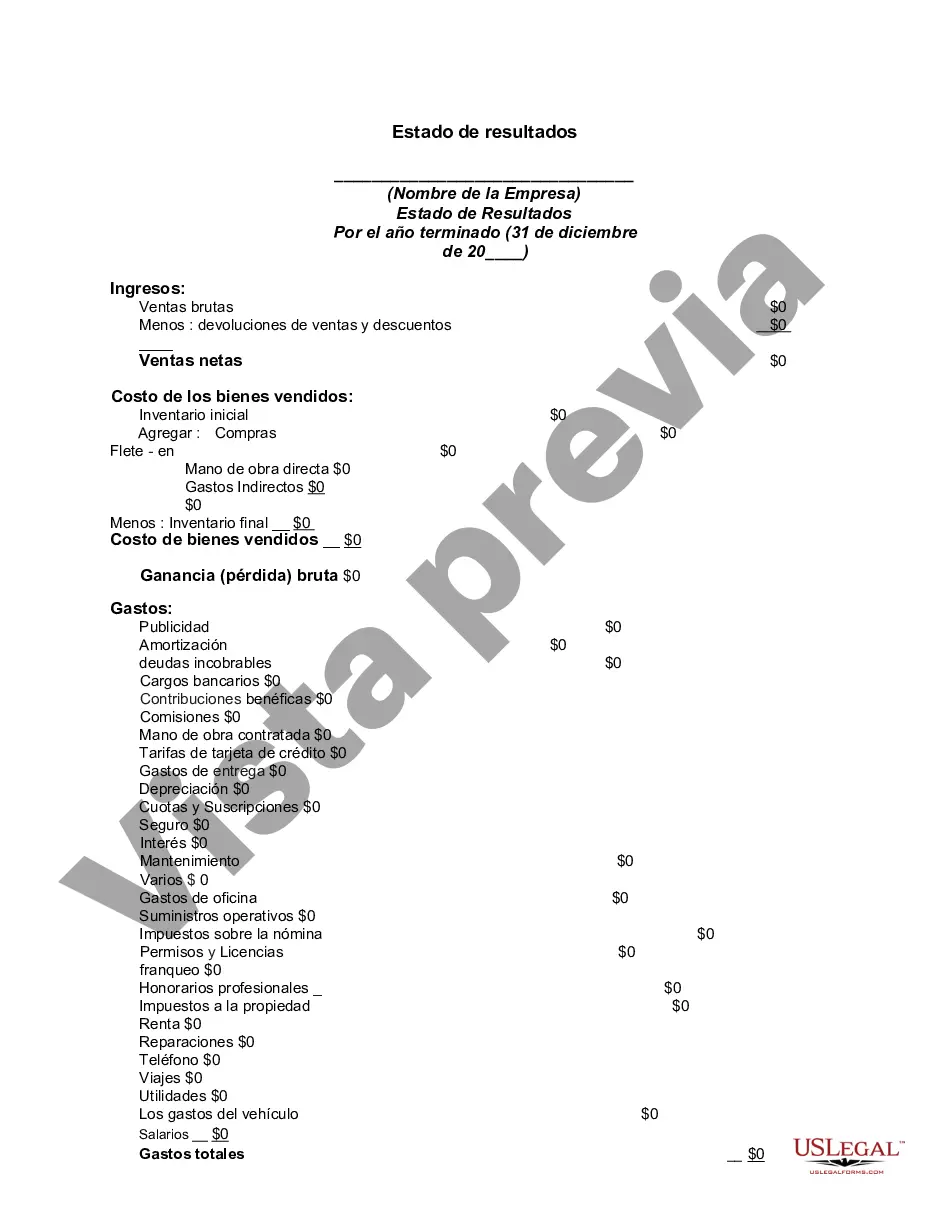

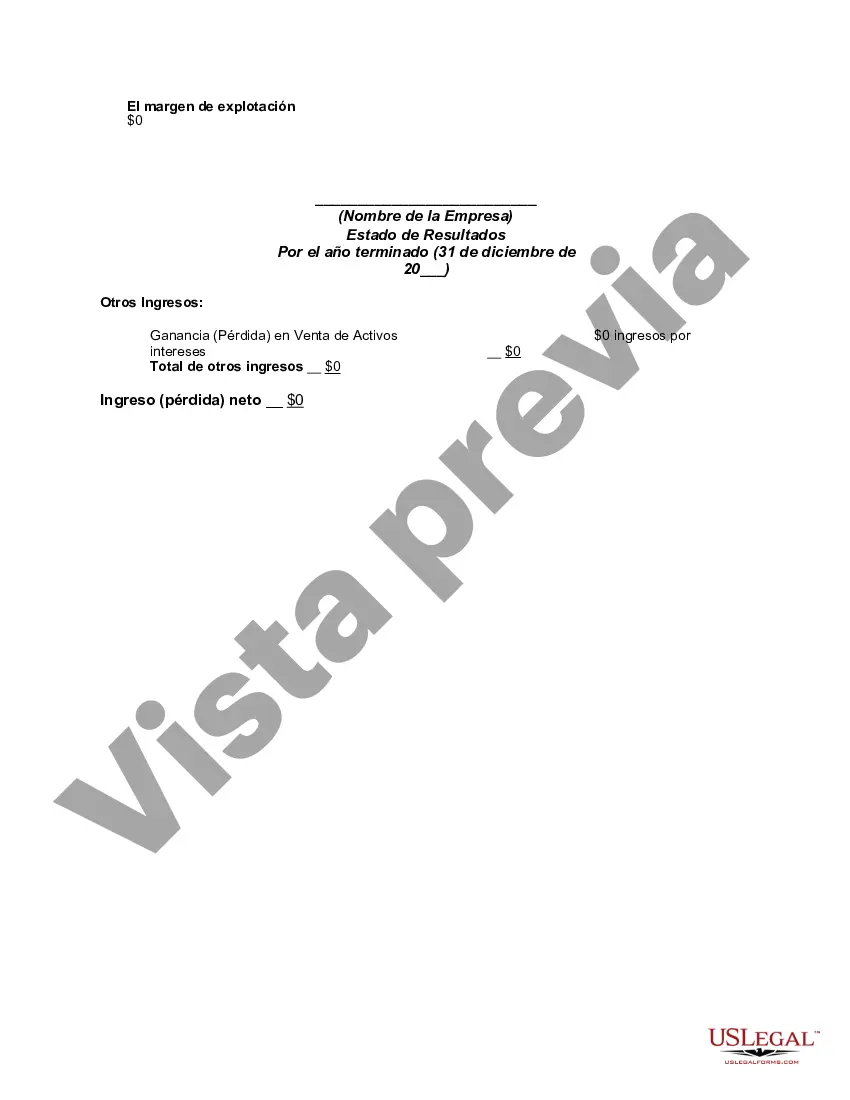

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Miami-Dade County Income Statement is a financial statement that summarizes the revenues, expenses, and net income of Miami-Dade County in Florida. It provides a comprehensive overview of the county's financial performance over a specific period, typically a fiscal year. The income statement is a crucial component of the county's financial reporting, serving as a tool for assessing the county's financial health and fiscal sustainability. Keywords: 1. Miami-Dade County: Refers to the county in southeastern Florida, known for its vibrant culture, diverse population, and economic significance within the state. 2. Income Statement: Also known as a profit and loss statement or statement of operations, it is a financial statement that showcases the revenues, expenses, gains, and losses that an organization incurs during a given period. 3. Financial Statement: A formal record summarizing the financial activities and position of an entity, providing insight into its operations, financial performance, and cash flows. 4. Revenues: Represents the income generated by Miami-Dade County from various sources, such as taxes, fees, grants, and intergovernmental aid. 5. Expenses: Refers to the costs incurred by the county in delivering public services, maintaining infrastructure, and administering various departments. Includes personnel costs, facility maintenance, supplies, and other operational expenses. 6. Net Income: Also referred to as the bottom line or profit, it is the difference between the total revenues and expenses. Net income indicates whether Miami-Dade County has generated a surplus or incurred a deficit during the specified period. 7. Fiscal Year: A 12-month accounting period used by governmental entities, including counties, for financial reporting and budgeting purposes. Miami-Dade County's fiscal year typically runs from October 1st to September 30th. 8. Financial Reporting: The process of providing financial information about an entity to external stakeholders, such as taxpayers, investors, and creditors. Miami-Dade County prepares and publishes its income statement as part of its financial reporting obligations. 9. Fiscal Sustainability: The ability of Miami-Dade County to meet its financial obligations and provide uninterrupted public services in the long run, considering factors such as revenue stability, expenditure control, and long-term financial planning. Types of Miami-Dade Florida Income Statement: 1. Annual Income Statement: The primary income statement prepared by Miami-Dade County on an annual basis. It provides a comprehensive overview of the county's financial performance for a fiscal year. 2. Comparative Income Statement: An income statement that presents the financial data for multiple fiscal years, allowing for a year-to-year analysis and comparison of revenues, expenses, and net income. 3. Departmental Income Statement: An income statement that breaks down the financial results by individual departments within Miami-Dade County. This statement highlights the revenues, expenses, and net income of each department, providing insight into their individual financial performance. 4. Project-Specific Income Statement: In certain cases, Miami-Dade County may prepare income statements specific to particular projects or initiatives. These statements focus only on the revenues, expenses, and net income related to the specified project, offering a detailed financial analysis for those endeavors. 5. Interim Income Statement: A financial statement prepared for a shorter period, such as a quarter or a specific month, to provide an update on Miami-Dade County's financial performance between annual statements. Understanding the Miami-Dade County income statement and its different types is essential for assessing the county's financial situation, identifying areas of improvement, and making informed decisions related to budgeting, resource allocation, and public service delivery.The Miami-Dade County Income Statement is a financial statement that summarizes the revenues, expenses, and net income of Miami-Dade County in Florida. It provides a comprehensive overview of the county's financial performance over a specific period, typically a fiscal year. The income statement is a crucial component of the county's financial reporting, serving as a tool for assessing the county's financial health and fiscal sustainability. Keywords: 1. Miami-Dade County: Refers to the county in southeastern Florida, known for its vibrant culture, diverse population, and economic significance within the state. 2. Income Statement: Also known as a profit and loss statement or statement of operations, it is a financial statement that showcases the revenues, expenses, gains, and losses that an organization incurs during a given period. 3. Financial Statement: A formal record summarizing the financial activities and position of an entity, providing insight into its operations, financial performance, and cash flows. 4. Revenues: Represents the income generated by Miami-Dade County from various sources, such as taxes, fees, grants, and intergovernmental aid. 5. Expenses: Refers to the costs incurred by the county in delivering public services, maintaining infrastructure, and administering various departments. Includes personnel costs, facility maintenance, supplies, and other operational expenses. 6. Net Income: Also referred to as the bottom line or profit, it is the difference between the total revenues and expenses. Net income indicates whether Miami-Dade County has generated a surplus or incurred a deficit during the specified period. 7. Fiscal Year: A 12-month accounting period used by governmental entities, including counties, for financial reporting and budgeting purposes. Miami-Dade County's fiscal year typically runs from October 1st to September 30th. 8. Financial Reporting: The process of providing financial information about an entity to external stakeholders, such as taxpayers, investors, and creditors. Miami-Dade County prepares and publishes its income statement as part of its financial reporting obligations. 9. Fiscal Sustainability: The ability of Miami-Dade County to meet its financial obligations and provide uninterrupted public services in the long run, considering factors such as revenue stability, expenditure control, and long-term financial planning. Types of Miami-Dade Florida Income Statement: 1. Annual Income Statement: The primary income statement prepared by Miami-Dade County on an annual basis. It provides a comprehensive overview of the county's financial performance for a fiscal year. 2. Comparative Income Statement: An income statement that presents the financial data for multiple fiscal years, allowing for a year-to-year analysis and comparison of revenues, expenses, and net income. 3. Departmental Income Statement: An income statement that breaks down the financial results by individual departments within Miami-Dade County. This statement highlights the revenues, expenses, and net income of each department, providing insight into their individual financial performance. 4. Project-Specific Income Statement: In certain cases, Miami-Dade County may prepare income statements specific to particular projects or initiatives. These statements focus only on the revenues, expenses, and net income related to the specified project, offering a detailed financial analysis for those endeavors. 5. Interim Income Statement: A financial statement prepared for a shorter period, such as a quarter or a specific month, to provide an update on Miami-Dade County's financial performance between annual statements. Understanding the Miami-Dade County income statement and its different types is essential for assessing the county's financial situation, identifying areas of improvement, and making informed decisions related to budgeting, resource allocation, and public service delivery.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.