Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation. Generally the Board of Directors of each Corporation have to adopt a resolution authorizing a Plan of Merger and Agreement and the Shareholders of each Corporation have to approve the Plan and Agreement.

Title: Understanding the Houston Texas Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger Introduction: The Houston Texas Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger is a legally binding document that grants authority to corporation board members to engage in negotiations pertaining to a merger. This resolution plays a crucial role in outlining the decision-making process and establishing guidelines for board members to follow during merger negotiations. In this article, we will explore the key components of this resolution while highlighting different types and variations that may exist. Key Components of the Houston Texas Resolution: 1. Purpose and Context: The resolution begins by clearly stating the purpose of engaging in merger negotiations and defines the context and goals to be achieved. It explains the reasons for considering a merger and the desired outcomes it aims to accomplish, such as enhancing shareholder value, expanding market reach, or gaining a competitive advantage. 2. Authorization of Negotiations: The resolution formally authorizes the board of directors to initiate negotiations related to a potential merger. It empowers the board to engage in discussions, perform due diligence, and explore the terms and conditions of the merger thoroughly. This authorization sets the groundwork for the board's subsequent decision-making process. 3. Scope of Authority: The resolution outlines the scope of authority conferred upon the board members regarding merger negotiations. It specifies the board's ability to make decisions, enter into agreements, and pursue actions necessary to facilitate the merger process. This ensures that board members have the necessary powers to protect the interests of the corporation and its shareholders during negotiations. 4. Appointment of Negotiating Committee: When applicable, the resolution may appoint or establish a negotiating committee to oversee the merger negotiations. This committee is responsible for representing the corporation's interests, evaluating proposals, and reporting progress to the board. The resolution may provide specific details regarding the composition, responsibilities, and authority of the negotiating committee. Types of Houston Texas Resolutions of Board of Directors Concerning Merger: 1. General Authorization Resolution: This is the most common type of resolution, granting the board of directors the general authority to initiate merger negotiations and undertake necessary actions to advance the process. It provides the broad framework within which negotiations can take place. 2. Specific Merger Authorization Resolution: In certain cases, the board may draft a resolution that authorizes negotiations concerning a specific merger opportunity or potential merger partner. This type of resolution focuses on granting authority for negotiations related to a particular merger proposal or opportunity. 3. Outline of Negotiation Parameters Resolution: This resolution includes explicit guidelines and parameters for the board members to follow during the merger negotiations. It may outline factors such as minimum valuation requirements, acceptable terms, or specific conditions that must be met before proceeding further. Conclusion: The Houston Texas Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger is a critical document that empowers board members to engage in merger negotiations on behalf of the corporation. By defining the purpose, scope of authority, and potential appointment of a negotiating committee, this resolution sets the stage for efficient and effective merger discussions. Companies can tailor their resolutions to address specific merger opportunities and define negotiation parameters to ensure the best interests of the corporation and its shareholders are protected throughout the process.Title: Understanding the Houston Texas Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger Introduction: The Houston Texas Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger is a legally binding document that grants authority to corporation board members to engage in negotiations pertaining to a merger. This resolution plays a crucial role in outlining the decision-making process and establishing guidelines for board members to follow during merger negotiations. In this article, we will explore the key components of this resolution while highlighting different types and variations that may exist. Key Components of the Houston Texas Resolution: 1. Purpose and Context: The resolution begins by clearly stating the purpose of engaging in merger negotiations and defines the context and goals to be achieved. It explains the reasons for considering a merger and the desired outcomes it aims to accomplish, such as enhancing shareholder value, expanding market reach, or gaining a competitive advantage. 2. Authorization of Negotiations: The resolution formally authorizes the board of directors to initiate negotiations related to a potential merger. It empowers the board to engage in discussions, perform due diligence, and explore the terms and conditions of the merger thoroughly. This authorization sets the groundwork for the board's subsequent decision-making process. 3. Scope of Authority: The resolution outlines the scope of authority conferred upon the board members regarding merger negotiations. It specifies the board's ability to make decisions, enter into agreements, and pursue actions necessary to facilitate the merger process. This ensures that board members have the necessary powers to protect the interests of the corporation and its shareholders during negotiations. 4. Appointment of Negotiating Committee: When applicable, the resolution may appoint or establish a negotiating committee to oversee the merger negotiations. This committee is responsible for representing the corporation's interests, evaluating proposals, and reporting progress to the board. The resolution may provide specific details regarding the composition, responsibilities, and authority of the negotiating committee. Types of Houston Texas Resolutions of Board of Directors Concerning Merger: 1. General Authorization Resolution: This is the most common type of resolution, granting the board of directors the general authority to initiate merger negotiations and undertake necessary actions to advance the process. It provides the broad framework within which negotiations can take place. 2. Specific Merger Authorization Resolution: In certain cases, the board may draft a resolution that authorizes negotiations concerning a specific merger opportunity or potential merger partner. This type of resolution focuses on granting authority for negotiations related to a particular merger proposal or opportunity. 3. Outline of Negotiation Parameters Resolution: This resolution includes explicit guidelines and parameters for the board members to follow during the merger negotiations. It may outline factors such as minimum valuation requirements, acceptable terms, or specific conditions that must be met before proceeding further. Conclusion: The Houston Texas Resolution of Board of Directors of Corporation Authorizing Negotiations Concerning Merger is a critical document that empowers board members to engage in merger negotiations on behalf of the corporation. By defining the purpose, scope of authority, and potential appointment of a negotiating committee, this resolution sets the stage for efficient and effective merger discussions. Companies can tailor their resolutions to address specific merger opportunities and define negotiation parameters to ensure the best interests of the corporation and its shareholders are protected throughout the process.

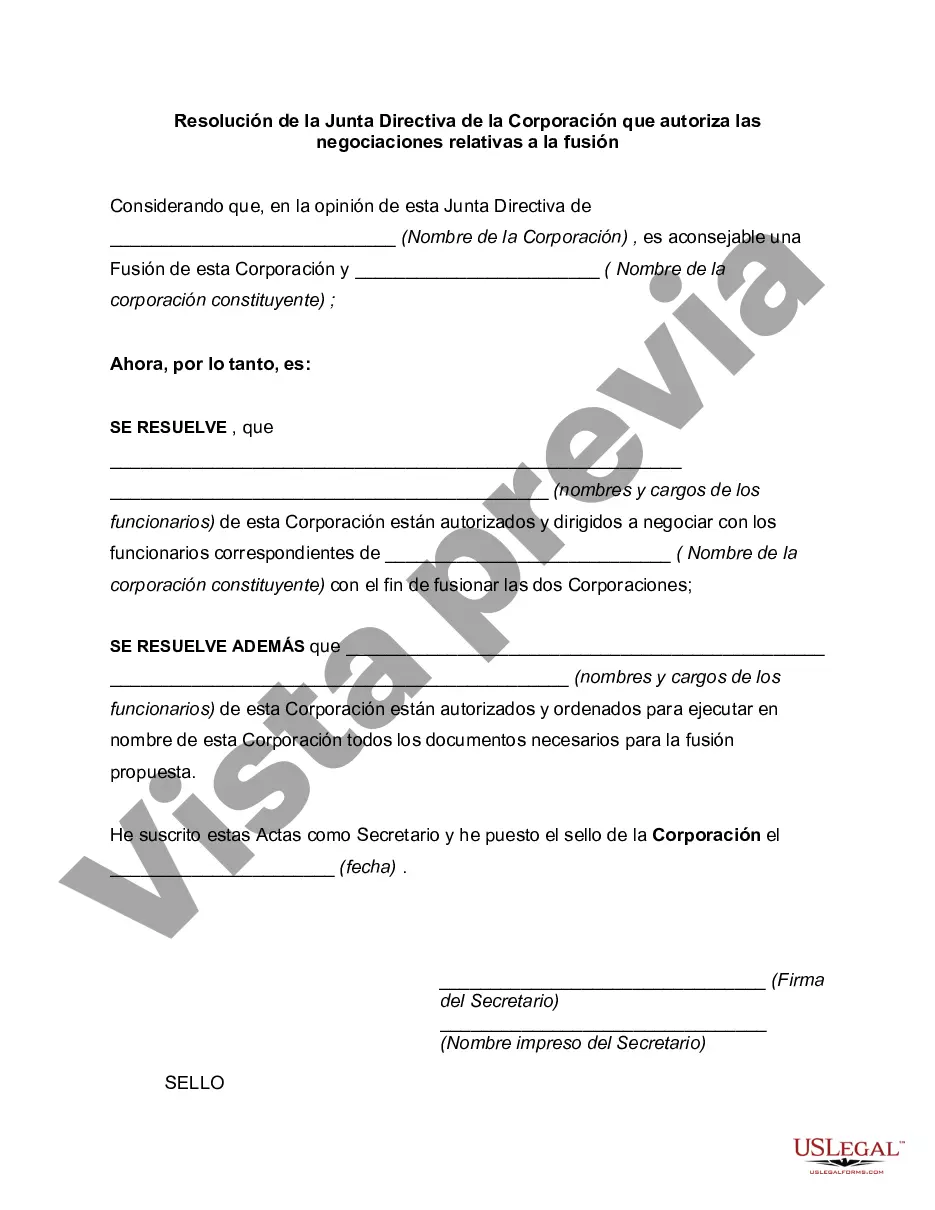

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.