Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

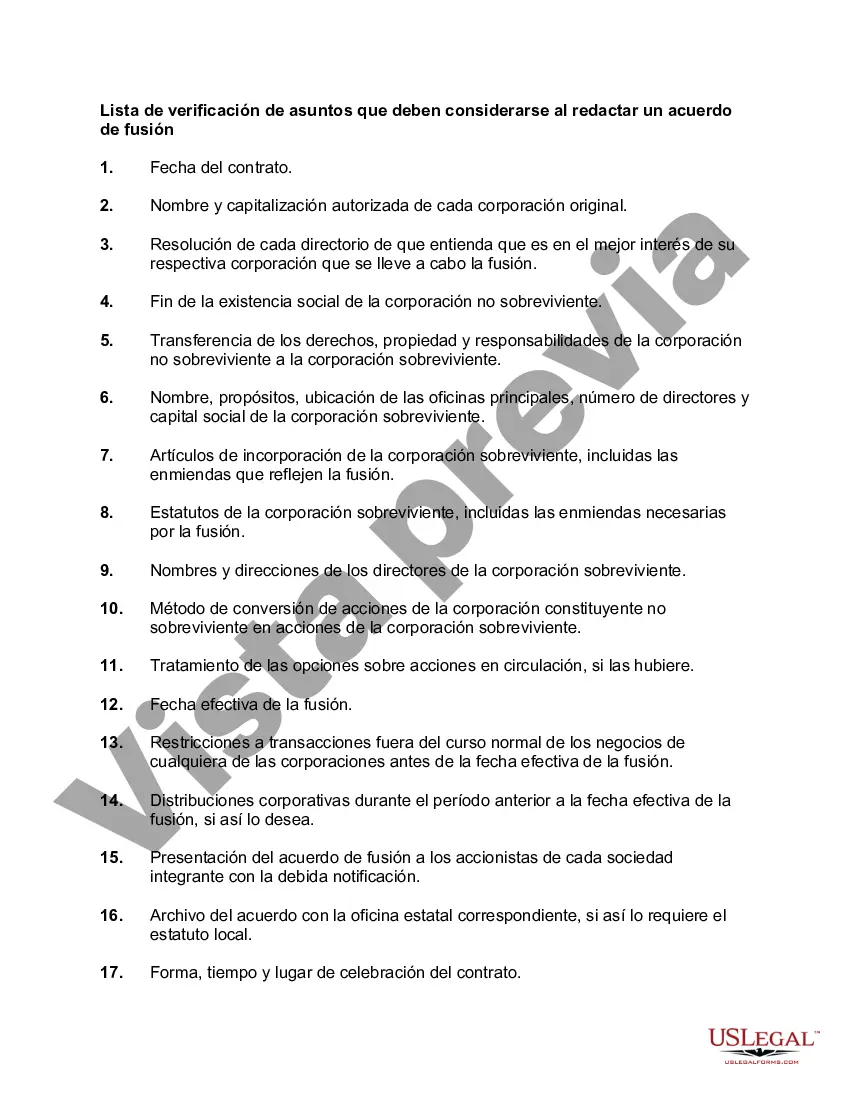

Collin County is a vibrant region located in the state of Texas. As one of the fastest-growing areas in the country, Collin County offers a plethora of opportunities for businesses, making it an ideal location for mergers and acquisitions. When drafting a merger agreement specific to Collin County, there are several crucial matters that should be considered. Below is a checklist of these matters and the important keywords associated with them: 1. Jurisdiction and Venue: Ensure that the merger agreement states Collin County as the jurisdiction and venue for any disputes or legal proceedings related to the agreement. This helps establish a clear legal framework for resolving any conflicts that may arise. 2. Local Compliance: Include a provision addressing compliance with Collin County's specific laws, regulations, and requirements governing business operations and mergers. Consider any industry-specific regulations that may apply. 3. Tax Implications: Understand and address the tax implications of the merger in relation to Collin County. This includes both local and state tax considerations, such as property tax, sales tax, and income tax requirements. 4. Due Diligence: Conduct a thorough due diligence process specific to Collin County. This involves examining the target company's financials, assets, liabilities, contracts, litigation history, and any other relevant business matters within the county. 5. Real Estate Considerations: Assess the impact of the merger on any real estate owned or leased by the target company in Collin County. Consider matters such as lease agreements, property titles, zoning restrictions, and environmental regulations. 6. Employment Agreements: Review and address any existing employment agreements within Collin County. This includes examining non-compete agreements, employee benefits, compensation structures, and potential workforce-related hurdles. 7. Intellectual Property: Identify and assess the target company's intellectual property assets based in Collin County. Determine the ownership rights, patents, trademarks, copyrights, or trade secrets involved and draft appropriate provisions for their transfer, licensing, or protection. 8. Data Privacy and Cybersecurity: Take into account Collin County's specific data privacy and cybersecurity laws when dealing with customer data, employee information, or any sensitive company data in the merger process. Safeguarding data privacy and implementing adequate cybersecurity measures is paramount. 9. Regulatory Approvals: Identify any Collin County-specific regulatory approvals that may be required for the merger. This includes licenses, permits, consents, or filings with local and state agencies. When drafting a merger agreement, it is crucial to tailor it specifically to Collin County's unique characteristics and legal landscape. Adhering to the matters discussed above will help ensure a smoother, legally compliant, and successful merger process.Collin County is a vibrant region located in the state of Texas. As one of the fastest-growing areas in the country, Collin County offers a plethora of opportunities for businesses, making it an ideal location for mergers and acquisitions. When drafting a merger agreement specific to Collin County, there are several crucial matters that should be considered. Below is a checklist of these matters and the important keywords associated with them: 1. Jurisdiction and Venue: Ensure that the merger agreement states Collin County as the jurisdiction and venue for any disputes or legal proceedings related to the agreement. This helps establish a clear legal framework for resolving any conflicts that may arise. 2. Local Compliance: Include a provision addressing compliance with Collin County's specific laws, regulations, and requirements governing business operations and mergers. Consider any industry-specific regulations that may apply. 3. Tax Implications: Understand and address the tax implications of the merger in relation to Collin County. This includes both local and state tax considerations, such as property tax, sales tax, and income tax requirements. 4. Due Diligence: Conduct a thorough due diligence process specific to Collin County. This involves examining the target company's financials, assets, liabilities, contracts, litigation history, and any other relevant business matters within the county. 5. Real Estate Considerations: Assess the impact of the merger on any real estate owned or leased by the target company in Collin County. Consider matters such as lease agreements, property titles, zoning restrictions, and environmental regulations. 6. Employment Agreements: Review and address any existing employment agreements within Collin County. This includes examining non-compete agreements, employee benefits, compensation structures, and potential workforce-related hurdles. 7. Intellectual Property: Identify and assess the target company's intellectual property assets based in Collin County. Determine the ownership rights, patents, trademarks, copyrights, or trade secrets involved and draft appropriate provisions for their transfer, licensing, or protection. 8. Data Privacy and Cybersecurity: Take into account Collin County's specific data privacy and cybersecurity laws when dealing with customer data, employee information, or any sensitive company data in the merger process. Safeguarding data privacy and implementing adequate cybersecurity measures is paramount. 9. Regulatory Approvals: Identify any Collin County-specific regulatory approvals that may be required for the merger. This includes licenses, permits, consents, or filings with local and state agencies. When drafting a merger agreement, it is crucial to tailor it specifically to Collin County's unique characteristics and legal landscape. Adhering to the matters discussed above will help ensure a smoother, legally compliant, and successful merger process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.