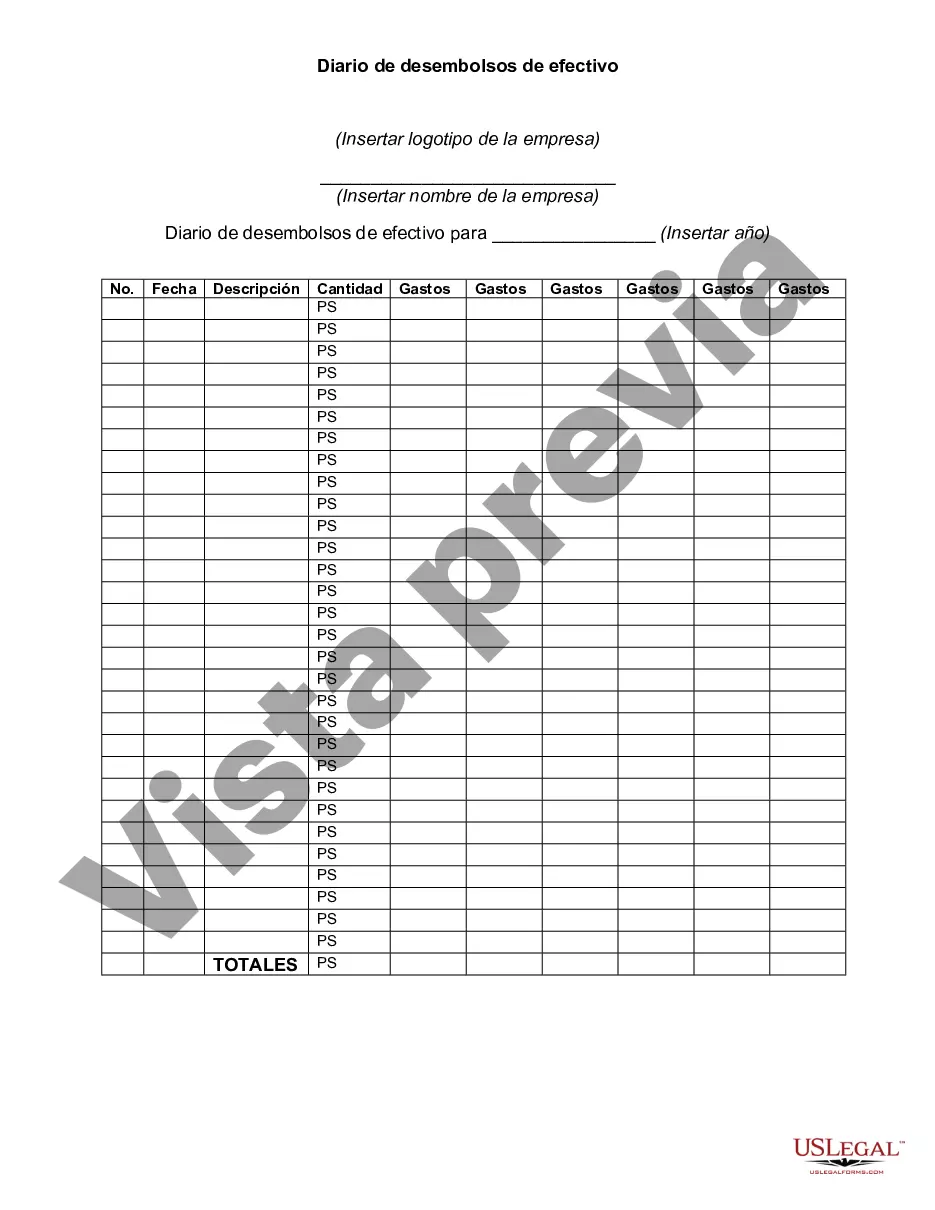

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

The Kings New York Check Disbursements Journal serves as a comprehensive record-keeping tool for financial transactions involving the disbursement of checks in the state of New York. It functions as a ledger to document all outgoing payments made by Kings New York, an organization or entity. This journal is designed with meticulous attention to detail, ensuring accurate and organized tracking of disbursements. It captures crucial information related to each transaction, including the payee's details, payment amount, check number, date of issuance, purpose or description of the payment, and any associated reference numbers. Additionally, it may incorporate space to record the account or department charged for the disbursement. The Kings New York Check Disbursements Journal distinguishes itself by its versatility, with several types catering to different purposes: 1. Regular Disbursements Journal: This is the standard version, encompassing check payments made by Kings New York for various routine expenses. It includes payments for utility bills, operational expenses, vendor payments, lease or rent obligations, and other day-to-day financial obligations. 2. Payroll Disbursements Journal: This specialized journal variant focuses solely on payroll-related check disbursements. It keeps a detailed log of employee wages, salaries, bonuses, and any deductions associated with taxes, insurance, or benefits. Such a journal ensures the accuracy and transparency of payroll transactions, vital for both Kings New York and its employees. 3. Travel and Expense Disbursements Journal: This specialized journal aims to streamline the tracking and documentation of travel-related expenses incurred by Kings New York personnel. It helps in recording and monitoring the reimbursement of travel costs, such as accommodation, meals, transportation, and other incidental expenses associated with business travel. 4. Grants and Donations Disbursements Journal: Kings New York may maintain this journal to specifically monitor the disbursement of funds related to grants received or donations made by the organization. It provides a systematic record of the recipients, amounts disbursed, specific project or cause associated with the funds, and any additional stipulations or conditions tied to the disbursement. These various types of Kings New York Check Disbursements Journals offer effective financial management and accountability, ensuring transparency and compliance with relevant regulations. By diligently recording and cross-referencing each disbursement, the organization can track expenditures, maintain accurate financial records, and facilitate auditing processes efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.