Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

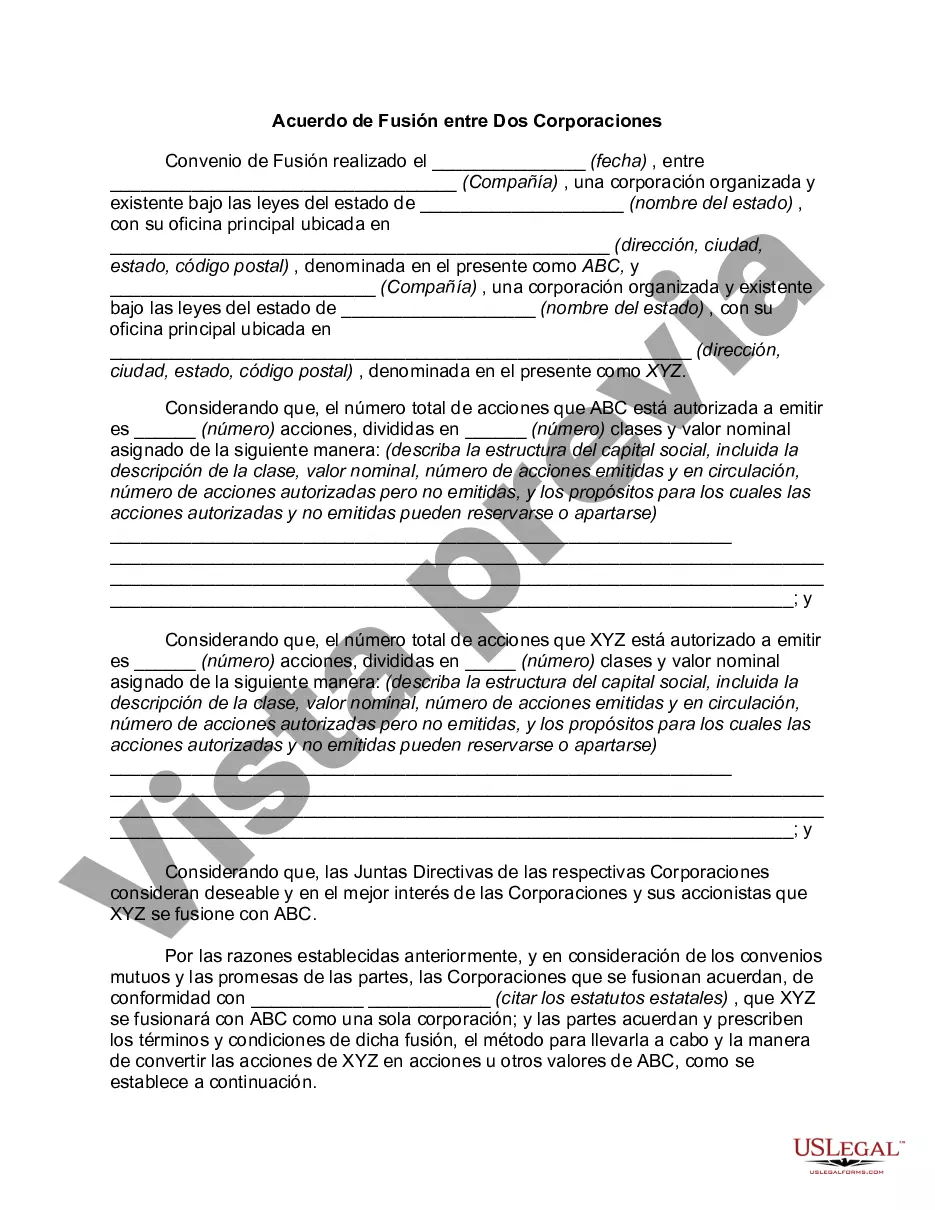

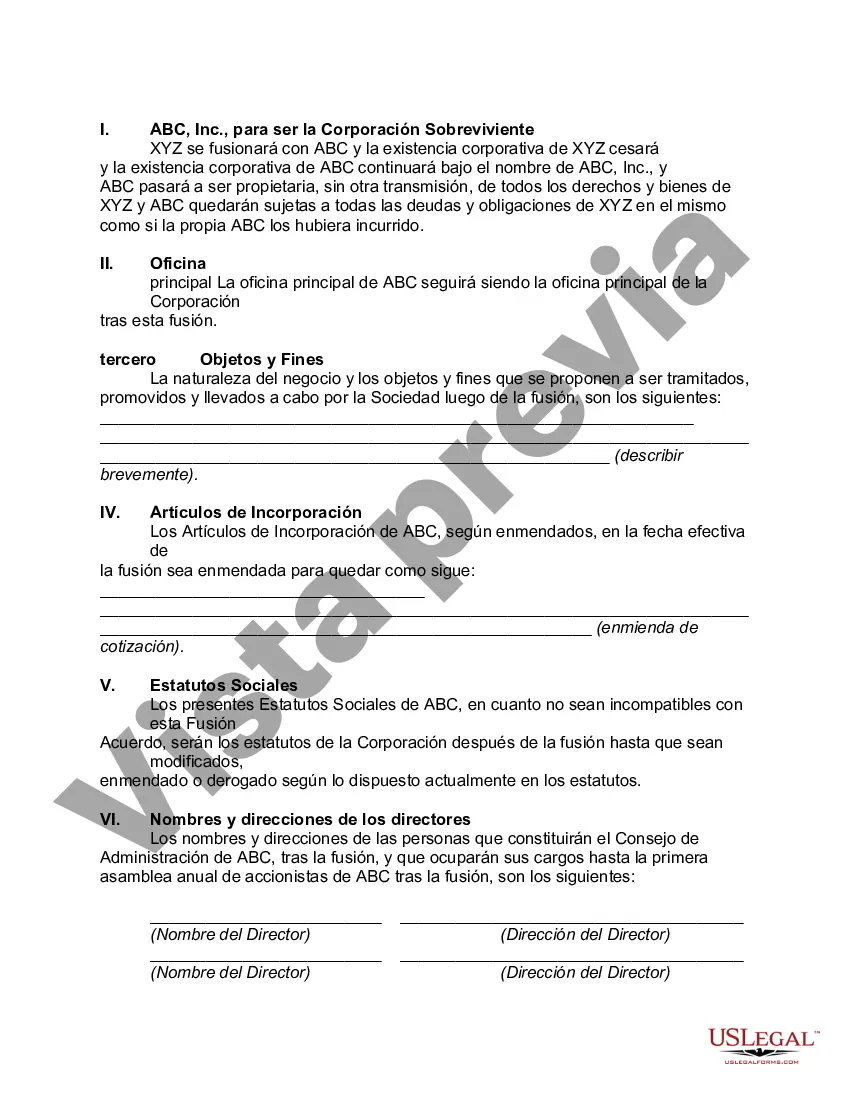

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

Houston Texas Merger Agreement between Two Corporations: A Comprehensive Overview A Houston Texas Merger Agreement between Two Corporations is a legally binding contract that outlines the terms and conditions under which two companies merge into a single entity in the region of Houston, Texas. This agreement is crucial in facilitating a smooth and efficient merger process while safeguarding the interests of both parties involved. Keywords: Houston Texas, Merger Agreement, Two Corporations, legally binding contract, terms and conditions, merge, single entity, smooth and efficient, safeguarding, interests. Types of Houston Texas Merger Agreements between Two Corporations: 1. Statutory Merger Agreement: A statutory merger agreement in Houston, Texas is typically executed when one company (the acquiring company) fully absorbs another company (the target company), resulting in the target company's assets and liabilities becoming part of the acquiring company. 2. Asset Purchase Agreement: In this type of merger agreement, the acquiring company purchases the target company's specific assets, liabilities, and contracts, rather than acquiring the target company as a whole. This enables the acquiring company to cherry-pick the assets it desires while leaving the target company with any remaining liabilities. 3. Stock Purchase Agreement: In a stock purchase agreement, the acquiring company purchases a significant number of shares or all of the target company's outstanding shares, thereby gaining control of the target company. This type of agreement allows for the acquisition of all the target company's assets, liabilities, contracts, and existing business operations. 4. Joint Venture Agreement: A joint venture merger agreement establishes a new entity in which both corporations contribute their resources, expertise, and capital, while maintaining their separate legal identities. This type of agreement allows the two corporations to collaborate and share risks, rewards, and responsibilities, while remaining independent entities. 5. Merger of Equals Agreement: In certain instances, two corporations of similar size and resources may engage in a merger of equals. This type of agreement aims to create a new entity where both companies have equal ownership and control, resulting in a merged corporation without a clear acquiring or target company. In Houston, Texas, these various types of merger agreements allow corporations to pursue different strategies based on their specific goals, financial situations, and market conditions. Each type of merger agreement offers unique benefits and considerations, necessitating careful evaluation and negotiation between the parties involved. In conclusion, a Houston Texas Merger Agreement between Two Corporations is a critical legal document that outlines the terms and conditions of a merger, protecting the interests of both merging entities. Different types of merger agreements, including statutory mergers, asset purchases, stock purchases, joint ventures, and mergers of equals, provide corporations with options based on their specific objectives and circumstances.Houston Texas Merger Agreement between Two Corporations: A Comprehensive Overview A Houston Texas Merger Agreement between Two Corporations is a legally binding contract that outlines the terms and conditions under which two companies merge into a single entity in the region of Houston, Texas. This agreement is crucial in facilitating a smooth and efficient merger process while safeguarding the interests of both parties involved. Keywords: Houston Texas, Merger Agreement, Two Corporations, legally binding contract, terms and conditions, merge, single entity, smooth and efficient, safeguarding, interests. Types of Houston Texas Merger Agreements between Two Corporations: 1. Statutory Merger Agreement: A statutory merger agreement in Houston, Texas is typically executed when one company (the acquiring company) fully absorbs another company (the target company), resulting in the target company's assets and liabilities becoming part of the acquiring company. 2. Asset Purchase Agreement: In this type of merger agreement, the acquiring company purchases the target company's specific assets, liabilities, and contracts, rather than acquiring the target company as a whole. This enables the acquiring company to cherry-pick the assets it desires while leaving the target company with any remaining liabilities. 3. Stock Purchase Agreement: In a stock purchase agreement, the acquiring company purchases a significant number of shares or all of the target company's outstanding shares, thereby gaining control of the target company. This type of agreement allows for the acquisition of all the target company's assets, liabilities, contracts, and existing business operations. 4. Joint Venture Agreement: A joint venture merger agreement establishes a new entity in which both corporations contribute their resources, expertise, and capital, while maintaining their separate legal identities. This type of agreement allows the two corporations to collaborate and share risks, rewards, and responsibilities, while remaining independent entities. 5. Merger of Equals Agreement: In certain instances, two corporations of similar size and resources may engage in a merger of equals. This type of agreement aims to create a new entity where both companies have equal ownership and control, resulting in a merged corporation without a clear acquiring or target company. In Houston, Texas, these various types of merger agreements allow corporations to pursue different strategies based on their specific goals, financial situations, and market conditions. Each type of merger agreement offers unique benefits and considerations, necessitating careful evaluation and negotiation between the parties involved. In conclusion, a Houston Texas Merger Agreement between Two Corporations is a critical legal document that outlines the terms and conditions of a merger, protecting the interests of both merging entities. Different types of merger agreements, including statutory mergers, asset purchases, stock purchases, joint ventures, and mergers of equals, provide corporations with options based on their specific objectives and circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.