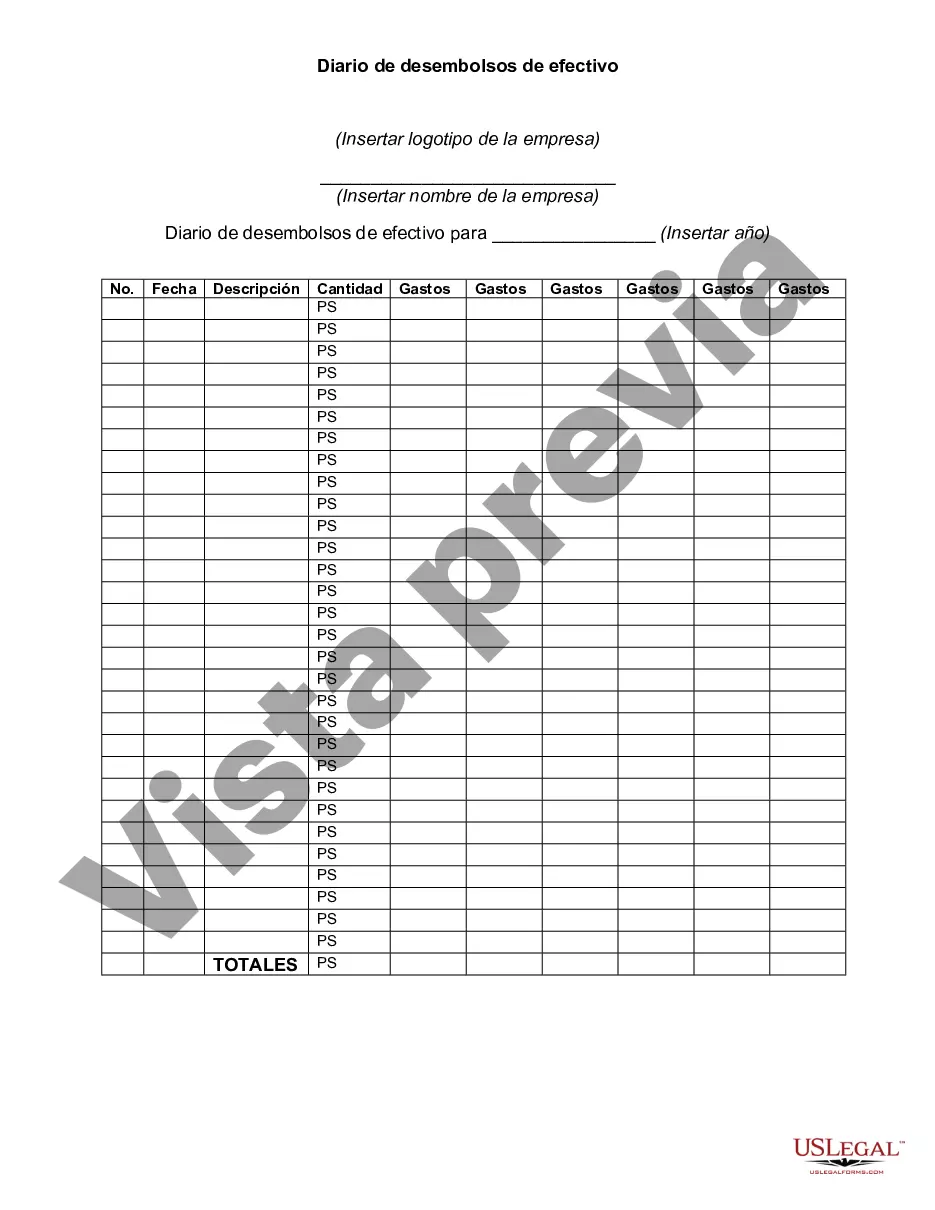

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

King Washington Check Disbursements Journal is a vital financial document utilized by businesses to track and record all outgoing payments made through checks. This journal serves as a comprehensive record of every check disbursed by a company, providing essential information for financial analysis, auditing, and accounting purposes. The King Washington Check Disbursements Journal includes various details about each check disbursement, such as the date, payee, check number, payment amount, purpose, and the account from which the funds are withdrawn. This journal acts as a reliable reference tool, helping businesses to maintain accurate financial records and ensure proper management of their outgoing payments. In addition to serving as an essential record-keeping tool, the King Washington Check Disbursements Journal also facilitates efficient financial management. By closely monitoring all check disbursements, businesses can analyze their spending patterns, identify potential cost-saving opportunities, and establish better control over their cash flow. There are different types of King Washington Check Disbursements Journals tailored to meet the specific needs of different businesses. Some of these variations include: 1. General King Washington Check Disbursements Journal: This type of journal records all standard check disbursements made by a company, including payments to vendors, suppliers, contractors, and utility companies. 2. Payroll King Washington Check Disbursements Journal: Specifically designed to manage employee payroll, this journal accurately captures details of payments made to employees through checks, including wages, salaries, bonuses, and deductions. 3. Expense Reimbursement King Washington Check Disbursements Journal: This journal focuses on recording reimbursements made to employees for business-related expenses. It tracks expenses such as travel, meals, accommodation, and other eligible expenditures. 4. Petty Cash King Washington Check Disbursements Journal: Used to monitor and replenish the petty cash fund, this journal documents the disbursement of small, immediate cash requirements for minor expenses in a business. Effectively managing check disbursements is crucial for financial stability and adherence to regulatory requirements. The King Washington Check Disbursements Journal serves as an indispensable tool in this process, facilitating accurate financial record-keeping, transparency, and prudent financial decision-making.King Washington Check Disbursements Journal is a vital financial document utilized by businesses to track and record all outgoing payments made through checks. This journal serves as a comprehensive record of every check disbursed by a company, providing essential information for financial analysis, auditing, and accounting purposes. The King Washington Check Disbursements Journal includes various details about each check disbursement, such as the date, payee, check number, payment amount, purpose, and the account from which the funds are withdrawn. This journal acts as a reliable reference tool, helping businesses to maintain accurate financial records and ensure proper management of their outgoing payments. In addition to serving as an essential record-keeping tool, the King Washington Check Disbursements Journal also facilitates efficient financial management. By closely monitoring all check disbursements, businesses can analyze their spending patterns, identify potential cost-saving opportunities, and establish better control over their cash flow. There are different types of King Washington Check Disbursements Journals tailored to meet the specific needs of different businesses. Some of these variations include: 1. General King Washington Check Disbursements Journal: This type of journal records all standard check disbursements made by a company, including payments to vendors, suppliers, contractors, and utility companies. 2. Payroll King Washington Check Disbursements Journal: Specifically designed to manage employee payroll, this journal accurately captures details of payments made to employees through checks, including wages, salaries, bonuses, and deductions. 3. Expense Reimbursement King Washington Check Disbursements Journal: This journal focuses on recording reimbursements made to employees for business-related expenses. It tracks expenses such as travel, meals, accommodation, and other eligible expenditures. 4. Petty Cash King Washington Check Disbursements Journal: Used to monitor and replenish the petty cash fund, this journal documents the disbursement of small, immediate cash requirements for minor expenses in a business. Effectively managing check disbursements is crucial for financial stability and adherence to regulatory requirements. The King Washington Check Disbursements Journal serves as an indispensable tool in this process, facilitating accurate financial record-keeping, transparency, and prudent financial decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.