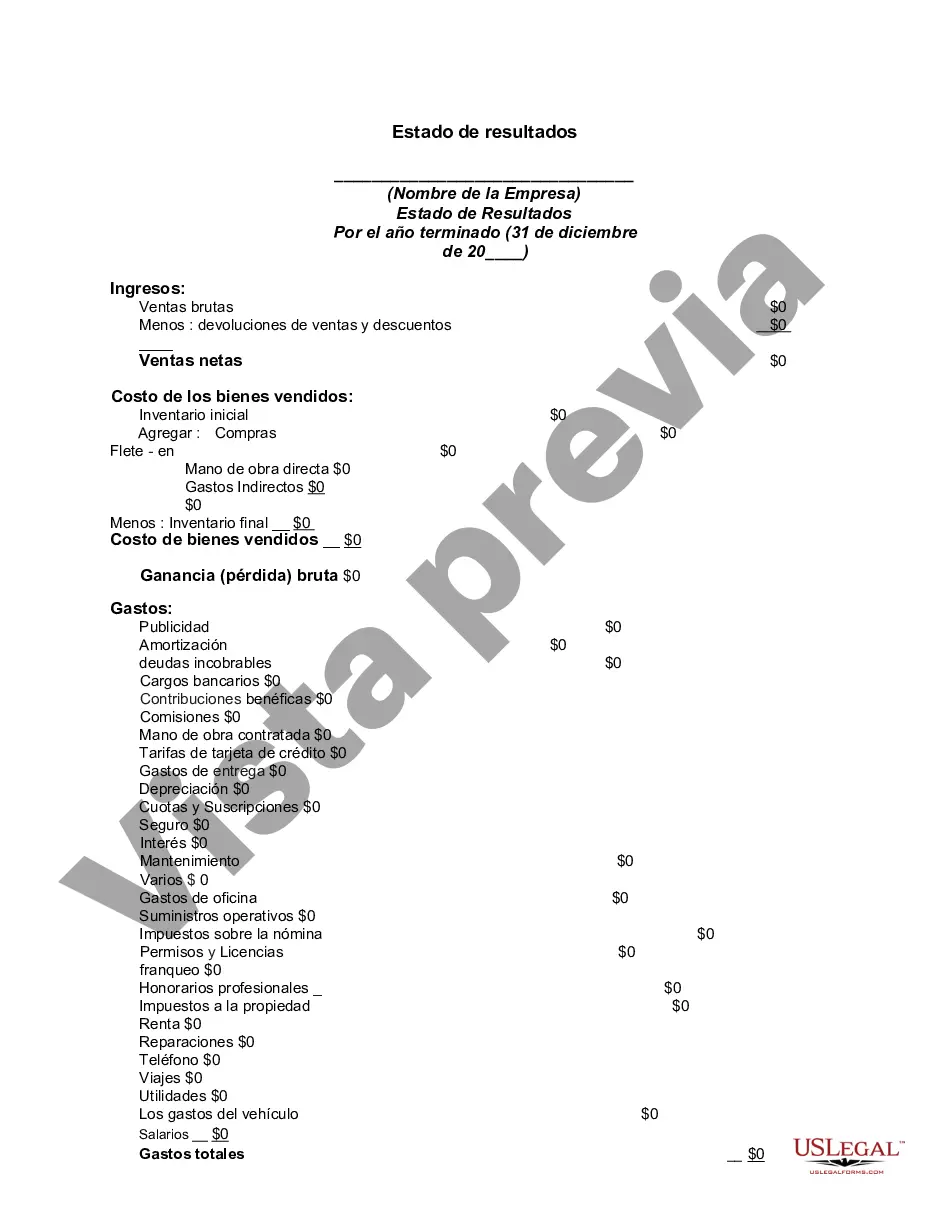

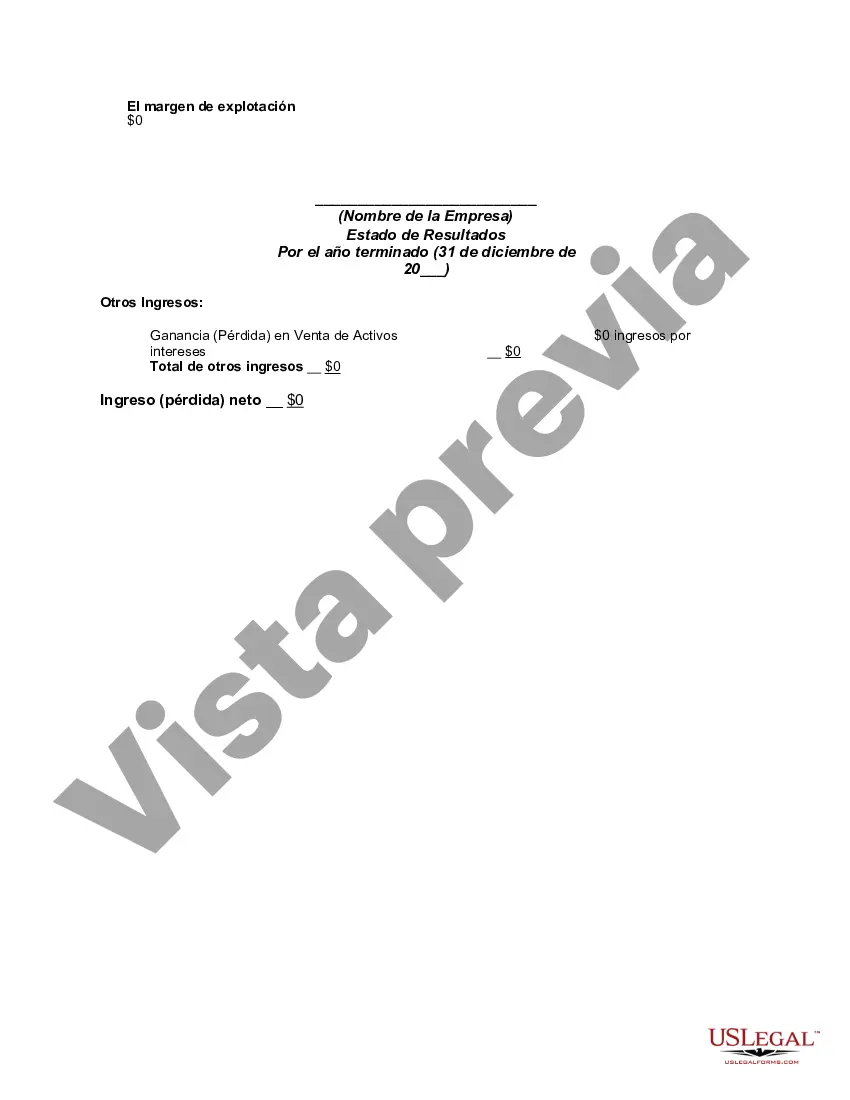

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Fulton County, Georgia Income Statement is a financial document that outlines the revenues, expenses, and net income of Fulton County government for a specific period. This statement provides a comprehensive overview of the financial performance, allowing individuals and organizations to evaluate the county's profitability and financial stability. Keywords: Fulton County, Georgia, income statement, financial document, revenues, expenses, net income, financial performance, profitability, financial stability. There are different types of Fulton County, Georgia Income Statements, including: 1. Operating Income Statement: This type focuses on the revenues and expenses directly related to the county's core operations, such as income from taxes, fees, licenses, and grants, as well as expenses like employee salaries, supplies, utilities, and maintenance costs. 2. Comprehensive Income Statement: This statement provides a broader view of the county's financial performance, including both operating and non-operating revenues and expenses. It may include gains or losses from investments, interests, donations, and other non-core activities. 3. Budgeted Income Statement: This statement reflects the projected revenues and expenses for a specific period, based on the county's approved budget. It helps in tracking the actual performance against the estimated figures and assists in budget planning and control. 4. Comparative Income Statement: A comparative income statement displays the financial data from multiple periods, typically presenting side-by-side columns of data to easily compare revenues, expenses, and net income changes over time. It enables analysts to identify trends, patterns, and fluctuations in the county's financial performance. 5. Audited Income Statement: An audited income statement is an extensively reviewed and verified financial document by independent auditors to ensure accuracy and compliance with accounting standards and regulations. It provides stakeholders with added confidence in the reliability of the reported financial data. Keywords: operating income statement, comprehensive income statement, budgeted income statement, comparative income statement, audited income statement, revenues, expenses, net income, projected revenues, projected expenses, approved budget, financial performance, non-operating revenues and expenses, gain or loss, investments, interests, donations, financial data, independent auditors, accounting standards, regulations, stakeholders.Fulton County, Georgia Income Statement is a financial document that outlines the revenues, expenses, and net income of Fulton County government for a specific period. This statement provides a comprehensive overview of the financial performance, allowing individuals and organizations to evaluate the county's profitability and financial stability. Keywords: Fulton County, Georgia, income statement, financial document, revenues, expenses, net income, financial performance, profitability, financial stability. There are different types of Fulton County, Georgia Income Statements, including: 1. Operating Income Statement: This type focuses on the revenues and expenses directly related to the county's core operations, such as income from taxes, fees, licenses, and grants, as well as expenses like employee salaries, supplies, utilities, and maintenance costs. 2. Comprehensive Income Statement: This statement provides a broader view of the county's financial performance, including both operating and non-operating revenues and expenses. It may include gains or losses from investments, interests, donations, and other non-core activities. 3. Budgeted Income Statement: This statement reflects the projected revenues and expenses for a specific period, based on the county's approved budget. It helps in tracking the actual performance against the estimated figures and assists in budget planning and control. 4. Comparative Income Statement: A comparative income statement displays the financial data from multiple periods, typically presenting side-by-side columns of data to easily compare revenues, expenses, and net income changes over time. It enables analysts to identify trends, patterns, and fluctuations in the county's financial performance. 5. Audited Income Statement: An audited income statement is an extensively reviewed and verified financial document by independent auditors to ensure accuracy and compliance with accounting standards and regulations. It provides stakeholders with added confidence in the reliability of the reported financial data. Keywords: operating income statement, comprehensive income statement, budgeted income statement, comparative income statement, audited income statement, revenues, expenses, net income, projected revenues, projected expenses, approved budget, financial performance, non-operating revenues and expenses, gain or loss, investments, interests, donations, financial data, independent auditors, accounting standards, regulations, stakeholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.