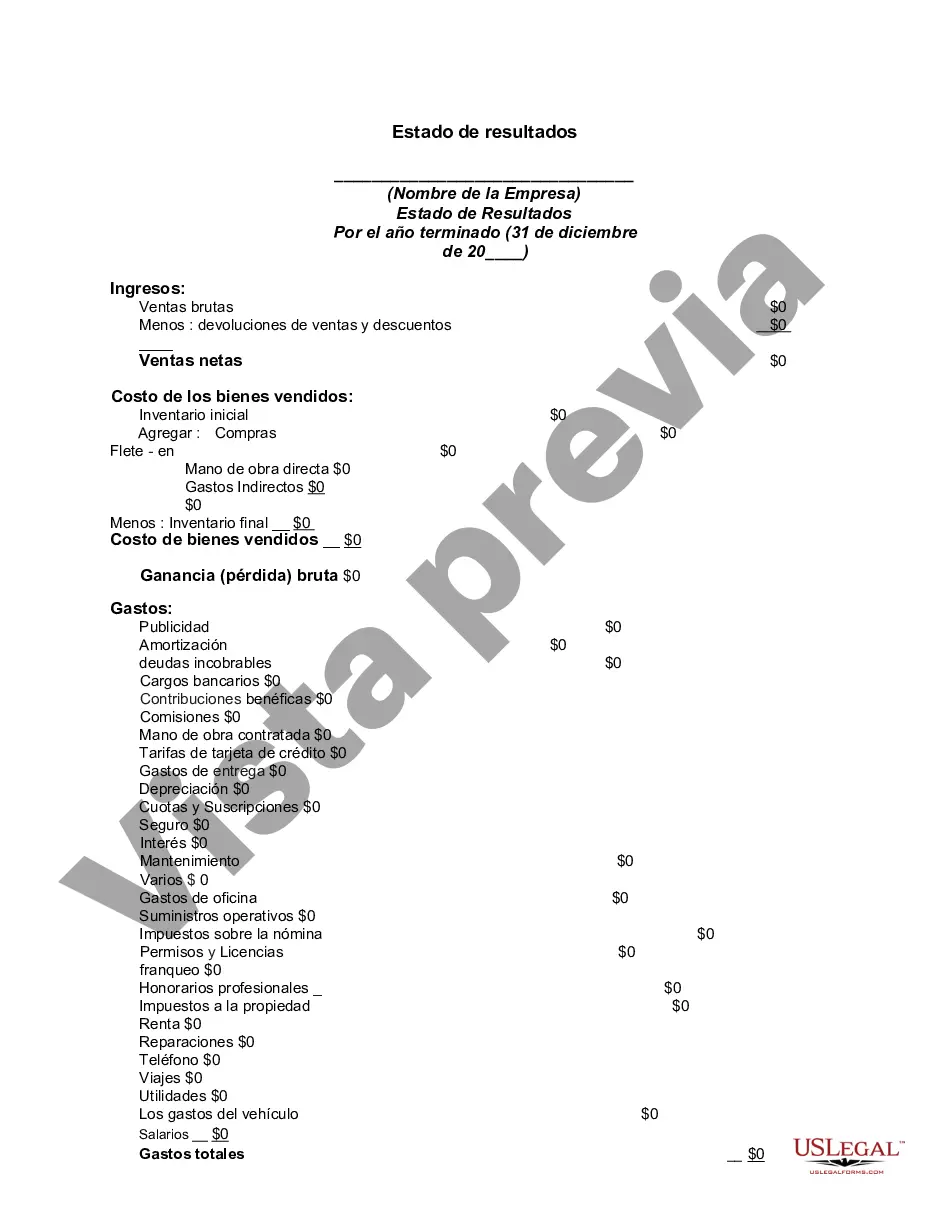

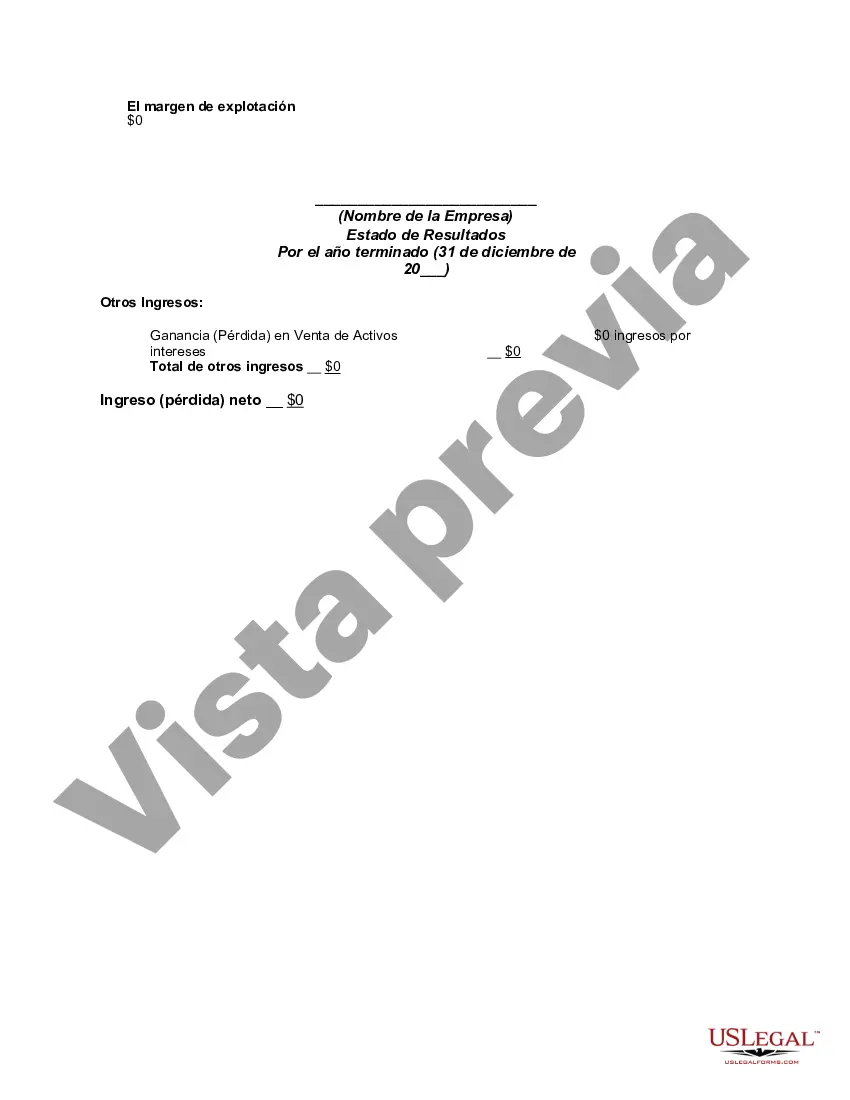

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Mecklenburg North Carolina Income Statement is a financial document that provides a comprehensive overview of the income and expenses of individuals, businesses, or organizations in Mecklenburg County, North Carolina. It showcases the financial performance and profitability of the entity during a specific period, typically on an annual basis. This statement is crucial for evaluating the financial health, stability, and growth potential of an entity operating in Mecklenburg County. Keywords: Mecklenburg North Carolina, income statement, financial document, income and expenses, individuals, businesses, organizations, financial performance, profitability, period, annual basis, financial health, stability, growth potential, evaluating. Different types of Mecklenburg North Carolina Income Statements can exist based on the nature of the entity or specific requirements. Some major variations include: 1. Individual Income Statement: This type of income statement focuses on the earnings and expenses of individuals residing in Mecklenburg County. It includes sources of income like salaries, investments, and self-employment, along with expenses such as housing, transportation, and taxes. 2. Business Income Statement: This statement highlights the revenues, costs, and expenses incurred by businesses operating in Mecklenburg County. It provides insights into the profitability of a company by showcasing revenue streams, operating expenses, and net income. Common categories in this statement include sales revenue, cost of goods sold, operating expenses, and net profit. 3. Non-Profit Organization Income Statement: Specifically designed for non-profit organizations in Mecklenburg County, this statement focuses on revenues, expenses, and net income or loss of non-profit entities. It includes funding sources such as grants, donations, and program service revenues, along with expenses related to program delivery, administrative costs, and fundraising activities. 4. Government Agency Income Statement: This type of income statement is applicable to government entities in Mecklenburg County, including local, state, or federal agencies. It outlines revenue sources like taxes, fees, or intergovernmental transfers, and expenses related to the provision of public services, infrastructure development, and administrative costs. These various versions of the Mecklenburg North Carolina Income Statement cater to the unique needs and characteristics of different entities operating within the county, facilitating effective financial analysis, planning, and decision-making.The Mecklenburg North Carolina Income Statement is a financial document that provides a comprehensive overview of the income and expenses of individuals, businesses, or organizations in Mecklenburg County, North Carolina. It showcases the financial performance and profitability of the entity during a specific period, typically on an annual basis. This statement is crucial for evaluating the financial health, stability, and growth potential of an entity operating in Mecklenburg County. Keywords: Mecklenburg North Carolina, income statement, financial document, income and expenses, individuals, businesses, organizations, financial performance, profitability, period, annual basis, financial health, stability, growth potential, evaluating. Different types of Mecklenburg North Carolina Income Statements can exist based on the nature of the entity or specific requirements. Some major variations include: 1. Individual Income Statement: This type of income statement focuses on the earnings and expenses of individuals residing in Mecklenburg County. It includes sources of income like salaries, investments, and self-employment, along with expenses such as housing, transportation, and taxes. 2. Business Income Statement: This statement highlights the revenues, costs, and expenses incurred by businesses operating in Mecklenburg County. It provides insights into the profitability of a company by showcasing revenue streams, operating expenses, and net income. Common categories in this statement include sales revenue, cost of goods sold, operating expenses, and net profit. 3. Non-Profit Organization Income Statement: Specifically designed for non-profit organizations in Mecklenburg County, this statement focuses on revenues, expenses, and net income or loss of non-profit entities. It includes funding sources such as grants, donations, and program service revenues, along with expenses related to program delivery, administrative costs, and fundraising activities. 4. Government Agency Income Statement: This type of income statement is applicable to government entities in Mecklenburg County, including local, state, or federal agencies. It outlines revenue sources like taxes, fees, or intergovernmental transfers, and expenses related to the provision of public services, infrastructure development, and administrative costs. These various versions of the Mecklenburg North Carolina Income Statement cater to the unique needs and characteristics of different entities operating within the county, facilitating effective financial analysis, planning, and decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.