Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation. Generally the Board of Directors of each Corporation have to adopt a resolution authorizing a Plan of Merger and Agreement and the Shareholders of each Corporation have to approve the Plan and Agreement.

Title: Exploring the Hennepin Minnesota Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger Introduction: In corporate governance, the Hennepin Minnesota Resolution of Board of Directors plays a crucial role when a corporation is considering a merger or acquisition. This resolution signifies the approval and authorization by the board to initiate negotiations concerning a potential merger. In this article, we delve into the details of the Hennepin Minnesota Resolution of Board of Directors concerning mergers, its significance, and potential variations it may have. 1. Understanding the Hennepin Minnesota Resolution of Board of Directors: The Hennepin Minnesota Resolution of Board of Directors is an official document that formalizes the decision-making process for conducting negotiations regarding a merger or acquisition. It serves as the primary authorization for the board of directors of a corporation to explore potential merger opportunities. 2. Key Components of the Hennepin Minnesota Resolution: a. Purpose: This section outlines the motivation behind the resolution, emphasizing the strategic goals and potential benefits of pursuing a merger. It may include enhancing market presence, achieving economies of scale, diversification, or gaining access to new technologies. b. Authorization: This clause grants explicit authorization to the board of directors or a designated committee to engage in negotiations concerning a merger. It specifies the scope of negotiation, including financial terms, conditions, and key decision-making responsibilities. c. Legal and Regulatory Considerations: As mergers involve legal and regulatory complexities, this section ensures that all relevant legal requirements, such as shareholder approvals or regulatory filings, are fulfilled within the framework of Hennepin Minnesota laws. d. Confidentiality and Exclusivity: Depending on the circumstances, the resolution may include provisions that require maintaining the confidentiality of negotiations and impose exclusivity agreements with potential merger partners. e. Reporting and Evaluation: This element outlines the reporting requirements for the board of directors, detailing the frequency and format through which progress updates on negotiations will be communicated. It may also include provisions for evaluating the merit of offers received during the negotiation process. 3. Types of Hennepin Minnesota Resolution of Board of Directors Concerning Mergers: a. Full Merger Authorization Resolution: This type of resolution authorizes the board of directors to initiate and conclude negotiations with potential merger partners independently. It grants them broad decision-making authority over the entire process. b. Limited Merger Authorization Resolution: In some cases, the board of directors might pass a resolution with specific limitations. For example, they may authorize negotiations only up to a particular financial threshold, beyond which further approval from shareholders or higher management is required. c. Preliminary Exploration Resolution: Before committing to extensive negotiations, a preliminary exploration resolution allows the board to conduct initial discussions and gather information to determine the potential merits of a merger. This resolution acts as a precursor to full authorization. Conclusion: The Hennepin Minnesota Resolution of Board of Directors concerning mergers serves as the pivotal document enabling corporations to explore and pursue merger opportunities. By authorizing negotiations and providing a framework for decision-making, this resolution ensures that all legal and regulatory obligations are met. Understanding the different types and key components of this resolution is essential for corporations looking to navigate the complex world of mergers and acquisitions effectively.Title: Exploring the Hennepin Minnesota Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger Introduction: In corporate governance, the Hennepin Minnesota Resolution of Board of Directors plays a crucial role when a corporation is considering a merger or acquisition. This resolution signifies the approval and authorization by the board to initiate negotiations concerning a potential merger. In this article, we delve into the details of the Hennepin Minnesota Resolution of Board of Directors concerning mergers, its significance, and potential variations it may have. 1. Understanding the Hennepin Minnesota Resolution of Board of Directors: The Hennepin Minnesota Resolution of Board of Directors is an official document that formalizes the decision-making process for conducting negotiations regarding a merger or acquisition. It serves as the primary authorization for the board of directors of a corporation to explore potential merger opportunities. 2. Key Components of the Hennepin Minnesota Resolution: a. Purpose: This section outlines the motivation behind the resolution, emphasizing the strategic goals and potential benefits of pursuing a merger. It may include enhancing market presence, achieving economies of scale, diversification, or gaining access to new technologies. b. Authorization: This clause grants explicit authorization to the board of directors or a designated committee to engage in negotiations concerning a merger. It specifies the scope of negotiation, including financial terms, conditions, and key decision-making responsibilities. c. Legal and Regulatory Considerations: As mergers involve legal and regulatory complexities, this section ensures that all relevant legal requirements, such as shareholder approvals or regulatory filings, are fulfilled within the framework of Hennepin Minnesota laws. d. Confidentiality and Exclusivity: Depending on the circumstances, the resolution may include provisions that require maintaining the confidentiality of negotiations and impose exclusivity agreements with potential merger partners. e. Reporting and Evaluation: This element outlines the reporting requirements for the board of directors, detailing the frequency and format through which progress updates on negotiations will be communicated. It may also include provisions for evaluating the merit of offers received during the negotiation process. 3. Types of Hennepin Minnesota Resolution of Board of Directors Concerning Mergers: a. Full Merger Authorization Resolution: This type of resolution authorizes the board of directors to initiate and conclude negotiations with potential merger partners independently. It grants them broad decision-making authority over the entire process. b. Limited Merger Authorization Resolution: In some cases, the board of directors might pass a resolution with specific limitations. For example, they may authorize negotiations only up to a particular financial threshold, beyond which further approval from shareholders or higher management is required. c. Preliminary Exploration Resolution: Before committing to extensive negotiations, a preliminary exploration resolution allows the board to conduct initial discussions and gather information to determine the potential merits of a merger. This resolution acts as a precursor to full authorization. Conclusion: The Hennepin Minnesota Resolution of Board of Directors concerning mergers serves as the pivotal document enabling corporations to explore and pursue merger opportunities. By authorizing negotiations and providing a framework for decision-making, this resolution ensures that all legal and regulatory obligations are met. Understanding the different types and key components of this resolution is essential for corporations looking to navigate the complex world of mergers and acquisitions effectively.

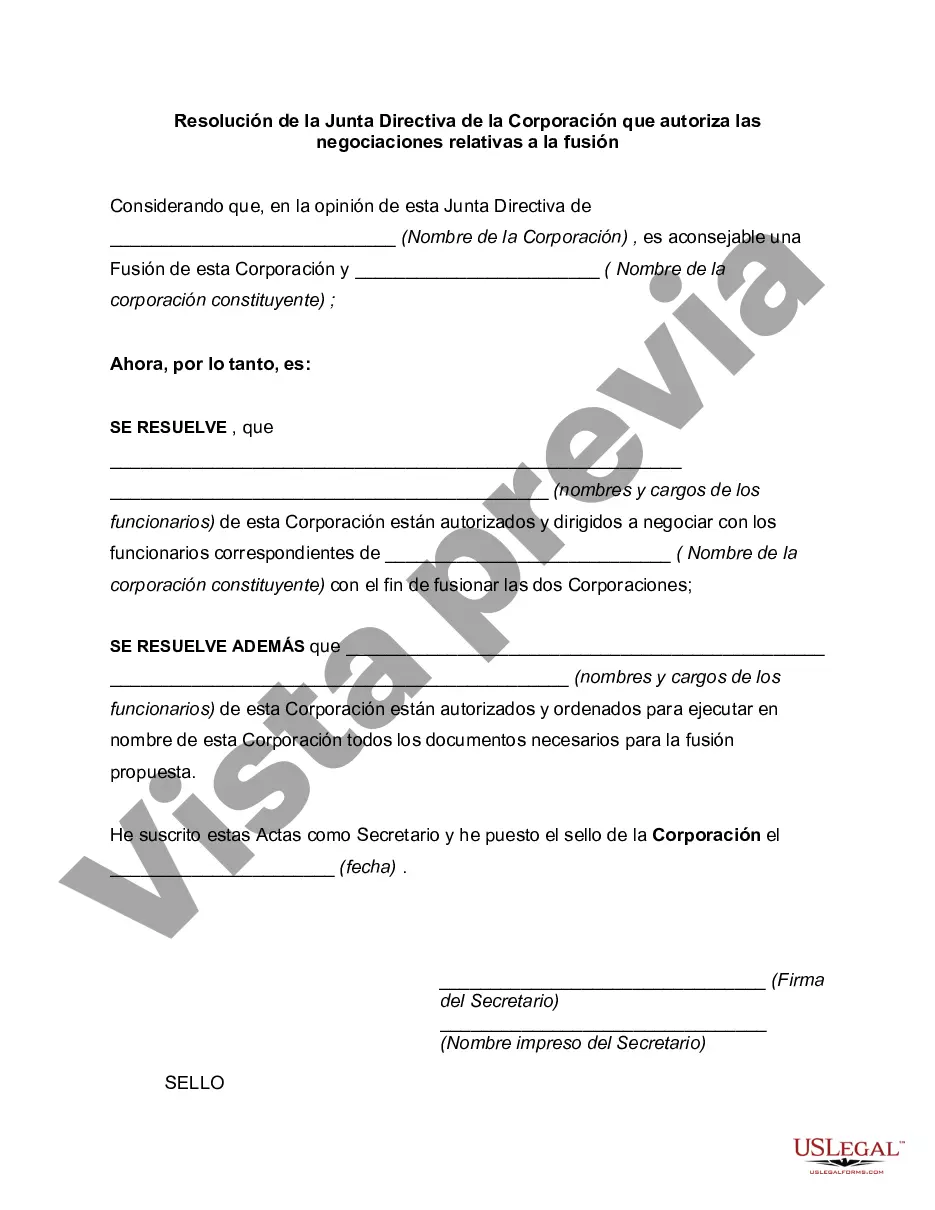

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.