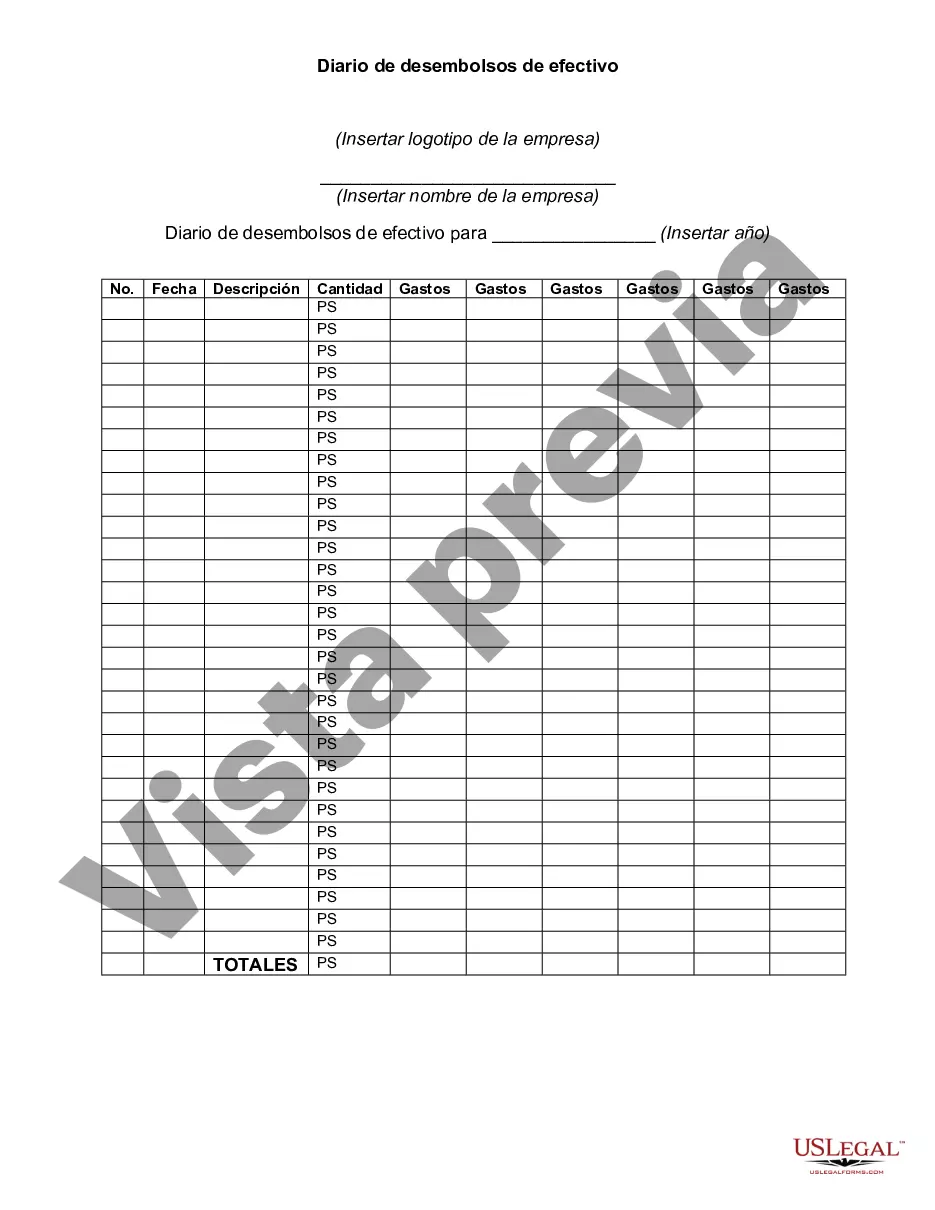

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Cook Illinois Check Disbursements Journal is a financial document that records all the outgoing checks issued by Cook Illinois Corporation, a prominent transportation company based in Illinois. This journal plays a crucial role in maintaining accurate financial records and ensuring transparency in the company's financial transactions. The Cook Illinois Check Disbursements Journal contains comprehensive information about each check disbursed, including the check number, date of issuance, payee name, purpose of payment, amount, and any additional supporting documents. This journal serves as an essential reference for auditing, verifying payments made, and reconciling accounts. There are various types of Cook Illinois Check Disbursements Journals: 1. Vendor Payments Journal: This journal records all outgoing checks made to vendors for services rendered or products supplied. It includes payments for fuel, vehicle maintenance, office supplies, advertising, and other expenses incurred by Cook Illinois Corporation. 2. Payroll and Employee Expenses Journal: This specific journal tracks all outgoing checks related to employee salaries, wages, benefits, and reimbursements. It includes payments made to drivers, office staff, and other employees, along with any associated deductions or additional allowances. 3. Contract Payments Journal: This journal focuses on recording payments made to contractors, subcontractors, or service providers hired by Cook Illinois Corporation for various projects. It includes disbursements for construction, infrastructure development, software implementation, and any other contractual obligations. 4. Tax and Government Payments Journal: This journal is dedicated to documenting outgoing checks issued for tax payments, licenses, permits, and other obligations to government entities. It ensures compliance with tax regulations and legal requirements, as well as transparency in financial activities. Accurate and detailed record-keeping in the Cook Illinois Check Disbursements Journal is vital for financial management, internal controls, and external audits. It enables tracking of expenses, detection of any discrepancies or irregularities, and timely identification of any fraudulent activities. Overall, the Cook Illinois Check Disbursements Journal is an integral component of the company's accounting system, providing an organized and systematic record of all financial transactions involving outgoing checks. It facilitates effective financial analysis, budgeting, and planning, ensuring the smooth functioning of Cook Illinois Corporation's operations.Cook Illinois Check Disbursements Journal is a financial document that records all the outgoing checks issued by Cook Illinois Corporation, a prominent transportation company based in Illinois. This journal plays a crucial role in maintaining accurate financial records and ensuring transparency in the company's financial transactions. The Cook Illinois Check Disbursements Journal contains comprehensive information about each check disbursed, including the check number, date of issuance, payee name, purpose of payment, amount, and any additional supporting documents. This journal serves as an essential reference for auditing, verifying payments made, and reconciling accounts. There are various types of Cook Illinois Check Disbursements Journals: 1. Vendor Payments Journal: This journal records all outgoing checks made to vendors for services rendered or products supplied. It includes payments for fuel, vehicle maintenance, office supplies, advertising, and other expenses incurred by Cook Illinois Corporation. 2. Payroll and Employee Expenses Journal: This specific journal tracks all outgoing checks related to employee salaries, wages, benefits, and reimbursements. It includes payments made to drivers, office staff, and other employees, along with any associated deductions or additional allowances. 3. Contract Payments Journal: This journal focuses on recording payments made to contractors, subcontractors, or service providers hired by Cook Illinois Corporation for various projects. It includes disbursements for construction, infrastructure development, software implementation, and any other contractual obligations. 4. Tax and Government Payments Journal: This journal is dedicated to documenting outgoing checks issued for tax payments, licenses, permits, and other obligations to government entities. It ensures compliance with tax regulations and legal requirements, as well as transparency in financial activities. Accurate and detailed record-keeping in the Cook Illinois Check Disbursements Journal is vital for financial management, internal controls, and external audits. It enables tracking of expenses, detection of any discrepancies or irregularities, and timely identification of any fraudulent activities. Overall, the Cook Illinois Check Disbursements Journal is an integral component of the company's accounting system, providing an organized and systematic record of all financial transactions involving outgoing checks. It facilitates effective financial analysis, budgeting, and planning, ensuring the smooth functioning of Cook Illinois Corporation's operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.