Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

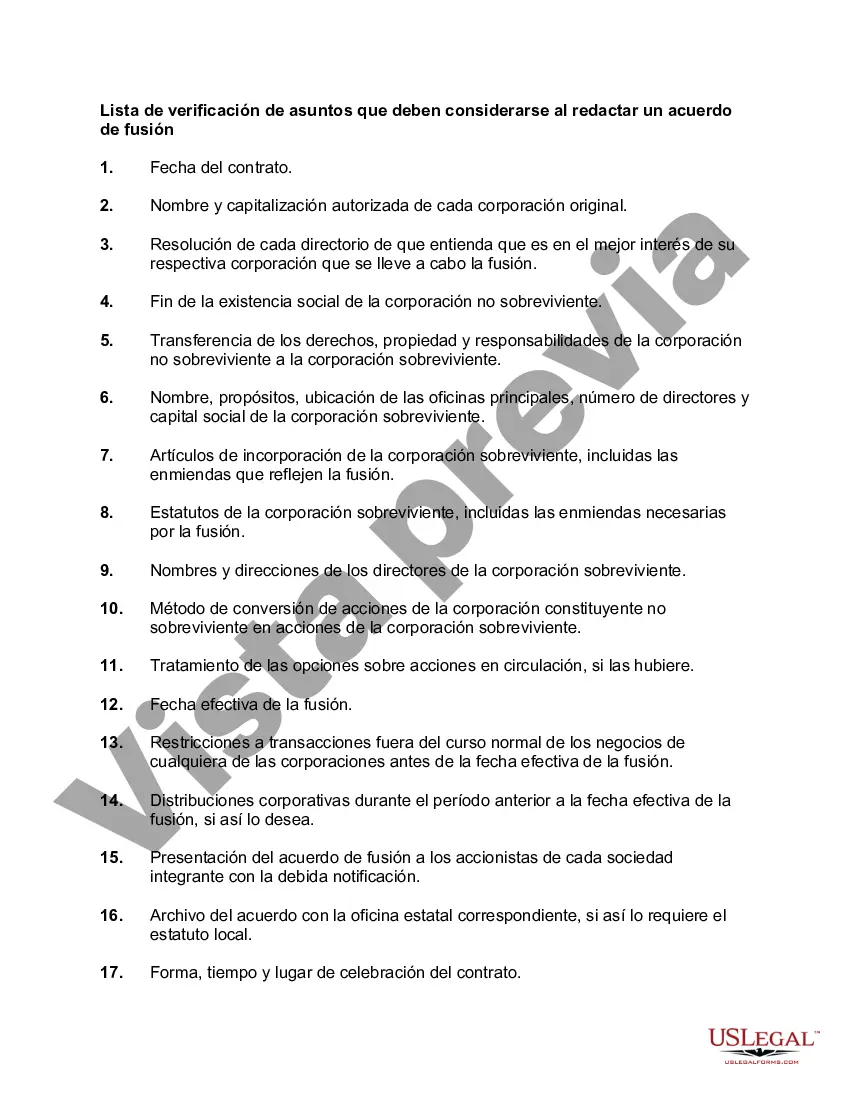

San Bernardino, California is a vibrant city located in the Inland Empire region of Southern California. Nestled between the picturesque San Bernardino Mountains and the vast Mojave Desert, this city offers a mix of natural beauty and urban amenities. Home to approximately 216,000 residents, San Bernardino boasts diverse communities, a rich history, and numerous recreational opportunities. In terms of drafting a merger agreement, there are several matters that should be considered to ensure a successful and legally sound merger. These factors include: 1. Business and Financial Structure: The agreement should clearly outline the organizational structure of the merged entity, including the formation of a new company or the acquisition of an existing one. Financial matters such as the capital structure, ownership percentages, and valuation of assets should also be addressed. 2. Governance and Management: Defining the roles and responsibilities of the management team, board of directors, and key personnel is crucial. This includes specifying the decision-making processes, appointment of officers, and the composition of the board. 3. Intellectual Property and Contracts: Any intellectual property owned by the merging entities must be identified and protected in the merger agreement. Existing contracts should be reviewed and addressed to ensure their continuity or termination. 4. Tax and Accounting Considerations: Provisions for tax and accounting matters, including potential tax liabilities, tax allocation, and financial reporting, should be included. Professional advice from tax and accounting experts may be necessary to navigate these complexities. 5. Employment and Workforce: Addressing issues related to employees, such as their rights, benefits, and potential redundancies, is essential. Ensuring a smooth transition for staff members and compliance with employment laws is critical. 6. Regulatory and Legal Compliance: Compliance with applicable regulatory requirements, permits, licenses, and antitrust laws should be addressed. This includes potential filings with government agencies and obtaining necessary approvals. 7. Confidentiality and Non-Compete Agreements: Protecting trade secrets, proprietary information, and restricting competitive activities should be considered. The merger agreement should include provisions to safeguard confidential information and prevent unfair competition. 8. Dispute Resolution and Governing Law: Clauses defining the resolution process for any disputes that may arise and the choice of governing law should be included. This ensures a clear roadmap for handling legal disagreements. 9. Due Diligence and Conditions Precedent: Conducting thorough due diligence on both entities is crucial before finalizing a merger agreement. Conditions precedent, such as obtaining necessary consents or approvals, should be specified. 10. Termination and Remedies: The agreement should outline the termination process, including the rights and obligations of both parties in case of termination. Remedies for breach of contract or non-compliance should also be addressed. It is essential to tailor the merger agreement to the specific circumstances and goals of the merging entities. Different types of merger agreements may include asset acquisitions, stock purchases, or mergers of equals, among others. Each type entails unique considerations and implications that should be carefully considered in the drafting process.San Bernardino, California is a vibrant city located in the Inland Empire region of Southern California. Nestled between the picturesque San Bernardino Mountains and the vast Mojave Desert, this city offers a mix of natural beauty and urban amenities. Home to approximately 216,000 residents, San Bernardino boasts diverse communities, a rich history, and numerous recreational opportunities. In terms of drafting a merger agreement, there are several matters that should be considered to ensure a successful and legally sound merger. These factors include: 1. Business and Financial Structure: The agreement should clearly outline the organizational structure of the merged entity, including the formation of a new company or the acquisition of an existing one. Financial matters such as the capital structure, ownership percentages, and valuation of assets should also be addressed. 2. Governance and Management: Defining the roles and responsibilities of the management team, board of directors, and key personnel is crucial. This includes specifying the decision-making processes, appointment of officers, and the composition of the board. 3. Intellectual Property and Contracts: Any intellectual property owned by the merging entities must be identified and protected in the merger agreement. Existing contracts should be reviewed and addressed to ensure their continuity or termination. 4. Tax and Accounting Considerations: Provisions for tax and accounting matters, including potential tax liabilities, tax allocation, and financial reporting, should be included. Professional advice from tax and accounting experts may be necessary to navigate these complexities. 5. Employment and Workforce: Addressing issues related to employees, such as their rights, benefits, and potential redundancies, is essential. Ensuring a smooth transition for staff members and compliance with employment laws is critical. 6. Regulatory and Legal Compliance: Compliance with applicable regulatory requirements, permits, licenses, and antitrust laws should be addressed. This includes potential filings with government agencies and obtaining necessary approvals. 7. Confidentiality and Non-Compete Agreements: Protecting trade secrets, proprietary information, and restricting competitive activities should be considered. The merger agreement should include provisions to safeguard confidential information and prevent unfair competition. 8. Dispute Resolution and Governing Law: Clauses defining the resolution process for any disputes that may arise and the choice of governing law should be included. This ensures a clear roadmap for handling legal disagreements. 9. Due Diligence and Conditions Precedent: Conducting thorough due diligence on both entities is crucial before finalizing a merger agreement. Conditions precedent, such as obtaining necessary consents or approvals, should be specified. 10. Termination and Remedies: The agreement should outline the termination process, including the rights and obligations of both parties in case of termination. Remedies for breach of contract or non-compliance should also be addressed. It is essential to tailor the merger agreement to the specific circumstances and goals of the merging entities. Different types of merger agreements may include asset acquisitions, stock purchases, or mergers of equals, among others. Each type entails unique considerations and implications that should be carefully considered in the drafting process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.