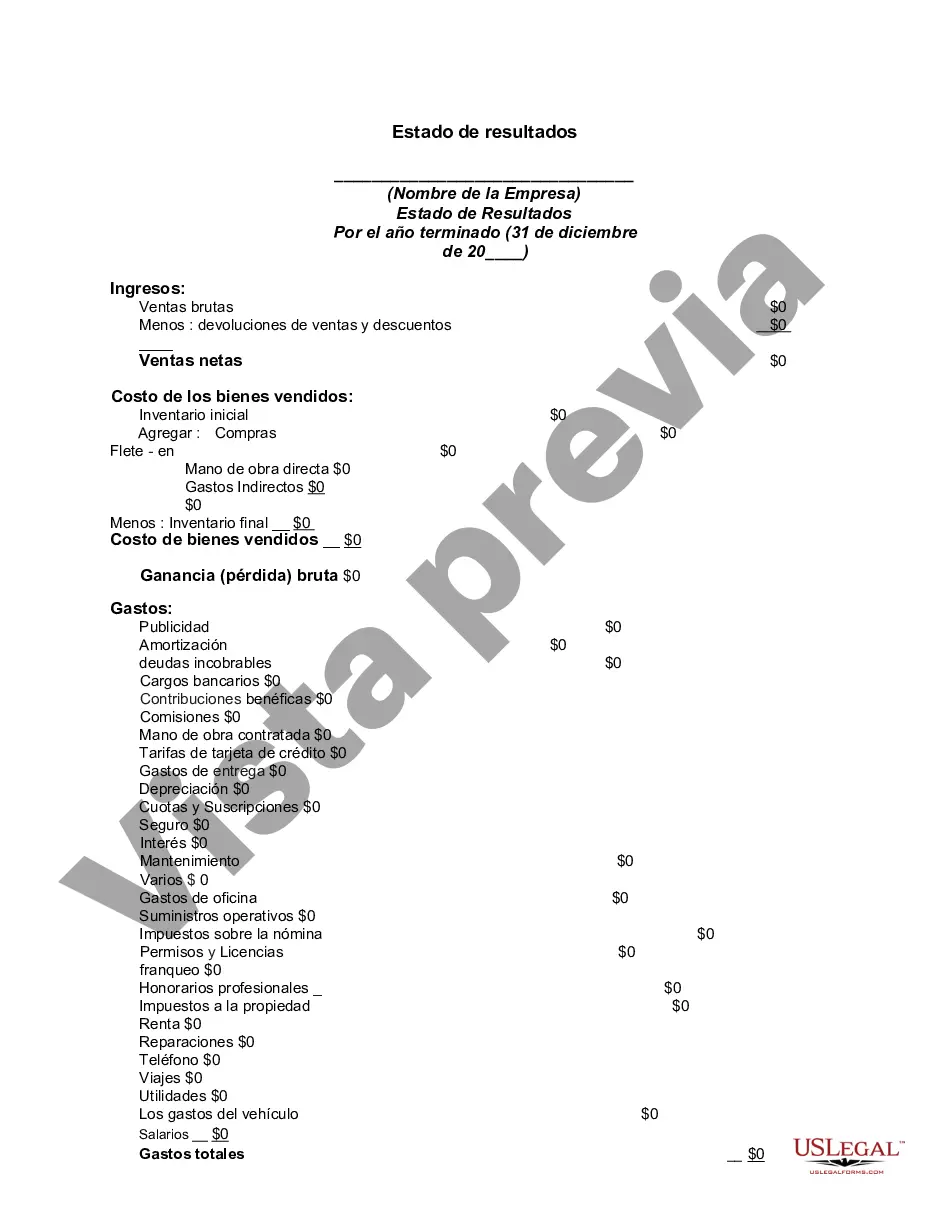

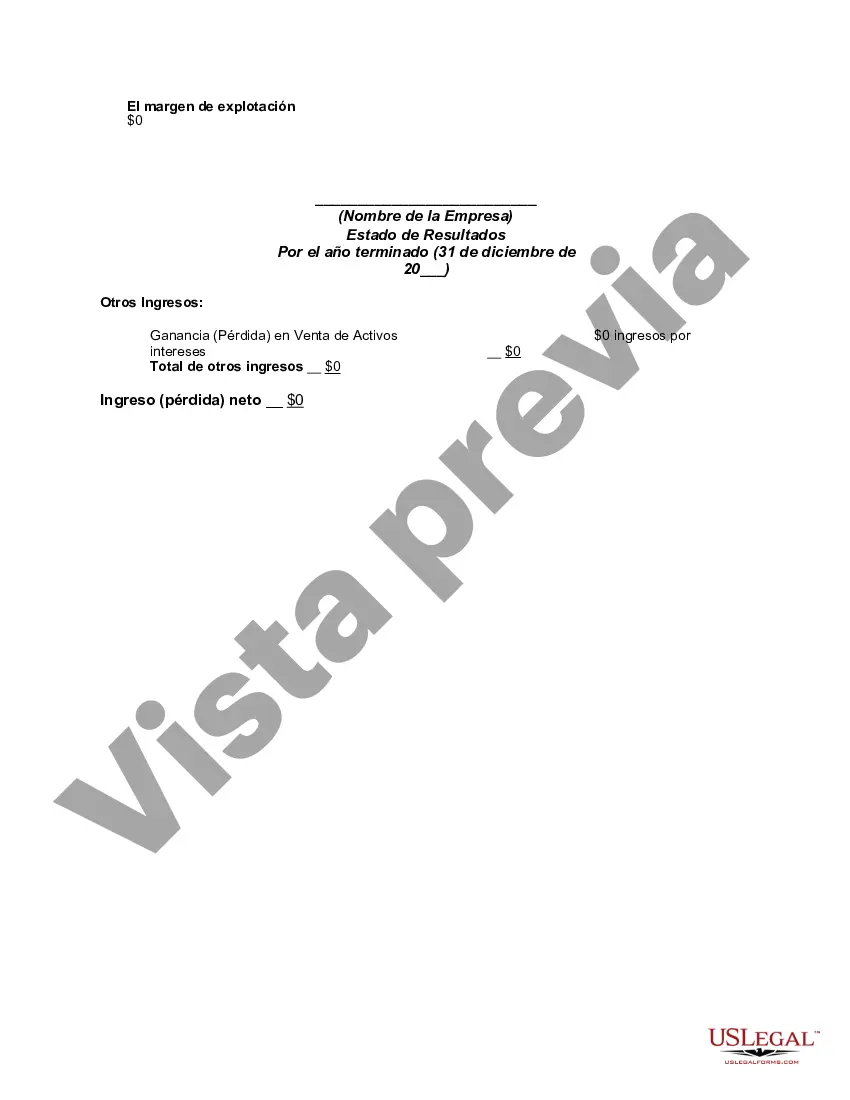

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Nassau New York Income Statement is a financial document that provides a comprehensive summary of an individual or organization's revenues, expenses, gains, losses, and net income or loss within a specific period in Nassau County, New York. It serves as a vital tool for assessing financial performance and determining the profitability or viability of an entity. The main components of the Nassau New York Income Statement typically include: 1. Revenue/Sales: This section encompasses the total amount of revenue generated through the sale of goods, provision of services, or any other income sources within the specified period. 2. Cost of Goods Sold (COGS)/Cost of Services: This category represents the direct costs associated with producing or delivering goods/services, including materials, labor, and overhead expenses. It is subtracted from the revenue to calculate gross profit. 3. Gross Profit: Gross profit is obtained by subtracting the COGS from the revenue and reflects the profit generated solely from the core operations of the entity. 4. Operating Expenses: Operating expenses include all costs incurred in running the day-to-day operations of the business, such as rent, salaries, utility bills, marketing expenses, and administrative costs. 5. Depreciation and Amortization: This section accounts for the systematic allocation of the costs of tangible assets (depreciation) and intangible assets (amortization) over their useful lives. It helps to recognize the wear and tear and the decline in the value of these assets. 6. Other Income or Expenses: This category covers any non-operating income or expenses, such as interest income, gains or losses from the sale of assets, lawsuits, or extraordinary events. These items are usually separate from the core operations of the entity. 7. Earnings Before Interest and Taxes (EBIT): EBIT represents the profit or loss generated by the entity before accounting for interest expenses and taxes. It is calculated by subtracting operating expenses, depreciation, and amortization from gross profit. 8. Interest Expenses: This section includes the interest paid on loans, credit facilities, or any other interest-bearing debt. 9. Income Taxes: Income taxes represent the amount of tax payable to the government based on the entity's taxable income. 10. Net Income or Net Loss: The net income or net loss is the final result obtained by subtracting interest expenses and income taxes from EBIT. It reflects the actual profitability or loss generated by the entity after all expenses and obligations are accounted for. Different types of Nassau New York Income Statements may include single-step income statements, multi-step income statements, and pro forma income statements. These variations can cater to different reporting needs, provide additional insights into specific revenue sources or costs, or highlight exceptional transactions impacting the financial results.The Nassau New York Income Statement is a financial document that provides a comprehensive summary of an individual or organization's revenues, expenses, gains, losses, and net income or loss within a specific period in Nassau County, New York. It serves as a vital tool for assessing financial performance and determining the profitability or viability of an entity. The main components of the Nassau New York Income Statement typically include: 1. Revenue/Sales: This section encompasses the total amount of revenue generated through the sale of goods, provision of services, or any other income sources within the specified period. 2. Cost of Goods Sold (COGS)/Cost of Services: This category represents the direct costs associated with producing or delivering goods/services, including materials, labor, and overhead expenses. It is subtracted from the revenue to calculate gross profit. 3. Gross Profit: Gross profit is obtained by subtracting the COGS from the revenue and reflects the profit generated solely from the core operations of the entity. 4. Operating Expenses: Operating expenses include all costs incurred in running the day-to-day operations of the business, such as rent, salaries, utility bills, marketing expenses, and administrative costs. 5. Depreciation and Amortization: This section accounts for the systematic allocation of the costs of tangible assets (depreciation) and intangible assets (amortization) over their useful lives. It helps to recognize the wear and tear and the decline in the value of these assets. 6. Other Income or Expenses: This category covers any non-operating income or expenses, such as interest income, gains or losses from the sale of assets, lawsuits, or extraordinary events. These items are usually separate from the core operations of the entity. 7. Earnings Before Interest and Taxes (EBIT): EBIT represents the profit or loss generated by the entity before accounting for interest expenses and taxes. It is calculated by subtracting operating expenses, depreciation, and amortization from gross profit. 8. Interest Expenses: This section includes the interest paid on loans, credit facilities, or any other interest-bearing debt. 9. Income Taxes: Income taxes represent the amount of tax payable to the government based on the entity's taxable income. 10. Net Income or Net Loss: The net income or net loss is the final result obtained by subtracting interest expenses and income taxes from EBIT. It reflects the actual profitability or loss generated by the entity after all expenses and obligations are accounted for. Different types of Nassau New York Income Statements may include single-step income statements, multi-step income statements, and pro forma income statements. These variations can cater to different reporting needs, provide additional insights into specific revenue sources or costs, or highlight exceptional transactions impacting the financial results.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.