Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

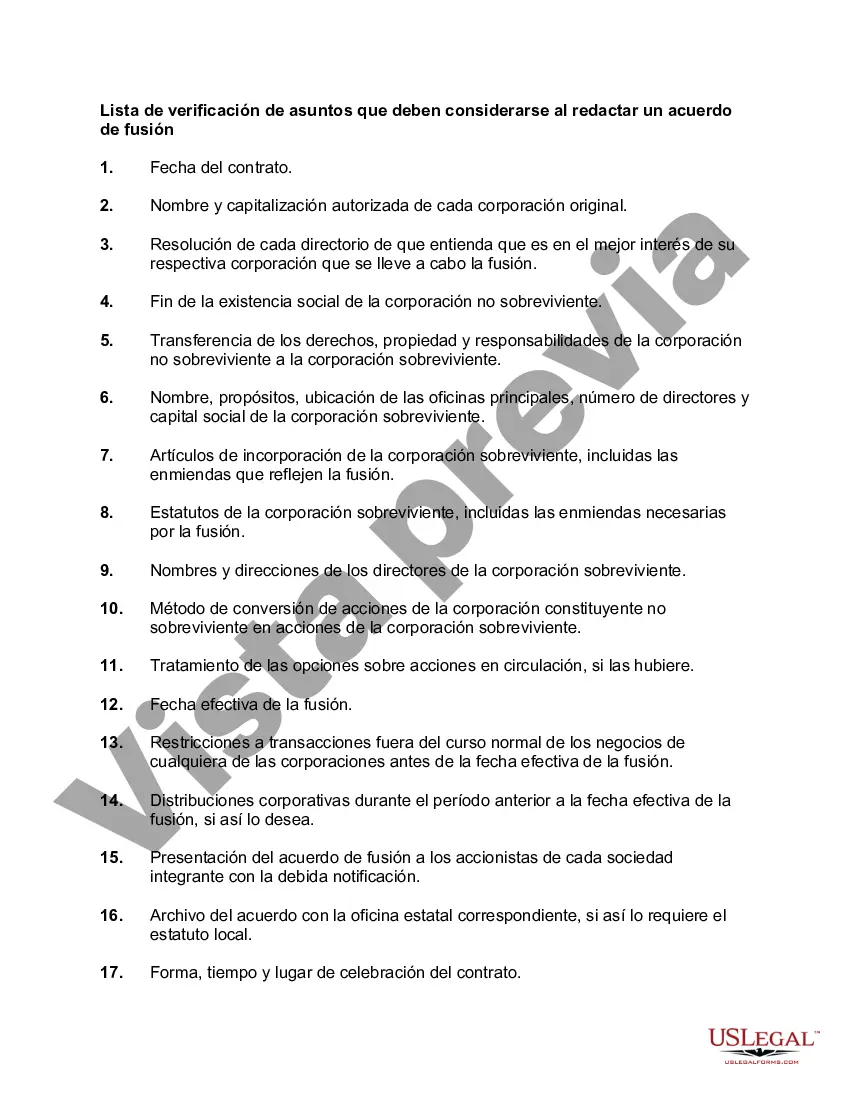

Allegheny, Pennsylvania is a county located in the southwestern part of the state. It is home to various industries, including manufacturing, healthcare, education, and finance. When drafting a merger agreement in Allegheny, Pennsylvania, there are several crucial matters that should be considered. These matters can be categorized into legal, financial, operational, and cultural aspects. Legal Matters: 1. Compliance with Pennsylvania State Laws: Ensure that the merger complies with all relevant laws and regulations of Pennsylvania and local jurisdictions. 2. Due Diligence: Conduct a thorough investigation of the involved companies to identify any legal risks or liabilities. 3. Intellectual Property Rights: Clarify the ownership, licensing, and protection of intellectual property assets PRE- and post-merger. 4. Contracts and Agreements: Assess the existing contracts and agreements of both companies and determine how they will be affected by the merger. 5. Dispute Resolution: Specify methods for resolving any potential legal disputes that may arise from the merger. Financial Matters: 1. Valuation and Purchase Price: Determine the value of each company and establish a fair purchase price for the merger. 2. Asset Evaluation: Assess the assets and liabilities of both companies, including real estate, inventory, and debt obligations. 3. Tax Implications: Consider the tax consequences of the merger for both companies and plan accordingly. 4. Financing: Determine the sources and structure of financing for the merger, including loans, equity, or a combination thereof. 5. Financial Reporting: Establish guidelines for financial reporting and disclosure requirements post-merger. Operational Matters: 1. Management and Governance Structure: Define the organizational structure and roles of key personnel post-merger. 2. Employee Transition: Address the integration of employees, including job retention, benefits, and potential redundancies. 3. IT Systems and Infrastructure: Plan for the integration of information technology systems and infrastructure to ensure a smooth transition. 4. Supply Chain and Logistics: Evaluate the impact of the merger on the supply chain and logistics operations of both companies. 5. Risk Management: Identify and mitigate potential operational risks associated with the merger. Cultural Matters: 1. Company Culture: Assess the cultural differences between the merging companies and develop strategies to bridge any gaps. 2. Communication and Change Management: Plan for effective communication to employees and stakeholders regarding the merger and manage potential resistance to change. 3. Branding and Marketing: Determine how to position the merged company's brand and ensure a consistent message to customers and the public. Different types of merger agreements could be specific to various industries such as healthcare, finance, technology, or manufacturing. For instance, a healthcare merger agreement will have additional considerations, including patient privacy compliance, regulatory approvals, and healthcare-specific liabilities. Similarly, a technology merger agreement may focus more on intellectual property rights, software integration, and data security.Allegheny, Pennsylvania is a county located in the southwestern part of the state. It is home to various industries, including manufacturing, healthcare, education, and finance. When drafting a merger agreement in Allegheny, Pennsylvania, there are several crucial matters that should be considered. These matters can be categorized into legal, financial, operational, and cultural aspects. Legal Matters: 1. Compliance with Pennsylvania State Laws: Ensure that the merger complies with all relevant laws and regulations of Pennsylvania and local jurisdictions. 2. Due Diligence: Conduct a thorough investigation of the involved companies to identify any legal risks or liabilities. 3. Intellectual Property Rights: Clarify the ownership, licensing, and protection of intellectual property assets PRE- and post-merger. 4. Contracts and Agreements: Assess the existing contracts and agreements of both companies and determine how they will be affected by the merger. 5. Dispute Resolution: Specify methods for resolving any potential legal disputes that may arise from the merger. Financial Matters: 1. Valuation and Purchase Price: Determine the value of each company and establish a fair purchase price for the merger. 2. Asset Evaluation: Assess the assets and liabilities of both companies, including real estate, inventory, and debt obligations. 3. Tax Implications: Consider the tax consequences of the merger for both companies and plan accordingly. 4. Financing: Determine the sources and structure of financing for the merger, including loans, equity, or a combination thereof. 5. Financial Reporting: Establish guidelines for financial reporting and disclosure requirements post-merger. Operational Matters: 1. Management and Governance Structure: Define the organizational structure and roles of key personnel post-merger. 2. Employee Transition: Address the integration of employees, including job retention, benefits, and potential redundancies. 3. IT Systems and Infrastructure: Plan for the integration of information technology systems and infrastructure to ensure a smooth transition. 4. Supply Chain and Logistics: Evaluate the impact of the merger on the supply chain and logistics operations of both companies. 5. Risk Management: Identify and mitigate potential operational risks associated with the merger. Cultural Matters: 1. Company Culture: Assess the cultural differences between the merging companies and develop strategies to bridge any gaps. 2. Communication and Change Management: Plan for effective communication to employees and stakeholders regarding the merger and manage potential resistance to change. 3. Branding and Marketing: Determine how to position the merged company's brand and ensure a consistent message to customers and the public. Different types of merger agreements could be specific to various industries such as healthcare, finance, technology, or manufacturing. For instance, a healthcare merger agreement will have additional considerations, including patient privacy compliance, regulatory approvals, and healthcare-specific liabilities. Similarly, a technology merger agreement may focus more on intellectual property rights, software integration, and data security.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.