Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

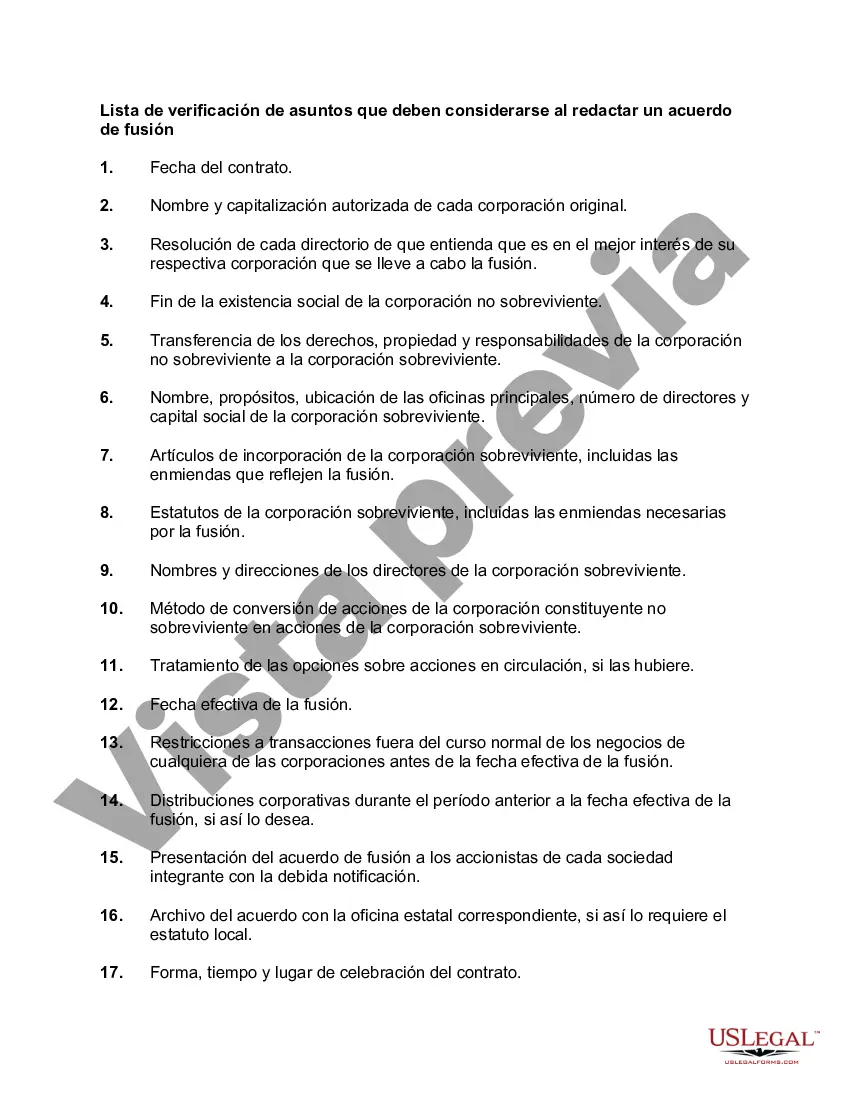

Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. It is the largest city in the state of Pennsylvania and offers a rich history, diverse culture, and numerous attractions. Here is a checklist of matters that should be considered when drafting a merger agreement in Philadelphia: 1. Structure of the Merger: Determine the type of merger agreement suitable for the specific circumstances, such as a statutory merger, stock-for-stock merger, or an asset acquisition. 2. Legal Requirements: Ensure compliance with the applicable laws and regulations in Philadelphia and Pennsylvania, including corporate laws, tax laws, and securities regulations. 3. Due Diligence: Conduct thorough due diligence on the target company, including financial statements, tax liabilities, legal disputes, and intellectual property rights. 4. Valuation and Consideration: Define the method of valuation for the target company and finalize the consideration to be paid, whether it involves cash, stock, or a combination of both. 5. Corporate Governance: Address matters related to post-merger management, board composition, and voting rights in the merged entity. 6. Employees and Employment Contracts: Review the implications of the merger on employees, including potential redundancies, employee benefits, and adherence to labor laws. 7. Intellectual Property: Evaluate and address any intellectual property assets, licenses, or restrictions related to the target company that may impact the merger agreement. 8. Contracts and Agreements: Review all contracts and agreements of the target company, including leases, supply contracts, customer contracts, and non-compete agreements. 9. Indemnification and Liability: Determine the extent of indemnification provisions, limitation of liability clauses, and warranties and representations given by both parties in the merger agreement. 10. Closing Conditions: Outline the conditions precedent for closing the merger, such as obtaining regulatory approvals, shareholder approvals, or third-party consents. Different types of Philadelphia Pennsylvania Checklist of Matters that Should be Considered in Drafting a Merger Agreement can vary based on the specifics of the industry, size of the companies, and any unique legal or financial considerations involved in the transaction. Some examples of industry-specific checklists could include healthcare-specific matters, technology-related matters, or real estate-related matters. It is essential to tailor the checklist to fit the specific needs and circumstances of the merger agreement.Philadelphia, Pennsylvania is a vibrant city located in the northeastern United States. It is the largest city in the state of Pennsylvania and offers a rich history, diverse culture, and numerous attractions. Here is a checklist of matters that should be considered when drafting a merger agreement in Philadelphia: 1. Structure of the Merger: Determine the type of merger agreement suitable for the specific circumstances, such as a statutory merger, stock-for-stock merger, or an asset acquisition. 2. Legal Requirements: Ensure compliance with the applicable laws and regulations in Philadelphia and Pennsylvania, including corporate laws, tax laws, and securities regulations. 3. Due Diligence: Conduct thorough due diligence on the target company, including financial statements, tax liabilities, legal disputes, and intellectual property rights. 4. Valuation and Consideration: Define the method of valuation for the target company and finalize the consideration to be paid, whether it involves cash, stock, or a combination of both. 5. Corporate Governance: Address matters related to post-merger management, board composition, and voting rights in the merged entity. 6. Employees and Employment Contracts: Review the implications of the merger on employees, including potential redundancies, employee benefits, and adherence to labor laws. 7. Intellectual Property: Evaluate and address any intellectual property assets, licenses, or restrictions related to the target company that may impact the merger agreement. 8. Contracts and Agreements: Review all contracts and agreements of the target company, including leases, supply contracts, customer contracts, and non-compete agreements. 9. Indemnification and Liability: Determine the extent of indemnification provisions, limitation of liability clauses, and warranties and representations given by both parties in the merger agreement. 10. Closing Conditions: Outline the conditions precedent for closing the merger, such as obtaining regulatory approvals, shareholder approvals, or third-party consents. Different types of Philadelphia Pennsylvania Checklist of Matters that Should be Considered in Drafting a Merger Agreement can vary based on the specifics of the industry, size of the companies, and any unique legal or financial considerations involved in the transaction. Some examples of industry-specific checklists could include healthcare-specific matters, technology-related matters, or real estate-related matters. It is essential to tailor the checklist to fit the specific needs and circumstances of the merger agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.