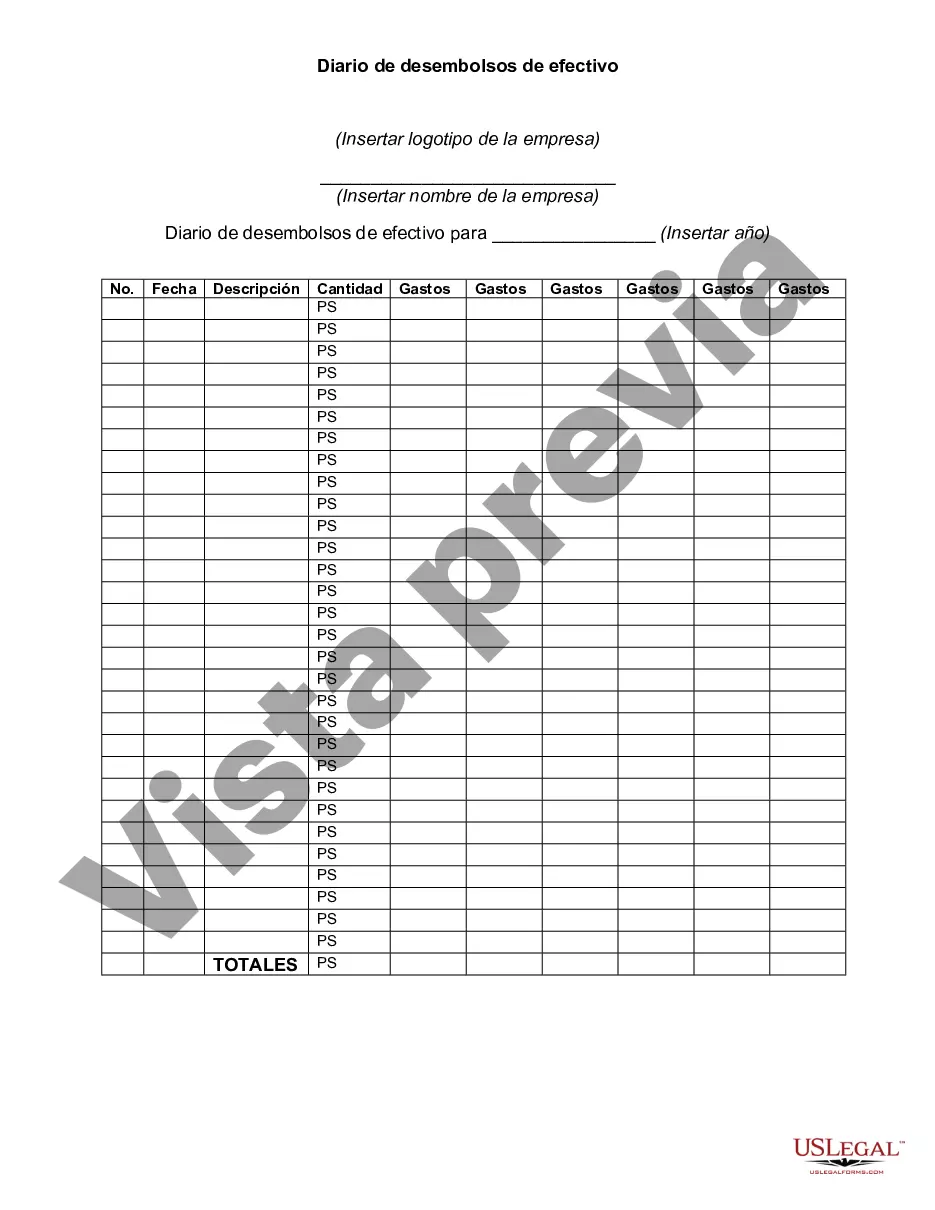

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Dallas, Texas is a vibrant and bustling city located in the southern United States. Known for its rich history, diverse culture, and thriving economy, Dallas is a hub of business, arts, sports, and entertainment. One essential financial document used by businesses in Dallas is the Dallas Texas Check Disbursements Journal. The Dallas Texas Check Disbursements Journal is a comprehensive record-keeping system used by businesses in the Dallas area to accurately track and manage their check disbursements. This journal plays a critical role in maintaining financial transparency, ensuring accurate reporting, and supporting auditing processes. Within the realm of Dallas Texas Check Disbursements Journals, there are several types, each catering to specific business needs: 1. General Dallas Texas Check Disbursements Journal: This variant serves as the primary ledger for recording all check disbursements made by a business in Dallas. It includes columns for essential information such as date, check number, payee name, description of the payment, and the amount disbursed. This journal allows for proper tracking of expenses, enabling businesses to analyze spending patterns, manage cash flows, and maintain accurate financial statements. 2. Dallas Texas Vendor Check Disbursements Journal: Designed specifically for businesses in Dallas that issue checks to vendors and suppliers, this type of check disbursements journal focuses on recording payments made to external parties. It includes fields for recording vendor names, payment terms, and any additional details relevant to vendor payments. This journal enables businesses to effectively manage their relationships with vendors, track outstanding payments, and evaluate vendor performance. 3. Payroll Dallas Texas Check Disbursements Journal: Companies in Dallas that employ staff members often use this specific journal to record all payroll-related check disbursements. It has dedicated columns for employee names, payment amounts, withholding information, and any other necessary payroll details. The use of this journal streamlines the payroll process, helps ensure accurate employee compensation, and allows businesses to maintain proper records for tax purposes. Regardless of the type, the Dallas Texas Check Disbursements Journal holds immense value for businesses, as it supports financial decision-making, minimizes errors, and facilitates efficient financial management. By maintaining detailed and accurate records of check disbursements, businesses in Dallas can ensure compliance with legal requirements, provide transparency to stakeholders, and gain valuable insights into their financial activities.Dallas, Texas is a vibrant and bustling city located in the southern United States. Known for its rich history, diverse culture, and thriving economy, Dallas is a hub of business, arts, sports, and entertainment. One essential financial document used by businesses in Dallas is the Dallas Texas Check Disbursements Journal. The Dallas Texas Check Disbursements Journal is a comprehensive record-keeping system used by businesses in the Dallas area to accurately track and manage their check disbursements. This journal plays a critical role in maintaining financial transparency, ensuring accurate reporting, and supporting auditing processes. Within the realm of Dallas Texas Check Disbursements Journals, there are several types, each catering to specific business needs: 1. General Dallas Texas Check Disbursements Journal: This variant serves as the primary ledger for recording all check disbursements made by a business in Dallas. It includes columns for essential information such as date, check number, payee name, description of the payment, and the amount disbursed. This journal allows for proper tracking of expenses, enabling businesses to analyze spending patterns, manage cash flows, and maintain accurate financial statements. 2. Dallas Texas Vendor Check Disbursements Journal: Designed specifically for businesses in Dallas that issue checks to vendors and suppliers, this type of check disbursements journal focuses on recording payments made to external parties. It includes fields for recording vendor names, payment terms, and any additional details relevant to vendor payments. This journal enables businesses to effectively manage their relationships with vendors, track outstanding payments, and evaluate vendor performance. 3. Payroll Dallas Texas Check Disbursements Journal: Companies in Dallas that employ staff members often use this specific journal to record all payroll-related check disbursements. It has dedicated columns for employee names, payment amounts, withholding information, and any other necessary payroll details. The use of this journal streamlines the payroll process, helps ensure accurate employee compensation, and allows businesses to maintain proper records for tax purposes. Regardless of the type, the Dallas Texas Check Disbursements Journal holds immense value for businesses, as it supports financial decision-making, minimizes errors, and facilitates efficient financial management. By maintaining detailed and accurate records of check disbursements, businesses in Dallas can ensure compliance with legal requirements, provide transparency to stakeholders, and gain valuable insights into their financial activities.

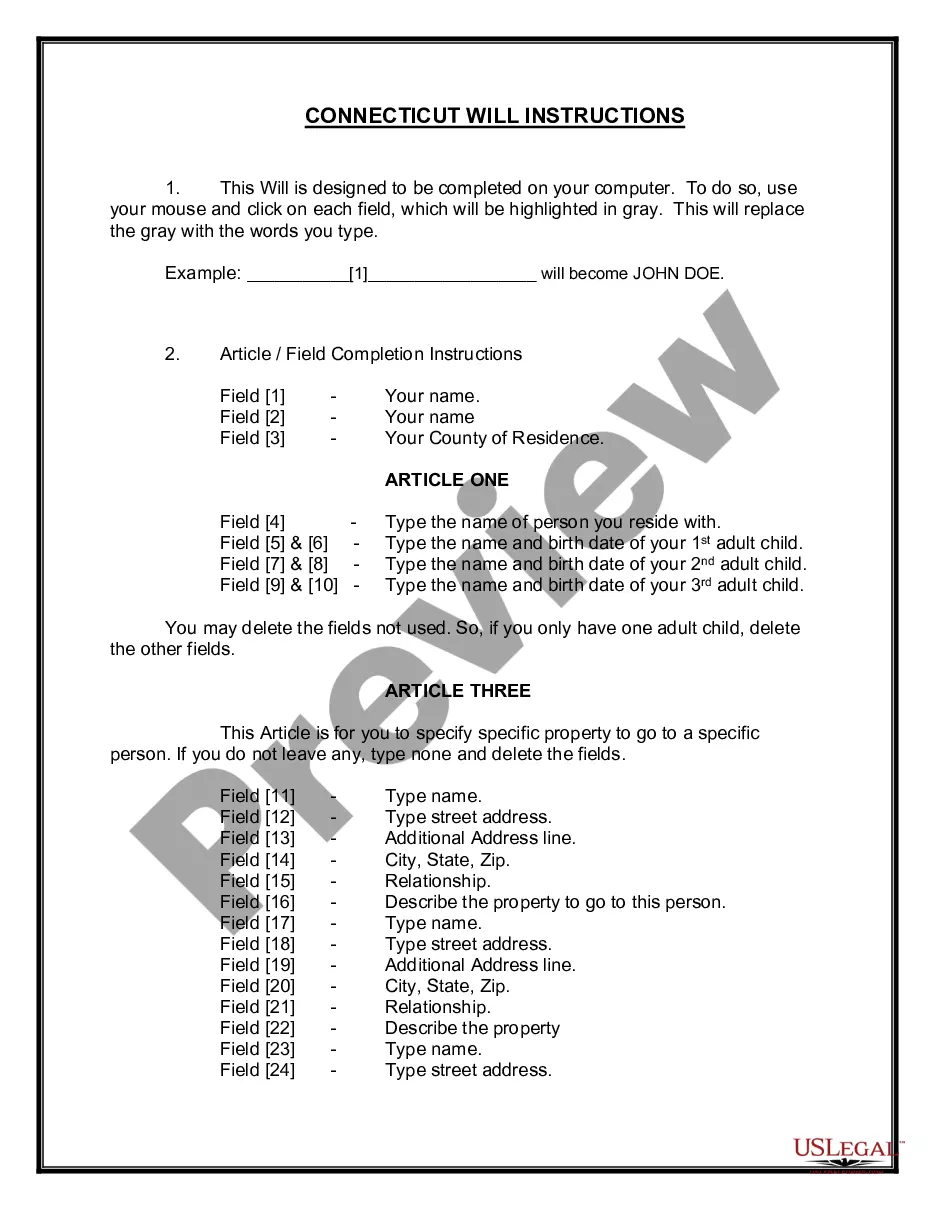

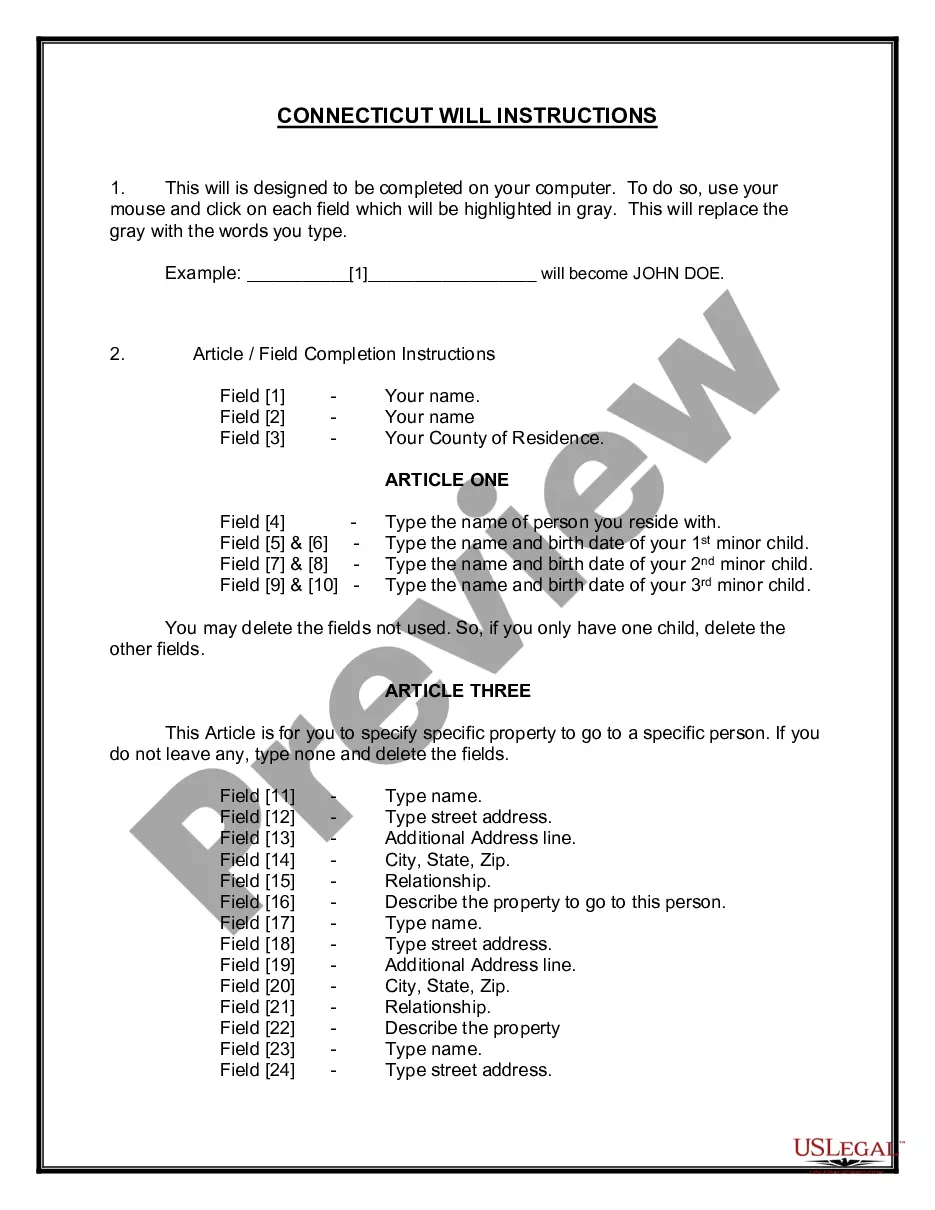

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.