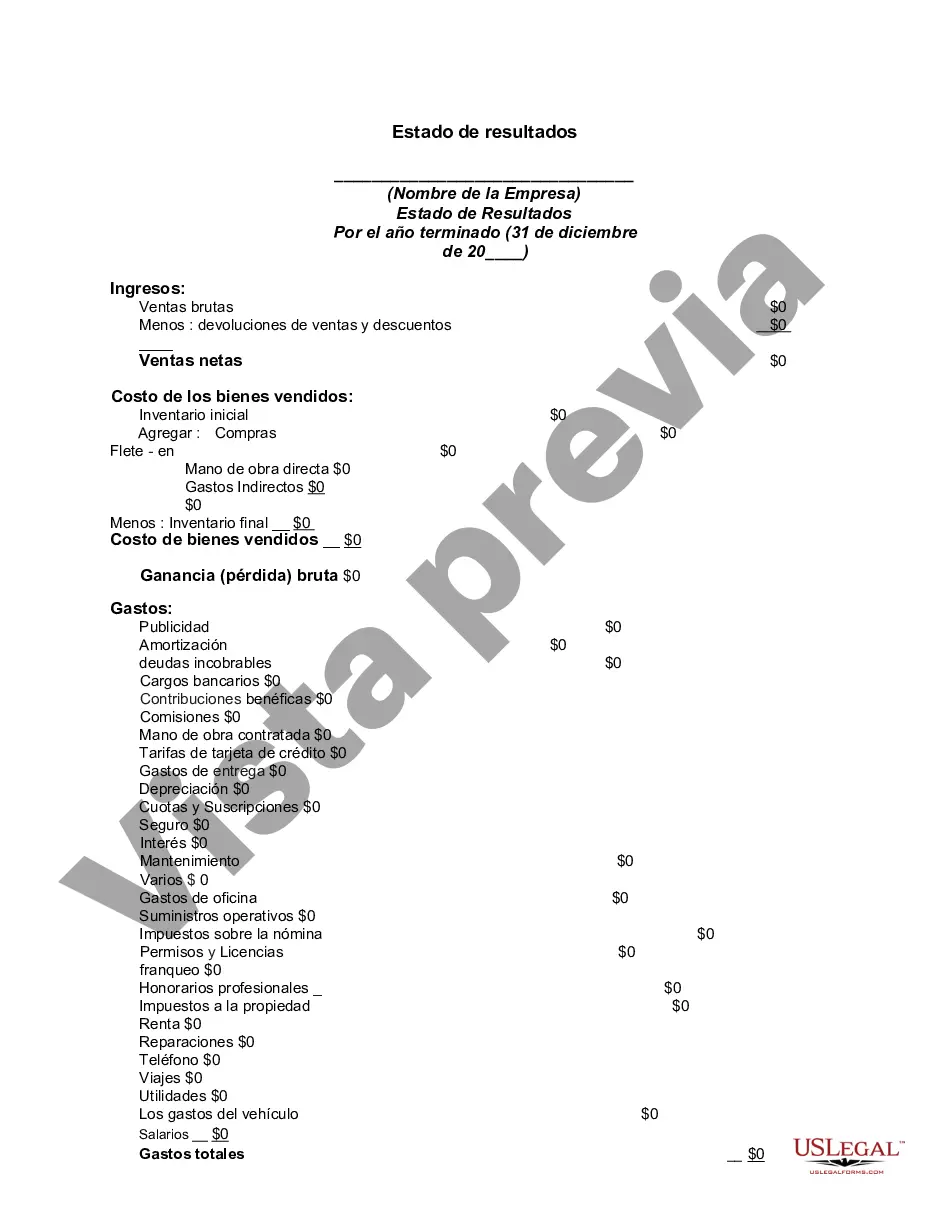

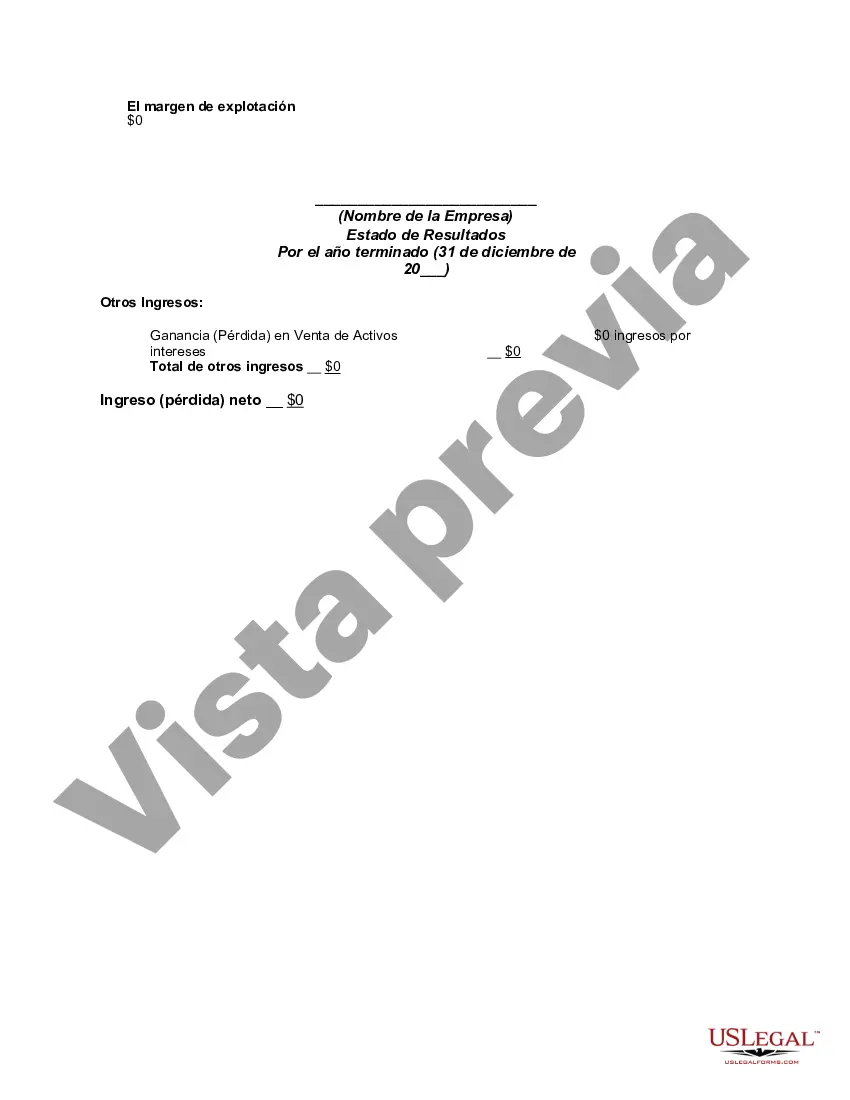

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

Salt Lake Utah Income Statement is a financial document that provides an overview of the income and expenses of an organization or individual residing in Salt Lake, Utah. This statement summarizes the revenues generated, the costs incurred, and the resulting net income or loss during a specific period. The primary purpose of the Salt Lake Utah Income Statement is to assess the profitability and financial performance of an entity operating in the Salt Lake City region. It helps individuals, businesses, and investors evaluate the profitability and make informed decisions related to income generation, cost management, and financial planning. Key components of the Salt Lake Utah Income Statement typically include revenues, cost of goods sold (COGS), operating expenses, gross profit or loss, other income and expenses, net income before taxes, and net income after taxes. These items are further broken down to provide detailed insights into the various sources of income and expenses specific to the Salt Lake Utah area. Moreover, the Salt Lake Utah Income Statement may have variations or subcategories depending on the type of entity or industry. Some types of income statements that can be found in Salt Lake Utah include: 1. Personal Income Statement: This is an income statement that represents the earnings, expenses, and net income of individuals or households in Salt Lake City. It includes various sources of income like salaries, wages, dividends, interest, and rental income, as well as personal expenses such as housing costs, transportation, entertainment, and taxes. 2. Business Income Statement: This statement is specifically designed for businesses operating in Salt Lake City, Utah. It reflects the revenues generated from sales of goods or services, costs directly associated with those sales (COGS), operating expenses such as rent, utilities, salaries, marketing, and administrative expenses. It provides insights into the gross profit or loss and net income of the business. 3. Nonprofit Income Statement: Nonprofit organizations in Salt Lake Utah also prepare income statements to evaluate their financial performance. These statements focus on revenues from donations, grants, program services, and fundraising activities, along with expenses related to carrying out the organization's mission, such as program costs, administrative costs, and fundraising expenses. In conclusion, the Salt Lake Utah Income Statement is a crucial financial document that showcases the income and expenses relevant to individuals, businesses, and nonprofits in the Salt Lake City area. It helps assess financial performance, profitability, and make informed decisions regarding income generation and cost management.Salt Lake Utah Income Statement is a financial document that provides an overview of the income and expenses of an organization or individual residing in Salt Lake, Utah. This statement summarizes the revenues generated, the costs incurred, and the resulting net income or loss during a specific period. The primary purpose of the Salt Lake Utah Income Statement is to assess the profitability and financial performance of an entity operating in the Salt Lake City region. It helps individuals, businesses, and investors evaluate the profitability and make informed decisions related to income generation, cost management, and financial planning. Key components of the Salt Lake Utah Income Statement typically include revenues, cost of goods sold (COGS), operating expenses, gross profit or loss, other income and expenses, net income before taxes, and net income after taxes. These items are further broken down to provide detailed insights into the various sources of income and expenses specific to the Salt Lake Utah area. Moreover, the Salt Lake Utah Income Statement may have variations or subcategories depending on the type of entity or industry. Some types of income statements that can be found in Salt Lake Utah include: 1. Personal Income Statement: This is an income statement that represents the earnings, expenses, and net income of individuals or households in Salt Lake City. It includes various sources of income like salaries, wages, dividends, interest, and rental income, as well as personal expenses such as housing costs, transportation, entertainment, and taxes. 2. Business Income Statement: This statement is specifically designed for businesses operating in Salt Lake City, Utah. It reflects the revenues generated from sales of goods or services, costs directly associated with those sales (COGS), operating expenses such as rent, utilities, salaries, marketing, and administrative expenses. It provides insights into the gross profit or loss and net income of the business. 3. Nonprofit Income Statement: Nonprofit organizations in Salt Lake Utah also prepare income statements to evaluate their financial performance. These statements focus on revenues from donations, grants, program services, and fundraising activities, along with expenses related to carrying out the organization's mission, such as program costs, administrative costs, and fundraising expenses. In conclusion, the Salt Lake Utah Income Statement is a crucial financial document that showcases the income and expenses relevant to individuals, businesses, and nonprofits in the Salt Lake City area. It helps assess financial performance, profitability, and make informed decisions regarding income generation and cost management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.