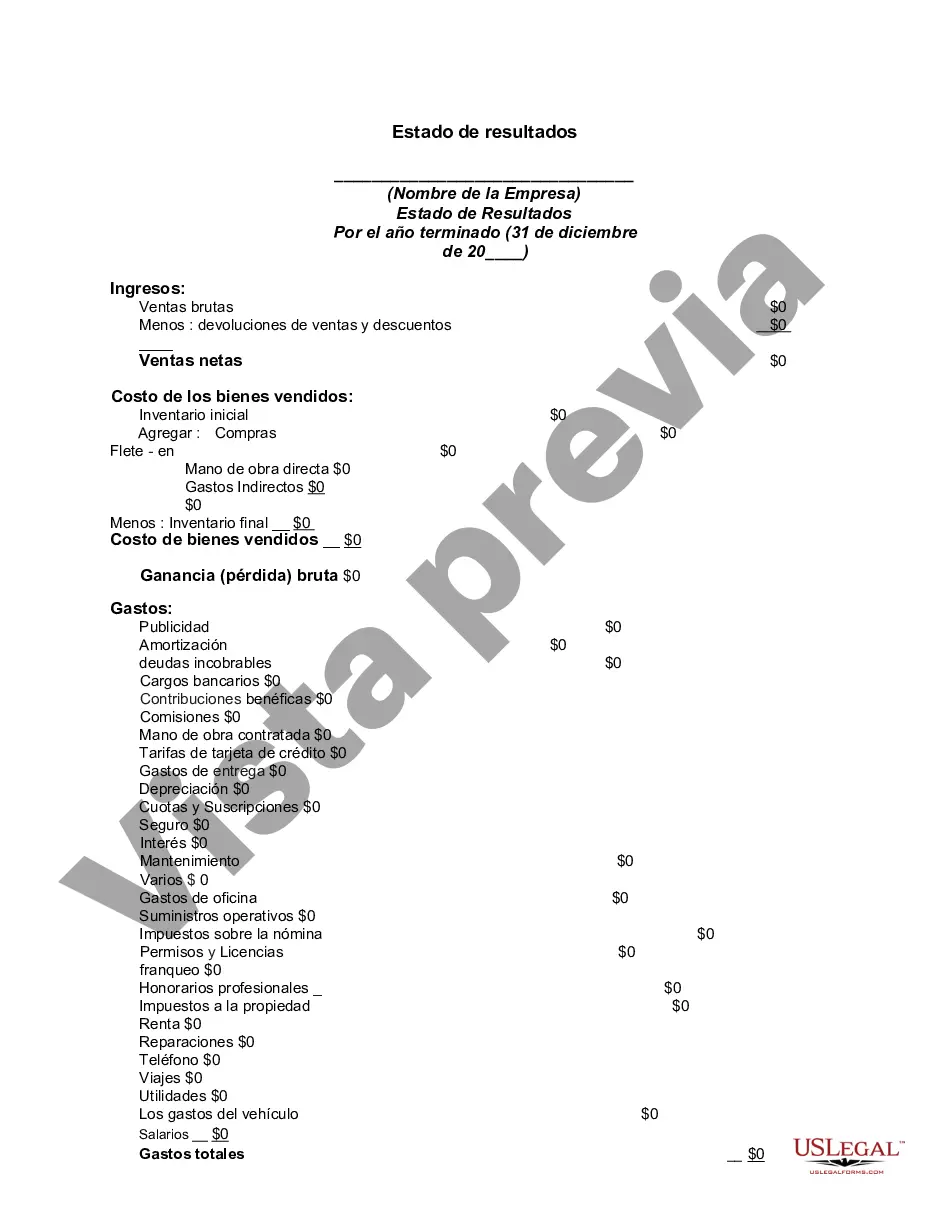

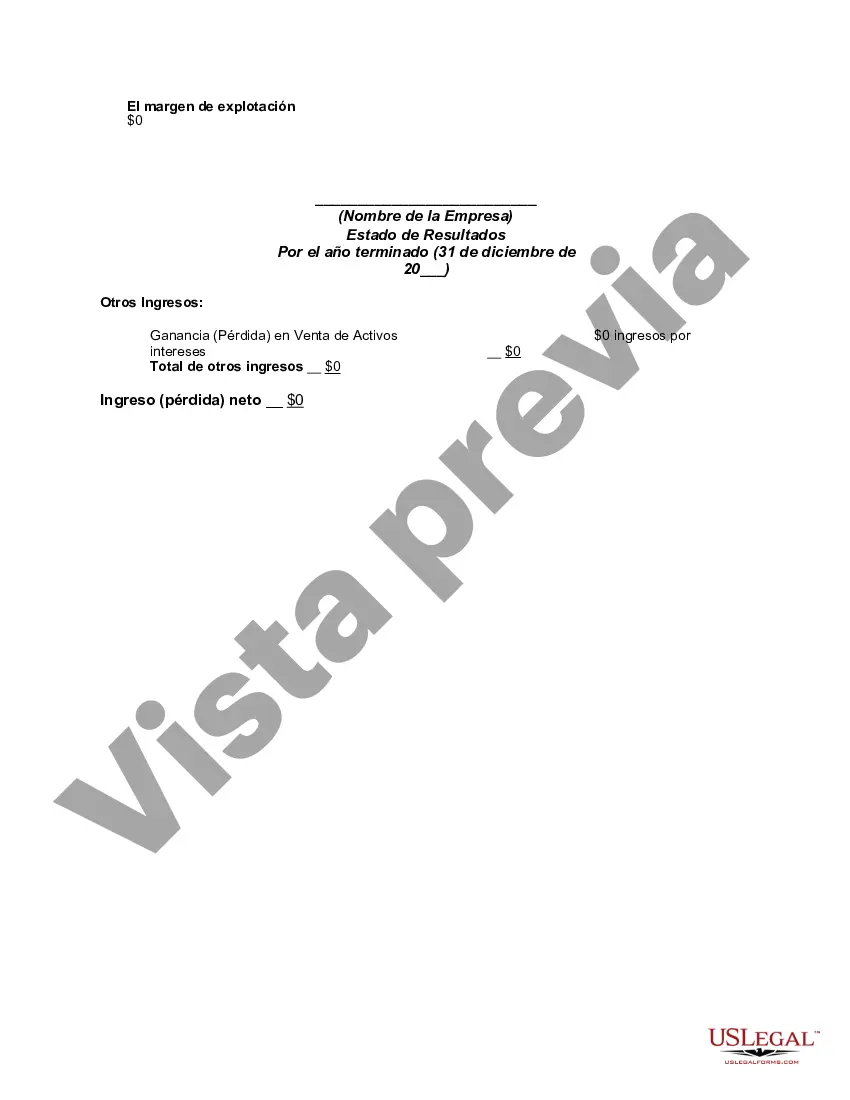

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Montgomery Maryland Income Statement, also known as the Montgomery County Maryland Income Statement, is a financial document that presents the revenues, expenses, and net income or loss of Montgomery County, Maryland, over a specific period. It provides a detailed overview of the county's financial performance, allowing stakeholders to assess its income and expenditure activities. The income statement begins with the county's operating revenues, which include sources like taxes, grants, licenses, fees, and other income generated from governmental activities. These revenues are listed separately, providing a breakdown of the various sources contributing to the county's income. Next, the income statement outlines the county's operating expenses, which encompass costs associated with delivering public services and maintaining government operations. These expenses may include employee salaries and benefits, utilities, supplies, contractual services, debt servicing, and other expenses incurred during the period under review. By subtracting the total operating expenses from the total operating revenues, the income statement determines the county's operating income or loss. This figure represents the surplus or deficit resulting from the county's day-to-day activities, excluding non-operating items like investment gains or losses. Apart from the operating section, the income statement may also include non-operating revenues and expenses. Non-operating revenues typically comprise income from investments, interests, and grants unrelated to regular governmental functions. On the other hand, non-operating expenses may include interests paid on outstanding debt or other costs not directly related to the county's operations. Finally, the net income or loss section of the income statement consolidates both the operating and non-operating components to determine the overall financial result for the period. A positive net income indicates a surplus, while a negative net income signifies a deficit. Different types or formats of income statements may also exist within Montgomery County, Maryland, depending on the specific needs and requirements of various departments or agencies. However, regardless of the format, the objective remains the same — to provide a comprehensive view of Montgomery County's financial performance and aid in better decision-making, budgeting, and financial planning within the local government.The Montgomery Maryland Income Statement, also known as the Montgomery County Maryland Income Statement, is a financial document that presents the revenues, expenses, and net income or loss of Montgomery County, Maryland, over a specific period. It provides a detailed overview of the county's financial performance, allowing stakeholders to assess its income and expenditure activities. The income statement begins with the county's operating revenues, which include sources like taxes, grants, licenses, fees, and other income generated from governmental activities. These revenues are listed separately, providing a breakdown of the various sources contributing to the county's income. Next, the income statement outlines the county's operating expenses, which encompass costs associated with delivering public services and maintaining government operations. These expenses may include employee salaries and benefits, utilities, supplies, contractual services, debt servicing, and other expenses incurred during the period under review. By subtracting the total operating expenses from the total operating revenues, the income statement determines the county's operating income or loss. This figure represents the surplus or deficit resulting from the county's day-to-day activities, excluding non-operating items like investment gains or losses. Apart from the operating section, the income statement may also include non-operating revenues and expenses. Non-operating revenues typically comprise income from investments, interests, and grants unrelated to regular governmental functions. On the other hand, non-operating expenses may include interests paid on outstanding debt or other costs not directly related to the county's operations. Finally, the net income or loss section of the income statement consolidates both the operating and non-operating components to determine the overall financial result for the period. A positive net income indicates a surplus, while a negative net income signifies a deficit. Different types or formats of income statements may also exist within Montgomery County, Maryland, depending on the specific needs and requirements of various departments or agencies. However, regardless of the format, the objective remains the same — to provide a comprehensive view of Montgomery County's financial performance and aid in better decision-making, budgeting, and financial planning within the local government.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.