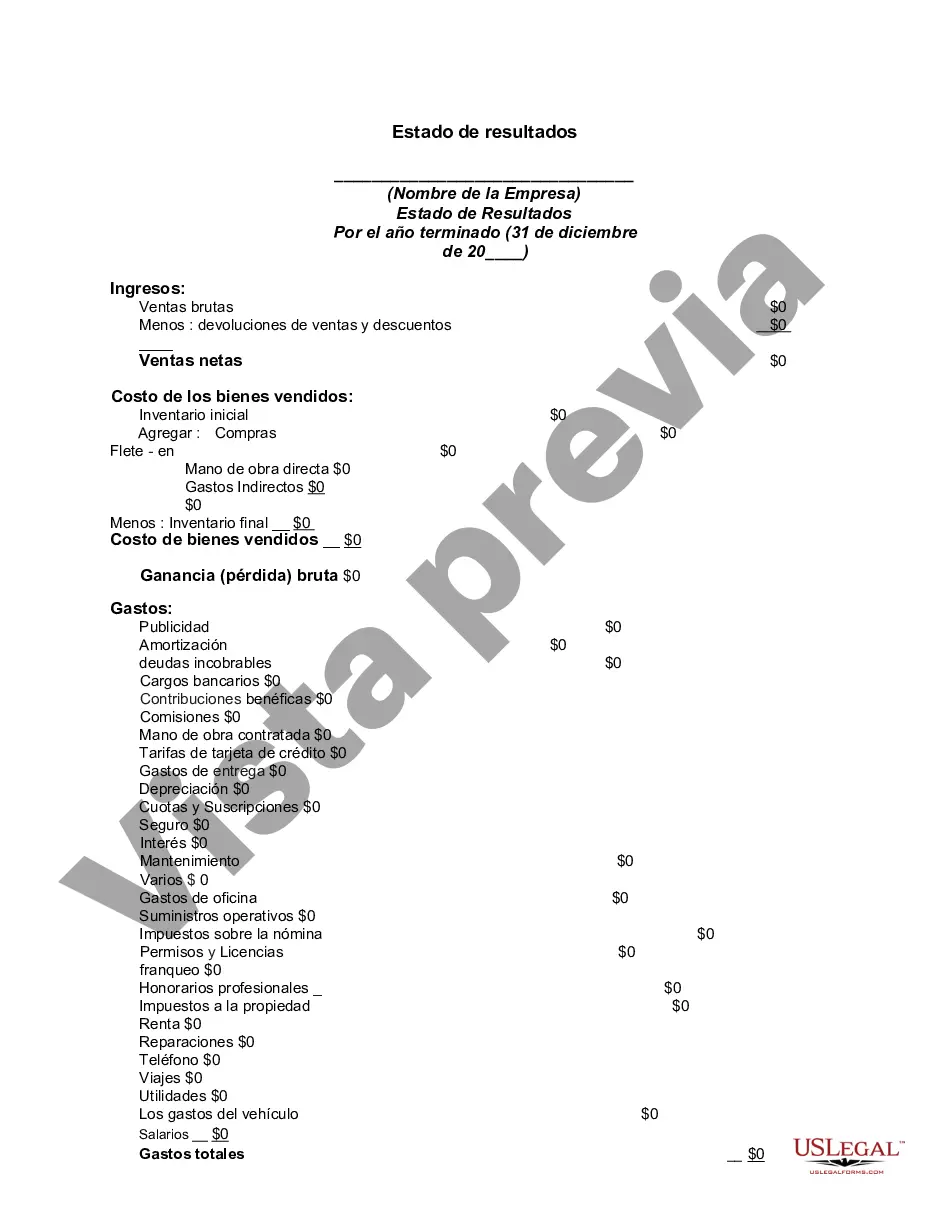

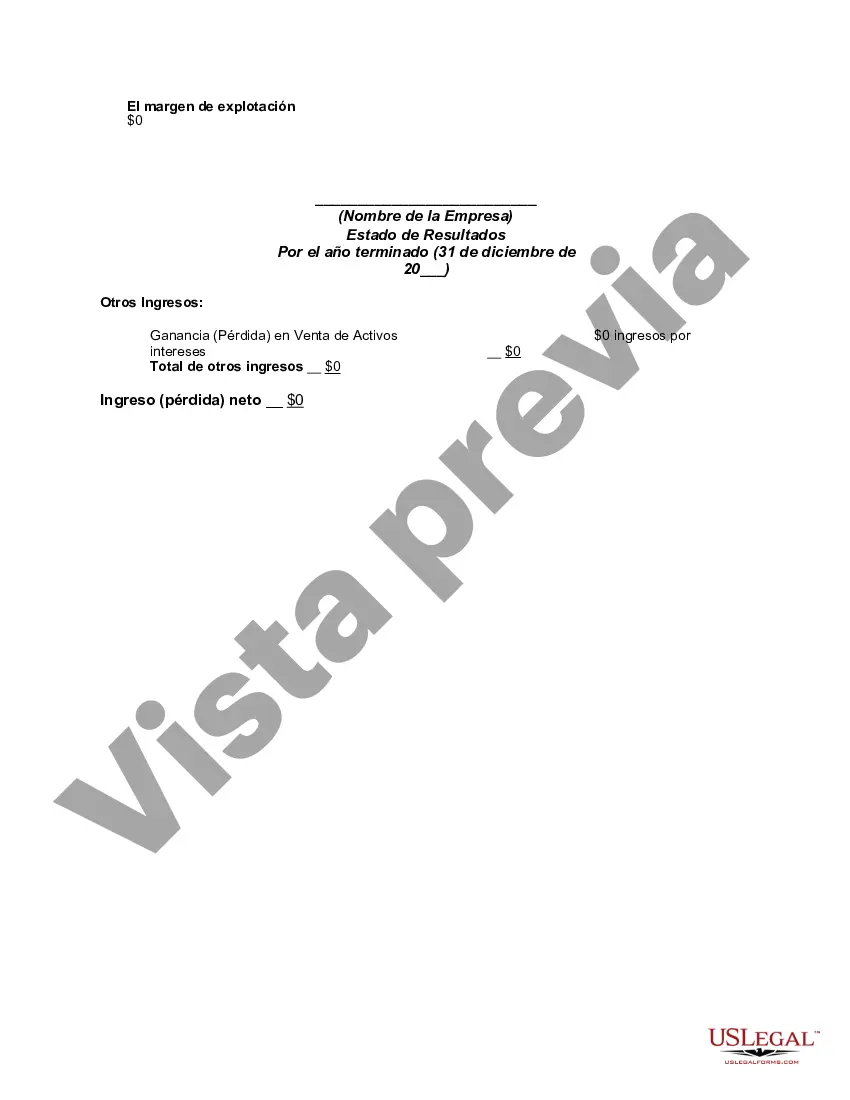

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Harris Texas Income Statement is a financial document that provides a detailed overview of the income and expenses of Harris County, Texas. It presents a comprehensive breakdown of the revenues, expenditures, and net income of the county for a specific period, typically on an annual basis. The income statement serves as a crucial tool for financial analysis, allowing individuals, organizations, and investors to assess the financial performance and profitability of Harris County. It provides valuable insights into the county's revenue sources, expenditure patterns, and overall fiscal health. Key components included in a Harris Texas Income Statement are: 1. Revenues: This section of the income statement lists all the income sources for Harris County, including taxes (property tax, sales tax, income tax), fees (license fees, permits), grants, intergovernmental transfers, and other miscellaneous revenue. It presents a comprehensive overview of the funds generated by the county. 2. Expenditures: This section focuses on the various categories of expenses for Harris County. It includes operating expenses, such as salaries and wages of employees, utilities, supplies, and contractual services. Additionally, it covers capital expenses, debt payments, grants, and transfers to other funds. 3. Net Income: The net income is calculated as the difference between total revenues and total expenditures. It represents the surplus or deficit for the specified time period. A positive net income signifies that the county's revenue exceeds its expenses, indicating financial health, while a negative net income indicates a deficit. The Harris Texas Income Statement is often prepared by the Finance Department or similar divisions within the county government. It helps elected officials, financial analysts, and citizens gain a comprehensive understanding of Harris County's financial position, enabling them to make informed decisions regarding budgeting, taxation, and financial planning. Further, while there may not be different types of Harris Texas Income Statements, variations may exist in terms of the level of detail provided or the specific categories of revenues and expenditures presented. For instance, some statements may include separate sections for operating revenues and non-operating revenues or break down expenditures by department or program. These variations aim to offer a more detailed insight into the financial aspects of the county operations.The Harris Texas Income Statement is a financial document that provides a detailed overview of the income and expenses of Harris County, Texas. It presents a comprehensive breakdown of the revenues, expenditures, and net income of the county for a specific period, typically on an annual basis. The income statement serves as a crucial tool for financial analysis, allowing individuals, organizations, and investors to assess the financial performance and profitability of Harris County. It provides valuable insights into the county's revenue sources, expenditure patterns, and overall fiscal health. Key components included in a Harris Texas Income Statement are: 1. Revenues: This section of the income statement lists all the income sources for Harris County, including taxes (property tax, sales tax, income tax), fees (license fees, permits), grants, intergovernmental transfers, and other miscellaneous revenue. It presents a comprehensive overview of the funds generated by the county. 2. Expenditures: This section focuses on the various categories of expenses for Harris County. It includes operating expenses, such as salaries and wages of employees, utilities, supplies, and contractual services. Additionally, it covers capital expenses, debt payments, grants, and transfers to other funds. 3. Net Income: The net income is calculated as the difference between total revenues and total expenditures. It represents the surplus or deficit for the specified time period. A positive net income signifies that the county's revenue exceeds its expenses, indicating financial health, while a negative net income indicates a deficit. The Harris Texas Income Statement is often prepared by the Finance Department or similar divisions within the county government. It helps elected officials, financial analysts, and citizens gain a comprehensive understanding of Harris County's financial position, enabling them to make informed decisions regarding budgeting, taxation, and financial planning. Further, while there may not be different types of Harris Texas Income Statements, variations may exist in terms of the level of detail provided or the specific categories of revenues and expenditures presented. For instance, some statements may include separate sections for operating revenues and non-operating revenues or break down expenditures by department or program. These variations aim to offer a more detailed insight into the financial aspects of the county operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.