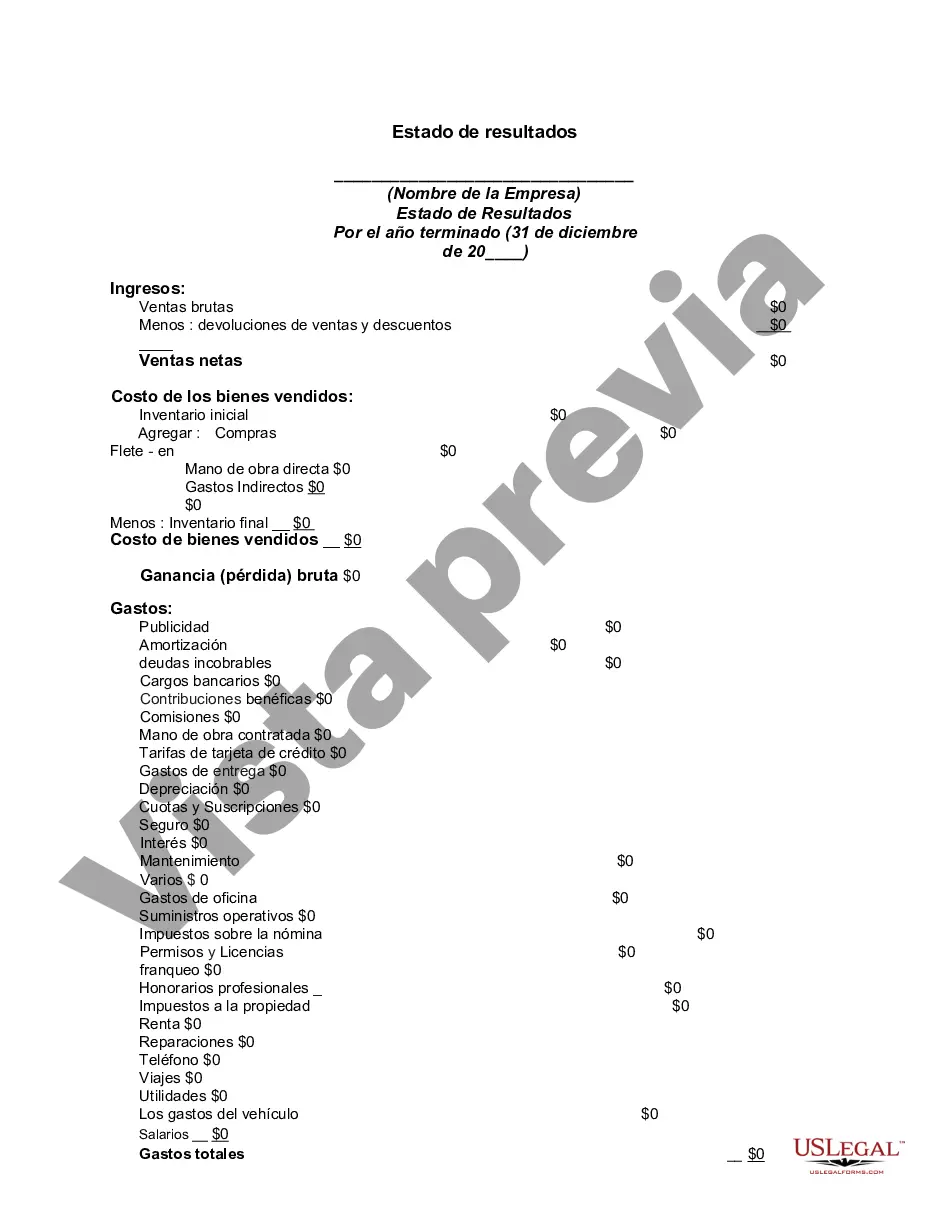

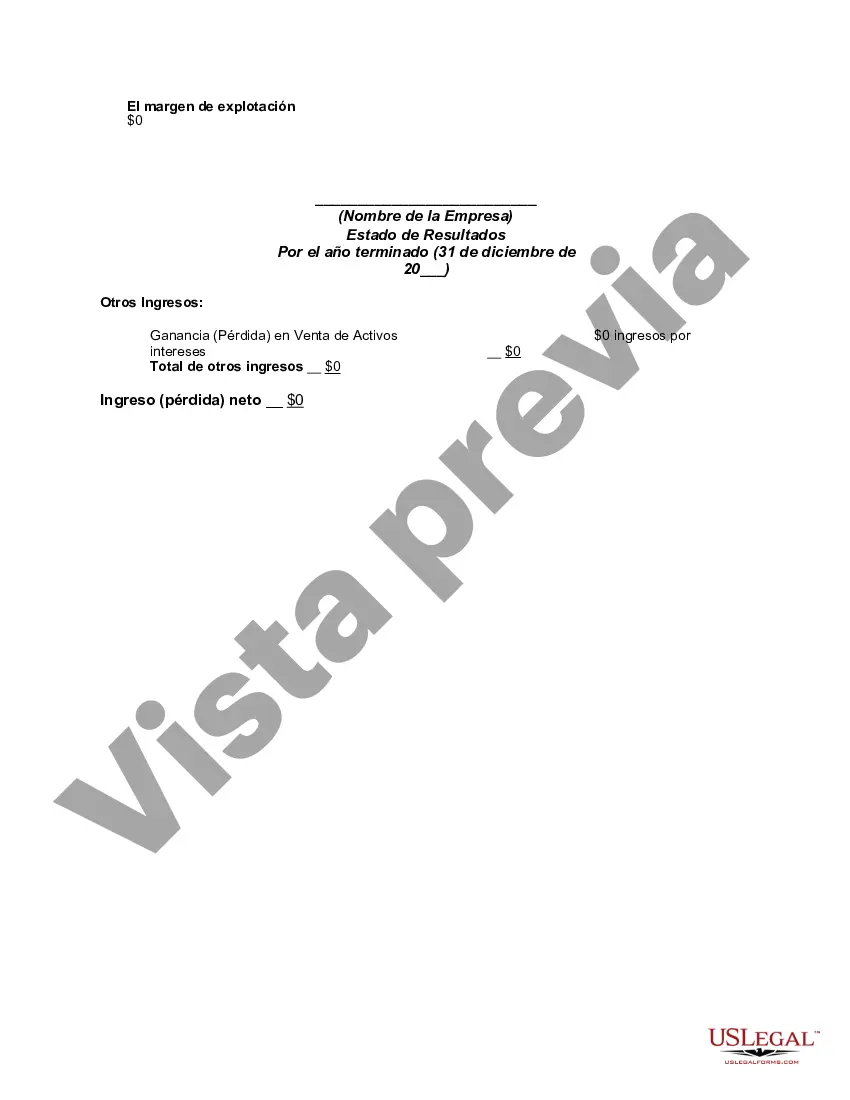

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Lima Arizona Income Statement is a financial document that presents the revenues, expenses, and resulting net income or loss of a business entity based in Lima, Arizona. This statement provides a comprehensive overview of the income generated and the expenses incurred during a specified period, usually a fiscal year. Here is a detailed description of the Lima Arizona Income Statement, including various types associated with it: 1. General Lima Arizona Income Statement: This type of income statement provides an overall view of the financial performance of a business located in Lima, Arizona. It typically includes revenues, such as sales, service fees, or rent, and deducts various expenses such as employee wages, operating costs, and taxes. The resulting net income or loss is then calculated by subtracting the total expenses from the total revenues. 2. Lima Arizona Operating Income Statement: This statement focuses specifically on the operational aspects of a business in Lima, Arizona. It excludes non-operating revenue and expenses, such as gains or losses from investments or interest income. This type of income statement helps analyze the core profitability of a business and its ability to generate income from its primary activities. 3. Lima Arizona Single-Step Income Statement: This type of income statement presents all sources of revenues and expenses in a single section without segregating them. It enables a quick and concise overview of the financial performance of a business based in Lima, Arizona. Typically, revenues are listed first, followed by various expenses, resulting in the net income or loss. 4. Lima Arizona Multi-Step Income Statement: On the other hand, the multi-step income statement categorizes revenues and expenses into multiple sections, providing a more detailed analysis. It usually includes sections like gross profit, operating income, and non-operating income or expenses. This type of statement helps in assessing the profitability of different business activities and identifying potential areas for improvement. Overall, the Lima Arizona Income Statement is a crucial financial tool that allows businesses in Lima, Arizona, to evaluate their financial performance, track their revenues and expenses, and make informed decisions for future growth.The Lima Arizona Income Statement is a financial document that presents the revenues, expenses, and resulting net income or loss of a business entity based in Lima, Arizona. This statement provides a comprehensive overview of the income generated and the expenses incurred during a specified period, usually a fiscal year. Here is a detailed description of the Lima Arizona Income Statement, including various types associated with it: 1. General Lima Arizona Income Statement: This type of income statement provides an overall view of the financial performance of a business located in Lima, Arizona. It typically includes revenues, such as sales, service fees, or rent, and deducts various expenses such as employee wages, operating costs, and taxes. The resulting net income or loss is then calculated by subtracting the total expenses from the total revenues. 2. Lima Arizona Operating Income Statement: This statement focuses specifically on the operational aspects of a business in Lima, Arizona. It excludes non-operating revenue and expenses, such as gains or losses from investments or interest income. This type of income statement helps analyze the core profitability of a business and its ability to generate income from its primary activities. 3. Lima Arizona Single-Step Income Statement: This type of income statement presents all sources of revenues and expenses in a single section without segregating them. It enables a quick and concise overview of the financial performance of a business based in Lima, Arizona. Typically, revenues are listed first, followed by various expenses, resulting in the net income or loss. 4. Lima Arizona Multi-Step Income Statement: On the other hand, the multi-step income statement categorizes revenues and expenses into multiple sections, providing a more detailed analysis. It usually includes sections like gross profit, operating income, and non-operating income or expenses. This type of statement helps in assessing the profitability of different business activities and identifying potential areas for improvement. Overall, the Lima Arizona Income Statement is a crucial financial tool that allows businesses in Lima, Arizona, to evaluate their financial performance, track their revenues and expenses, and make informed decisions for future growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.