Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

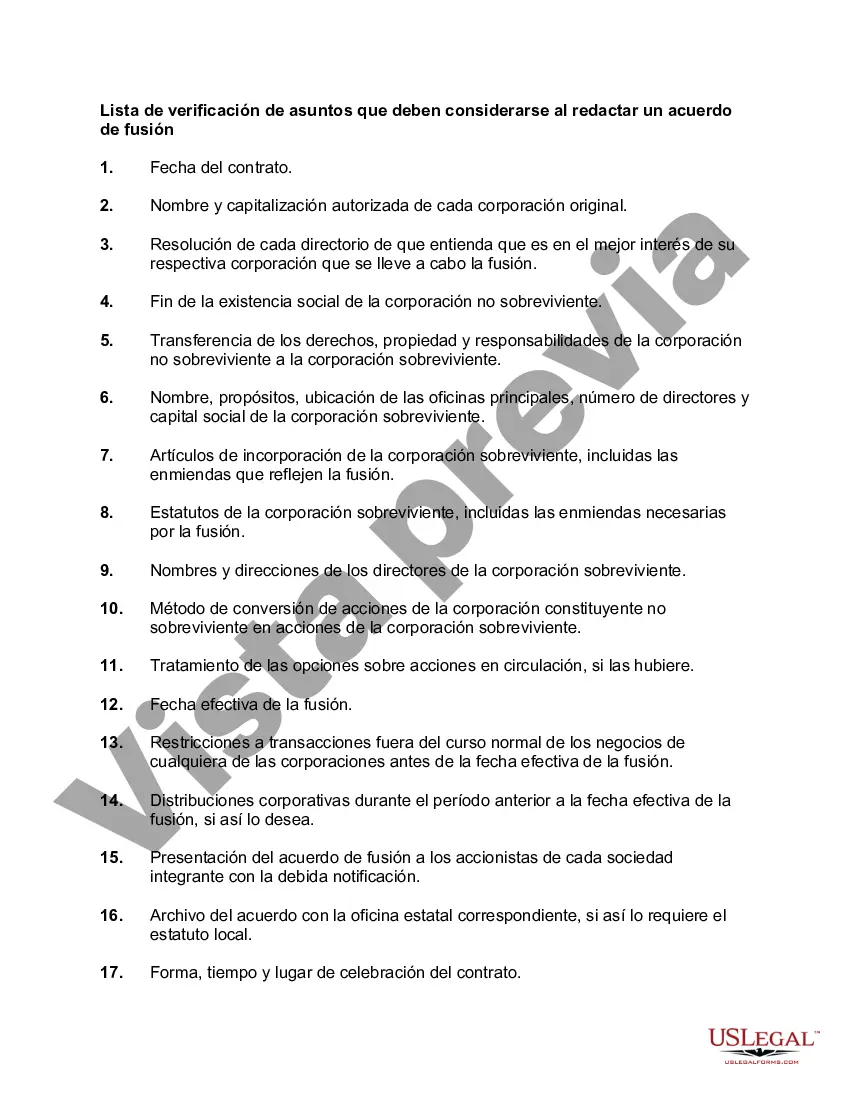

Phoenix Arizona is the fifth largest city in the United States, known for its warm climate, vibrant culture, and breathtaking landscapes. Located in the Sonoran Desert, this bustling city offers a wide array of opportunities for individuals and businesses alike. When drafting a merger agreement in Phoenix, Arizona, it is crucial to consider various matters that will ensure a smooth and successful transition. Here is a comprehensive checklist of important factors to keep in mind: 1. Legal Considerations: — Comply with applicable federal and state laws concerning mergers and acquisitions. — Review and understand the relevant provisions of the Arizona Revised Statutes pertaining to mergers and corporate entities. — Consult with an experienced corporate attorney specializing in mergers and acquisitions. 2. Due Diligence: — Conduct thorough due diligence of the target company, including its financial records, tax liabilities, contracts, intellectual property, and potential legal risks. — Assess the target company's corporate governance practices, such as board composition and decision-making processes. 3. Objectives and Structure: — Clearly define the objectives and motivations behind the merger, including anticipated synergies, cost savings, market expansion, and strategic positioning. — Determine the most suitable merger structure, such as a merger of equals, an acquisition, or a stock swap. 4. Terms and Conditions: — Define the purchase price or exchange ratio, including considerations for determining fair market value. — Establish the payment terms, such as cash, stock, or a combination of both. — Outline any contingent payments, earn-outs, or other financial arrangements. — Determine the treatment of outstanding debt, options, warrants, or other securities. 5. Representations and Warranties: — Specify the representations and warranties to be provided by each party, ensuring that they accurately represent the state of their respective businesses. — Address any limitations of liability or indemnification obligations related to breach of these representations and warranties. 6. Integration Plan: — Develop a comprehensive integration plan that outlines the steps, responsibilities, and timelines for post-merger integration, including operational, financial, cultural, and technological aspects. — Consider the potential impact on employees, customers, suppliers, and other stakeholders, ensuring a smooth transition while minimizing disruptions. 7. Approvals and Regulatory Compliance: — Identify any required approvals from regulatory bodies, such as the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC). — Comply with any antitrust, competition, or other regulatory requirements, both at the federal and state levels. 8. Confidentiality and Non-Disclosure: — Establish strict confidentiality provisions to protect sensitive information during negotiations and due diligence. — Determine the extent of non-disclosure obligations for both parties, ensuring the protection of proprietary information. 9. Dispute Resolution and Governing Law: — Determine the applicable governing law and jurisdiction for any disputes arising from the merger agreement. — Consider alternative dispute resolution mechanisms, such as arbitration or mediation, to resolve conflicts efficiently. Different types of Phoenix Arizona Checklist of Matters that Should be Considered in Drafting a Merger Agreement may include specific industry regulations and requirements, tax considerations, labor and employment laws, environmental regulations, intellectual property rights, or sector-specific compliance standards, depending on the nature of the businesses involved in the merger. Overall, a well-drafted merger agreement in Phoenix, Arizona, should address these crucial matters to safeguard the interests of both parties and facilitate a successful merger or acquisition.Phoenix Arizona is the fifth largest city in the United States, known for its warm climate, vibrant culture, and breathtaking landscapes. Located in the Sonoran Desert, this bustling city offers a wide array of opportunities for individuals and businesses alike. When drafting a merger agreement in Phoenix, Arizona, it is crucial to consider various matters that will ensure a smooth and successful transition. Here is a comprehensive checklist of important factors to keep in mind: 1. Legal Considerations: — Comply with applicable federal and state laws concerning mergers and acquisitions. — Review and understand the relevant provisions of the Arizona Revised Statutes pertaining to mergers and corporate entities. — Consult with an experienced corporate attorney specializing in mergers and acquisitions. 2. Due Diligence: — Conduct thorough due diligence of the target company, including its financial records, tax liabilities, contracts, intellectual property, and potential legal risks. — Assess the target company's corporate governance practices, such as board composition and decision-making processes. 3. Objectives and Structure: — Clearly define the objectives and motivations behind the merger, including anticipated synergies, cost savings, market expansion, and strategic positioning. — Determine the most suitable merger structure, such as a merger of equals, an acquisition, or a stock swap. 4. Terms and Conditions: — Define the purchase price or exchange ratio, including considerations for determining fair market value. — Establish the payment terms, such as cash, stock, or a combination of both. — Outline any contingent payments, earn-outs, or other financial arrangements. — Determine the treatment of outstanding debt, options, warrants, or other securities. 5. Representations and Warranties: — Specify the representations and warranties to be provided by each party, ensuring that they accurately represent the state of their respective businesses. — Address any limitations of liability or indemnification obligations related to breach of these representations and warranties. 6. Integration Plan: — Develop a comprehensive integration plan that outlines the steps, responsibilities, and timelines for post-merger integration, including operational, financial, cultural, and technological aspects. — Consider the potential impact on employees, customers, suppliers, and other stakeholders, ensuring a smooth transition while minimizing disruptions. 7. Approvals and Regulatory Compliance: — Identify any required approvals from regulatory bodies, such as the Federal Trade Commission (FTC) or the Securities and Exchange Commission (SEC). — Comply with any antitrust, competition, or other regulatory requirements, both at the federal and state levels. 8. Confidentiality and Non-Disclosure: — Establish strict confidentiality provisions to protect sensitive information during negotiations and due diligence. — Determine the extent of non-disclosure obligations for both parties, ensuring the protection of proprietary information. 9. Dispute Resolution and Governing Law: — Determine the applicable governing law and jurisdiction for any disputes arising from the merger agreement. — Consider alternative dispute resolution mechanisms, such as arbitration or mediation, to resolve conflicts efficiently. Different types of Phoenix Arizona Checklist of Matters that Should be Considered in Drafting a Merger Agreement may include specific industry regulations and requirements, tax considerations, labor and employment laws, environmental regulations, intellectual property rights, or sector-specific compliance standards, depending on the nature of the businesses involved in the merger. Overall, a well-drafted merger agreement in Phoenix, Arizona, should address these crucial matters to safeguard the interests of both parties and facilitate a successful merger or acquisition.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.