Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

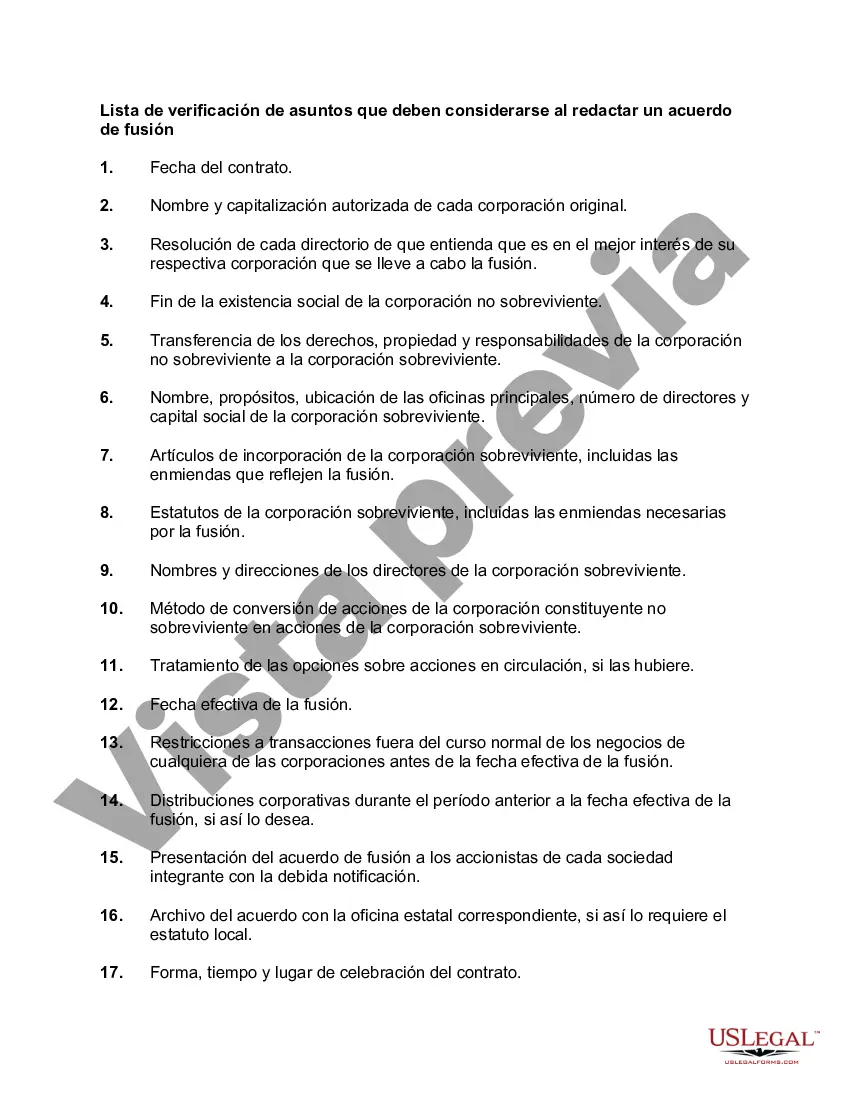

Chicago, Illinois is a vibrant city that holds significant importance in various domains, including business and commerce. When considering drafting a merger agreement in Chicago, there are several essential matters that should be taken into account. The checklist of these considerations can be categorized into different types, such as legal, financial, operational, and due diligence matters. 1. Legal Matters: — Corporate Structure: Analyze the legal structure of the merging entities and ensure compliance with relevant laws and regulations. — Ownership and Control: Determine the rights and responsibilities of the merging parties, including voting rights, board representation, and management control. — Governing Law and Jurisdiction: Specify the applicable laws and jurisdiction for any potential disputes that may arise from the merger agreement. — Regulatory Compliance: Assess and comply with industry-specific regulations and obtain necessary approvals from governmental bodies, if required. — Intellectual Property: Identify and protect the intellectual property rights of the merging companies, including patents, trademarks, copyrights, and trade secrets. 2. Financial Matters: — Asset and Liability Allocation: Determine the method for allocating assets and liabilities between the merged entities, ensuring a fair and equitable distribution. — Purchase Price and Consideration: Establish the purchase price and the form of consideration, such as cash, stocks, or a combination thereof. — Financial Statements: Review the financial statements of both entities to evaluate their financial health, ensuring transparency and accuracy for the merger process. — Tax Implications: Assess the tax consequences of the merger, including potential tax advantages and liabilities, at both the entity and individual levels. 3. Operational Matters: — Integration Planning: Develop a detailed integration plan to harmonize operations between the merging entities smoothly, including merging cultures, workforce, systems, and processes. — Employees and Human Resources: Address employee-related matters, such as compensation, benefits, and potential redundancies to ensure a smooth transition for the workforce. — Contracts and Obligations: Identify and analyze contracts, leases, and other legal obligations of the merging entities to determine any necessary modifications or terminations. — Supplier and Customer Relationships: Consider the impact of the merger on existing supplier and customer relationships and create strategies to mitigate any potential disruptions. 4. Due Diligence Matters: — Legal Due Diligence: Conduct a thorough legal due diligence review of the merging entities, analyzing contracts, litigation history, regulatory compliance, and any other legal issues that may impact the merger. — Financial Due Diligence: Perform an in-depth financial analysis of the merging entities, including reviewing financial statements, auditors' reports, and assessing any potential risks or hidden liabilities. — Operational Due Diligence: Evaluate the operational aspects of the merging entities, including organizational structure, processes, systems, and potential synergies that can be achieved through the merger. — Cultural Due Diligence: Identify and assess cultural differences between the merging entities, understanding potential challenges and strategies for promoting collaboration and integration. Drafting a thorough merger agreement checklist specific to Chicago, Illinois, considering these key matters, ensures that all important aspects are duly addressed and mitigates potential risks associated with the merger process.Chicago, Illinois is a vibrant city that holds significant importance in various domains, including business and commerce. When considering drafting a merger agreement in Chicago, there are several essential matters that should be taken into account. The checklist of these considerations can be categorized into different types, such as legal, financial, operational, and due diligence matters. 1. Legal Matters: — Corporate Structure: Analyze the legal structure of the merging entities and ensure compliance with relevant laws and regulations. — Ownership and Control: Determine the rights and responsibilities of the merging parties, including voting rights, board representation, and management control. — Governing Law and Jurisdiction: Specify the applicable laws and jurisdiction for any potential disputes that may arise from the merger agreement. — Regulatory Compliance: Assess and comply with industry-specific regulations and obtain necessary approvals from governmental bodies, if required. — Intellectual Property: Identify and protect the intellectual property rights of the merging companies, including patents, trademarks, copyrights, and trade secrets. 2. Financial Matters: — Asset and Liability Allocation: Determine the method for allocating assets and liabilities between the merged entities, ensuring a fair and equitable distribution. — Purchase Price and Consideration: Establish the purchase price and the form of consideration, such as cash, stocks, or a combination thereof. — Financial Statements: Review the financial statements of both entities to evaluate their financial health, ensuring transparency and accuracy for the merger process. — Tax Implications: Assess the tax consequences of the merger, including potential tax advantages and liabilities, at both the entity and individual levels. 3. Operational Matters: — Integration Planning: Develop a detailed integration plan to harmonize operations between the merging entities smoothly, including merging cultures, workforce, systems, and processes. — Employees and Human Resources: Address employee-related matters, such as compensation, benefits, and potential redundancies to ensure a smooth transition for the workforce. — Contracts and Obligations: Identify and analyze contracts, leases, and other legal obligations of the merging entities to determine any necessary modifications or terminations. — Supplier and Customer Relationships: Consider the impact of the merger on existing supplier and customer relationships and create strategies to mitigate any potential disruptions. 4. Due Diligence Matters: — Legal Due Diligence: Conduct a thorough legal due diligence review of the merging entities, analyzing contracts, litigation history, regulatory compliance, and any other legal issues that may impact the merger. — Financial Due Diligence: Perform an in-depth financial analysis of the merging entities, including reviewing financial statements, auditors' reports, and assessing any potential risks or hidden liabilities. — Operational Due Diligence: Evaluate the operational aspects of the merging entities, including organizational structure, processes, systems, and potential synergies that can be achieved through the merger. — Cultural Due Diligence: Identify and assess cultural differences between the merging entities, understanding potential challenges and strategies for promoting collaboration and integration. Drafting a thorough merger agreement checklist specific to Chicago, Illinois, considering these key matters, ensures that all important aspects are duly addressed and mitigates potential risks associated with the merger process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.