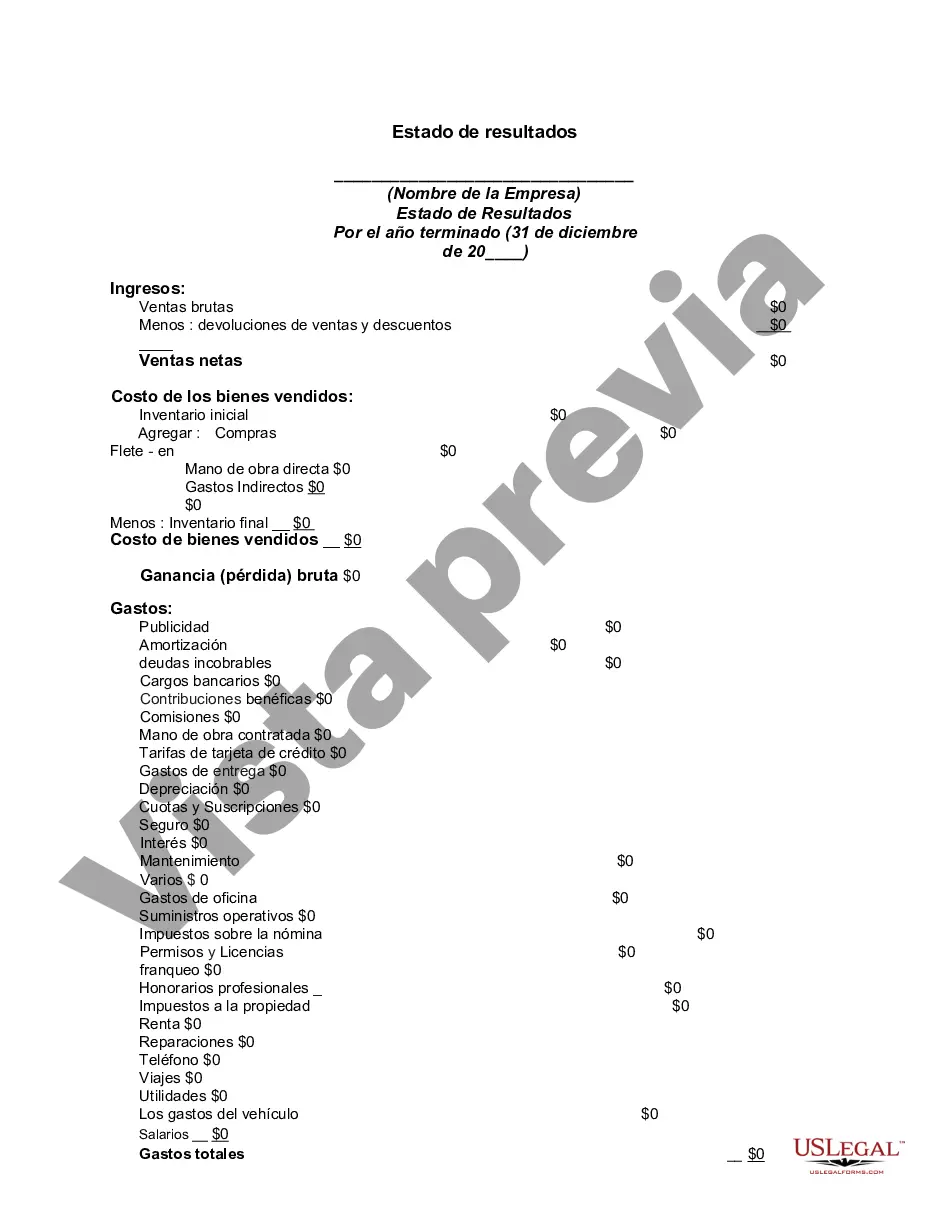

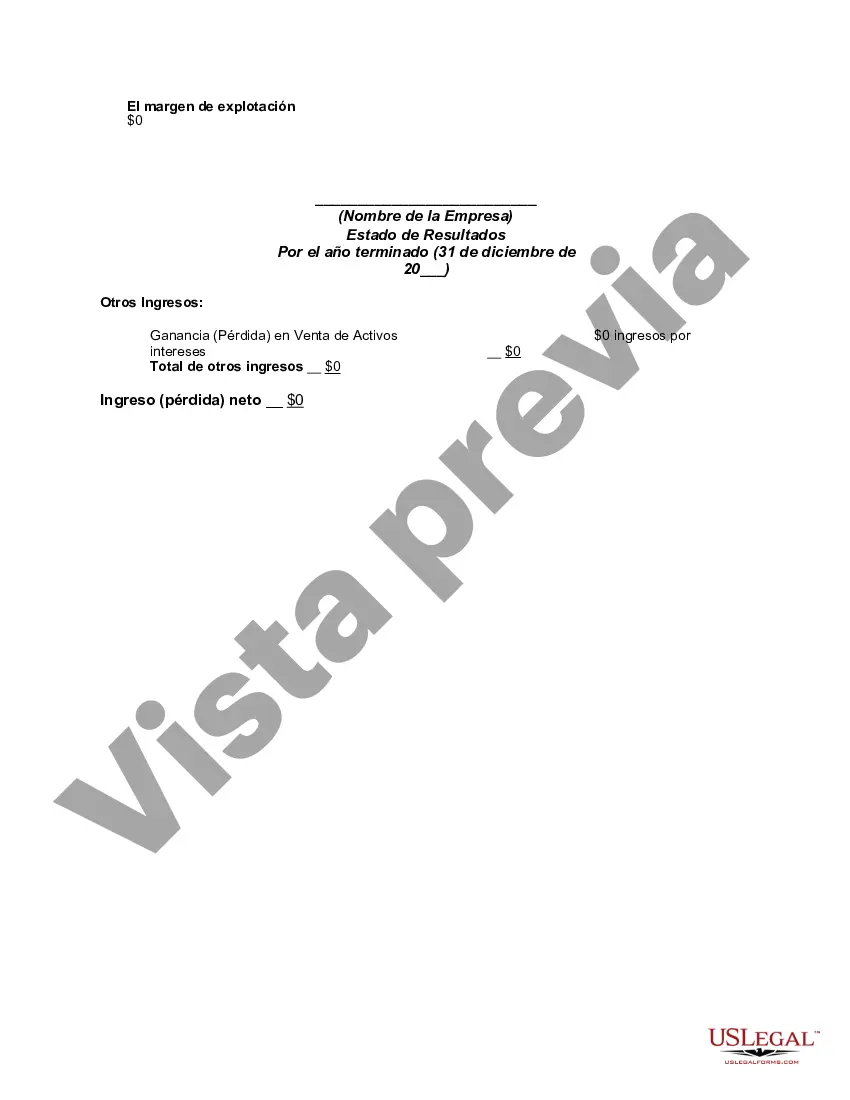

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Los Angeles, California Income Statement: The Los Angeles, California Income Statement provides a comprehensive overview of the financial performance of individuals, businesses, and organizations operating in the city. It captures the revenue, expenses, gains, and losses incurred by entities in Los Angeles. This statement is a crucial financial document that helps evaluate an entity's profitability and financial health. Key components featured in the Los Angeles, California Income Statement include: 1. Revenue: This section outlines the total income generated through primary business activities, such as product sales or service fees, in Los Angeles. 2. Cost of Goods Sold (COGS): COGS represents the direct expenses associated with the production or procurement of goods or services sold in Los Angeles. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue, indicating the profit made after accounting for direct costs. 4. Operating Expenses: These expenses comprise the costs incurred to run daily operations in Los Angeles, such as rent, utilities, salaries, marketing, and administrative expenses. 5. Operating Income: Operating income is the result of subtracting operating expenses from gross profit, providing a measure of profitability before interest and taxes. 6. Non-Operating Income: This section represents any income generated from non-primary activities, like interest earned from investments, capital gains, or rental income in Los Angeles. 7. Non-Operating Expenses: Non-operating expenses include costs that are not directly related to the core business operations in Los Angeles, such as interest payments on loans or taxes. 8. Net Income before Taxes: Net income before taxes illustrates the profit generated after accounting for both operating and non-operating income and expenses, excluding taxes. 9. Taxes: This section includes various taxes imposed on individuals or entities operating in Los Angeles, such as income tax, property tax, sales tax, and others. 10. Net Income: Net income is the final result after deducting taxes from the net income before taxes. It represents the profit or loss generated by an entity in Los Angeles after accounting for all income and expenses. Different types of Los Angeles, California Income Statements may exist, tailored to different types of entities. For instance, individual income statements focus on personal financial situations, indicating income sources, deductions, and taxable income. Business income statements provide insights into the financial performance and profitability of different businesses operating in Los Angeles, taking into consideration various industry-specific factors. In conclusion, the Los Angeles, California Income Statement is a vital financial tool that allows individuals, businesses, and organizations to analyze their financial performance, assess profitability, and make informed decisions related to operations, investments, and resource allocation.Los Angeles, California Income Statement: The Los Angeles, California Income Statement provides a comprehensive overview of the financial performance of individuals, businesses, and organizations operating in the city. It captures the revenue, expenses, gains, and losses incurred by entities in Los Angeles. This statement is a crucial financial document that helps evaluate an entity's profitability and financial health. Key components featured in the Los Angeles, California Income Statement include: 1. Revenue: This section outlines the total income generated through primary business activities, such as product sales or service fees, in Los Angeles. 2. Cost of Goods Sold (COGS): COGS represents the direct expenses associated with the production or procurement of goods or services sold in Los Angeles. 3. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue, indicating the profit made after accounting for direct costs. 4. Operating Expenses: These expenses comprise the costs incurred to run daily operations in Los Angeles, such as rent, utilities, salaries, marketing, and administrative expenses. 5. Operating Income: Operating income is the result of subtracting operating expenses from gross profit, providing a measure of profitability before interest and taxes. 6. Non-Operating Income: This section represents any income generated from non-primary activities, like interest earned from investments, capital gains, or rental income in Los Angeles. 7. Non-Operating Expenses: Non-operating expenses include costs that are not directly related to the core business operations in Los Angeles, such as interest payments on loans or taxes. 8. Net Income before Taxes: Net income before taxes illustrates the profit generated after accounting for both operating and non-operating income and expenses, excluding taxes. 9. Taxes: This section includes various taxes imposed on individuals or entities operating in Los Angeles, such as income tax, property tax, sales tax, and others. 10. Net Income: Net income is the final result after deducting taxes from the net income before taxes. It represents the profit or loss generated by an entity in Los Angeles after accounting for all income and expenses. Different types of Los Angeles, California Income Statements may exist, tailored to different types of entities. For instance, individual income statements focus on personal financial situations, indicating income sources, deductions, and taxable income. Business income statements provide insights into the financial performance and profitability of different businesses operating in Los Angeles, taking into consideration various industry-specific factors. In conclusion, the Los Angeles, California Income Statement is a vital financial tool that allows individuals, businesses, and organizations to analyze their financial performance, assess profitability, and make informed decisions related to operations, investments, and resource allocation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.